Should You Pay For A Buyer Agent?

September 15, 2024

You know those guides that say you should bang pots and pans, to scare off a bear?

Or that you should talk calmly to an armed kidnapper to humanise yourself?

Those are the kinds of solutions only someone in my current position – safely hammering away on a keyboard in my room – would present. I refuse to believe that many people would attempt that in the actual scenarios. And this is, I think, one of the issues the Singapore Estate Agents Association (SEAA) faces with their recent pact.

SEAA has signed guidelines with a lot of property agents, asking for buyers’ agents to collect service fees from their clients. This goes against the established norm, where in most cases, it’s the seller who pays the commission for both (i.e., there’s a two per cent commission on the sale of the property, of which the buyer and seller’s agents both get one per cent). This is negotiable, but only in the same way most United Nations crises are: a low chance of success, coupled with nobody being very happy.

And to no one’s surprise, it was recently revealed that the real world take up was “tepid”.

Now the intentions are definitely good. If everyone was willing to pay for their own buyer’s agent, property transactions would actually be easier on all of us. Sellers’ agents wouldn’t have to ghost other potential agents, and there would be less impulse to engage in certain shenanigans.

The problem is exactly the same as the aforementioned bear attack scenario. Sure, a property agent might understand how – industry wide and in an abstract sense – asking a buyer for money makes sense. But in reality, very few want to be the ones to try it.

It doesn’t matter if you explain that oh in the end the costs even out as the seller has to pay lower commissions, which can be factored into the pricing etc. That doesn’t matter in the face of FREE, which causes the human brain to immediately ignore the numbers and divide everything into: Free/Not free.

Besides, how are they going to do it, unless there’s a guarantee everyone else is guaranteed to stick to the guidelines? If Agent A wants to charge their buyer, and Agent B doesn’t, then Agent A will soon be looking for a change of career.

I understand that, by using guidelines, it’s possible for the industry to try and self-regulate before the authorities step in.

And maybe because it’s an organisation of professional salespeople, they’re confident they can sell any idea, even to other salespeople. But this is a classic collective action problem: even if it would be good for the property market as a whole, it’s nigh impossible to find the momentum needed for what is, essentially, a simultaneous behavioural change across the entire industry. Because again, this doesn’t work if some agents won’t charge buyers, whilst others try to. It’s just too much of an edge to lose, in an already competitive business.

More from Stacked

How Much You Need to Earn to Afford a One or Two-Bedder Condo In 2026 (As a Single)

The start of the house-hunting season looms on the horizon and we’re already seeing activity in the new launch market.…

In the end, this may boil down to requiring government-level regulations, rather than guidelines or an honour system (see what is happening in the US).

Meanwhile in other property news:

- A new condo review is up! Check out 8@BT, a Bukit Timah condo which has some of the most efficient layouts we’ve seen.

- Condo units with private pools aren’t necessarily expensive, but they are hard to find. Here are some where you can have a quiet soak, sans screaming kids at the pool area.

- Not all the best located freehold properties are obvious, or super pricey. Here are the hidden gems in the central areas, which you’ve probably missed.

- 999-year lease homes, for $3.88 million or under, and also next to an MRT station. Need we say more? Check it out.

Weekly Sales Roundup (02 September – 08 September)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KLIMT CAIRNHILL | $5,690,000 | 1496 | $3,803 | FH |

| 19 NASSIM | $5,321,000 | 1475 | $3,608 | 99 yrs (2019) |

| TEMBUSU GRAND | $3,517,000 | 1432 | $2,457 | 99 yrs (2022) |

| THE CONTINUUM | $3,384,000 | 1270 | $2,664 | FH |

| GRANGE 1866 | $3,024,000 | 1012 | $2,989 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KASSIA | $1,009,000 | 474 | $2,130 | FH |

| SORA | $1,250,000 | 538 | $2,323 | 99 yrs (2023) |

| PINETREE HILL | $1,353,000 | 538 | $2,514 | 99 yrs (2022) |

| HILLHAVEN | $1,509,511 | 700 | $2,157 | 99 yrs (2023) |

| LENTORIA | $1,562,000 | 732 | $2,134 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| LEEDON RESIDENCE | $5,880,000 | 2131 | $2,759 | FH |

| REGENCY PARK | $5,125,000 | 2250 | $2,278 | FH |

| THE DRAYCOTT | $5,000,000 | 2637 | $1,896 | FH |

| NEWTON ONE | $4,608,000 | 1916 | $2,405 | FH |

| THE SUITES AT CENTRAL | $4,310,000 | 1733 | $2,487 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| STRATUM | $680,000 | 452 | $1,504 | 99 yrs (2012) |

| PALMERA EAST | $715,000 | 431 | $1,661 | FH |

| D’NEST | $762,000 | 484 | $1,573 | 99 yrs (2010) |

| NORTH PARK RESIDENCES | $818,900 | 431 | $1,902 | 99 yrs (2015) |

| HILLION RESIDENCES | $820,000 | 474 | $1,731 | 99 yrs (2013) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| REGENCY PARK | $5,125,000 | 2250 | $2,278 | $3,237,000 | 22 Years |

| THE WINDSOR | $2,898,888 | 1798 | $1,613 | $1,548,888 | 14 Years |

| CLOVER BY THE PARK | $2,480,000 | 1292 | $1,920 | $1,435,000 | 15 Years |

| VARSITY PARK CONDOMINIUM | $2,720,000 | 1894 | $1,436 | $1,370,000 | 16 Years |

| EAST VIEW | $2,180,000 | 1098 | $1,986 | $1,242,658 | 28 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE SCOTTS TOWER | $1,300,000 | 667 | $1,948 | -$916,416 | 13 Years |

| THE PEAK @ CAIRNHILL I | $1,060,000 | 527 | $2,010 | -$340,000 | 13 Years |

| 26 NEWTON | $1,088,000 | 484 | $2,246 | -$86,129 | 8 Years |

| URBAN VISTA | $1,170,000 | 797 | $1,469 | -$51,233 | 11 Years |

| NYON | $1,900,000 | 915 | $2,077 | $1,000 | 5 Years |

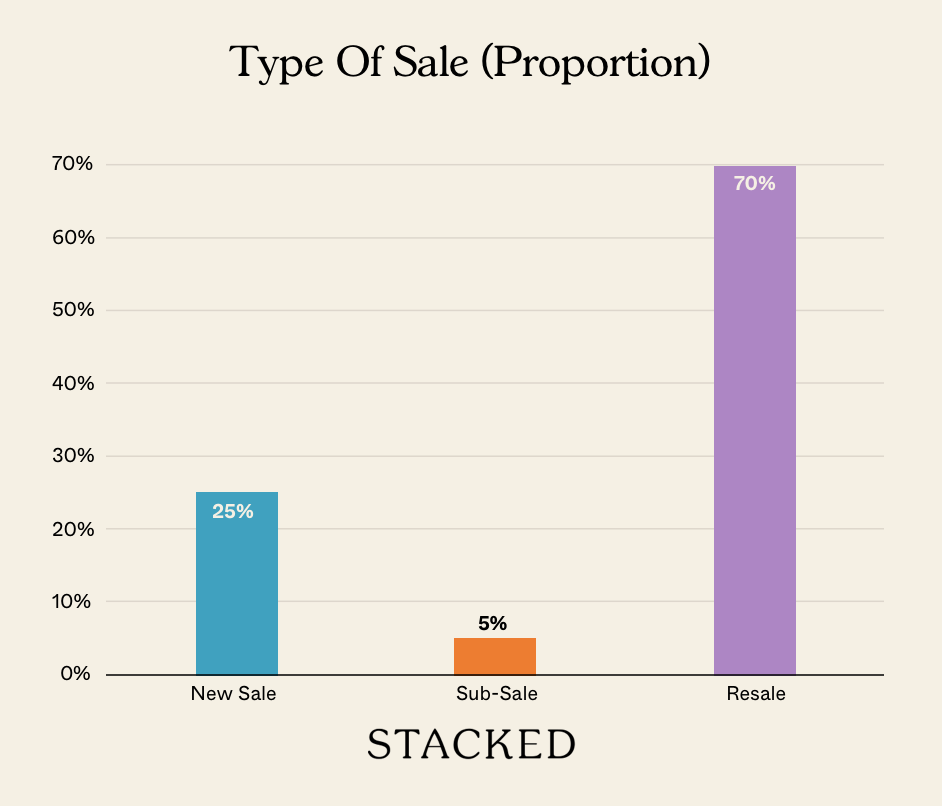

Transaction Breakdown

For more on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Should I pay a buyer’s agent when buying property in Singapore?

Why is it difficult for real estate agents to charge buyers directly in Singapore?

What are the challenges of implementing guidelines for buyers to pay their agents?

Are there any benefits to buyers paying for their own real estate agent?

What alternatives might be needed to change the current practice of agent commissions in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments