Where Should Singaporeans Buy Property In France? A Full Guide For Young Investors

September 13, 2025

For many young Singaporeans, France conjures images of flaky pastries, cobblestone streets, and that unmistakable joie de vivre. But beyond Instagram dreams and Parisian clichés lies a surprisingly accessible and strategic property market; one worth exploring even as a first-time overseas buyer.

When I bought my own French property, it was primarily for personal use, but I also made sure it was a viable investment. I wanted a property that at least holds its value, even though only time will tell if I made the right call.

If you’re a Singaporean in your late twenties eyeing a stable, suburban French property, know that there’s much more to France than just Paris. Many regional cities offer an appealing mix of affordability, liveability, and long-term value that the capital can’t always match. So where should you look? Here are four French cities I’ll put on your radar, each with its own unique appeal.

First, an important note:

France currently has no restrictions on foreign buyers. However, Singapore passport holders can visit France visa-free only for up to 90 days in a 180-day period; longer stays require a long-stay visa. Rental income from French property is taxable in France even as a foreigner.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Nantes

First up is Nantes, a forward-looking city on France’s Atlantic coast with a thriving tech, education, and cultural scene. Consistently ranked among France’s most liveable cities, it strikes a great balance between vibrancy and calm.

For tech professionals, Nantes is particularly attractive, thanks to its start-up ecosystem and innovation hubs. Finding employment here is easier than in many other regional cities. Nantes is well-connected nationally and internationally. The city’s central train station is a TGV hub – high-speed trains reach Paris in about two hours and 10 minutes, and direct TGVs link Nantes with Lille, Lyon, and Marseille. Nantes Atlantique International Airport lies about 10 km from downtown, with flights to Paris, London, Amsterdam, and other European hubs. Within the city, transit is excellent: the tramway network, buses, and regional trains provide car-free mobility.

Rental yields are healthy, averaging around five and a half per cent, while property prices have climbed by about four to six per cent between 2023 and 2025; a clear sign of demand and growth. The strong student population also keeps the city youthful, with lively nightlife and plenty of cultural activities.

That said, prices have risen in recent years. You can now expect to pay around €350,000 for an ~861 square foot apartment. It’s still far cheaper than Paris, where as of mid-2025, you’d expect to pay about ~€875 psf to €918 psf, or about €760,000 to €790,000.

But being on the coast, Nantes sees grey, rainy winters; if you dislike the cold, you might find yourself escaping to southern Europe in December. Overall, Nantes offers a balanced mix of opportunities for investment and owner-occupancy, and good quality of life at much lower costs than Paris.

Annecy

Not everyone wants to live in the middle of a buzzing city. Annecy, often called the “Pearl of the French Alps,” is famous for its lake and mountain scenery. The climate is temperate alpine, with warm, pleasant summers and cold, snowy winters. This seasonal contrast fuels a year-round recreational scene: sailing, swimming, and cycling in summer, and skiing in winter. Crime in Annecy is very low, and the city is exceptionally safe and clean. Annecy was once an insider secret of the Rhône-Alpes region, although it has since been popularised on social media.

Annecy is well-connected, with Geneva Airport 45 km away and TGV to Paris in under four hours.

If you’re a fan of winter sports and you are somehow working in Geneva, Annecy is the gem to be (Swiss salaries, French cost of living). Due to the limited supply of housing in the area, prices hold their value really well, so don’t flinch at the price tag, because this is one of those great long-term investments that require bigger capitals.

Culturally, Annecy offers museums, a castle, an international animation festival, and lakeside events. While it’s a smaller city, the quality of life is very high. Healthcare access is solid, and Geneva’s medical facilities are nearby. English is not widely spoken though, so French language skills will help.

You can expect to pay from €360,000 to €560,000 for an 861 sq ft property here. Apartments average around €576 per square foot, making Annecy one of the priciest markets outside Paris. Rental yields are modest at about three percent, though short-term rentals can earn higher revenues. For those looking at settling down with families, this location is exceptionally safe and clean. I cannot say this for many areas of France, but Annecy is truly unique in this case.

More from Stacked

Can You Upgrade From An HDB To A $1.8M Condo In 2025? Here’s What It Takes

There was a time when $1.8 million could buy you a spacious 1,200+ sq. ft. condo, and you’d still have…

Rental yields average 3.4 per cent to 3.7 per cent. However, property prices have climbed ~17–21 per cent over the past five years for the area, so capital appreciation can be quite significant, and above average for France.

Annecy is a premium choice with high capital appreciation potential, but commensurately high prices.

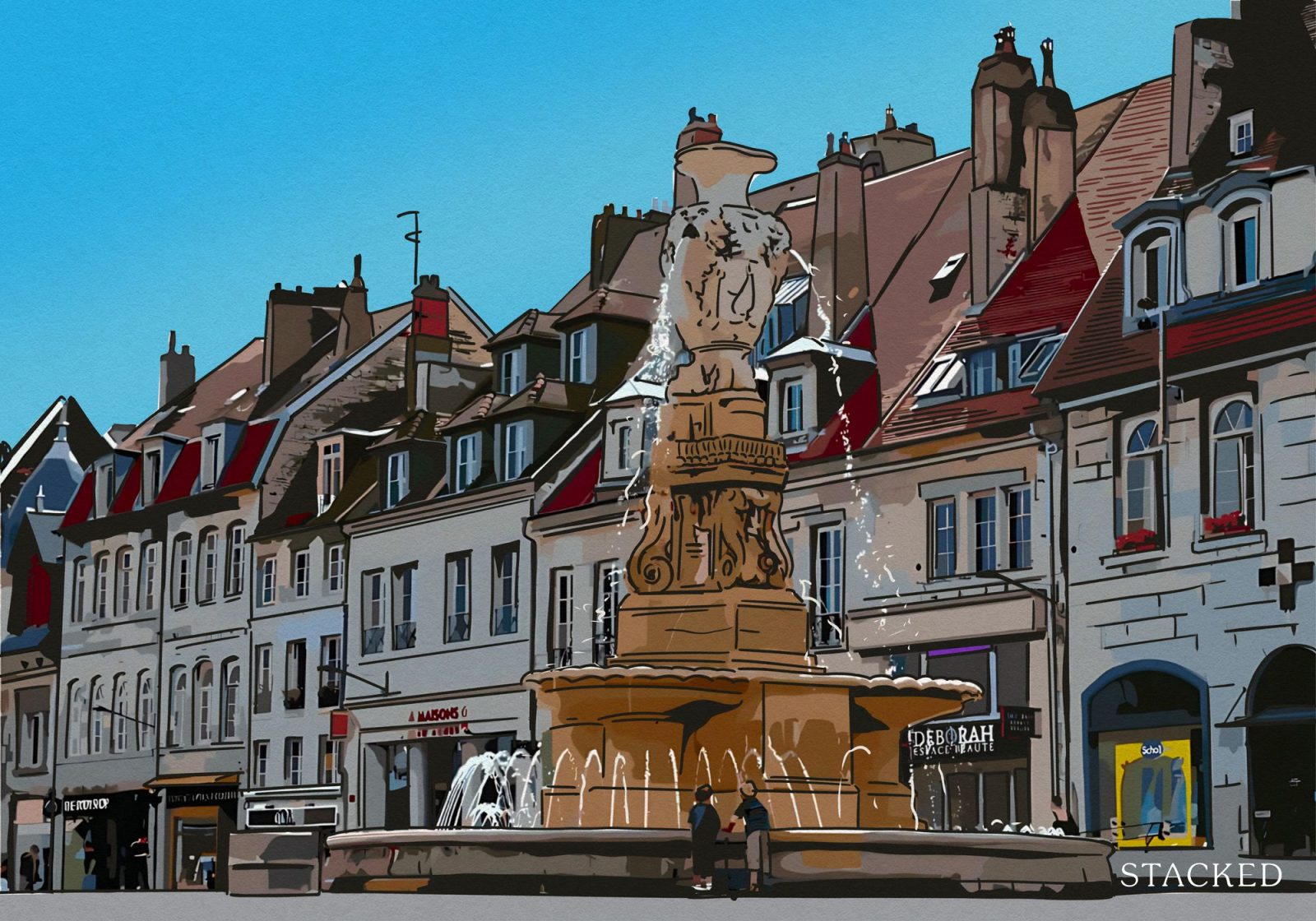

Strasbourg

Tucked away in France’s northeast near the German border, Strasbourg offers one of the most balanced investment profiles for young buyers seeking long-term stability without the Parisian price tag. As the official seat of the European Parliament and home to a large student population, Strasbourg combines institutional weight with vibrant day-to-day life. Strasbourg’s connectivity is exceptional: TGV to Paris in under under hours, with Frankfurt and Basel airports nearby.

Affordability is a key advantage here. Admittedly, this is where I bought my studio. Good things must share.

The average property price ranges between €297 to €353 per square foot, which means an 861 sq ft apartment would cost roughly €260,000 to €300,000; well below what you’d pay in Annecy or Nantes. For a first-time buyer from Singapore, that lower entry point, paired with a high standard of living, makes Strasbourg especially attractive.

What’s more, the city has exceptional infrastructure: one of the best tram systems in France, extensive cycling lanes for bike commutes, and a close proximity to Germany opens up both lifestyle and employment options (Separate visas will apply accordingly).

Capital growth here is modest, typically around two to four per cent annually. However, with the city’s low vacancy rates, decent safety, and steady tenant demand, investing in property here provides a kind of “quiet compounding” that benefits patient investors.

If you’re looking for a city where your property quietly grows in value while offering a pleasant lifestyle and solid rental options, Strasbourg, and the areas surrounding it, should be on your radar. Flood insurance is recommended near waterways.

Besançon

Tucked into the folds of the Jura mountains in eastern France, Besançon is one of the country’s most overlooked gems: a UNESCO World Heritage city that blends riverside beauty, academic excellence, and low property prices. Besançon is a tranquil, authentic city with a continental climate. Safety is high, and healthcare access is good. The city is walkable, green, and family-friendly, though quieter than others.

Besançon is less connected than the others but still served by TGV to Paris in under three hours and by nearby airports in Basel and Lyon.

Known as the birthplace of Victor Hugo and the heart of France’s historic watchmaking industry, Besançon has reinvented itself as a hub for green innovation and higher education. If you work in the field of microtechnology, micromechanics, or biomedical engineering, this is the place for both study and work in those fields.

Property prices are low, averaging around €223 per square foot, with rental yields of six to seven per cent thanks to strong demand and low prices. Long-term rentals are preferred; short-term tourism is minor. Regulations are minimal beyond basic landlord permits in certain areas.

That said, Besançon won’t deliver rapid price appreciation: annual growth sits around one to two per cent, but that’s exactly the appeal for a buyer seeking stability, lifestyle, and low entry costs.

For a Singaporean investor who wants to step off the beaten track and own a home in a well-maintained, climate-forward city with a strong academic heartbeat, Besançon might just be the best-kept secret in France.

Affordability exists outside Paris. Cities like Montpellier and Toulouse are still accessible with under €200,000 for studio or one-bedroom units, even if not mentioned in this article.

Suburban areas offer better value and lifestyle than city centres, so it would be great to consider neighbourhoods outside of the city center as well!

For young Singaporeans looking at France as a first overseas foothold, there are way better options than just the Paris arrondissements. There are many regions offering the best balance between charm and culture without compromising safety, affordability, or value.

Whether it’s Strasbourg’s quiet sophistication or Nantes’ seaside youthfulness, your French property investment doesn’t have to be a fantasy. It just has to be well-placed.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Melody Koh

Melody is a designer who currently works in Tech and writes for fun. Her latest obsession is analysing and writing about real estate affordability for the younger generation. Coming from an Industrial Design background, she has a strong passion for spatial design and furnishing . Having worked in Finance for almost a decade, Melody has a keen interest in sustainable investments and a nose to sniff out numbers that don't make sense.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

0 Comments