URA’s 2025 Draft Master Plan: 80,000 New Homes Across 10 Estates — Here’s What To Look Out For

June 25, 2025

URA’s Draft Master Plan 2025 is here, and with it, a sweeping plan to introduce at least 80,000 new homes across more than 10 neighbourhoods in the next 10 to 15 years. While some might call us cynical, we will say it’s also good optics right now, in a year when home prices are frighteningly high: everything helps, even if it may be a while before the increased supply sets in. Nonetheless, interest will almost certainly be on the practicalities of the upcoming sites; and not all are created equal. Here’s our take on the ones likely to draw the most attention:

The five main headliners (in our opinion as of June 2025)

- Newton/Monk’s Hill/Scotts Road Cluster

- Paterson/Orchard MRT (specifically)

- Dover–Medway/One-North

- Mediapolis (greater One-North area)

- Kranji (former Turf Club)

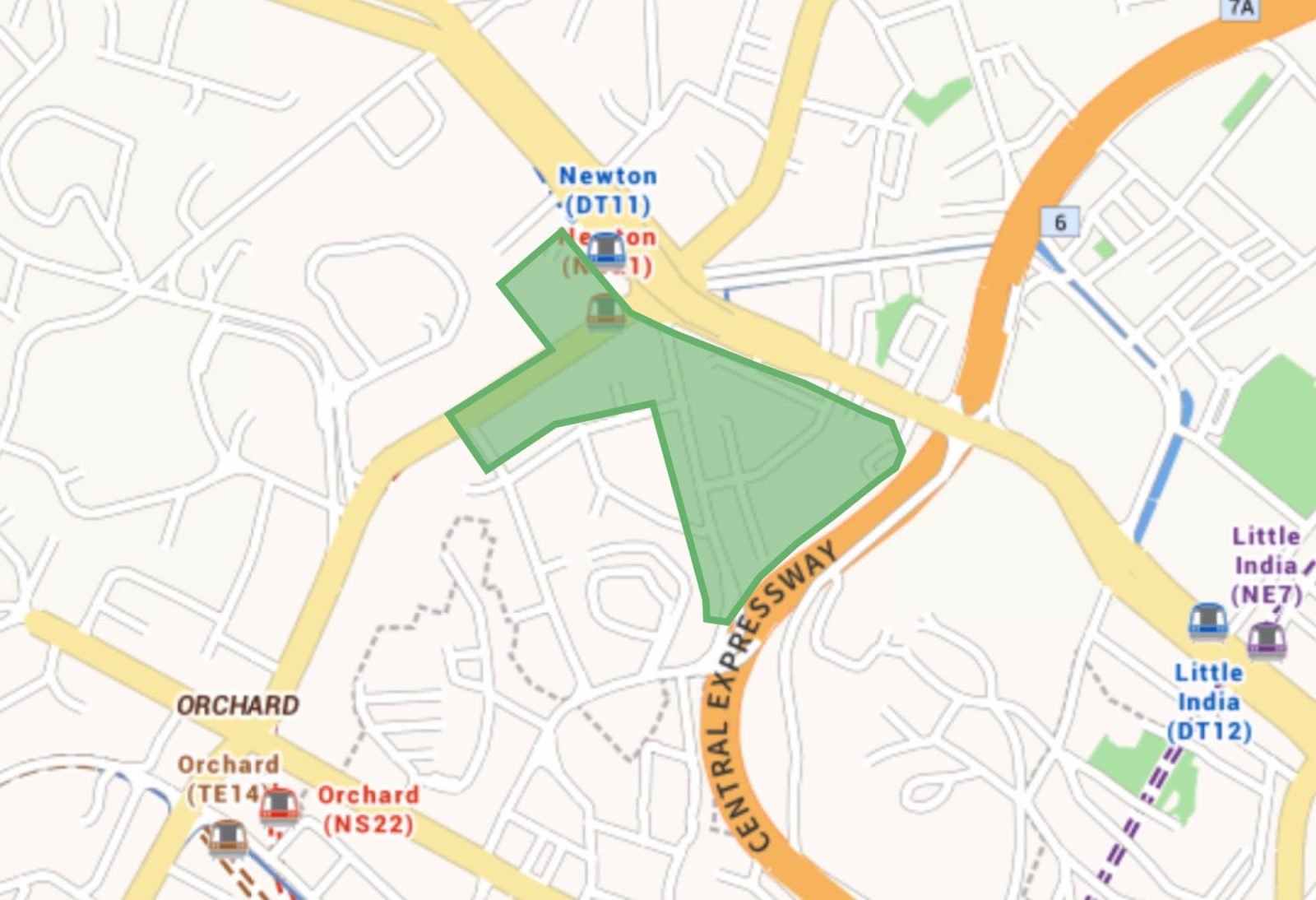

1. Newton/Monk’s Hill/Scotts Road Cluster

This is arguably the star of the entire Draft Plan.

This combined area will yield around 5,000 new private homes in a “mixed-use” precinct. Newton, currently more business than family oriented, will be balanced out by a planned “village square” next to Newton MRT station. (NSL, DTL).

Add to this a linear park along Monk’s Hill Road, which will then link Newton MRT directly to Emerald Hill: that’s a much-needed bit of car-light connectivity, in Newton’s notoriously dense and congested urban zone. From this, we can see Newton is being repositioned as more than just a gateway for CBD commuters or an address for investors. The mix will bring in ground-level retail, integrated green spaces, and better walkability; and this could eventually turn Newton into a true residential enclave.

This will be a major draw for investors and owner-occupiers alike: It’s rare to see this scale of redevelopment in a mature Core Central Region (CCR) neighbourhood, and even rarer for it to come with the future upside of more greenery and street-level vibrancy.

So even with the increased supply, we expect pricing here to remain premium, to reflect both centrality and scarcity. This area is already out of reach for most average Singaporeans, and an upgrade might take that even further.

2. Paterson/Orchard MRT (specifically)

This area will yield around 1,000 new private homes, but the highlight is a mixed-use development planned on top of Orchard MRT station (NSL, TEL). From what’s known, the project will likely be a “vertical village” style of residences, retail, F&B, and office space. It’s built on the old Institute of Education site, which is a major piece of prime land finally being reactivated.

While the volume of new units is small in count (compared to the rest of the list), this is part of ongoing attempts to make Orchard more of a balanced live-work-play enclave. In the current era, simply having an area packed with designer malls is far less appealing than it used to be, especially with the retail scene losing ground to e-commerce.

There isn’t much else to say about this, as it’s Orchard Road. Most of you know what to expect from Singapore’s most famous district. Ultra-premium pricing is a matter of course, and whatever appears here won’t be for the average homeowner. It remains to be seen how popular this plot of land would be, as we enter into the second half of 2025 with the focus back on new CCR properties. There would likely need to be some revision to the foreigner ABSD, to support the pricing levels in this area.

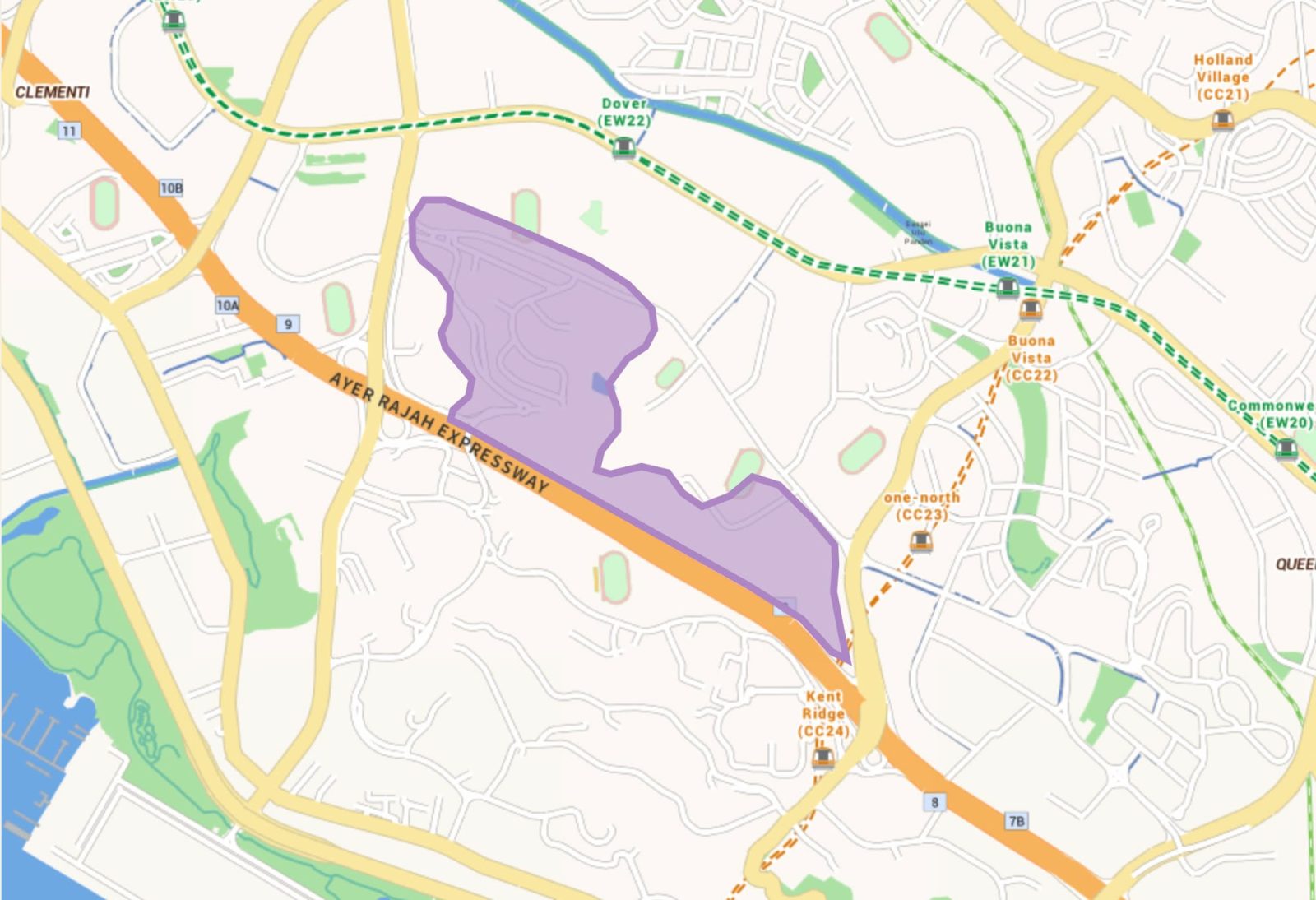

3. Dover-Medway/One-North

For those who think One-North is still too underdeveloped, this may be the secret sauce needed: around 6,000 new homes will be here, and they’re a mix of public and private; so we can expect some HDB projects.

Because the market tends to underrate One-North though, we think it will be a sleeper hit at first. The location, to be precise, is nestled between Kent Ridge and One-North MRT (CCL); the general area is a tech and media hub right now. The area is also being cleared gradually because SIT and UWC’s campuses are relocating: once the student body and faculty join the current presence of INSEAD and ESSEC, more landlords might be eyeing the location.

For homeowners who want to be near areas like Holland V, but without the price tag of District 10, this is also an area worth watching. We relate this to Mediapolis below as they’re both in One-North.

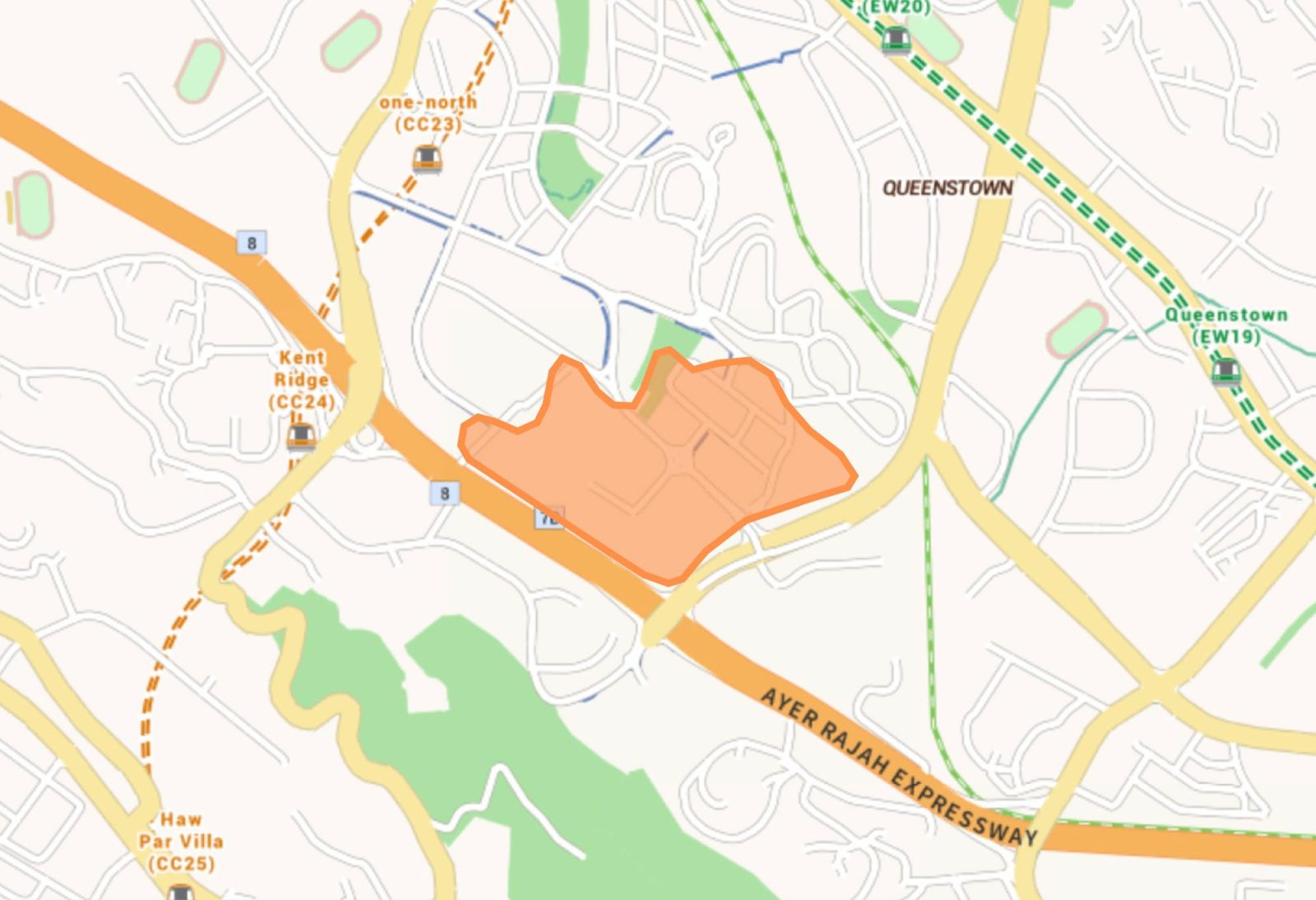

4. Mediapolis (greater One-North area)

Yet another One-North area expansion, this spot focuses on the area near Wessex Estate and the Rail Corridor. Wessex Estate is home to a rare cluster of colonial-era black-and-white bungalows, many of which are still leased to artists and expats; and if you combine it with the green spine of the Rail Corridor, this provides a peaceful and more private enclave within the One-North area.

This location has a distinct, almost bohemian* vibe not often found in Singapore’s newer districts, and has a lot of room to be taken further.

Around 5,000 new private homes are slated for this enclave. Nearby access to key institutions and employers (including media startups, biomedical firms, and research campuses) will make this interesting to investors, and we expect high interest from landlords targeting expatriates and professionals. While there may be homeowner interest because of the area’s uniqueness, we feel One-North is not yet fully on the radar for owner-occupiers.

*By bohemian, we refer to the “very expensive but pretending to be poor” variety.

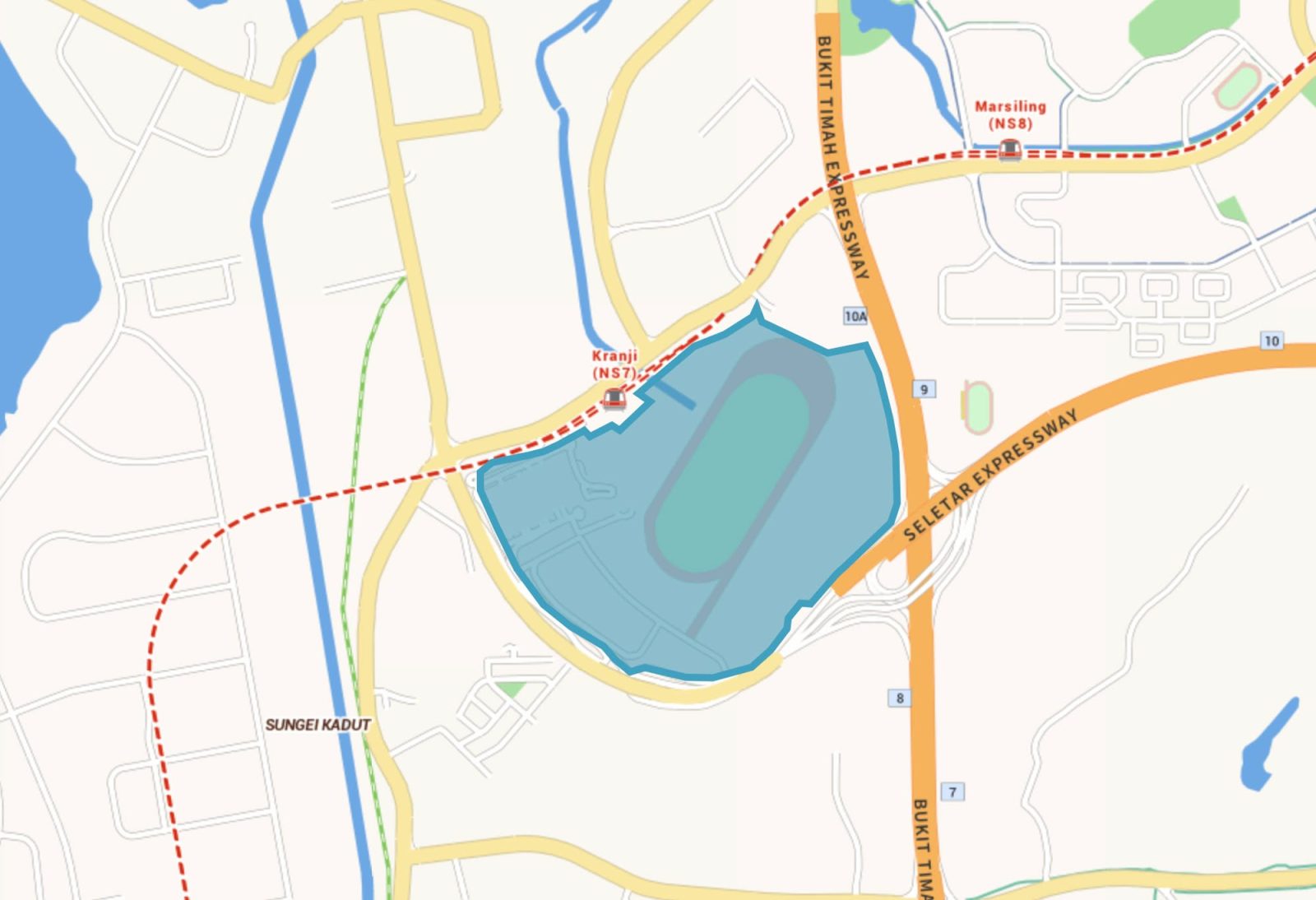

5. Kranji (former Turf Club)

We knew the former Turf Club was being cleared for this a while back, so this isn’t really new or surprising. But now we have a few more details, starting with the fact that around 14,000 new homes will be here; some of which will be HDB.

This number makes it the largest single housing infusion from the Draft Plan. What used to be the Turf Club will become a “riverine estate” near the Kranji Nature Corridor: this will be a stretch of interconnected greenery and riverfront that includes Sungei Mandai, Sungei Pang Sua, and the upcoming Mandai Mangrove and Mudflat Nature Park.

More from Stacked

Will My HDB Flat Be Worth $0 When The Lease Expires, And Should We Change Things?

Probably one of the biggest questions most HDB buyers have is: what happens when the 99-year lease is up? Does…

Unfortunately, those plans are doable precisely because the area is remote for now, so this will be for buyers looking at long-term transformation and affordability.

The URA’s artist impressions depict low- to mid-rise housing framed by water features, park connectors, and generous greenery. If it’s true to the image, we’d say the blend of nature and built environment is something rarely seen at this scale. In the long term, it could turn Kranji into a new model for sustainable suburban living. But as of right now, it won’t be the first choice for those who are seeking convenience.

The other five areas on the plan

These next five aren’t insignificant; some are massive in scale. But they either have longer timelines, lack detail for now, or simply don’t carry the same near-term weight for homeowners looking at the 5- to 10-year horizon.

- Sembawang Shipyard

- Paya Lebar Air Base (PLAB)

- Pearl’s Hill

- Marina South

- Bukit Timah Turf City/Keppel Golf Course/Mount Pleasant

1. Sembawang Shipyard

The shipyard is expected to cease operations in 2028, and the area will eventually be converted into a mixed-use waterfront district. Think new housing, community spaces, and possibly a new lifestyle precinct that embraces the area’s maritime heritage. Some of the old industrial infrastructure and berths may be retained and repurposed, giving it a potentially cool, repurposed-docklands vibe (we’ll see).

Still, it’s a long way off. Realistically, we would guess no one’s moving in until well into the 2030s. But this could be one of those sleeper zones in the future, especially for homeowners who value coastal views and heritage charm.

2. Paya Lebar Air Base (PLAB)

This isn’t really news as it’s been announced and discussed for a few years now. Once PLAB relocates post-2030, about 800 hectares of land (roughly five times the size of Toa Payoh!) will get freed up. That’s an unprecedented amount of space in Singapore’s east.

The idea is to build an entirely new town here, with housing, commercial hubs, and green corridors linking to the nearby Defu area. Just as critically, lifting airspace height restrictions could benefit surrounding towns like Hougang and Bedok Reservoir, where we might see more redevelopment and intensification.

For now, it’s still far away on the calendar, but the sheer size of this site means it will cause a major shake up when it happens.

3. Pearl’s Hill

Pearl’s Hill has already been earmarked in past plans, and is part of the push to inject more residential options into central areas. Located next to Chinatown and Outram, it’s one of those ultra-rare CCR pockets that still has some open land, and elevated terrain too.

It won’t match the flashiness of Newton or Orchard, but for owner-occupiers who prefer Chinatown (or just a somewhat quieter hilltop vibe), this might be a future hidden gem; especially once Greater Southern Waterfront plans pick up steam nearby.

Pearl’s Hill will also see its first new HDB blocks in about 40 years, once the changes get underway. There’s no exact date, but it was announced that developments here will unfold progressively, over the next 10 years.

4. Marina South

Marina South has been sitting in the URA’s plans for a while, and this announcement confirms its place on the roadmap. The vision remains the same: a waterfront live-work-play enclave with high-density housing, leisure spaces, and integration with Marina Barrage, Gardens by the Bay, and the Central Business District.

But progress has been slow. In one major government land sale here, the results were quite poor (we have the full details in this article).

The surrounding area still lacks the everyday ecosystem of schools, supermarkets, and lived-in vibrancy that homeowners typically look for. So in its current state, Marina South feels more like a place built for Instagram, not day-to-day living. Until the first few developments set the tone and more anchor amenities come in (think: transport nodes, schools, full-service malls), it remains a long-term target rather than a near-term draw for homeowners.

5. Bukit Timah Turf City/Keppel Golf Course/Mount Pleasant

This is more of a grab-bag category, and many have been in the news for a few years already – but here’s the gist:

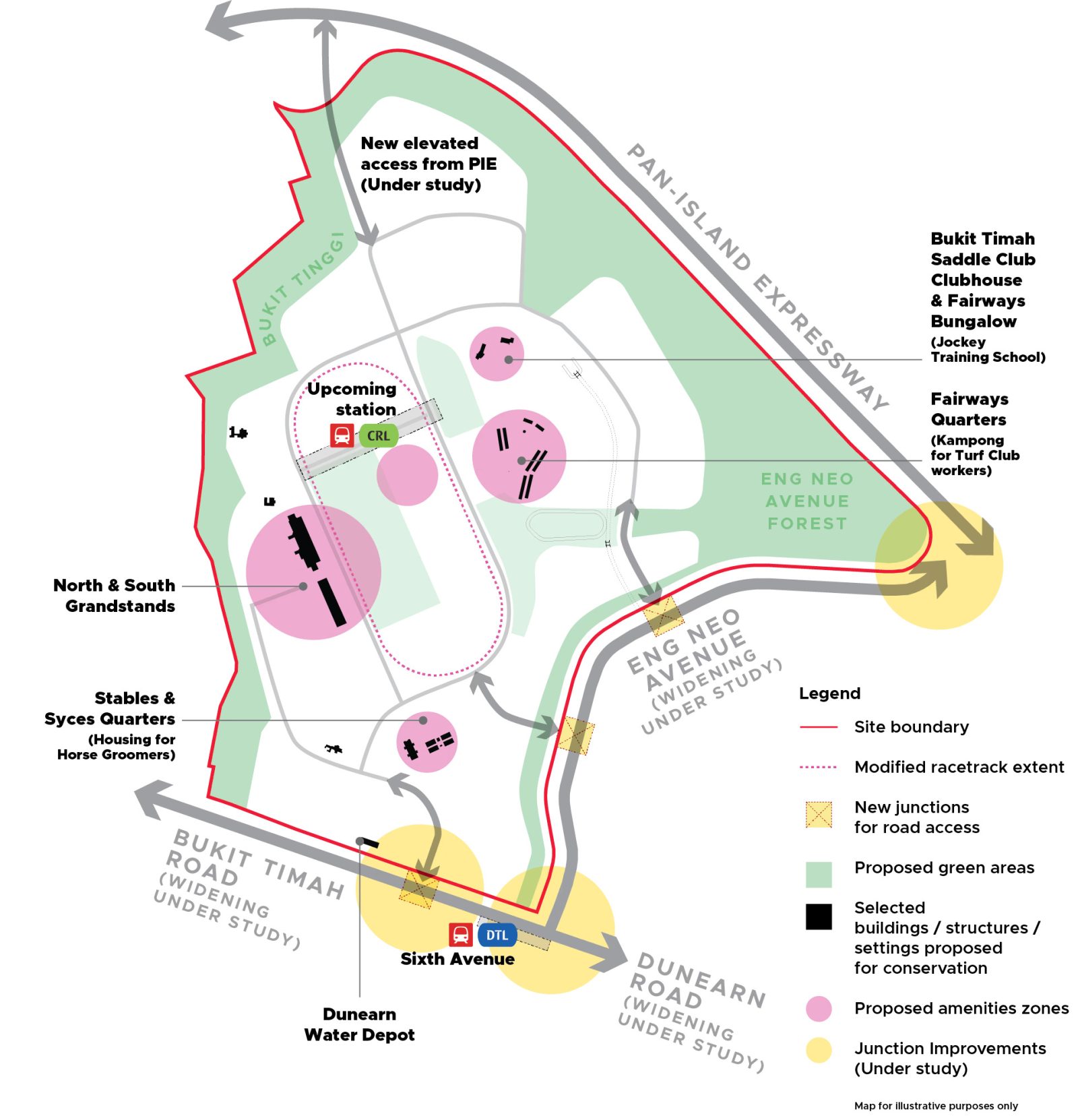

- Turf City (Bukit Timah): Formerly the Bukit Timah Racecourse, this will be redeveloped into a 176-hectare mixed estate with both public and private housing. This will include the first new HDB flats in Bukit Timah in almost 40 years. The area will retain some conserved colonial structures and integrate forested areas into the layout. With future CRL access (via Turf City MRT station), this is one of the few central brownfield opportunities left.

- Keppel Golf Course: Part of the wider Greater Southern Waterfront plan, this site will offer new housing in a very prestigious and green area near the CBD and Sentosa. Details remain limited, but expectations are high.

- Mount Pleasant: Already known for its integration of greenery and heritage (e.g. colonial black-and-whites, old police academy buildings), this is meant to be a quiet, upscale residential node, likely focused on private or premium public housing.

Together, these form a trio of “high-pedigree” redevelopments. They’re still far off in the distance; but we feel their centrality and prestige will make them heavily contested when sites eventually go up for sale.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

0 Comments