This 5-Room HDB in Clementi Just Sold For $1.458M: Here’s What The Seller Could Have Made

August 23, 2025

Every time we think HDB prices might have peaked, another flat sets a new benchmark. This time, it is Clementi’s turn, where a 5-room flat at Clementi Crest has just changed hands for $1.458 million – a new record for the estate.

If you’ve been following million-dollar HDB transactions, you’ll know Clementi has been creeping closer to the top for a while now. The location is convenient, the estate is mature, and resale demand has always been strong. So it’s not shocking here that prices in Clementi are at such levels in 2025.

Nearly $900K in gains for the first owners

This block at 445B Clementi Ave 3 only hit its Minimum Occupation Period (MOP) earlier this year. Back when Clementi Crest first launched, a 5-room flat here would have cost around $576,000. With today’s resale price, the sellers likely walked away with close to $882,888 in gains.

Of course, after accounting for renovation costs, CPF accrued interest, and transaction fees, the final profit would be lower. But whichever way you slice it, that’s an incredible result.

It also comes in $58,888 higher than Clementi’s last record, a nearby 5-room at Block 440C that sold for $1.4 million.

What was special about the flat?

The unit is a standard 5-room “Improved” model, with a size of 113 sqm. It sits on a high floor between the 25th to 27th storey, with a lease that only started in 2021 (so almost the full 99 years remain).

The layout itself is quite typical: three bedrooms, with a small foyer area at the entrance that gives a bit more privacy. The living and dining spaces are kept separate, which is something buyers often appreciate; it feels a little closer to a condo-style setup.

Why did it do so well?

More from Stacked

The Best Condo Rental Yields Near International Schools In Singapore Isn’t Where You’d Expect

If you’re buying a rental asset, this unchallenged nugget of “insight” will be dropped by the seller: it’s near the…

There are a few clear reasons this Clementi Crest flat managed to set a new benchmark:

1. Freshly MOP-ed

Buyers love brand-new resale stock. With the long BTO wait times, flats that just hit MOP attract plenty of interest; you’re basically getting something close to new without waiting five to six years.

2. The Clementi Factor

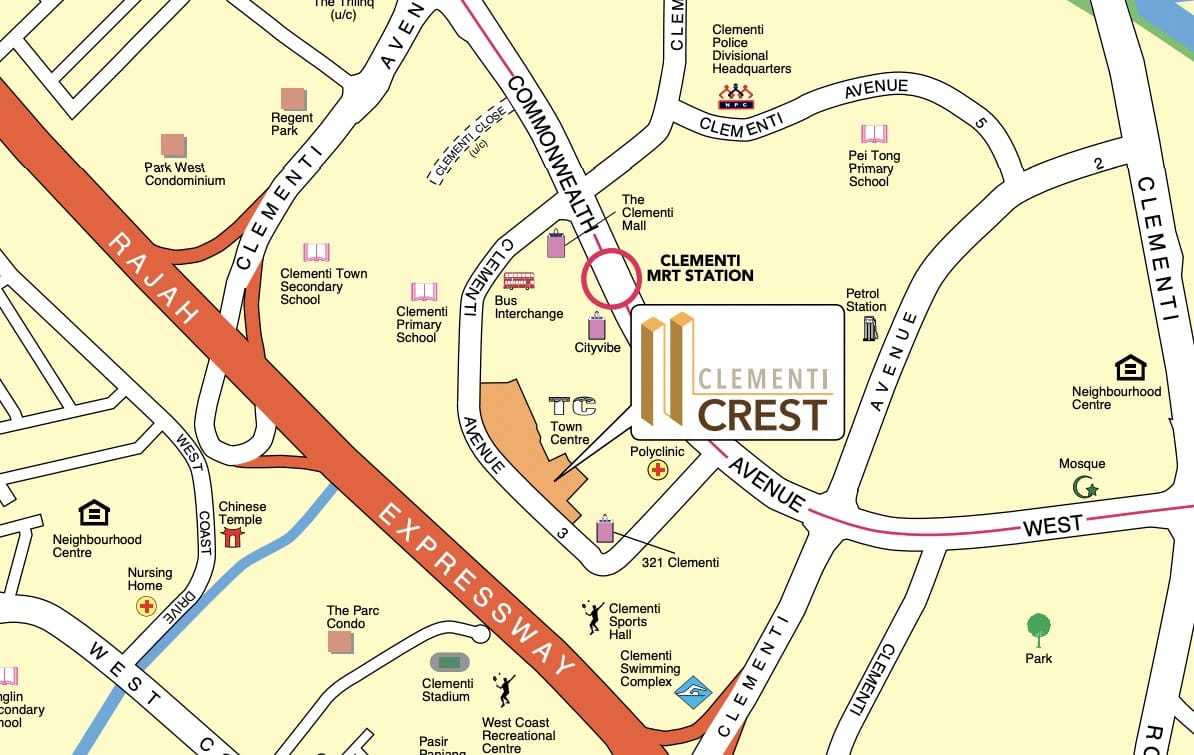

This is a town that ticks almost every box: MRT connectivity, Clementi Mall, plenty of schools, and a well-established neighbourhood vibe. Families and investors alike know what they’re getting here. Here’s a look at where the development is:

3. High Floor Premium

Units on the 25th floor and above always fetch more, and this one has the views to match.

4. Layout That Works

A foyer at the entrance and distinct living/dining zones give it an edge compared to some newer flats, where space feels tighter. For those comparing against condos in the area, the value proposition is clear: similar liveability at a lower quantum.

What’s next for Clementi Crest?

Currently, 5-room flats here are listed at around $1.3M and up. With this new record, expect more ambitious asking prices, especially for high-floor stacks.

And because Clementi Crest has just reached its MOP, this is likely only the start. We can expect more units to come onto the market, and quite possibly, more records to be broken in the months ahead.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What made the Clementi Crest flat sell for a record price?

How much profit did the seller likely make from the sale of the Clementi flat?

Why are high-floor flats in Clementi Crest selling for more?

What factors are driving the recent record-breaking HDB resale prices in Clementi?

What is the outlook for HDB flats in Clementi Crest after this sale?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Singapore Property News You Can Now Buy Part Of A $300M Singapore Bungalow — But You Can’t Live In It

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

0 Comments