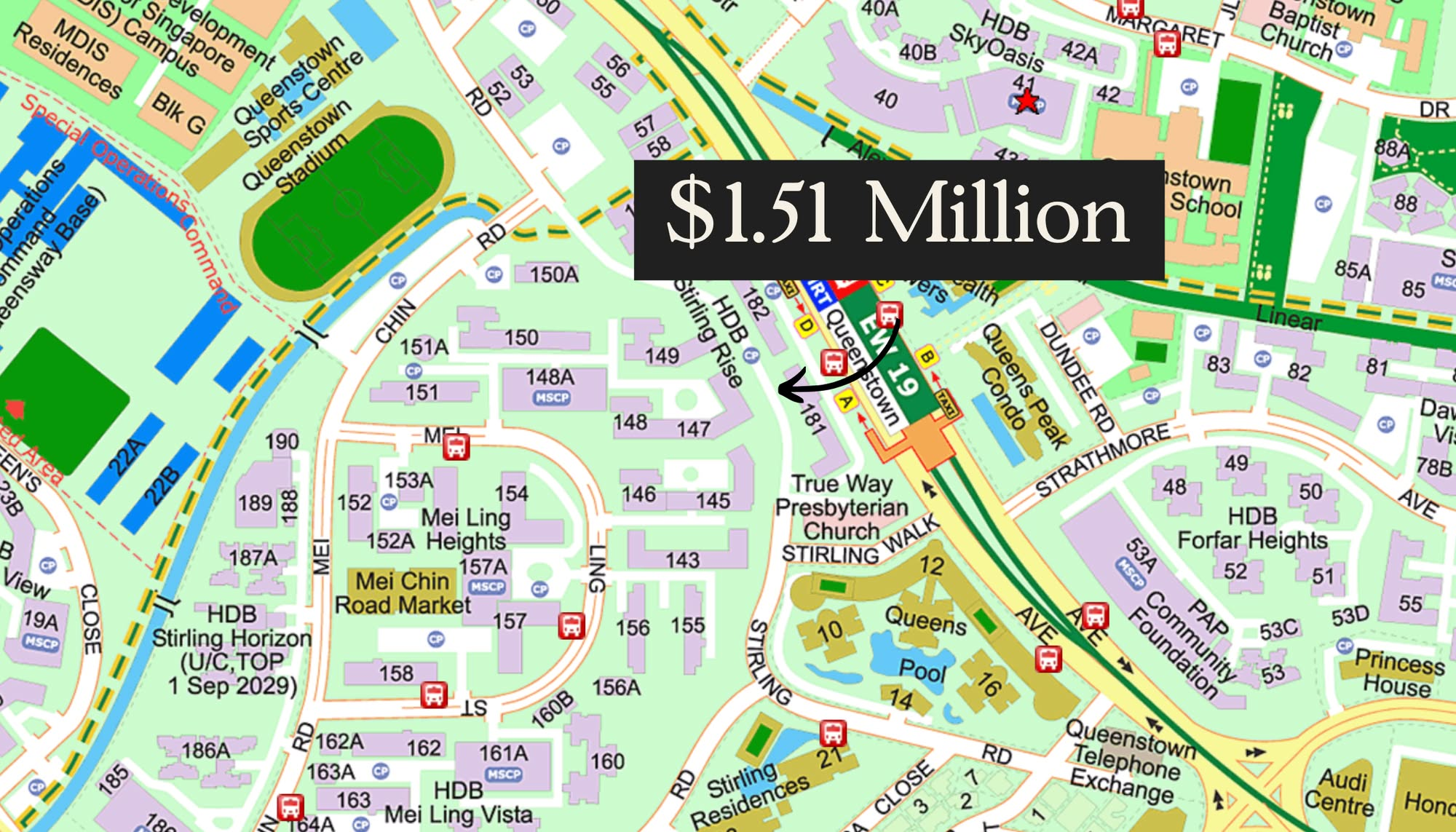

This Rare HDB Maisonette In Queenstown Just Set A $1.51M Record: Here’s Why

May 21, 2025

Another day, another million-dollar HDB transaction. Except this one deserves a closer look.

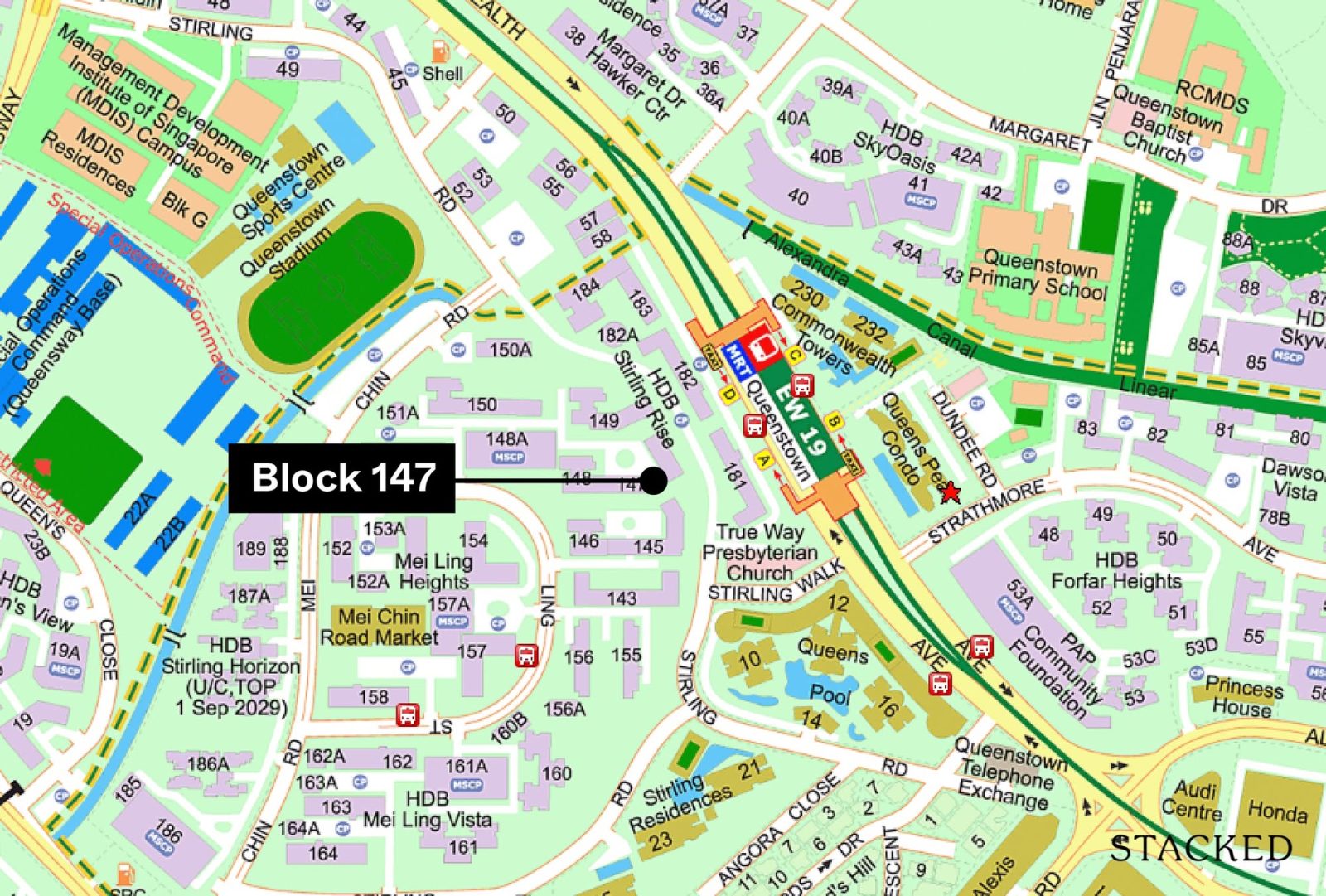

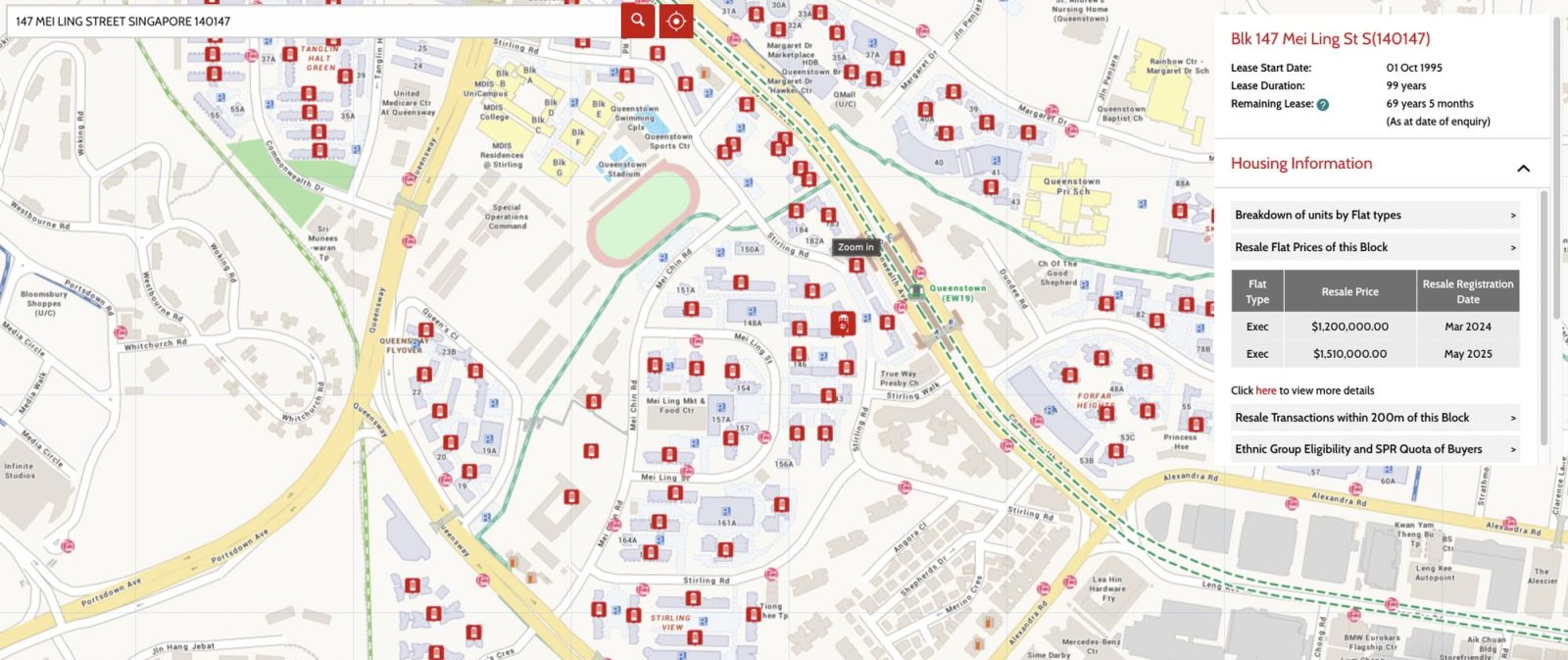

In May 2025, a 146 sqm executive maisonette at Block 147 Mei Ling Street changed hands for $1.51 million, becoming the most expensive executive flat in Singapore to date.

When an HDB flat approaches private property prices, the obvious question is: what makes it worth that much? Is the buyer overpaying, or is there something special about this particular unit?

After examining the details, there are several factors that explain this premium price tag. Here’s why this maisonette stands out in Singapore’s competitive property market:

1. It’s A Rare Executive Maisonette In An Even Rarer Location

Executive maisonettes were discontinued decades ago, making this spacious two-storey flat an increasingly coveted rarity.

But what’s even more significant: only 356 Executive flats have ever been sold in Queenstown. Compare that to estates like Bukit Batok (2,734), Pasir Ris (7,460), or Jurong West (6,508), and you can see why this is such an extreme outlier in one of Singapore’s most central towns.

2. Location: Prime Connectivity With Lifestyle Benefits

Situated along Mei Ling Street, this spot is quite unique for a centrally located home. It’s practically next door to Queenstown MRT station and within walking distance of the Alexandra Park Connector and the Rail Corridor. But perhaps more importantly, it’s one of the rare spots where it doesn’t feel overcrowded, despite its convenient location.

The newly-opened Margaret Drive Hawker Centre is just a 5-minute walk away, and residents enjoy easy access to the amenities at SkyResidence, SkyOasis and SkyVille@Dawson. Even Mei Chin Road Market is just next door.

3. This Isn’t A One-Off Price Spike

Before you dismiss this as a fluke, consider the price trajectory in this cluster. Another Executive flat in the same area, at Block 148 (levels 19-21), was transacted for $1.35 million in November 2024.

The next most expensive sale was at Block 150 for $1.32 million in May 2025. This suggests we’re looking at a consistent valuation pattern rather than a random outlier.

4. Compared To Private Options? Still A Million Dollars Cheaper

As with most million-dollar HDB flats at this price point, it’s not so much the competition of resale HDBs, as it is with the price gap when compared to private property in the area. This is a crucial distinction that’s often missed in discussions about “expensive” HDB flats.

When buyers are shopping in the $1.5 million range, they’re typically weighing options across different property types. They’re not deciding between this executive maisonette and a regular 5-room HDB elsewhere, they’re most likely comparing it to entry-level private condos in the same area. The relevant question becomes: “What’s the premium I’m paying for condo facilities, and is it worth it?”

More from Stacked

What The Future Of Singapore Real Estate Could Look Like: 6 Exciting Predictions

Let’s imagine for a second that you are in art class and the teacher gave you this description to create:

Let’s put this price in perspective with nearby private developments:

A similar-sized unit at Queens (a 99-year leasehold condo completed in 2002) goes for around $1.98 million with just 72 years left on the lease—only 3 years more than this HDB’s remaining 69 years.

Move up to Commonwealth Towers or The Anchorage, and you’re looking at prices between $2.9 million to $3.2 million for similar sizes, though these are either newer or freehold properties.

For buyers prioritising space and location over facilities, even at a record price, this maisonette offers a comparative value at nearly $1 million less than comparable private options.

5. Schools Aren’t The Draw Here

Interestingly, despite the premium price, school proximity isn’t driving this valuation. There are only two primary schools within 1KM, and neither is particularly sought-after.

This suggests the record price is primarily driven by the unit’s size, central location, and inherent scarcity rather than the typical school-zone premium we see in other million-dollar flat transactions.

What This Means For The Market: When HDBs Compete With Condos

This transaction highlights an emerging trend in Singapore’s property landscape: as certain HDB types become increasingly rare and buyers grow more space-conscious, large-format HDBs in prime areas are evolving into luxury alternatives to condos.

They may not come with swimming pools or 24-hour security, but when you consider the value equation of floor space, MRT proximity, and the unique appeal of a two-storey layout in Singapore’s increasingly gentrified central regions, the appeal becomes clear.

And with fewer than 400 Executive units ever sold in Queenstown, $1.5 million might just be the new norm for these unicorn properties, not the exception.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did this HDB maisonette in Queenstown sell for a record price of $1.51 million?

What makes this executive maisonette in Queenstown so unique compared to other HDB flats?

How does the price of this HDB flat compare to private condos nearby?

Is the high price of this flat driven by nearby schools?

Does this transaction indicate a trend of HDB flats becoming luxury options?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

0 Comments