Singapore’s CBD Office Rents Have Risen For 7 Straight Quarters — But Who’s Really Driving The Demand?

February 4, 2026

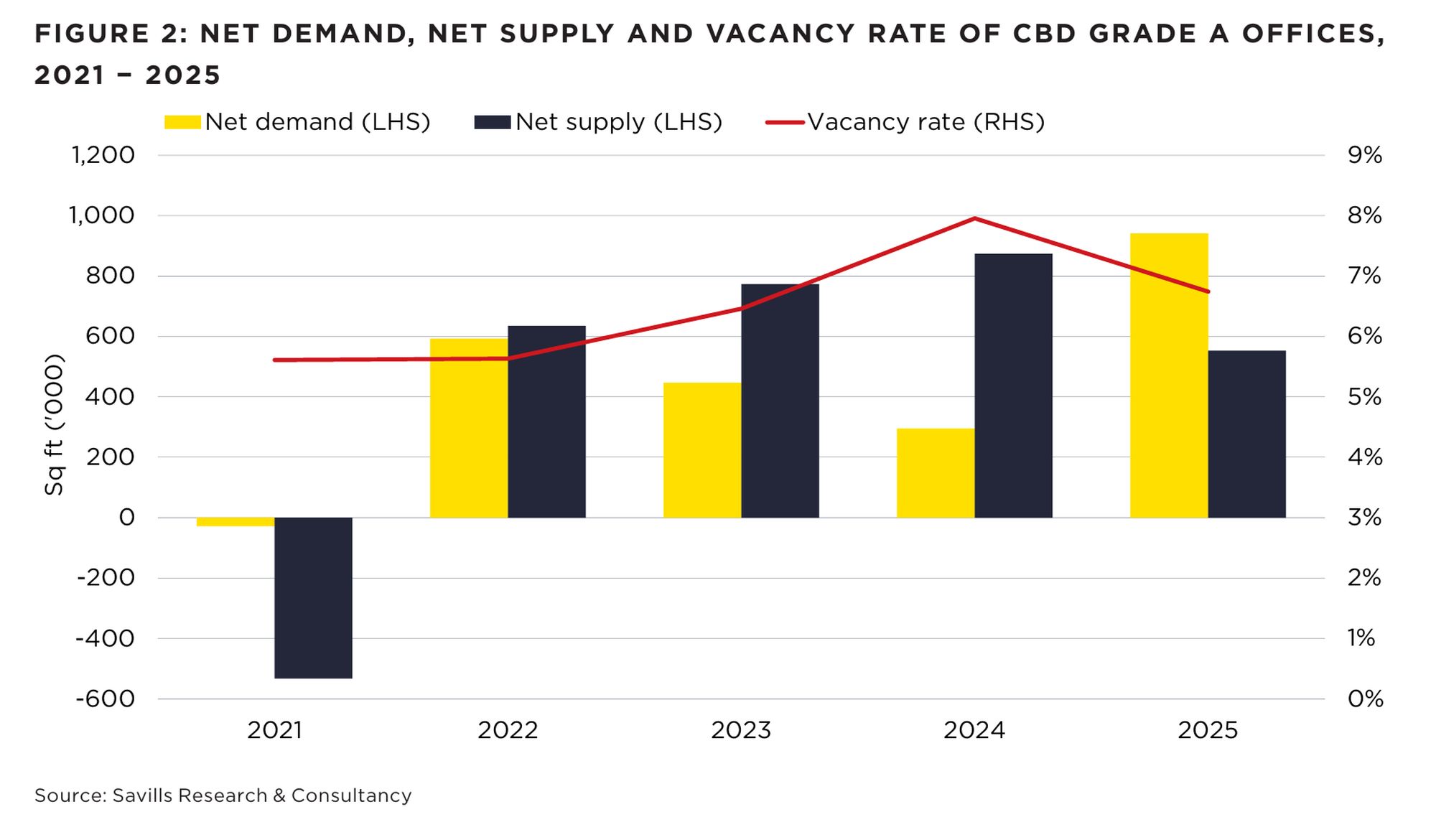

In 2025, Singapore’s office market shed the negative sentiment that clouded much of the sector in 2024, which saw technology companies layoff their workforce amid heightened global economic uncertainty.

Last year, market conditions in the local office market improved from the second quarter of the year, ending the year on firmer footing with easing vacancies and continued rental growth.

“We experienced a somewhat strong finish to 2025 with leasing activity steadily increasing throughout the year. There was a modest recovery in net demand in the last quarter, as well as a reduction in shadow stock. These factors, working together, ensured the leasing market remained stable with rents inching up across the board,” says Ashley Swan, executive director, commercial and industrial, at Savills Singapore.

He adds that shadow and previously vacant space in some Grade A buildings have largely been backfilled, and some occupiers have even re-taken space they had earlier given up. “While there were pockets of both expansion and consolidation in the quarter, there was still no single, dominant demand driver in the market”.

Large corporate tenants adopted a flight-to-quality strategy, gravitating towards premium buildings as the market faces a tight supply pipeline of new top-tier offices.

As a result, the average Central Business District (CBD) office rents rose for the seventh consecutive quarter in 4Q2025, climbing 0.3% q-o-q to $9.96 psf. In contrast, average CBD office rents rose 0.8% in 3Q2026.

Over the whole of 2025, office rents in this prime segment increased 1.8%, outperforming the 1.1% growth the market recorded in 2024. This is the strongest yearly gain in office rents since 2022, when rents climbed 2.2% y-o-y.

Rental growth was also broad-based across most of the CDB micro-markets in 4Q2025, with allocations recording quarterly rental price increases.

More from Stacked

From A Haunting Cemetery To The Next HDB Town: Why Bidadari Estate Was Transformed

The word Bidadari is actually the Malay word for “angel”, a derivative of the Sanskrit word *widyadari* which refers to an…

The strongest growth was in the Beach Road/Middle Road precinct, which rose 1% following three consecutive quarters of flat performance. Savills attributes the latest uptick to higher rents in Duo Tower. Average Grade A office rents in this precinct were about $8.18 psf, with the vacancy rate of 6.9%.

Meanwhile, City Hall recorded the strongest annual rental growth among the CBD micro-markets in 2025, jumping 3.3% over the 12 months. Average office rents in City Hall were $10.58 psf in 4Q2025, with vacancies of about 2.3%.

| Location | Monthly Rent (S$ Per Sq Ft) | Vacancy Rate (%) |

| Marina Bay | 13.19 | 8.4% |

| Raffles Place | 10.25 | 4.2% |

| Shenton Way | 9.13 | 4.7% |

| Tanjong Pagar | 8.73 | 25.5% |

| City Hall | 10.58 | 2.3% |

| Orchard Road | 9.06 | 1.8% |

| Beach Road/Middle Road | 8.18 | 6.9% |

“With vacancies in premium CBD buildings continuing to ease amid a limited pipeline of new Grade A supply, rents for Grade A offices should remain supported. Demand is expected to stay concentrated among larger and financially stronger occupiers,” says Alan Cheong, executive director, research and consultancy, at Savills Singapore.

He adds that non-Grade A office buildings may face rising vacancy pressures in the coming months as their tenant base, which typically consists of smaller companies, comes under greater margin stress.

Overall, Savills expects rental growth of 2% in the CBD office market this year.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How have Singapore CBD office rents changed recently?

What is driving the demand for office space in Singapore?

Which areas in Singapore saw the highest rental growth?

Are office vacancies in Singapore decreasing or increasing?

What is the outlook for office rents in Singapore this year?

Timothy Tay

As Editor-in-Chief of Stacked, Timothy leads the newsroom and shapes our editorial direction, ensuring readers receive timely, thoughtful, and well-researched news and analysis. He brings over eight years of experience as a business and real estate journalist, with a strong track record across both print and digital platforms. His reporting spans luxury residential, commercial real estate, and capital markets, alongside in-depth coverage of sustainability and design.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Singapore Property News The Most Expensive Resale Flat Just Sold for $1.7M in Queenstown — Is There No Limit to What Buyers Will Pay?

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Pro River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

0 Comments