Singapore Cooling Measures – History of cooling measures since 2009

July 30, 2018

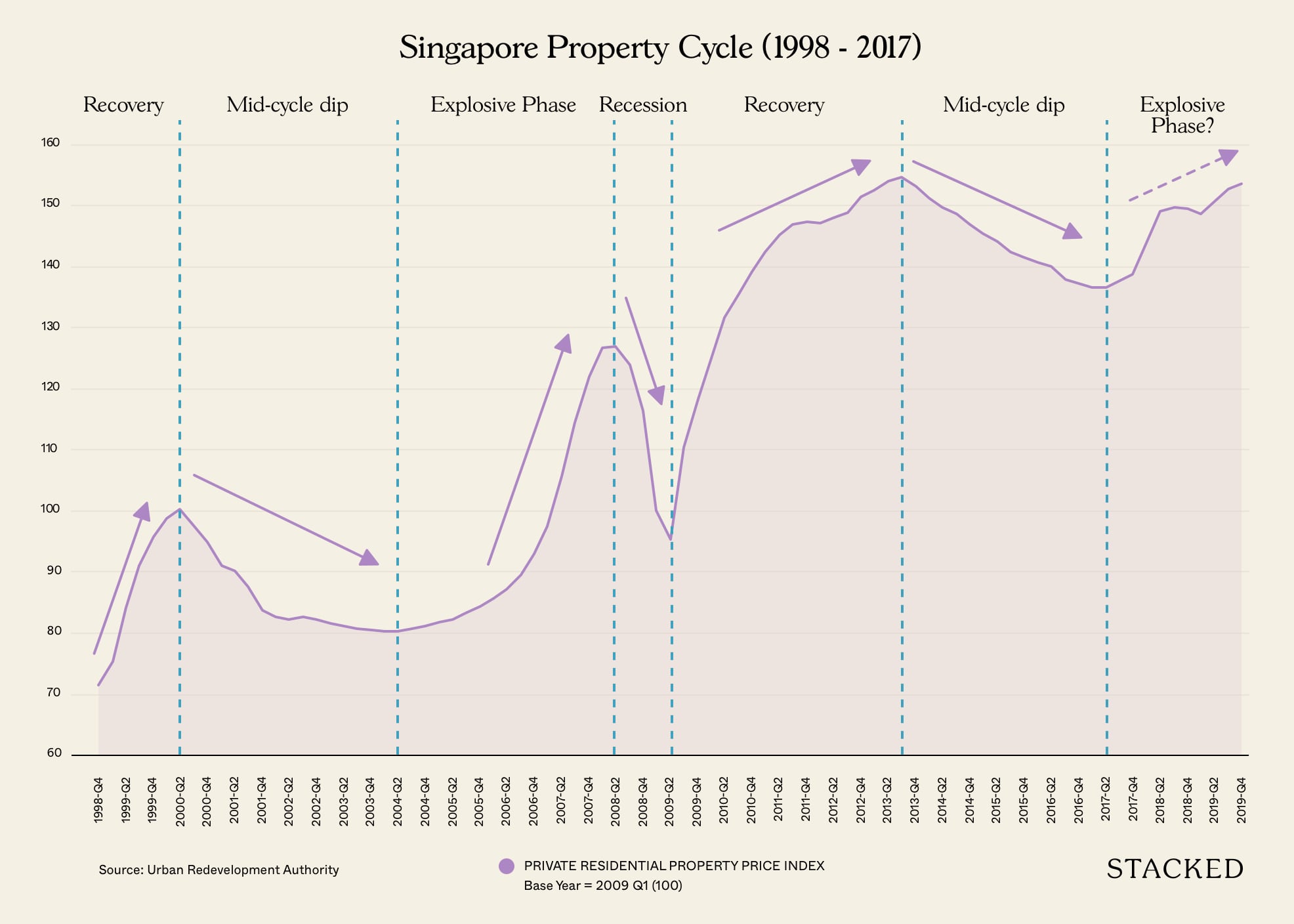

Could this be one of the most untimely Singapore cooling measures? For some time this year, it seemed like the property market was on the road to “recovery” and buying sentiment was on a brighter note before the news was released.

So ever since the recent cooling measures was announced, as expected, there has been a ton of news and reactions to it. Unsurprisingly, shares in property stocks took quite a hit after the news was released. The news even affected an en bloc sale, with Tee Land deciding against exercising its option to purchase Teck Guan Ville. Developers are also up in arms against the move, with the Real Estate Developers’ Association of Singapore (Redas) saying there is “no rationale” for the property cooling measures imposed. Not only that, they maintained that there was no need for the additional cooling measures on developers, which is in reference to the raising of ABSD to 25% and the extra 5% ABSD that cannot be waived.

In other words, if you are looking to buy for your own stay or to invest, the Government’s intervention of cooling measures in Singapore can really be a make or break with regards to your purchasing decisions. So to make an informed decision, it is always best to keep abreast of all property news and happenings in Singapore. Hence, we have compiled a history of all Singapore cooling measures since the first introduction in 2009.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

2009 Singapore Cooling Measures

14 September 2009

– Interest Absorption Scheme (IAS) and Interest-Only Housing Loans (IOL) programs were abolished

2010 Singapore Cooling Measures

20 February 2010

– Introduction of Seller’s Stamp Duty (SSD) for properties sold within 1 year of purchase, this was up to 3% of the sales price

– Lowered the loan-to-value ratio (LTV) to 80% for all housing loans

30 August 2010

– SSD holding period increased to properties sold within 3 years of purchase, which resulted in the following

– 3% for properties sold within the first year

– 2% for 2 years

– 1% for 3 years

– For buyers that have more than one outstanding loan (including HDB) the minimum cash downpayment was increased from 5% to 20% of the purchase price

– LTV lowered from 80% to 70%

2011 Singapore Cooling Measures

14 January 2011

– SSD increased to 4 years, with higher tax as follows

– 16% for properties sold within the first year

– 12% for 2 years

– 8% for 3 years

– 4% for 4 years

– LTV was lowered to 50% for purchases that were not individuals or households

– For individuals and households with one or more outstanding loans, the LTV was lowered to 60%

8 December 2011

– Additional 10% duty for foreigners implemented

– Permanent Residents (PR) that are buying the second and subsequent property will have to pay ABSD of 3%

– Singapore Citizens (SC) that own two properties and are buying their third and subsequent properties have to pay ABSD of 3%

– How the ABSD is computed is as follows:

– 1% on the first $180,000

– 2% on the next $180,000

– 3% on the remainder

More from Stacked

For Freehold Condos At Stevens, Will Glyndebourne Or The Equatorial Be A Better Option?

Hi Stacked Homes,

2012 Singapore Cooling Measures

6 October 2012

– Max tenure of residential loans was capped at 35 years

– Loans with terms in excess of 30 years would have higher LTV requirements, for both HDB and private properties

2013 Singapore Cooling Measures

12 January 2013

– PRs first property will now have a 5% ABSD

– Second property at 10% ABSD

– SC second property at 7% ABSD

– Third property at 10% ABSD

– Foreigners and company 15% ABSD

– LTV rates were tighter, if second housing loan this is at 50%

– For third housing loan this was set at 40%

– For housing loan tenures past 30 years this was even stricter at 30% and 20% respectively

– Minimum cash downpayment for individuals applying for a second and subsequent housing loan raised to 25% from 10%

Property Market CommentaryWhy Knowing The Singapore Property Cycle Can Make You A Better Investor

by Sean GohThere were also measures specific to HDB

– Introduction of Mortgage Service Ratio (MSR) for HDB loans and refinancings

– This means for private loans this is capped at 30% of a borrower’s gross monthly income

– For HDB loans this is lowered from 40% to 35%

– PRs that own a HDB flat will not be allowed to sublet their whole flat

– PRs that own a HDB flat must sell it within six months of purchasing a private property in Singapore

29 June 2013

– Introduction of Total Debt Service Ratio (TDSR) that is capped at 60% for housing loans for local and overseas properties

– For join borrowers, banks must use the income-weighted average age of borrowers when applying for a housing loan

28 August 2013

– Maximum HDB loan tenure reduced from 35 to 30 years

9 December 2013

– Reduction of cancellation fees for ECs from 20% to 5% to relive financial burden of buyers

– Second-timer applicants who buy EC units direct from developers will now have to pay a resale levy

– MSR for housing loans for EC bought direct from developers will be capped at 30%

This was the last round of cooling measures for some time until 2017.

2017 Singapore Cooling Measures

10 March 2017

– Revision of SSD to a 3 year holding period, instead of 4 years previously

– SSD rates will be lower by 4% for each tier, so it will began from 12% for properties sold in the first year, to 4% for properties sold in the third year

– TDSR will no longer be applied to mortgage equity withdrawal loans with LTV ratios of 50% and below

2018 Singapore Cooling Measures

6 July 2018

– Full details written extensively here

As always, feel free to leave a comment below or you can always reach us at stories@stackedhomes.com!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What were the first cooling measures introduced in Singapore in 2009?

How did Singapore's property cooling measures change in 2010?

What were the key cooling measures implemented in Singapore in 2013?

When was the Singapore property market subject to the revision of SSD to a 3-year holding period?

What was the impact of the recent cooling measures on property stocks and en bloc sales?

Stanley Goh

Stanley loves crunching numbers in excel and analysing them. Naturally, he helps Stacked Homes generate articles based on his analysis as much as he can. When he's not using Excel, he enjoys watching movies and eating chocolates.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

4 Comments

Very comprehensive and well-written! If at anytime the government removes the cooling measures, Singapore will see a huge growth in property prices again. There’s a lot of pent-up demand from buyers who were priced out from the measures.