Why Buying Or Refinancing Your Home Makes More Sense In 2026

January 22, 2026

If you’re due to refinance your private home loan this year, or a hopeful HDB upgrader looking to buy a resale condo, initial financial market forecasts point to an exceptionally favourable interest rate environment this year.

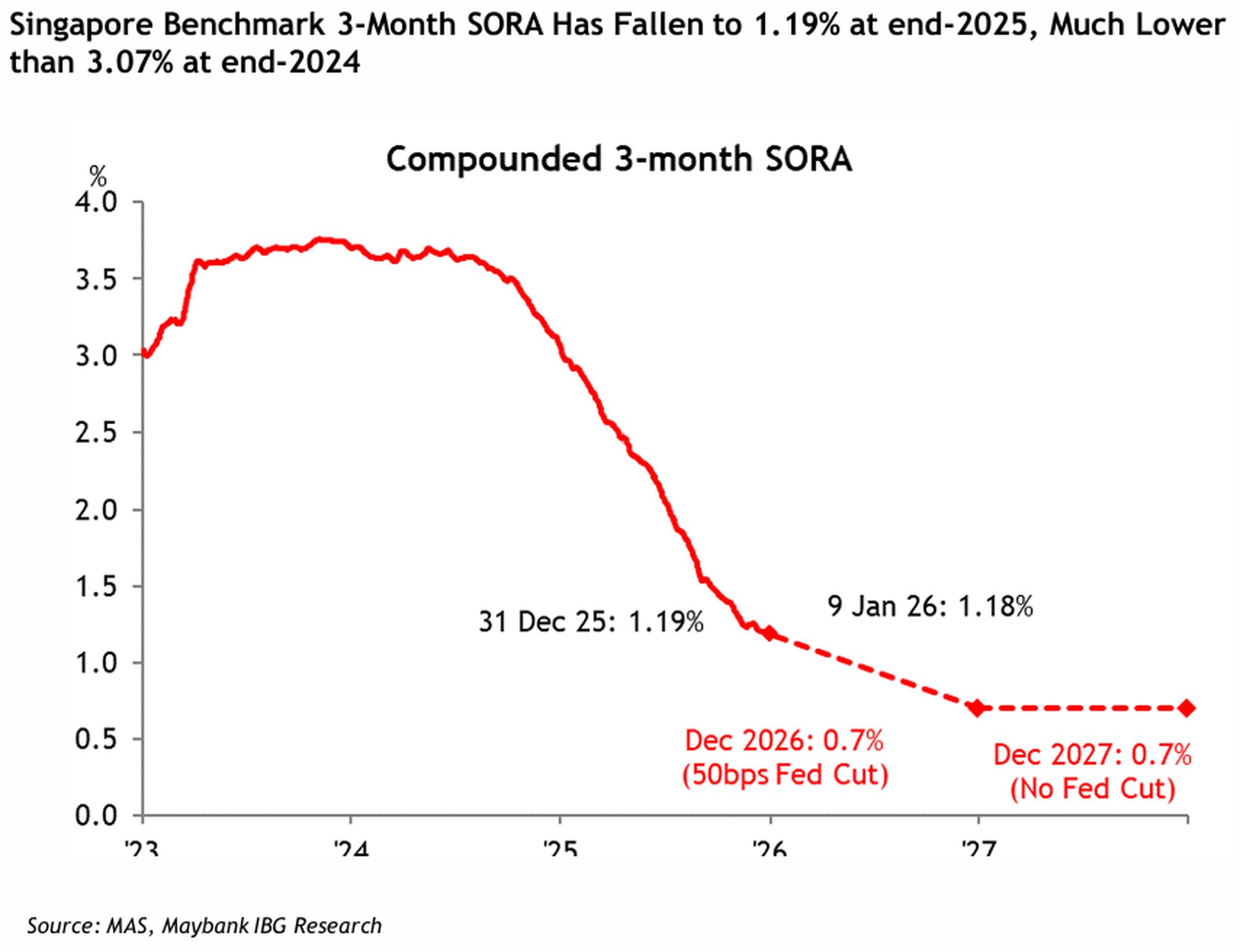

Chua Hak Bin, regional co-head, Macro Research at Maybank Research (Singapore), forecasts that the benchmark three-month Singapore Overnight Rate Average (SORA) could fall to 0.7% by the end of this year.

He was a guest speaker at the BCA-Redas Built Environment and Real Estate Prospects Seminar on Jan 22. The guest of honour was Chee Hong Tat, the Minister for National Development.

The three-month SORA has already slipped significantly since end-2024 when it was about 3.07%. At the close of 2025, the compounded rate had fallen to 1.19%. As of Jan 9, the rate was 1.18%.

The compounded three-month SORA is the key benchmark for most floating-rate home loans in Singapore, and directly influences mortgage interest rates by acting as the base rate before banks add their own margin.

The favourable interest rate will also be welcome news to developers and builders in the real estate market, who are gearing up for a strong growth trajectory in the construction sector over the next three years.

Chua adds that the average mortgage rate among most Singapore banks has fallen below 2% in recent months, as banks here adjust their interest rates in anticipation of further rate cuts by the US Federal Reserve.

In his opening address, the Minister for National Development shared that Singapore’s construction industry is expected to book between $47 to $53 billion in construction projects this year.

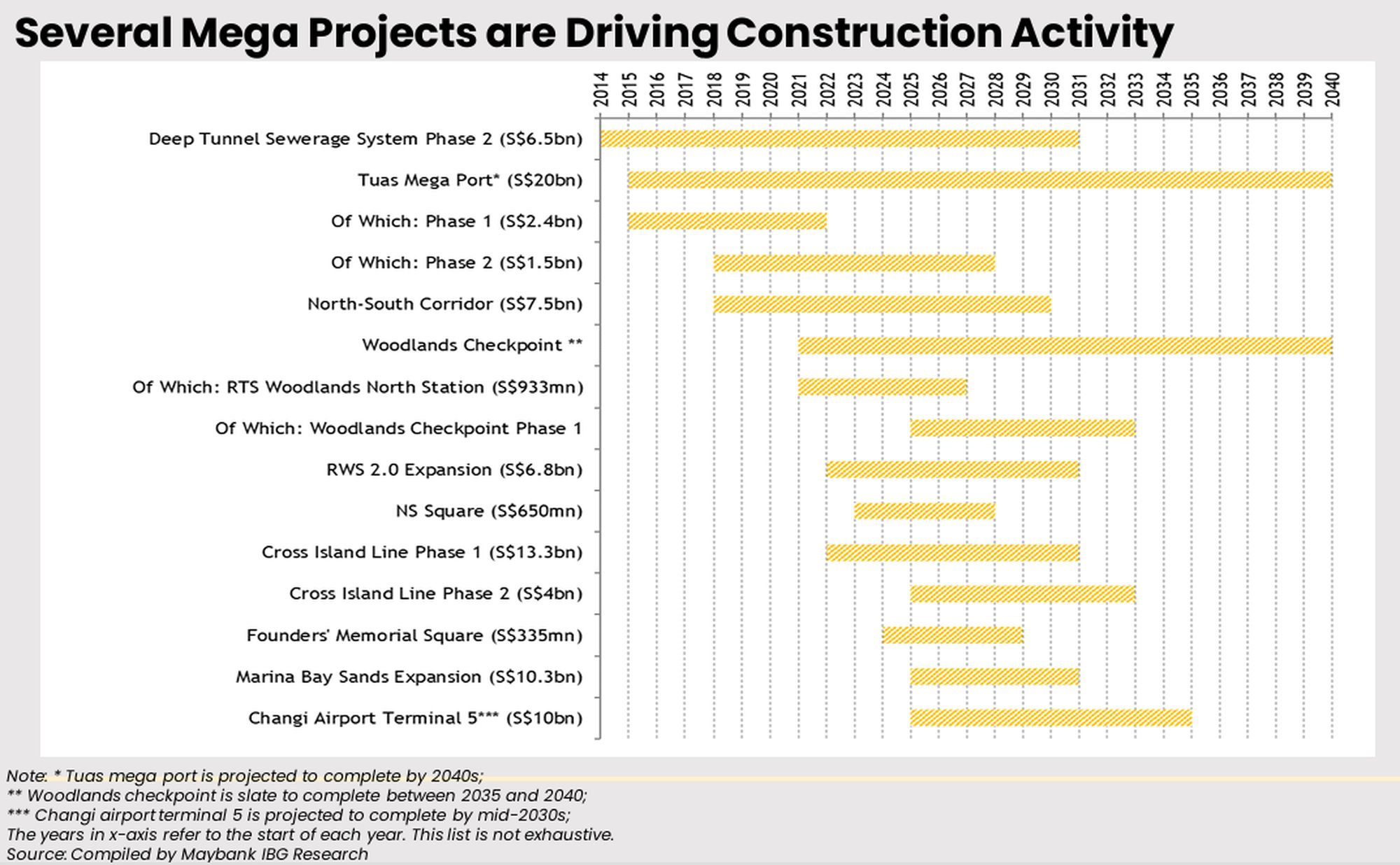

Several mega-projects are driving up construction activity. One of the largest infrastructure projects is the development of the Tuas Mega Port, which has an estimated gross development value of $20 billion. This mega-port project is projected to be completed by the 2040s.

More from Stacked

Year-End Review: Top 10 Most Expensive/Cheapest Property in Singapore 2019

As the year draws to a close, here at Stacked Homes we thought it'd be fitting to end off with…

Other public works contributing to the strong construction demand include the North-South corridor ($7.5 billion), expansion of Resorts World Sentosa ($6.8 billion), the first phase of the Cross Island Line ($13.3 billion), the expansion of Marina Bay Sands ($10.3 billion), and the construction of Changi Airport Terminal 5 ($10 billion).

Besides mega-infrasturcture projects, a steady stream of public housing developments and private residential developments is also in the pipeline. This year, HDB will launch 19,600 BTO flats, and over the next two years, 55,000 new BTO flats will be launched. This is 10% more than the government’s earlier commitment of 50,000 flats.

“If the demand remains strong, HDB has the capacity to further increase the BTO supply, going beyond our 55,000 target from 2025 to 2027,” says Chee.

The swell in available BTO projects that have been launched by the government has contributed to a decrease in the overall median application rates for first-timer families applying for three-room and larger BTO flats. The rate used to be nearly 7 times in 2020 but has fallen to between 1.1 and 1.9 times in 2025.

“Looking ahead, the Government will closely monitor economic and property market conditions, and take necessary actions to ensure a stable and sustainable property market. We also urge potential home-buyers to be prudent and exercise caution, as the global economic outlook remains uncertain and there are dark clouds in the horizon,” says Chee.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Timothy Tay

As Editor-in-Chief of Stacked, Timothy leads the newsroom and shapes our editorial direction, ensuring readers receive timely, thoughtful, and well-researched news and analysis. He brings over eight years of experience as a business and real estate journalist, with a strong track record across both print and digital platforms. His reporting spans luxury residential, commercial real estate, and capital markets, alongside in-depth coverage of sustainability and design.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Latest Posts

Property Market Commentary Singapore’s Tallest HDB Yet: A 60-Storey Project Is Coming To Pearl’s Hill

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments