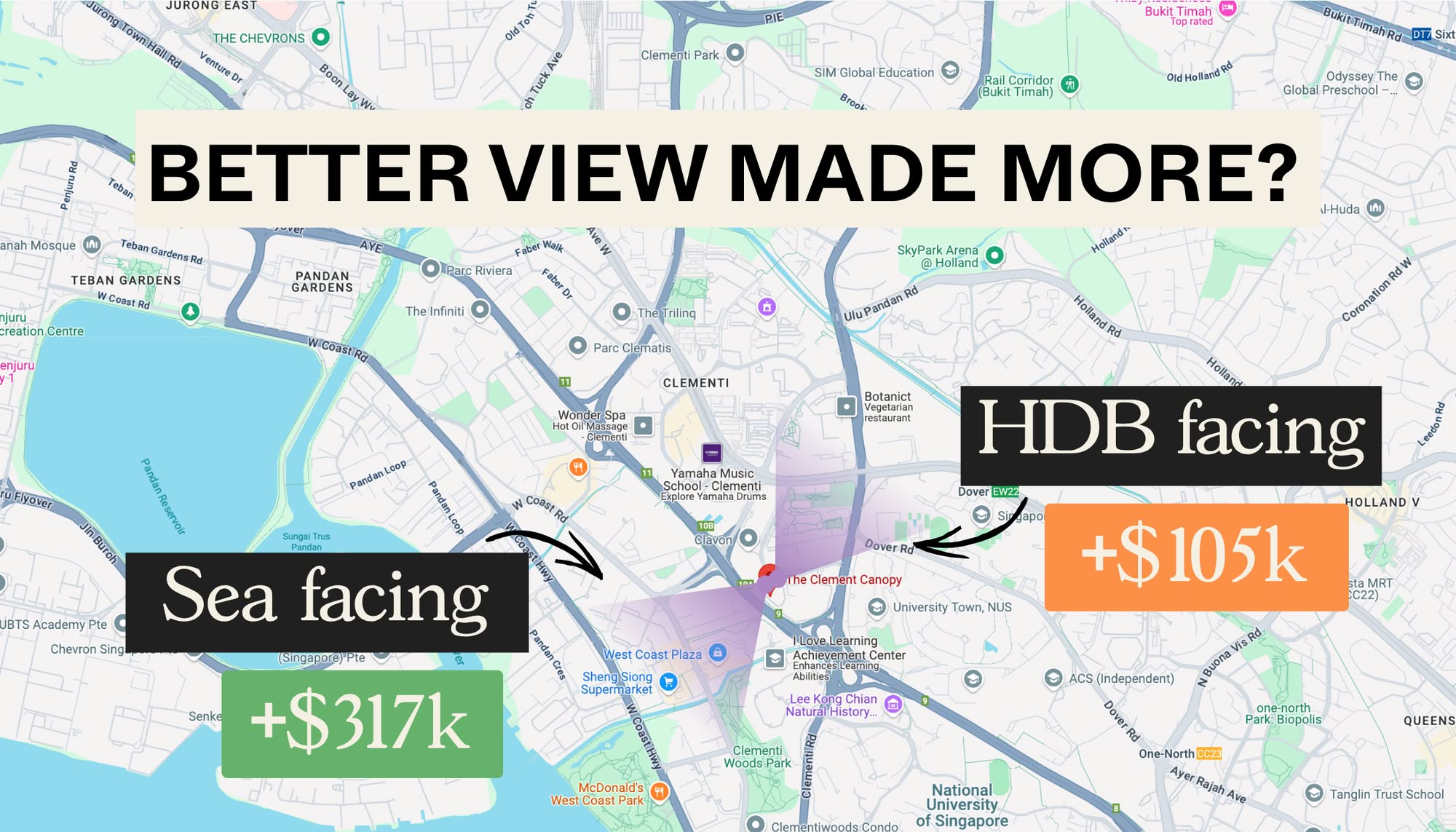

$317K Condo Profit Vs $105K: We Analysed How Views Affected Clement Canopy Resale Gains

May 13, 2025

In this Stacked Pro breakdown:

- We analysed resale outcomes across all 2- to 4-bedroom stacks at The Clement Canopy to see how different facings—sea view vs. Clementi Forest—impacted gains

- Some owners who entered early saw standout gains, while others paid premiums for similar units and earned comparatively smaller profits

- From floor level premiums to layout efficiency and launch timing, we break down the real factors that shaped buyer profits

Already a subscriber? Log in here.

This is part of our ongoing series of case studies, where we look at how different views can affect resale gains and pricing. In this case study, we’re looking at former headline development Clement Canopy, which dominated the news with its gigantic lagoon / pool setup. We’re going to examine how different blocks/stacks facing Clementi Forest versus West Coast Park have impacted gains. Here’s what we found:

Join our Telegram group for instant notifications

Join Now

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

Popular Posts

BTO Reviews

February 2026 BTO Launch Review: Ultimate Guide To Choosing The Best Unit

Editor's Pick

I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Market Commentary

We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights We Compared Lease Decay Across HDB Towns — The Differences Are Significant

February 12, 2026

Property Investment Insights This Singapore Condo Skipped 1-Bedders And Focused On Space — Here’s What Happened 8 Years Later

February 10, 2026

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

February 8, 2026

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

February 5, 2026

Latest Posts

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

February 13, 2026

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

February 13, 2026

On The Market Here Are The Cheapest 4-Room HDB Flats Near An MRT You Can Still Buy From $450K

February 13, 2026

Singapore Property News Why Housing Took A Back Seat In Budget 2026

February 13, 2026

0 Comments