How Turning 38 Oxley Road Into a Monument Could Affect Property Prices in District 9

November 10, 2025

What happens when a national monument appears too close to your home?

Not a common question, since national monuments aren’t in the habit of creeping up overnight. But this is the interesting consideration that’s less talked about, with regard to 38 Oxley Road.

For those who haven’t heard the news, the government announced on Nov. 3rd that the home of our late founding Prime Minister, Mr Lee Kuan Yew, will be gazetted as a national monument. This modest bungalow, built in 1898, was the setting for many pivotal meetings in the 1950s, and it might be argued that the People’s Action Party (PAP) was in a sense born here.

Whilst I’m aware of the political tussles about the preservation of this place* I think it has interesting implications for real estate too. Gazetting the site as a national monument means it will come under legal protection: once the preservation order is issued, the building can no longer be altered or demolished without approval, and any changes are subject to preservation guidelines.

The government has also indicated it will acquire the property after gazetting under the Land Acquisition Act, and it will eventually be opened to the public as a heritage site. However, all private living spaces will be removed or obscured out of respect for the late Mr. Lee’s wishes for privacy.

*If you want my opinion on whether we should have monuments, my answer is that I prefer to read a book than look at a physical remnant; especially in a land-scarce country. But I accept this shows a barbaric lack of appreciation for history, and that it doesn’t work for everyone.

But what does this mean for nearby properties?

Mr. Lee himself was quite aware of the impact; he wrote in Hard Truths to Keep Singapore Going (2011) that demolishing his house – and changing the planning rules – would raise the land value. He specifically mentioned that neighbouring houses couldn’t be built higher because of his Oxley Road bungalow.

With the government now opting to preserve the site, it strongly signals that those height limits and the area’s low density settings will remain in force. In fact, I’d be surprised if the controls didn’t become even tighter, to maintain the area’s ambience. Without upzoning for taller buildings, no drastic change in land use, etc., we’re not likely to see future redevelopments in the area.

For existing nearby residents who like the low density feel, that’s a big plus. For those hoping to see rising land values and developer offers, it’s the opposite.

Then there’s the issue of any crowds a national monument might bring

When the home was still a purely private residence, the only attention it brought was a curious drive-by every now and again. There wasn’t much to see anyway, as the house is mainly blocked off from public view. This won’t be the same when it becomes a monument open to the public – and I’d point out the late Mr. Lee has his fair share of admirers from abroad, so tourists as well as locals are going to come knocking.

But the road just outside the bungalow is a mere two-lane street that’s already used as a cut-through right now. It’s most definitely not going to accommodate large crowds, or multiple tour buses. And when it comes to crowds that large, noise pollution is a definite risk for the neighbours. It’s the opposite of why people buy landed homes in low-density areas.

There’s also speculation that the government might acquire adjacent properties to expand the heritage site. That doesn’t just mean a bigger national monument with more attention – it could also mean residents further away might also end up being neighbours to said monument. There’s nothing concrete here, but we can see why it might have some existing residents on high alert.

More from Stacked

Are Condos In Singapore With The Number “8” More Prosperous?

In Asia, few numbers are more emblematic of prosperity than the iconic “8.” In Mandarin, “8” (“ba”) sounds similar to…

Is there a benefit to all of this though?

You could argue that having a prestigious national monument close to your home is an intangible benefit. Some might argue the prestige boosts property values, although I haven’t the slightest clue how to measure that.

The only real benefit I’d see is that it will keep the area low-density, although the noise that comes with visitors could negate that benefit. It would seem that, when a national monument does appear nearby, you want to be roughly within the neighbourhood (to bask in the prestige), but also just far enough to avoid the worst of the traffic.

I do feel for the people affected. But at the same time, I’m sure that somewhere in this wide world, someone is living next to Mozart’s house* or something, and they probably have it much worse.

*No. 9 Getreidegasse, 5020 Salzburg, Austria.

Meanwhile in other property news…

- Did you know you can find (leasehold) landed homes in Singapore for under $1 million? Or freehold ones at around just $3 million? Here’s where.

- You can make a loss on property even during a property boom, as we’ve seen from this $1.55 million loss (and others.)

- A three-bedder near Queenstown MRT station for $2.3 million – is it possible? Well we found five at least.

- Newer versus older condos in District 5: does age make a difference, and what do you need to know? Join our Stacked Pro readers in finding out.

Weekly Sales Roundup (27 October – 02 November)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MEYER BLUE | $5,908,000 | 1905 | $3,101 | FH |

| PROMENADE PEAK | $5,282,300 | 1582 | $3,338 | 99 yrs (2024) |

| ONE MARINA GARDENS | $5,113,061 | 1647 | $3,105 | 99 yrs (2023) |

| ZYON GRAND | $4,814,000 | 1518 | $3,172 | 99 years |

| SCENECA RESIDENCE | $4,200,000 | 2400 | $1,750 | 99 yrs (2021) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CANBERRA CRESCENT RESIDENCES | $1,330,100 | 667 | $1,993 | 99 yrs (2024) |

| BLOOMSBURY RESIDENCES | $1,417,000 | 570 | $2,484 | 99 yrs (2024) |

| SCENECA RESIDENCE | $1,555,000 | 753 | $2,064 | 99 yrs (2021) |

| OTTO PLACE | $1,573,000 | 872 | $1,804 | 99 yrs (2024) |

| PENRITH | $1,700,000 | 614 | $2,771 | 99 yrs (2024) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| HILLTOPS | $8,000,000 | 2390 | $3,348 | FH |

| BUCKLEY CLASSIQUE | $7,280,000 | 4359 | $1,670 | FH |

| THE WHARF RESIDENCE | $6,880,000 | 2852 | $2,412 | 999 yrs (1841) |

| GOODWOOD RESIDENCE | $6,600,000 | 2669 | $2,472 | FH |

| PALM SPRING | $6,250,000 | 3014 | $2,074 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE HILLFORD | $580,888 | 398 | $1,459 | 60 yrs (2013) |

| GLASGOW RESIDENCE | $635,000 | 431 | $1,475 | 999 yrs (1886) |

| RIPPLE BAY | $728,888 | 484 | $1,505 | 99 yrs (2011) |

| RIVERSAILS | $735,000 | 506 | $1,453 | 99 yrs (2011) |

| ESPIRA SUITES | $756,888 | 441 | $1,715 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| BALMORAL RESIDENCES | $4,250,000 | 1744 | $2,437 | $2,500,000 | 21 Years |

| THE MAKENA | $3,400,000 | 1518 | $2,240 | $2,200,000 | 22 Years |

| PALM SPRING | $6,250,000 | 3014 | $2,074 | $2,000,000 | 10 Years |

| OLEANDER TOWERS | $2,600,000 | 1819 | $1,429 | $1,770,000 | 24 Years |

| TRELLIS TOWERS | $2,584,800 | 1141 | $2,265 | $1,644,800 | 28 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| SCOTTS SQUARE | $3,185,000 | 947 | $3,362 | -$669,290 | 18 Years |

| BELLE VUE RESIDENCES | $4,026,000 | 1830 | $2,200 | -$602,414 | 15 Years |

| THE COAST AT SENTOSA COVE | $2,820,000 | 2024 | $1,394 | -$530,000 | 14 Years |

| MARINA ONE RESIDENCES | $1,380,000 | 764 | $1,806 | -$332,700 | 6 Years |

| ST REGIS RESIDENCES SINGAPORE | $5,400,000 | 2121 | $2,547 | -$263,520 | 19 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| WING FONG MANSIONS | $1,230,000 | 1141 | $1,078 | 236% | 19 Years |

| GARDENVISTA | $2,275,000 | 1173 | $1,939 | 217% | 22 Years |

| OLEANDER TOWERS | $2,600,000 | 1819 | $1,429 | 213% | 24 Years |

| THE DEW | $1,495,000 | 1313 | $1,138 | 200% | 24 Years |

| THE MORNINGTON | $1,688,000 | 1249 | $1,352 | 199% | 20 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| MARINA ONE RESIDENCES | $1,380,000 | 764 | $1,806 | -19% | 6 Years |

| SOPHIA HILLS | $1,135,000 | 560 | $2,028 | -18% | 8 Years |

| SCOTTS SQUARE | $3,185,000 | 947 | $3,362 | -17% | 18 Years |

| THE COAST AT SENTOSA COVE | $2,820,000 | 2024 | $1,394 | -16% | 14 Years |

| BELLE VUE RESIDENCES | $4,026,000 | 1830 | $2,200 | -13% | 15 Years |

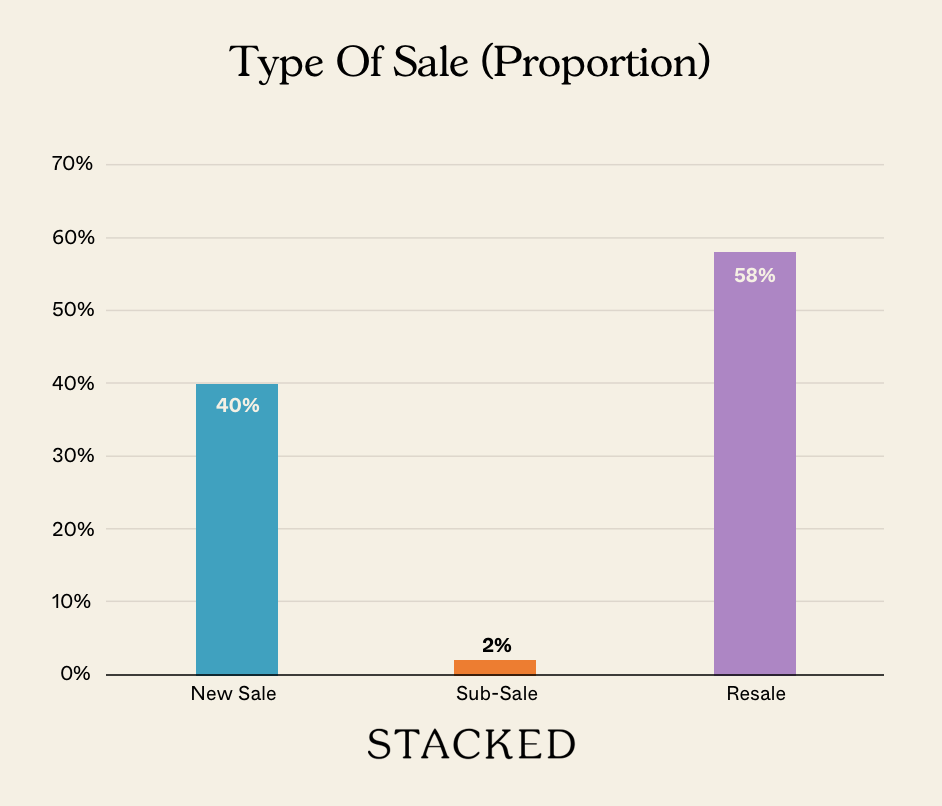

Transaction Breakdown

Follow us on Stacked for news and events in the Singapore property market.

Featured Image: By Bahnfrend – Own work, CC BY-SA 4.0

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How might turning 38 Oxley Road into a monument affect nearby property values?

Will the monument status of 38 Oxley Road lead to increased tourist traffic in the area?

Does the preservation of 38 Oxley Road as a monument impact property development restrictions nearby?

What are the potential downsides for residents living near the monument?

Could the monument status increase property prestige or value in the neighborhood?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Latest Posts

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments