This Latest $962 PSF Land Bid May Push Dairy Farm Homes Past $2,300 PSF — Here’s Why

January 22, 2026

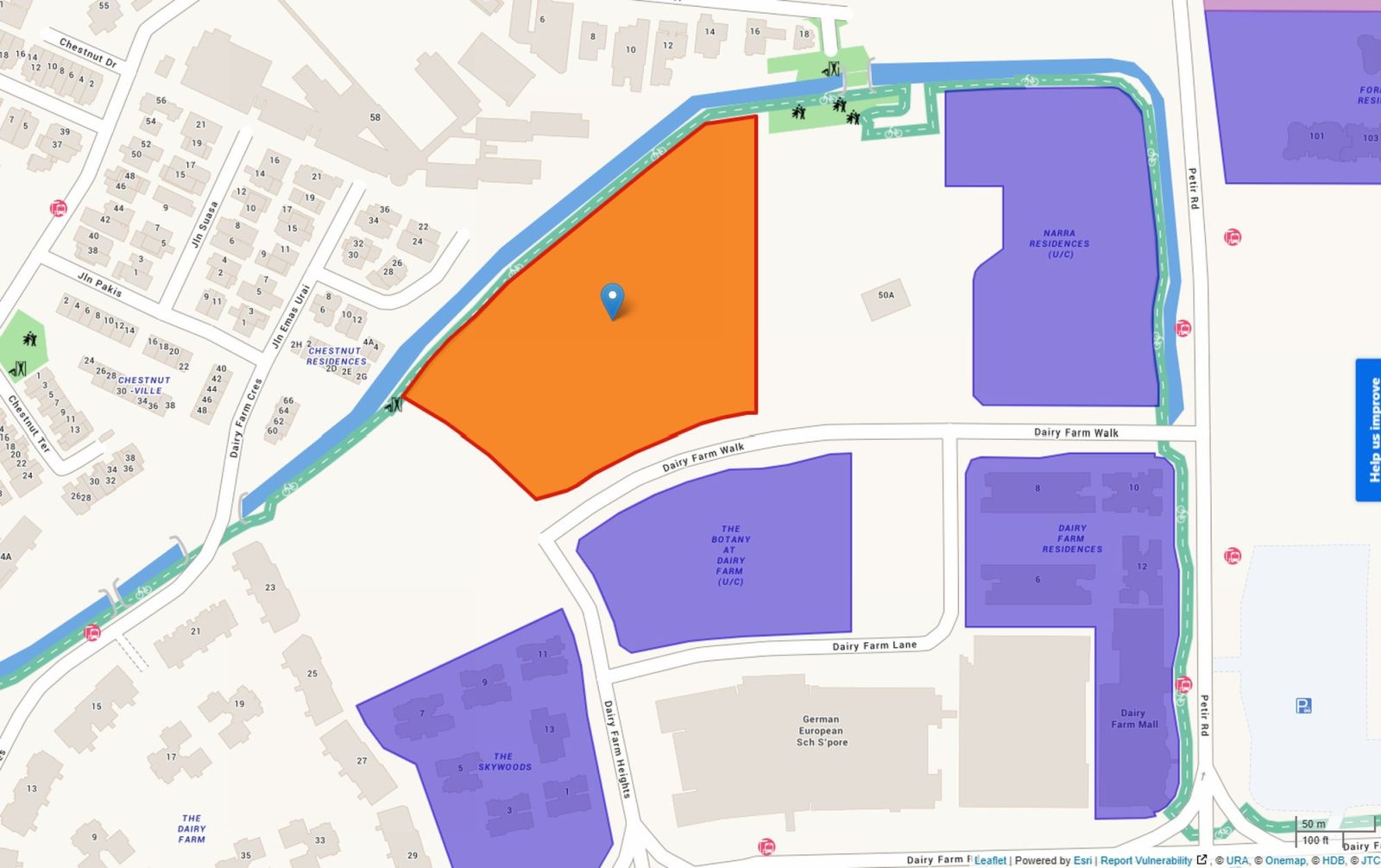

The tender for a residential site at Dairy Farm Walk attracted five bids when it closed today. The top bid of $427.0 million was submitted by a consortium comprising ABR Holdings, LWH Holdings, Macly Capital, and RP Ventures (a subsidiary of Roxy Pacific Holdings).

Based on the top bid of $427.0 million, this works out to about $962 psf per plot ratio (ppr).

According to industry analysts, if the site is awarded to the top bidder, the new condominium could see indicative launch prices from around $2,200 to $2,300 psf, depending on unit mix and positioning. The site is expected to yield up to 480 new private homes.

Meanwhile, a joint venture between GuocoLand and Hong Leong Holdings submitted the second-highest bid of $425.25 million ($959 psf ppr). The gap between the top two bids was just 0.4%.

“The competitive response reflects sustained developer confidence in the city-fringe segment, particularly in areas with limited new private housing supply and conserved natural surroundings,” said Marcus Chu, CEO of ERA Singapore.

The other participants included a consortium comprising Santarli Realty, Apex Asia, Soon Li Heng, and Kay Lim Realty ($410.87 million, $926 psf ppr); Kingsford Group ($377.25 million, $850 psf ppr); and Sim Lian Group ($372.5 million, $840 psf ppr).

The latest plot on Dairy Farm Walk was offered as part of the 2H2025 Government Land Sales (GLS) Programme.

The 316,819 sq ft site has a Gross Plot Ratio (GPR) of 1.4 and a maximum allowable gross floor area of around 443,000 sq ft. Height limitations mean that the residential blocks will be no more than six storeys, which matches the low-rise character of the surrounding Dairy Farm area.

This site is just up the road from the recently launched Narra Residences.

This land parcel is just minutes from Narra Residences, a recently launched private condominium along Dairy Farm Walk, developed by the Santarli-Apex Asia-led consortium.

They were awarded the site last January, with a winning bid of $504.51 million ($1,020 psf ppr). The 540-unit project is expected to launch for sale on Jan 31 with prices from $1,930 psf.

Based on indicative pricing, one-bedroom units at Narra Residences start from about $998,000 (roughly $1,930 psf for a 517 sq ft unit). We will provide a more comprehensive view of Narra Residences’ pricing, along with nearby Dairy Farm projects, in our upcoming Stacked Pro pricing review.

While the recently closed GLS site has a smaller GFA, pricing here is likely to be influenced by benchmarks set by earlier condos in this neighbourhood, including Narra Residences, The Botany at Dairy Farm, and Dairy Farm Residences.

The lower gross plot ratio of the latest Dairy Farm Walk GLS site likely played a part in moderating land bids, says Wong Siew Ying, head of research and content at PropNex. For context, the other four sites all had gross plot ratios of 2.1.

“A lower plot ratio limits how much floor space can be built on a piece of land; it also means that the development will be spread across multiple low-rise blocks which would then entail more lifts and common facilities to be built,” says Wong.

She adds that the site also features a sloping terrain, and when combined with the need for more low-rise blocks and lifts, this may result in relatively higher construction costs. “These factors could have led to more conservative bids from developers”.

A positive response to the launch of Narra Residences may raise buyers’ confidence in this site.

Earlier last year (January 2025), developer bids were notably more cautious for the Dairy Farm area. This was not due to lack of confidence, so much as developers at the bidding more selectively; at the time, it was known that a good number of sites (many in the pricier Core Central Region) were upcoming, so most developers reserved their capital for the broader pipeline of these sites.

More from Stacked

Can Lower-Income Singaporeans Better Afford HDB Flats In 2024? Here’s What The New Measures Mean

Since the news of the cooling measures in August, we've written about how it has impacted the middle-class group in…

2026 will see interest move back to the other regions, however, so subsequent bids in non-central areas are likely to be more aggressive. With Narra Residences seeing a positive response, developer sentiment toward the Dairy Farm is also likely to firm up; we’re likely to see continued interest here in future, should further land parcels come up for grabs.

“With no West-region OCR residential sites on the 1H2026 GLS confirmed List, the Dairy Farm Walk parcel stood out as a rare opportunity for developers targeting this segment, which likely contributed to the strong turnout and competitive bidding,” says Chu of ERA Singapore.

Currently, five GLS sites (excluding Executive Condominiums) remain open for tender, with another seven sites on the 1H2026 GLS confirmed list set to be launched. Developers who are unsuccessful in their current bids may pivot to other opportunities, such as the ongoing tender of another OCR site at Lentor Central,” he says.

Why Dairy Farm continues to attract interest from developers

Dairy Farm’s lack of very large malls, dense transport infrastructure, etc., is not a drawback; it is the very appeal of the area. This is a highly private enclave that has the feel of a low-density, landed-like area, but without the severe tradeoffs in accessibility that usually come with that.

The site is within walking distance of Hillview MRT station on the Downtown Line (DRL), still offering direct connectivity to the city. Road access is also strong, with the Bukit Timah Expressway (BKE) and Pan-Island Expressway (PIE) both nearby, making it convenient for drivers as well.

The key differentiator is the proximity to greenery. The area sits alongside Dairy Farm Nature Park and Chestnut Nature Park, with Bukit Timah Nature Reserve forming a natural buffer nearby. This combination of greenery and accessibility, without the same kind of high prices found in other parts of Bukit Timah, makes this a growth area for family condos.

Daily amenities are supported by HillV2, Rail Mall, and Dairy Farm Mall (the commercial segment of Dairy Farm Residences). Together, these reduce the need for noisy mall clusters, while still providing across-the-road retail and dining. For families, the site is within one kilometre of established primary schools such as Bukit Panjang Primary School and CHIJ Our Lady Queen of Peace.

While the 2H 2025 GLS Programme is introducing a broader range of sites, the Dairy Farm and Hillview area remains relatively insulated from oversupply.

With only a small number of recent and upcoming launches in this micro-location, buyers are not faced with an overwhelming volume of new options competing simultaneously.

To be clear, this is predominantly a family-oriented, owner-occupier area, so buyers are likely to be less concerned with ROI or short-term flips. But even so, the relatively low amount of competition supports future resale value.

For buyers, this site is not flashy or market-changing, but it plays toward the strengths of the Dairy Farm area. Condos here have consistently offered lower density, greenery-adjacent environments, with a clear owner-occupier profile. These are traits that tend to age well, even if it’s not the most headline-grabbing location.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What does the $962 psf bid mean for Dairy Farm homes?

How old is the Dairy Farm Walk land site?

Why is Dairy Farm still attractive to developers?

What are the main factors affecting land bids at Dairy Farm?

When is the Narra Residences launching and what are its prices?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

0 Comments