Should I Buy A 1 Bedroom At Parc Rosewood As A Single?

September 24, 2021

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Question 1

Hi Stacked,

I’ve read your review for Parc Rosewood, as well as the article on 1 bedroom units. I’d like to ask if you have any opinions/advice for me.

I’m currently single and 31 (i.e. not eligible for HDB), and would be able to save enough for a single-bedder some time next year (assuming current prices. Parc Rosewood seemed like a pretty compelling option. I’m buying to stay, not rent.

I had a chat with my property agent friend, and listed out the pros and cons of making that purchase in the near future.

Cons

- Buying resale typically means you’d lose out on the potential capital gains vs a new launch

- Buying a one-bedder runs the risk of not being harder to sell it off, as it’s too small for most situations

- A 2-bedder might be more ‘re-saleable’ in the future, but I would need about a year to save the difference

Pros

- Even with the loss of potential capital gain when buying resale, new condos aren’t necessarily getting cheaper either

- The interest rates are low right now, with expectations for it to rise within the next couple of years. So it might be wise to lock in the lower interest rate now

- My assumption, is that with the general trend of people marrying later, combined with increased flexibility in working, there would be even greater demand for such lower cost shoebox units. To have their own place, and a more conducive WFH environment. So the re-salability and capital gain may not be THAT bad.

A bit lengthy, but looking forward to what you guys think.

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hey there,

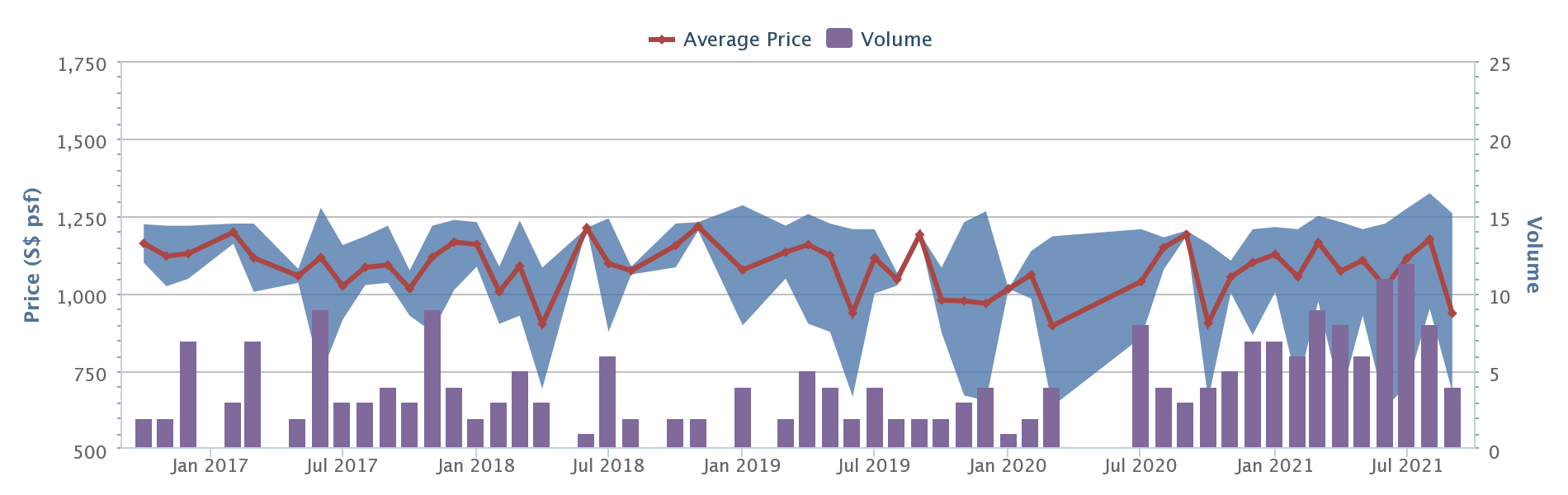

Thank you for writing in to us. It has been close to a year since we did the full review of Parc Rosewood and looking at the price and volume, it has risen upwards (much like most of the market). Current psf stands at $1,093 psf as compared to $999 psf at the point of writing. Transaction volume is extremely commendable with 52 units having changed hands this year (Up till 25 July 2021 caveat) as compared to 38 units for the whole of 2020.

26 out of 52 resale comes from the 1 bedders units (431 sqft) hence indicating healthy demand for shoeboxes thus it is not conclusive that there is no market for shoebox unit. Demographic of 1 bedder buyers varies from singles looking for own stay to Investors for rental income or even retirees that prefer a small unit for easy upkeep. Of course, 2 bedders has a wider range of buyers which includes small families but there is also demand for 1 bedders too.

Price of the 1 bedders (431sqft) has significantly rose over a short period of time as well. Back in January 2021 one could get a unit $498k – low $5xxk and in July 2021 a SLE facing unit transacted for $549k! Quantum wise, it is still one of the most affordable 1 bedder in SG especially for a full-fledged condo with proper facilities and low maintenance fees hence there is demand for it.

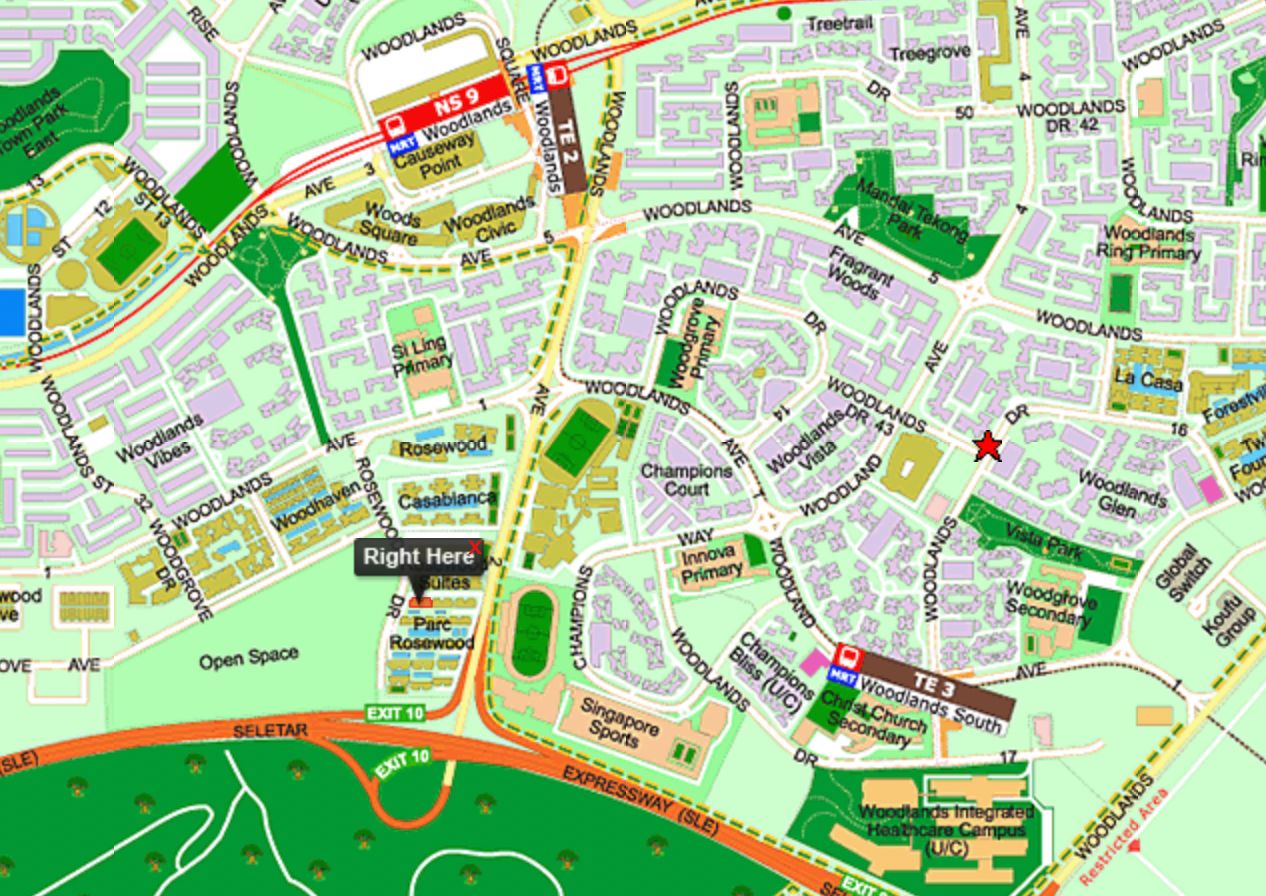

Parc Rosewood location is not that bad, basic amenities is minutes walk to The Woodgrove. For more options there’s Civic centre, Woods Square and Causeway Point. Bus connectivity is alright too, 3 bus stops away to Interchange and MRT. The layout is squarish and comes with Household shelter which is rare in today’s new launches. Household shelter can be use for storage space. To be safe for exiting, choose a unit away from SLE and main road noise (Ave 2). All in all, as there is a lack of 1 bedders in Woodlands (Parc Rosewood and Woodhaven, mostly loft unit type), we foresee potential for appreciation over the years, price will go according to overall general market sentiments.

Question 2

Hi Stacked,

I’m just curious as to your thoughts on choosing between a newer but smaller condo like Parc Rosewood, or an older but bigger condo like The Woodgrove.

Thanks!

Hey there,

Thank you for writing in to us. Depending on the unit size you are looking for and you purpose of purchase. Here’s our take on both development mentioned.

The Woodgrove:

- TOP in 1997

- lacks facilities (Small pool)

- Amenities right next door, The Woodgrove for NTUC, food options.

- 4.2% gross yield, extremely healthy

- $734psf

- Low transaction volume, 4 in 2020, 0 in 2021

- Looks dated, need lotsa upkeep in future.

- Unit does not come with balcony.

- Unit comes with service yard for laundry area.

- Spacious size

We actually did a full review on Parc Rosewood exactly a year ago.

Here are some pointers:

- Price has appreciated since then. $999psf at point of writing to $1091psf currently.

- TOP in 2014

- Huge low rise development

- A lot of small unit type (1/2 bedders)

- Tons of pools! 10 to be exact

- Affordable quantum and maintenance fees

- There’s a minimart in the development itself

- 3.7% gross rental yield, healthy!

- Distance between blocks are near

- Layout is squarish

- Open kitchen layout

- Healthy resale volume, 38 in 2020, 47 in 2021

- Located deepest in along Rosewood Drive, bus connectivity from side gate takes you to Woodlands Interchange.

We are leaning towards Parc Rosewood for proper own stay as it is a full-fledged condo with facilities and decently sized units. The healthy resale volume is a plus as well.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market, or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments