SERS: Singapore’s $94,000 Housing Lottery Or A Bad Bet?

July 20, 2025

It’s August 1995, and you wake up at 7 am because the peeling paint and cockroach community in your decaying flat have given you itchy patches the size of a football field.

Your block may be in a great location, but it’s so run down it looks like the rubble in one of those Call of Duty maps. But you’re waking up to good news for once: because that’s the month and year when the government announces the Selective Enbloc Redevelopment Scheme (SERS), soon to be Singapore’s favourite gamble next to Toto and 4D.

The idea for SERS is to revive ageing neighbourhoods. If your HDB is in the four to five per cent of eligible units, then your satisfaction and silence are bought by (1) a subsidised replacement flat with a fresh 99-year lease, (2) compensation at market value, (3) priority allocation for the new replacement flats, and (4) financial assistance, like certain waivers or subsidises for fees.

TL; DR: HDB just descended from the heavens with a big cheque, paying you an insanely generous amount for the crumbling slab of concrete that you live in.

Some people will take this opportunity to upgrade, picking a bigger flat with their priority allocation, and being carried above the peasants at selection like the Queen’s own Pomeranian.

As to how good this can get, well, consider the SERS exercise for Pine Ville in Ang Mo Kio, as explained, apparently, by a cat that likes fried rice (there’s no name and that’s what the author profile says.)

When the alleged cat obtained its SERS unit in the October 2023 exercise, it paid $538,000 for a 4-room flat (around 1,001 sq ft and on the 20th storey). In 2025, during a Sale of Balance Flats (SBF) exercise, the same type of flat was being sold for $632,000. That’s a gain of $94,000 in roughly 18 months, or an ROI of about 11 per cent per year.

Even if you leave out the benefit of a topped-up lease, you can see how the resale values by the end of the Minimum Occupancy Period (MOP) can take some people into condo territory.

That said, SERS isn’t all roses

First, do keep in mind that Pine Ville blogger-cat still had to cough up $157,000 extra just to snag that shiny new flat. It’s worth it, of course, and still a jackpot win – but there’s still an initial hit to the pocket.

This was also an issue at an Ang Mo Kio SERS exercise, where one couple pointed out they got $450,000 compensation for their flat, but the replacement costs $565,000. This isn’t a problem for the young and financially secure, but for older folks with limited income, or those in already tight financial situations, this “lottery win” feels as nice as ripping a toenail on a brick.

By the way: you scored a sweet $538,000 flat, but now your kids get to pay $632,000 for the exact same unit.

More from Stacked

PPVC Construction : Why It Matters For Investors (The Good, Bad, And Ugly)

Let’s roll back time to the year 2017.

It’s nice to see property values go up. But when public housing goes up this fast, it feels a bit like I’ve climbed to the top, then kicked over the ladder and yelled to the next generation: “Good luck in Tengah, kids! Buy extra mosquito repellent!”

As the Pine Ville cat put it: “It’s like TOTO after all. LOL.” But that also implies the winning tickets had to be funded by losing tickets somewhere, somehow.

Whilst I was writing this, one reader also had an interesting opinion about SERS, being themselves a “lottery winner” from a long-ago SERS:

“If you’re old when this happens, you’re paying good money for decades of lease you’ll never live to use. Or if you had everything settled with a fully‑paid old flat, congratulations, now you can deal with having to borrow money again.

There’s also no real sense of the community moving. It’s supposed to revive the neighbourhood, but where do you see that? Everything just talks about upgrading. Don’t underestimate how much this messes with elderly residents or people with special needs.”

Meanwhile in other property news…

- I thought the condos that no one wanted to sell must have been the best ones. The data clowned me.

- A Clementi 4-room flat sold for $1.28 million. Does that mean everyone in Clementi can now order their BMWs? Not quite, not all flats are like this.

- A new launch, River Valley condo, where prices start from just $1.2 million. This is where it is.

- Reflections at Keppel Bay is one of our most iconic condos, and maybe one of the most gorgeous; but the performance…meh.

Weekly Sales Roundup (07 July – 13 July)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $8,007,000 | 2368 | $3,381 | FH |

| ONE MARINA GARDENS | $5,160,002 | 1647 | $3,133 | 99 yrs (2023) |

| PINETREE HILL | $4,596,000 | 1733 | $2,652 | 99 yrs (2022) |

| LYNDENWOODS | $4,131,000 | 1647 | $2,508 | 99 years |

| ELTA | $3,954,000 | 1776 | $2,226 | 99 yrs (2024) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| HILL HOUSE | $1,298,000 | 431 | $3,015 | 999 yrs (1841) |

| LYNDENWOODS | $1,398,000 | 635 | $2,201 | 99 years |

| CLAYDENCE | $1,473,600 | 614 | $2,402 | FH |

| BLOOMSBURY RESIDENCES | $1,628,000 | 678 | $2,401 | 99 yrs (2024) |

| THE HILL @ONE-NORTH | $1,819,020 | 732 | $2,485 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CYAN | $5,680,000 | 2077 | $2,734 | FH |

| LINCOLN SUITES | $5,560,000 | 3143 | $1,769 | FH |

| BELLE VUE RESIDENCES | $4,880,000 | 2443 | $1,997 | FH |

| KING’S MANSION | $4,690,000 | 2734 | $1,715 | FH |

| GLENTREES | $4,450,000 | 2863 | $1,554 | 999 yrs (1885) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE HILLFORD | $585,000 | 398 | $1,469 | 60 yrs (2013) |

| SILVERSCAPE | $650,000 | 409 | $1,589 | FH |

| SUITES @ KOVAN | $680,000 | 366 | $1,858 | FH |

| EUHABITAT | $725,000 | 517 | $1,403 | 99 yrs (2010) |

| EIGHT RIVERSUITES | $866,800 | 441 | $1,964 | 99 yrs (2011) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| OCEAN PARK | $4,100,000 | 2110 | $1,943 | $2,875,000 | 20 Years |

| CASA CAIRNHILL | $3,671,200 | 1572 | $2,336 | $2,521,200 | 22 Years |

| THE BELVEDERE | $3,550,000 | 1367 | $2,597 | $2,473,516 | 18 Years |

| ST PATRICK’S COURT | $2,570,000 | 1507 | $1,705 | $2,000,000 | 27 Years |

| GRANDE VISTA | $3,500,000 | 3477 | $1,007 | $2,000,000 | 29 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| SCOTTS SQUARE | $2,560,000 | 947 | $2,703 | -$1,156,975 | 18 Years |

| LINCOLN SUITES | $5,560,000 | 3143 | $1,769 | -$510,000 | 16 Years |

| ROBINSON SUITES | $1,150,000 | 495 | $2,323 | -$485,000 | 15 Years |

| JIA | $2,000,000 | 1798 | $1,113 | -$454,000 | 14 Years |

| THE CLIFT | $980,000 | 495 | $1,979 | -$153,500 | 14 Years |

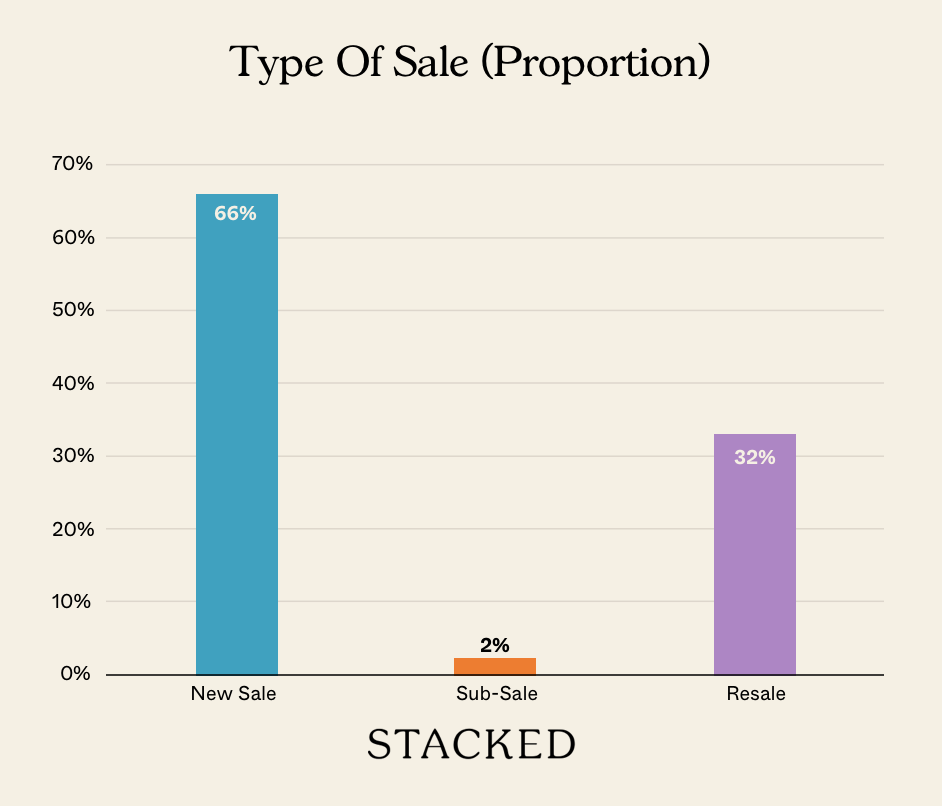

Transaction Breakdown

For more on the Singapore property market and its ongoing changes, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is Singapore's SERS program and how does it work?

How much did the Pine Ville flat increase in value after SERS?

What are some drawbacks of participating in SERS?

Are property prices rising in Singapore, and what does that mean for residents?

What are some recent high and low prices for new and resale flats in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Latest Posts

Editor's Pick These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Editor's Pick A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

2 Comments

Hi, I am The cat that likes fried rice. Can I have your permission to link this article in my 563amk.com blog?

Sure!