Springleaf Residence Sells 870 of 941 Units (92%) At Launch — What’s Driving Demand?

August 17, 2025

The last time we saw new launches move this quickly was earlier this year, with Lyndenwoods (343 units) and more recently, Rivergreen (524 units) both achieving 90 plus per cent on launch weekend. However, Springleaf Residence is notable for its sheer scale: at 941 units, it’s the first mega-development since Emerald of Katong to reach this level of sales absorption.

That scale is important. It’s one thing to clear 300 units in a weekend; it’s another to move nearly 1,000 in a part of Singapore that has never tested launch demand at this volume before.

Who bought what

In just 2 days, 870 units had been sold, leaving just 71 still available (although, as we understand, it was 880 yesterday with 10 bounce out units). The one-bedders, priced from around $860,000 (just eight were ever available), are all gone. The same happened with the two-bedders, where all of the 332 basic and standard layouts were snapped up.

It was a similar story with the three-bedders, where all but 2 of the bigger three-bedder 1,023 sq ft units were left. Smaller families clearly saw value in securing a three-bedroom under the $1.8 million mark, and that has always been the key affordability marker in the OCR.

The larger formats saw steady, if more selective, demand. Out of 138 four-bedders, 130 have been sold, leaving just eight on the board. Even the five-bedders, traditionally the hardest segment to move, held their own. At close to $3 million and above, 32 have already been taken up, which is no small feat given the limited buyer pool at this quantum. Supply here was never vast to begin with, and for families set on a five-bedroom in the OCR, options at this size and price point remain rare.

Conserved units, with their quirks and premiums, have moved unevenly. The two-bedders are all sold out, while the three-bedders still have 12 left.

What the prices reveal

The way pricing was calibrated is really what explains the momentum. The one-bedders were deliberately kept just under the $900,000 threshold.

The two-bedders, priced from around $1.05 million to $1.2 million, were a sweet spot in 2025’s context. It is rare in 2025 to find a brand new condo, minutes from an MRT station, with a two-bedder still hovering close to $1.1 million — and the clean sweep reflects that.

Three-bedders were the next attractive option. Most transactions were under $1.8 million, and that was the magic number that drove families in.

The four-bedders were priced competitively too, mostly between $2.46 million and $2.8 million.

The five-bedders, at 1,453 to 1,475 square feet, started from about $2.97 million and went well past the $3 million mark. This was where demand fell away. For buyers with this budget, Springleaf is still a gamble compared to more proven neighbourhoods, and so the 39 remaining five-bedders are less a sign of weakness than of natural market positioning.

More from Stacked

The Allure Of Older Properties: Who Are Buying These Places?

“LEASE DECAY”, the ad screams, “DID YOU KNOW YOUR HDB VALUE IS $0 IN THE END, OMG”. It’s probably one…

Why did Springleaf Residence sell so quickly?

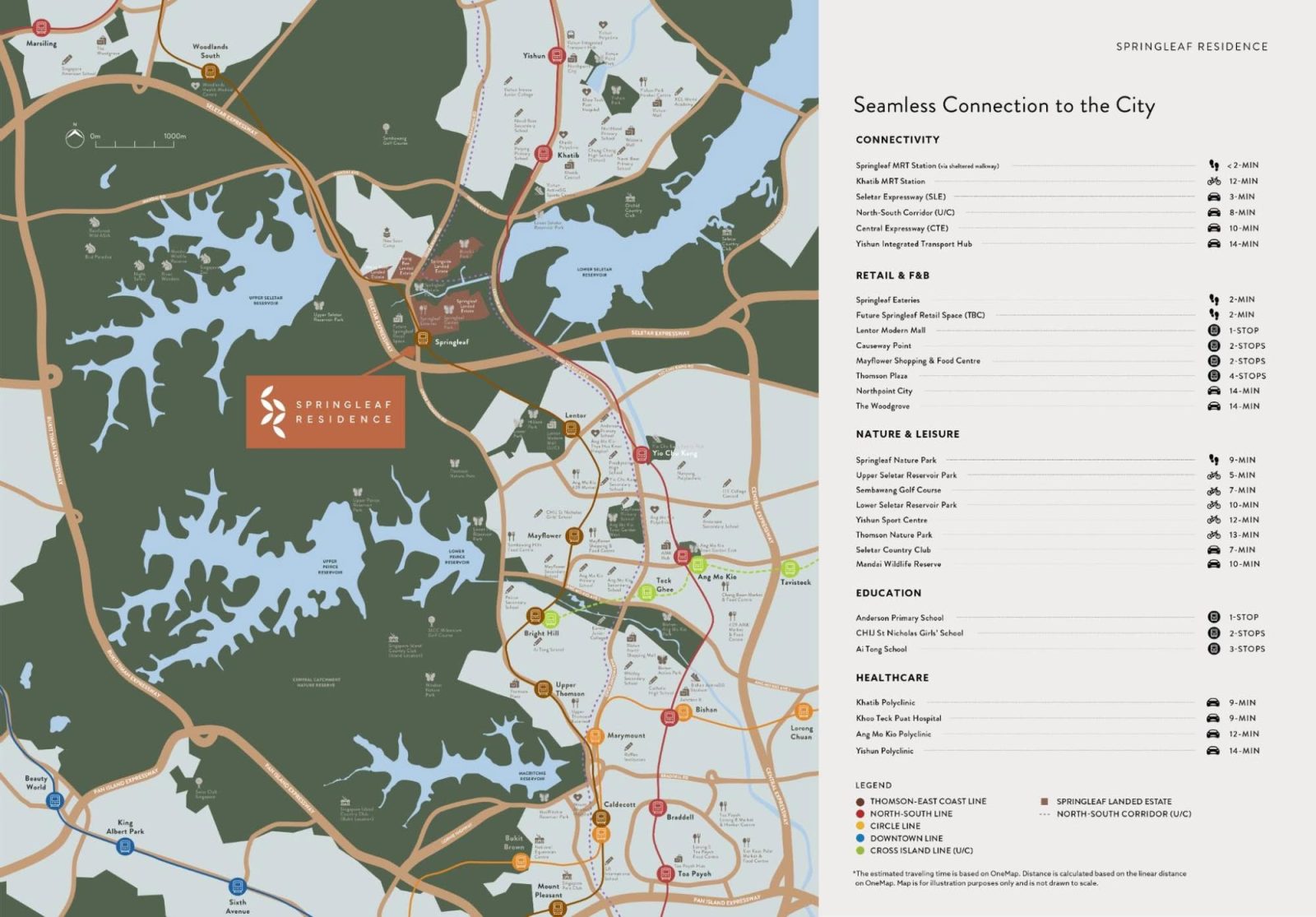

It wasn’t any single factor, but the convergence of several. Entry quantum mattered most: keeping one-bedders below $900,000 and two-bedders under $1.3 million created that attraction. MRT access within two to three minutes gave even expressway-facing stacks a certain resilience, as buyers knew connectivity was secured.

More importantly, GuocoLand resisted the temptation to overplay premiums. Inner-facing stacks came at a justifiable uplift, but not one that pushed them out of reach. This allowed every segment of the market, singles, couples, upgraders, and even families seeking four bedrooms, to find a unit that felt fair for its price.

In any case, from recent past experiences of mega-developments like Emerald of Katong and Chuan Park, Singaporeans love their large projects – and Springleaf Residence was no exception.

What this says about the market (and what comes next)

In 2025, OCR quantum still drives behaviour. 2-bedders around $1.1 million and 3-bedders under $1.8 million are the triggers that move entire categories of buyers.

Springleaf itself, however, remains untested. There is still no primary school within one kilometre, a fact that may not matter at launch but could weigh on resale demand once families start to consider the long-term, if nothing else changes in the area in the future.

Pricing also sets up an interesting comparison. The numbers here are not far off what Lentor Mansion launched at in early 2024, in what many would consider a stronger and more established location. That comparison is likely to cap expectations, with Springleaf’s resale performance tied to how Lentor performs in the next few years.

Beyond Springleaf, some eyes will turn to Canberra Crescent Residences. Buyers who missed out here are likely to spill over, especially as the area continues to build momentum.

For GuocoLand, the sell-through is a decisive win. For buyers, the true test will be whether Springleaf evolves into a lived-in neighbourhood that justifies the confidence of the 92 per cent who bought in.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why did Springleaf Residence sell so many units so quickly?

What types of units sold the fastest at Springleaf Residence?

How did pricing influence the demand for units at Springleaf Residence?

What makes Springleaf Residence different from other recent launches?

Are there any concerns about the long-term demand for Springleaf Residence?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Latest Posts

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

0 Comments