Treasure at Tampines Pricing Review: How Its Prices Compare to D18, OCR, and the Wider Market

August 26, 2025

A pricing review of Treasure at Tampines has some challenges; the main one being scale. As of 2025, Treasure at Tampines is the single largest condo project in Singapore with 2,203 units. At this size, it’s really more akin to a micro-town or estate than a typical condo project. That also means a more varied profile of owners, which can range from pure owner-occupiers to entry-level investors to multi-generational families. This can all impact buying and selling behaviour, and the ultimate price point.

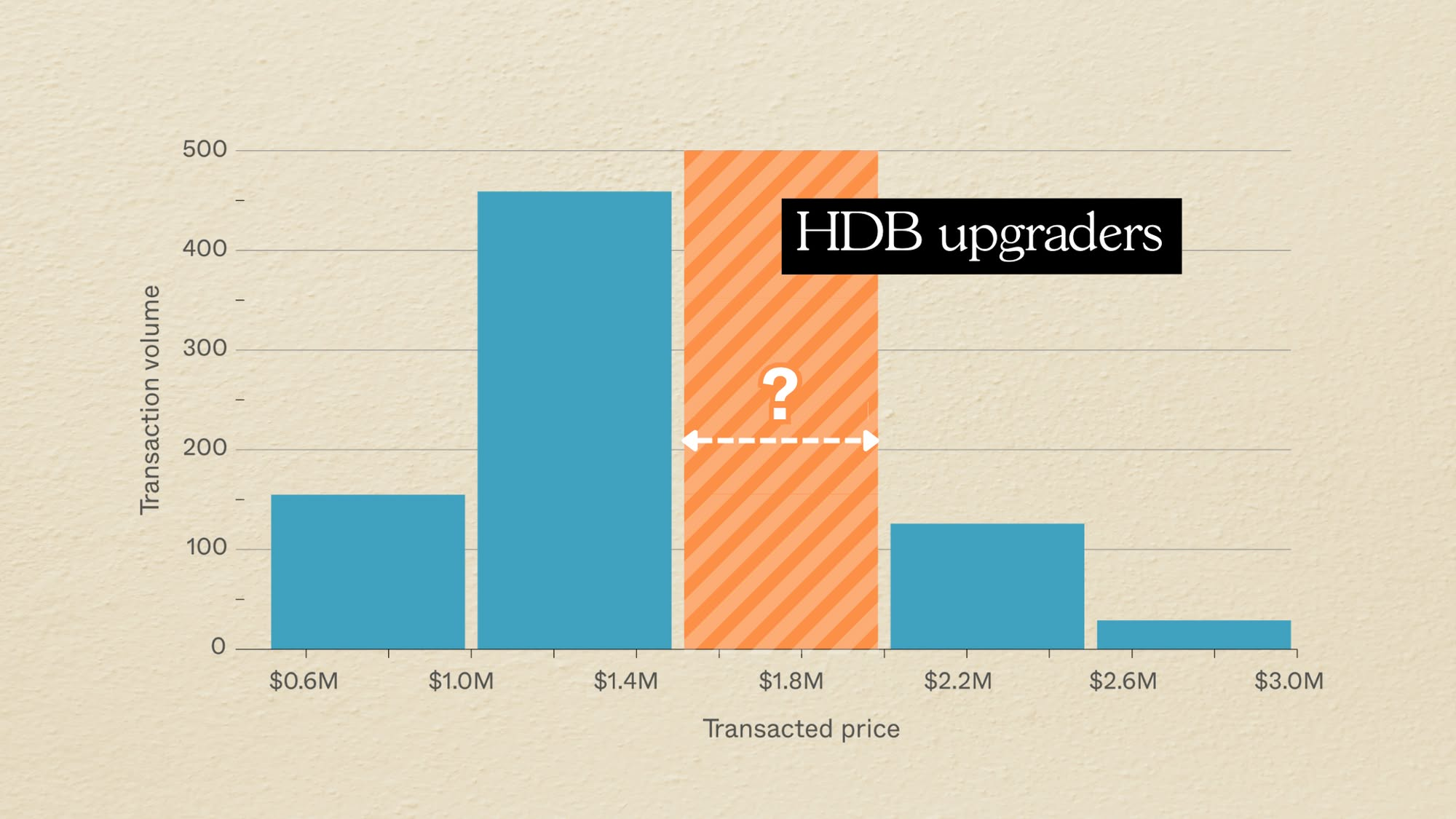

Nonetheless, Treasure at Tampines has always been known for being competitively priced; this was part of the sales pitch since even before the launch day. Now on the resale market, it’s one of the few projects where a three-bedder can be had for below $1.7 million; an increasingly rare possibility in 2025.

But does being cheaper necessarily mean better value? Let’s take a closer look at the numbers:

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Investment Insights Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments