This Man Created A Nice Community Corner In An HDB Void Deck, And It Was Shut Down. Why?

August 13, 2023

HDB projects becoming the “elevator music” of residential properties.

You know the type of songs: you hear them playing in lifts, or call-waiting devices, or on any album by a boy band between 1990 to 2010.

Music that’s pleasant, inoffensive, and oh-so forgettable. It’s manufactured music: built to appease the widest range of potential audiences, with high production quality but little distinct personality.

And to some extent, that’s beginning to be the way I feel about HDB flats.

Take, for instance, this Yew Tee recreation area, where someone bothered to bring in furniture and recreate kampung vibes. It’s something organic and spontaneous; a meeting place for residents, which happened without deliberate town council engineering. And as we’d expect, orders have come to clear it all away.

Probably not to remove the gathering spot mind you, but maybe to rebuild it in a way that meets the authorities’ approval or designs.

This is exactly the opposite of what I last wrote about some of the void decks in Holland where there was a mini-library with donated books for residents to peruse for free. It’s sad to see creativity or natural community-building actions such as this get shut down so quickly just because of one person who had complained.

Now I’m not totally against this: I get why it happens.

A certain degree of standardisation and regulation is important. Whilst I’m not a lawyer, I would guess someone in a position of authority has thought something like:

“What if some kid falls head-first off that swing? What if someone gets cut on a rusty, tetanus-ridden piece of old furniture? Who’s liable? OH MY GOD IS IT US? IT’S GOING TO BE US.”

On that level, I understand why we need to clear out self-made resident corners or peel gold foil off HDB stairs.

And I admit aesthetics are also a concern, as most people like clean, uniform appearances.

(I don’t, because I associate uniformity with sterility, hospitals, and passport offices. I like graffiti, and flickering neon lights, and urban grime. But again, I gather HDB must focus on the most universal – and hence most basic – of appearances.)

But I always fear we’ll tilt too far into the generic, and become a faceless urban horror of sameness

When I was growing up (a term I’m now old enough to use for credibility), HDB towns were more like different kampungs. They had rather distinct identities. Bedok always seemed to have the most aggressive caroms players. Eunos seems to have had the most linguistic talent*. Tiong Bahru was practically a Shao Lin temple of different martial arts groups.

Today, most of these distinctions have faded into a sea of increasingly quiet void decks, NTUC and Sheng Siong outlets, and coffee shops where even the food is predictable.

(For those of you readers who keep asking me why I insist on telling you where the nearest NTUC or Sheng Siong is, it’s sometimes the only interesting factor I can find, okay! There, now you know the horrible truth).

So while I understand the need for uniform standards, and the need for housing to – as it were – serve the interests of the majority, I also fear that one day we’ll go too far. That we’ll come to a point where one neighbourhood melts into another, in a sea of identical blocks, and create a cityscape like that Backrooms creepypasta.

I hope it never fully comes to that.

*In 1980s Eunos, you could hear Malay residents ordering food in Hokkien, Chinese residents pronouncing Indian foods correctly, and Indian residents successfully mediating in arguments with three different dialects involved.

More from Stacked

The Effect Of Trump’s Policies On Singapore Property: What Could Happen This Time?

The US seems to be undergoing a volatile time, and it’s just the start of their current President’s (the Trump…

Meanwhile, in other more serious property news:

- MASSIVE condo units above 1,700 sq. ft., but still priced at $2 million or below! Yes, they exist, we found some.

- Or maybe location is what you care about? Here are some three-bedders in the CCR, at $1.9 million or below.

- Check out 26 upcoming new launch condos in Singapore, one of which will be our tallest yet.

- For those seeking good resale flats, a whole slew of new units may become available soon. Heres’ where the next batch of flats to reach MOP are likely to appear.

Weekly Sales Roundup (31 July – 06 August)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ONE PEARL BANK | $7,888,000 | 2788 | $2,829 | 99 yrs (2019) |

| THE RESERVE RESIDENCES | $5,690,353 | 2250 | $2,529 | 99 yrs (2021) |

| LIV @ MB | $3,889,000 | 1518 | $2,562 | 99 yrs (2021) |

| THE LAKEGARDEN RESIDENCES | $3,554,000 | 1550 | $2,293 | 99 yrs leasehold |

| ONE BERNAM | $3,510,000 | 1421 | $2,470 | 99 yrs (2019) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE LAKEGARDEN RESIDENCES | $1,040,600 | 484 | $2,148 | 99 yrs leasehold |

| LENTOR HILLS RESIDENCES | $1,088,000 | 484 | $2,246 | 99 yrs (2022) |

| THE MYST | $1,187,000 | 484 | $2,451 | 99 yrs (2023) |

| GRAND DUNMAN | $1,251,000 | 452 | $2,767 | 99 yrs (2022) |

| THE ATELIER | $1,498,000 | 549 | $2,729 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| 3 ORCHARD BY-THE-PARK | $11,000,000 | 2831 | $3,886 | FH |

| CAPE ROYALE | $5,802,000 | 2508 | $2,313 | 99 yrs (2008) |

| EQUATORIAL APARTMENTS | $4,550,000 | 2497 | $1,822 | FH |

| CAIRNHILL CREST | $4,325,000 | 2013 | $2,149 | FH |

| MAPLE WOODS | $3,750,000 | 1787 | $2,099 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PARK RESIDENCES KOVAN | $640,000 | 355 | $1,802 | FH |

| CARDIFF RESIDENCE | $660,000 | 431 | $1,533 | 99 yrs (2011) |

| LOFT @ RANGOON | $686,000 | 409 | $1,677 | FH |

| KINGSFORD WATERBAY | $695,000 | 484 | $1,435 | 99 yrs (2014) |

| PARC IMPERIAL | $700,000 | 366 | $1,913 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| EQUATORIAL APARTMENTS | $4,550,000 | 2497 | $1,822 | $3,412,000 | 20 Years |

| ASTRIDVILLE | $3,600,000 | 2217 | $1,624 | $1,850,000 | 17 Years |

| THOMSON 800 | $2,850,000 | 1625 | $1,753 | $1,718,600 | 25 Years |

| DUCHESS CREST | $3,588,800 | 2088 | $1,719 | $1,592,200 | 27 Years |

| MAPLE WOODS | $3,750,000 | 1787 | $2,099 | $1,410,000 | 12 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| BLISS LOFT | $1,000,000 | 807 | $1,239 | -$30,000 | 11 Years |

| MOUNT SOPHIA SUITES | $912,000 | 560 | $1,629 | -$28,000 | 13 Years |

| MULBERRY TREE | $1,050,000 | 635 | $1,653 | $47,000 | 6 Years |

| NESS | $790,000 | 570 | $1,385 | $51,800 | 11 Years |

| MY MANHATTAN | $1,300,000 | 1076 | $1,208 | $54,542 | 11 Years |

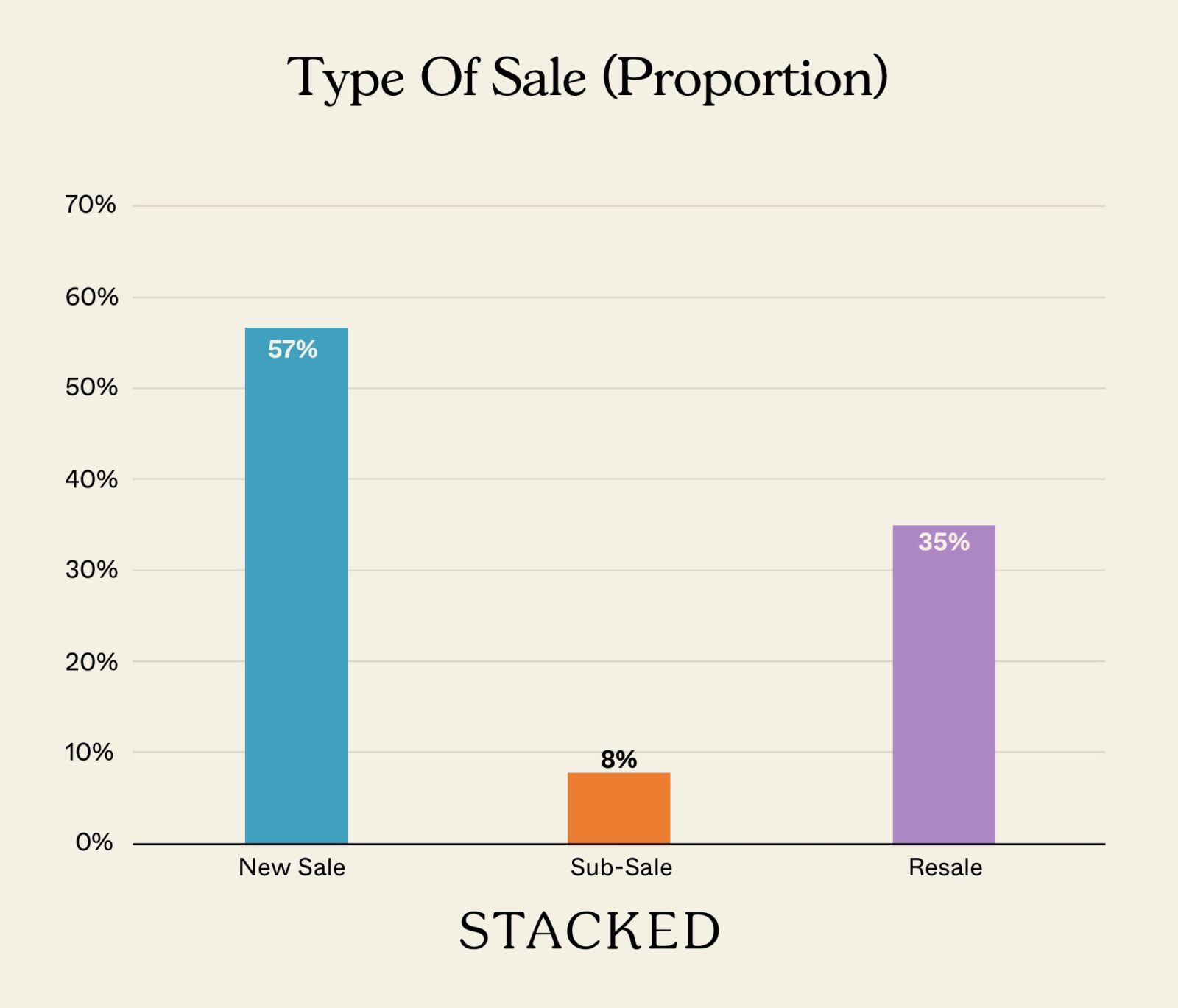

Transaction Breakdown

Some interesting links this week:

- Propnex survey says that 56 per cent of respondents do not intend to defer buying a property in 2023

Here are some of the more interesting responses:

Nearly 6 in 10 respondents do not plan to defer property purchase this year despite new cooling measures and market uncertainties

- Majority of those polled do not expect overall home prices to fall in 2023

- Buyers remain price conscious with pricing sweet-spot predominantly at $1 million to $1.5 million

- District 15 emerged as the most preferred location; the ideal unit size favoured by respondents ranges from 800 sq ft to 1,200 sq ft

- Most respondents value eco-friendly features at home but are unwilling to pay much price premium for them

Here’s my problem with such surveys and looking at this information: these more than 450 respondents, were they surveyed before or after the Propnex Masterclass? Because naturally, that would have an effect on how these people felt about the property market based on how the agency has “briefed” these people.

Second, I guess we do have to take it with a pinch of salt from a survey done by a property agency that essentially makes money from buying and selling property. Would it not have been much better to use an independent surveyor?

Well… those are just some of my personal thoughts on the survey. What do you think, do you expect overall home prices to fall in 2023?

For more information on the Singapore property market, and reviews of new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why was the community corner in the HDB void deck shut down?

Is it common for community spaces in HDB estates to be removed or cleared?

What are the reasons behind the regulation of community spaces in HDB flats?

How do community spaces in HDB estates affect neighborhood identity?

What is the balance between regulation and community-building in HDB estates?

Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Singapore Property News Why Housing Took A Back Seat In Budget 2026

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments