Unconventional Tactics Some Singaporeans Use To Save Money When Buying Property

July 21, 2024

Could you possibly spend $0 on renovations?

That was my question to a friend of mine, who just bought a resale flat. This isn’t a new flat either: we’re talking 1970-something construction, and there’s still a squat toilet. Usually with a flat this old, you expect any savings from lease decay to be swallowed up by a scary Interior Design bill. But as a sign of the times, my friend has done nothing but refurnish: new tables, chairs, beds, etc.

But all of the old renovation, from cupboards with slightly peeling edges, to the occasional missing tile, is still as it was – likely from a renovation that was over a decade or two ago. But his reason for keeping it that way?

The first would be avoiding the reno loan.

He detests the idea of owning money, and taking a home loan was a big enough shock to the system. So rather than add another few thousand dollars a month in debt, he’s content to live with the conditions for the next few years, until he can renovate with just cash.

The other reason is that he has a planned holding period: five years at best, and 10 years at most. This isn’t unique to him; and as resale prices and renovation costs go up, I come across it increasingly often: homeowners who don’t go beyond bare maintenance because – I quote – “This is the government’s house, don’t spend too much money to make it nice.”

Which shows a stark divide in how Singaporeans think of their flats

On one side, you have those who, despite all arguments the government may put out, think of HDB flats as being not-really-theirs.

These are the people who point out that the form you sign when getting your flat says “lessee,” or that 99-year leaseholds and eligibility criteria aren’t “true” ownership.

For this batch, they’re often driven to make the jump to private property (especially freehold private property), and they tend to see their flat as just a stepping stone. And they are, rather ironically, more appreciative of existing renovations. One strategy among them, like my buddy’s, is to look for a resale flat with renovations they can tolerate for just five years.

On the other side, you have the “pure” home buyers who see their flat as a home forever. This batch tends to ignore the value of renovations altogether. I’ve seen them tear down renovations that are only two or three years old, even if it was by top-end design firms. The reason is that, because they see it as their own space, it’s vital to have it reflect their own character and lifestyle – and they’ll splurge on renovations if they have to, because they often intend to live out their lives (or most of their lives) there.

It’s definitely something for sellers to think about: knowing which group your prospective buyer falls into gives you a sense of how much to emphasise your renovations.

On the same topic of savings, here are a couple of ways we’re seeing people save on their home purchases. Some of them are old, but have come back into prominence lately:

- Want to live in a hotspot like Bishan, Holland V, Paya Lebar, etc.? Rather than scout out that exact location, move one MRT stop away and check in the neighbouring area instead. The price difference between Aljunied and Paya Lebar, or Eunos and Paya Lebar, can be significant – but the travel time often isn’t.

- Start cycling. A 20-minute walk to the MRT station can be halved to 10 minutes, or sometimes even less, when you get on a bicycle. The ever-rising number of park connectors helps with this too. And once you move 20+ minutes from the MRT station on foot, you’ll find properties start to get quite a lot cheaper.

- On a similar note, check the bus routes more carefully. My favourite example of this is Normanton Park. It looks far from any MRT station on the map – but I frequented this area very often, and it’s absurdly easy to get from Normanton Park to Fusionopolis; just take a bus from outside the condo. You’ll be at the One-North MRT station, along with a supermarket, restaurants, offices, etc. in minutes.

- Pick the cheaper bank loan even if it has a longer lock-in period. Sounds crazy right? But here’s the thing: if you’re not the sort who likes checking on interest rates and refinancing, talking to mortgage brokers, etc. then the lock-in isn’t really a drawback, since you don’t intend to refinance for a long time anyway. Also, as some mortgage brokers will tell you, interest rates seem unlikely to dip significantly in the near future, as they’ve just come out from historical lows for almost a decade.

- Buy the unit that doesn’t have the best view. If you’re the sort who mainly keeps your curtains drawn, or you work in the office and only come home when it’s all dark, is it really worth paying the premium for a greenery view? The premium might be enough to pay a few months of your mortgage or get a bigger space.

Meanwhile in other property news…

More from Stacked

New Central Condos Cheaper Than City Fringe Ones In 2022? Here Are 4 Simple Reasons Why

The CCR has long maintained a reputation as Singapore’s prime region, where one finds the most luxurious – and pricey…

- Need a spacious three-bedder (above 1,700 sq.ft.) for under $2 million? Here’s where to start looking.

- Should you buy a new or resale one-bedder, if your main concern is gains? We took a look at the numbers.

- Subsale offers can be tempting, but do you really make more if you sell your condo unit before it’s built? Here’s the reality of it.

- So all you need is the smallest and most affordable private home? Here are some of your options, and as a bonus, they’re freehold too (but beware, some are truly tiny).

Weekly Sales Roundup (08 July – 14 July)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MIDTOWN MODERN | $6,638,000 | 1808 | $3,671 | 99 yrs (2019) |

| THE RESERVE RESIDENCES | $4,257,171 | 1625 | $2,619 | 99 yrs (2021) |

| THE REEF AT KING’S DOCK | $3,709,000 | 1346 | $2,757 | 99 yrs (2021) |

| THE CONTINUUM | $3,572,000 | 1249 | $2,861 | FH |

| TEMBUSU GRAND | $3,506,000 | 1432 | $2,449 | 99 yrs (2022) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SORA | $1,230,000 | 538 | $2,285 | 99 yrs |

| THE MYST | $1,234,000 | 517 | $2,388 | 99 yrs (2023) |

| THE LAKEGARDEN RESIDENCES | $1,261,300 | 527 | $2,391 | 99 yrs (2023) |

| TEMBUSU GRAND | $1,360,000 | 527 | $2,579 | 99 yrs (2022) |

| GEMS VILLE | $1,473,120 | 797 | $1,849 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| URBAN RESORT CONDOMINIUM | $6,280,000 | 2551 | $2,462 | FH |

| AALTO | $6,150,000 | 2443 | $2,517 | FH |

| PARVIS | $5,000,000 | 2013 | $2,484 | FH |

| THE SEAFRONT ON MEYER | $4,700,000 | 2099 | $2,239 | FH |

| TRILIGHT | $4,680,000 | 2110 | $2,218 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SUITES@ KATONG | $680,000 | 388 | $1,755 | FH |

| HILLION RESIDENCES | $800,000 | 463 | $1,728 | 99 yrs (2013) |

| RIVER ISLES | $810,000 | 517 | $1,568 | 99 yrs (2012) |

| BOTANIQUE AT BARTLEY | $868,000 | 517 | $1,680 | 99 yrs (2014) |

| MELVILLE PARK | $870,000 | 958 | $908 | 99 yrs (1992) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| PARVIS | $5,000,000 | 2013 | $2,484 | $2,015,000 | 15 Years |

| AALTO | $6,150,000 | 2443 | $2,517 | $1,986,000 | 14 Years |

| KENSINGTON PARK CONDOMINIUM | $2,650,000 | 1658 | $1,599 | $1,850,000 | 21 Years |

| THE WINDSOR | $2,400,000 | 1625 | $1,477 | $1,740,000 | 26 Years |

| VIVA | $4,050,000 | 1528 | $2,650 | $1,690,200 | 15 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ORCHARD SCOTTS | $3,900,000 | 2497 | $1,562 | -$1,643,340 | 15 Years |

| URBAN RESORT CONDOMINIUM | $6,280,000 | 2551 | $2,462 | -$1,360,300 | 13 Years |

| THE ASANA | $1,165,000 | 506 | $2,303 | -$198,864 | 7 Years |

| V ON SHENTON | $1,980,000 | 958 | $2,067 | -$44,700 | 9 Years |

| PINETREE HILL | $1,769,000 | 764 | $2,315 | $28,000 | 1 Year |

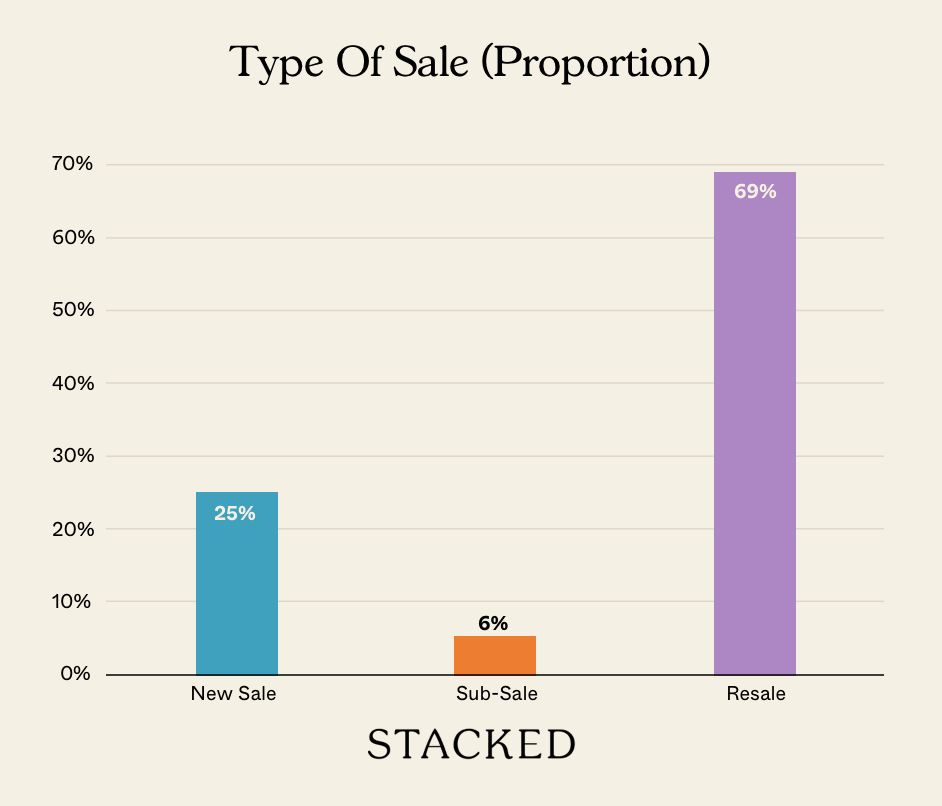

Transaction Breakdown

Follow us on Stacked for more news on the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How can some Singaporeans save money when buying resale flats?

Why do some homeowners choose not to renovate their flats in Singapore?

What are the different attitudes towards flats among Singaporeans?

Are there cost-saving tips for buying property in Singapore?

What should I consider when choosing a property based on views or location?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

0 Comments