The surest way to raise someone’s blood pressure in Singapore is to say shrinking home sizes don’t matter, because there are fewer of you living under that roof.

I recall this argument surfacing sometime around 2020, when the issue of shrinking HDB flats made the front pages more often.

(As an aside: they shrank the most between the ‘70s and ‘80s, but the size supposedly stayed about the same from ‘00s onward.)

There was no getting around the fact that flats were definitely smaller, so a common argument was that there was still the same amount of square footage per person. In other words, the homes may be smaller, but there are also fewer people living in them, and this carries the suggestion that there is, therefore, no “real” loss in quality of life.

A recent report notes that our household size was 3.0 in 2023/24, down from 3.1 persons in 2018. While the number of Singaporeans and PRs living in flats rose to 3.18 million in 2023 (up from 3.15 million in 2018),

Some other highlights are:

- One-person households have risen to 15.6 per cent, up from 12.6 per cent in 2018 and just 8.4 per cent in 2013.

- Among singles surveyed, 80.3 per cent have no clear plans to marry, but over six in ten intend to move out.

- Of those planning to move, 72.3 per cent prefer to buy their own home.

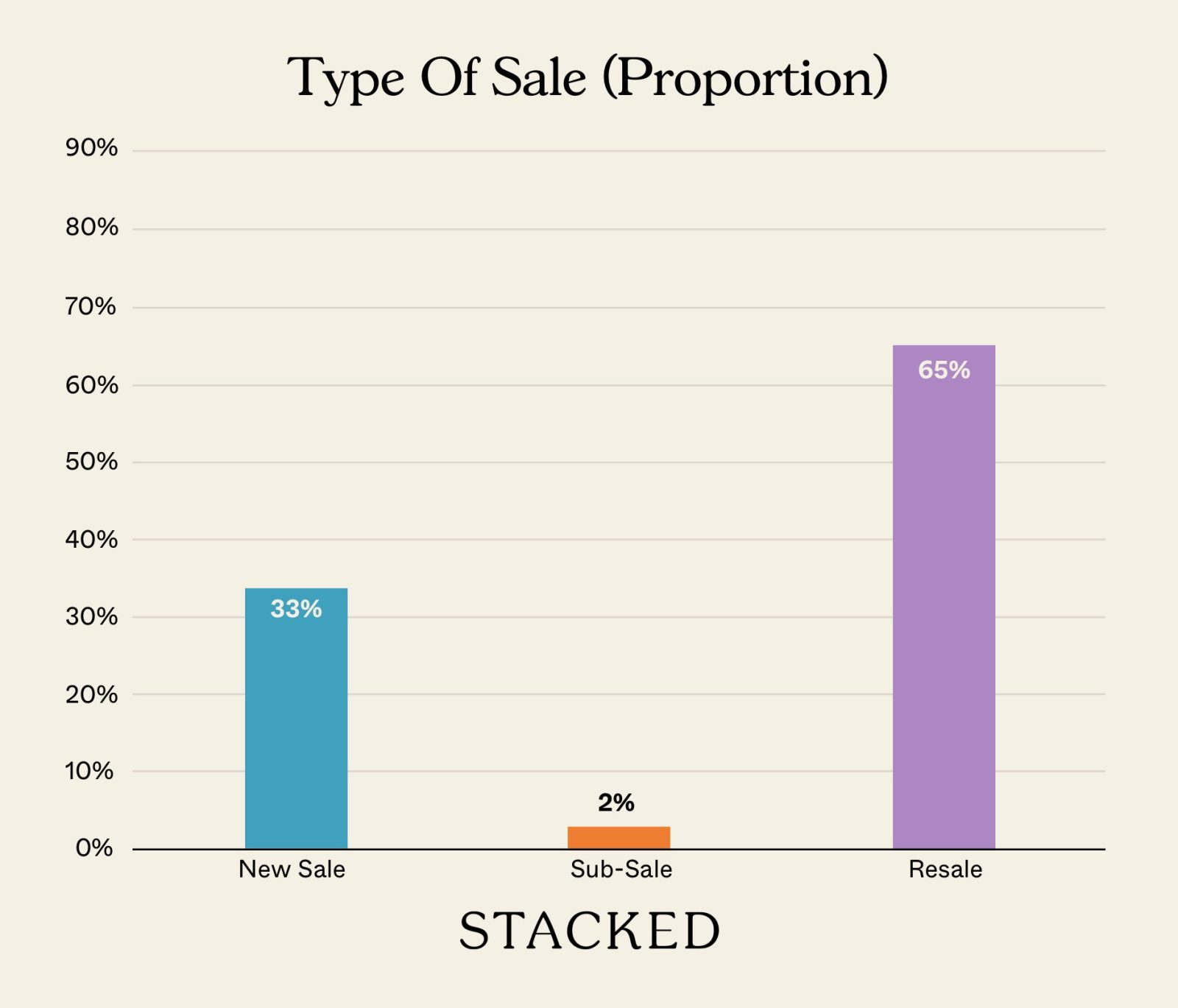

Taken together, this also explains forecasts of rising home prices. I mentioned here how it affects private home prices, as shrinking household sizes plus a rising population fuel the demand for more units. What applies here could just as easily apply to the HDB market, especially resale flats.

But my focus here is not on price, but rather on whether we’ve avoided losing a certain quality of life.

In practice, the need for space doesn’t scale in a linear manner. A household of three does not automatically require 25 per cent less sq ft than a household of four; and a single resident doesn’t utilise ⅓ the spatial intensity in a family of three.

Case in point: even as a single or a couple, there is a huge difference between a functional kitchen and just a small pantry. It’s still preferable to have a living/dining room spacious enough to eat, and not have to do it standing in the kitchen. And there’s a definite psychological side:

Singles working from home often spend more hours in their flat. Couples without children still need a room to close off sometimes, when work spills into evenings (or when living together demands a bit of strategic distance, as long-time partners will understand.)

Spatial constraints feel especially awkward when the couple are both on work calls at the same time, or both have different working and sleeping schedules. A dumbbell layout is efficient, but the living room being between two bedrooms greatly increases the odds you’ll wake someone if you come home at 4 am. Traditional layouts may require more square footage and waste some corridor space, but they’re spared this issue.

Then there’s the issue of age. I’m often told that older people will need less space; this is conventional wisdom.

That’s said by people who have never had to be caretakers, for older family members. Ageing-in-place design requires:

- Wider corridors

- Wheelchair-turning radii

- Space for medical equipment or mobility aids

- Room for a caregiver to assist

A two-person senior household, like a retired couple, can sometimes require more functional space, not less.

Psychologists studying micro-apartment living in dense cities (notably Hong Kong and Seoul) consistently find higher stress, worse sleep, and poorer mental health even among singles living in very small units.

Now I’m not going into a full-blown discussion on sleep quality here, but consider this: when your bed is also your dining table/work station/Playstation and Xbox sofa, you mentally dissociate the place with rest. Quality of sleep can drop sharply if you work where you sleep, eat where you sleep, game where you sleep, etc. There’s just not enough distance from all the stimuli.

More from Stacked

50 New Launches With Remaining Units in 2025 (From $1,654 PSF)

As we reach the end of 2025, it’s fair to say demand is still roaring. The last few new launches,…

We see homes getting smaller at a rather frightening pace

This is definitely true in the private market, where we see more smaller families trying to squeeze into two-bedders. It’s a bit less pronounced in HDB flats where, even if units have shrunk, it’s not quite at the pace we see in many recent condo launches (especially those in prime areas).

But regardless of which market segment you look at, we are normalising smaller and smaller homes. And some of us – or some policy makers – may like to think that because households have shrunk with the units, everything still balances out.

I greatly doubt that.

First, you accept that the dining table has to be smaller. Then you accept that the study is really just a corner of the bedroom. Then you accept that guests can’t stay over, or that both of you can’t be on calls at the same time without someone retreating to the bathroom. Then you accept that ageing parents can’t move in because there isn’t space for mobility aids.

And before long, the question isn’t whether we can live like this but whether we should. So we should reframe our ideas on how much “layout efficiency” can compensate for, and on whether or not we can afford to go even smaller just because of lower household numbers.

Meanwhile in other property news…

- This Stacked reader gave up their condo to their parents, while deciding to live in their parents’ old flat. Unusual? Here’s why.

- Will relaxing the en-bloc requirements for old properties help them, or end up causing more issues? Here’s the rundown.

- There are some rare condos that have almost zero sales in Singapore over 10 whole years. Here’s a look at what’s going on:

- Parc Komo is the amenity hub for its immediate area, and made waves for being freehold at launch. But why has its performance trailed over the years? Find out with our Stacked Pro readers.

Weekly Sales Roundup (6 – 12 December)

Top 5 Most Expensive New Sales (By Project)

| Project Name | Price (S$) | Area (sqft) | $PSF | Tenure |

| 32 Gilstead | 15,000,000 | 4176 | 3,592 | FH |

| Upperhouse at Orchard Boulevard | 7,852,000 | 2056 | 3,819 | 99 yrs (2024) |

| Watten House | 5,063,000 | 1539 | 3,289 | 99 yrs |

| Zyon Grand | 4,713,000 | 1518 | 3,105 | 99 yrs (2024) |

| Nava Grove | 3,514,200 | 1335 | 2,633 | 99 yrs (2024) |

Top 5 Cheapest New Sales (By Project)

| Project Name | Price (S$) | Area (sqft) | $PSF | Tenure |

| The Continuum | 1,338,000 | 560 | 2,390 | FH |

| Novo Place | 1,373,000 | 872 | 1,575 | 99 yrs (2023) |

| River Green | 1,386,000 | 420 | 3,302 | 99 yrs (2024) |

| The Continuum | 1,398,000 | 560 | 2,498 | FH |

| Zyon Grand | 1,521,000 | 474 | 3,211 | 99 yrs (2024) |

Top 5 Most Expensive Resale

| Project Name | Price (S$) | Area (sqft) | $PSF | Tenure |

| Dormer Park | 5,350,000 | 2465 | 2,170 | FH |

| Kopar at Newton | 4,260,000 | 1604 | 2,656 | 99 yrs (2019) |

| Goodwood Gardens | 4,100,000 | 1776 | 2,308 | FH |

| Marina Bay Residences | 3,850,000 | 1636 | 2,353 | 99 yrs (2005) |

| Valley Park | 3,400,000 | 1550 | 2,194 | 999 yrs (1877) |

Top 5 Cheapest Resale

| Project Name | Price (S$) | Area (sqft) | $PSF | Tenure |

| Hedges Park Condominium | 700,000 | 484 | 1,445 | 99 yrs (2010) |

| The Jovell | 715,000 | 527 | 1,356 | 99 yrs (2018) |

| The Alps Residences | 745,000 | 506 | 1,473 | 99 yrs (2015) |

| Kingsford Hillview Peak | 757,000 | 527 | 1,435 | 99 yrs (2012) |

| Riverfront Residences | 810,000 | 517 | 1,568 | 99 yrs (2018) |

Top 5 Biggest Winners

| Project Name | Price (S$) | Area (sqft) | $PSF | Gain ($) | Holding Period |

| Dormer Park | 5,350,000 | 2465 | 2,170 | 3,660,000 | 24 Years |

| The Atria at Meyer | 3,230,000 | 1346 | 2,401 | 2,357,000 | 27 Years |

| The Dairy Farm | 3,350,000 | 2131 | 1,572 | 2,120,000 | 29 Years |

| Tanglin Park | 2,660,000 | 1109 | 2,399 | 1,722,000 | 23 Years |

| Signature Park | 2,320,000 | 1389 | 1,671 | 1,700,000 | 21 Years |

Top 5 Biggest Losers

| Project Name | Price (S$) | Area (sqft) | $PSF | Loss ($) | Holding Period |

| The Greenwich | 818,000 | 603 | 1,357 | -93,330 | 14 Years |

| One Pearl Bank | 953,000 | 431 | 2,213 | -24,000 | 6 Years |

| Kingsford Hillview Peak | 757,000 | 527 | 1,435 | 19,000 | 9 Years |

| RV Residences | 2,000,000 | 861 | 2,323 | 28,780 | 8 Years |

| Katong Regency | 1,138,000 | 570 | 1,995 | 38,000 | 14 Years |

Top 5 Biggest Winners (ROI%)

| Project Name | Price (S$) | Area (sqft) | $PSF | ROI (%) | Holding Period |

| City Square Residences | 1,908,000 | 872 | 2,188 | 279% | 21 Years |

| Signature Park | 2,320,000 | 1389 | 1,671 | 274% | 21 Years |

| The Atria at Meyer | 3,230,000 | 1346 | 2,401 | 270% | 27 Years |

| The Centris | 1,790,000 | 1066 | 1,680 | 227% | 19 Years |

| Dormer Park | 5,350,000 | 2465 | 2,170 | 217% | 24 Years |

Top 5 Biggest Losers (ROI%)

| Project Name | Price (S$) | Area (sqft) | $PSF | ROI (%) | Holding Period |

| The Greenwich | 818,000 | 603 | 1,357 | -10.20% | 14 Years |

| One Pearl Bank | 953,000 | 431 | 2,213 | -2.50% | 6 Years |

| RV Residences | 2,000,000 | 861 | 2,323 | 1.50% | 8 Years |

| Kingsford Hillview Peak | 757,000 | 527 | 1,435 | 2.60% | 9 Years |

| Cairnhill Residences | 2,300,000 | 904 | 2,544 | 2.60% | 13 Years |

Transaction Breakdown

Follow us on Stacked for news and updates on the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How many years are left on the lease of a typical HDB flat?

Does a smaller home mean I’ll have less space to live comfortably?

Why is smaller home size a concern for older people in Singapore?

How does living in a small apartment affect mental health and sleep?

Are smaller homes in Singapore affecting the quality of life?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

1 Comments

Very relevant article with good points.

A friend of mine has to do her conf. calls in her walk-in closet or else on the balcony, if her partner is also on a call (they live in a 400+sq ft studio).

And not enough thought is given to live-in helpers (which almost every family has, and in fact many increasingly have 2 helpers, one to look after elderly members).

In my condo, my neighbour’s helpers (they have 2) usually have their back door open, and they sometimes sit on the door stoop. Their unit is a 4-bedder with private lift, so their back door leads to the walkway where my front door is. When I peek in, I can see there is hardly any space at the back for 2 helpers, and during the day they may sit on a small foot stool. The kitchen does not have any windows as well, so it’s dark at the back – and they leave the back door open to ventilate the kitchen.