PPVC Construction : Why It Matters For Investors (The Good, Bad, And Ugly)

April 3, 2021

Let’s roll back time to the year 2017.

You are a savvy property investor, and have realised that the property market has bottomed out.

So you believe it is now the right time to start buying your investment property.

You’ve been to multiple new launch showflats – it’s quiet – just the way you like it.

Be greedy when others are fearful – you know the drill.

You’ve narrowed it down to 2 candidates for potential rentability in the future.

Clement Canopy at Clementi, and Forest Woods at Serangoon.

It’s a toss up between the 2, how do you really decide? Clement Canopy will be an attractive rental play (NUS and the like). Plus, you’ve always liked UOL projects for its landscaping.

That said, the distance to the MRT could be a concern.

Forest Woods is no slouch either in the developer department – CDL is one of the most well known in Singapore. It is closer to an MRT station too – Serangoon MRT (Circle and North East line).

So on that note, you decide to go for Forest Woods.

Sounds sensible, right?

Now, let’s see how that decision has played out in 2021.

| Clement Canopy | Forest Woods | |

| TOP | March 2019 | Nov 2020 |

| Purchase Price | $949,000 | $908,000 |

| Size | 657 | 667 |

| Rental | ||

| Monthly Rent | $2,800 | $2,800 |

| June 2019 | $33,600 | – |

| June 2020 | $22,400 | First rental transaction commenced in Feb 2021* |

| Total Gross Rental Income | $56,000 | $5,600 |

Capital appreciation aside, it’s clear to see that as of today, Clement Canopy would have been the smarter choice if rental income was your priority.

It all boils down to the additional time that you would have gained in rental income.

Despite Forest Woods being launched earlier during end 2016, Clement Canopy comes out on top because it was built faster and completed nearly a year quicker than Forest Woods.

So is it just a coin flip as to which developments would be completed faster?

Well, not quite. If you haven’t heard already, let me introduce you to today’s topic – buying a PPVC condo.

Given that it is now “launch season” of the 2019 GLS sites (where majority were required to be built by PPVC), it seems as good a time as any to talk about it.

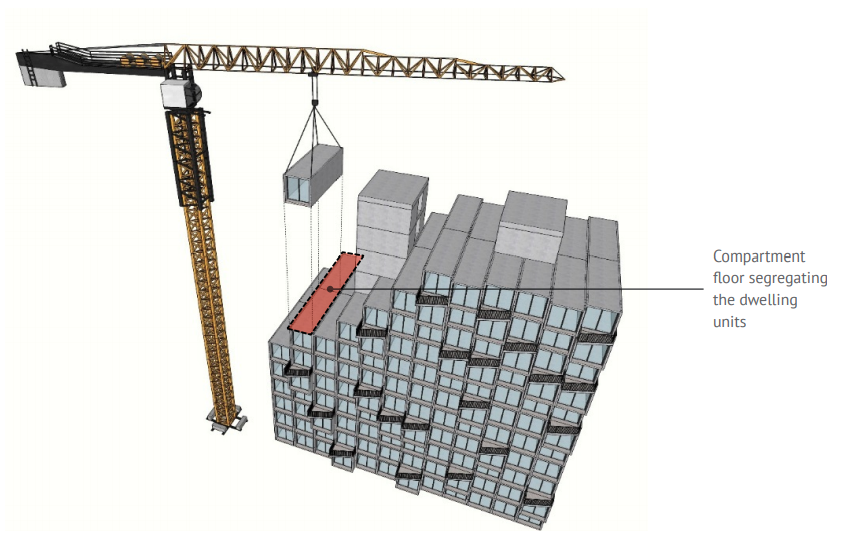

PPVC actually stands for Prefabricated Prefinished Volumetric Construction.

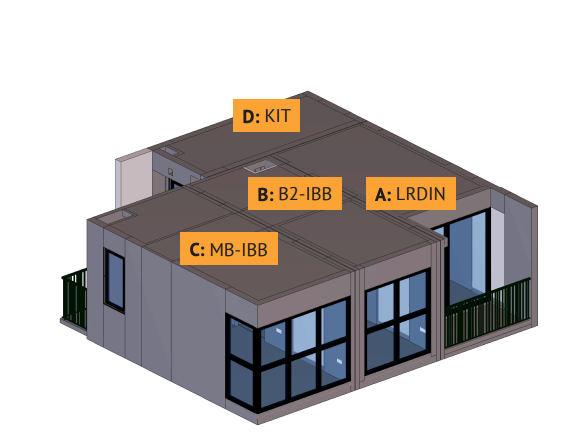

In simple terms, this means assembling modular shoe-box like structures to make a building.

These modules have side openings, where if assembled side-by-side, will make up the doorways and corridors – which eventually form your unit layout.

As always, there are pros and cons to such a way of construction, so let me go through with you the good, the bad, and the ugly of PPVC construction.

The Good – Faster completion and better quality

Like I mentioned in the introduction, the biggest benefit of buying a PPVC condo is its shorter construction period.

Because the modules are made in a factory-like setting production is much faster and less affected by site logistics or space constraints.

You can see this in current sites like Midtown Modern or Stirling Residences, for example.

So aside from quick construction, another plus point is that it does have a positive effect on the build quality.

With the controlled nature of PPVC construction, the odds of defects are much lower as the installation of finishes and cabinets are all done under a controlled setting in a factory.

Contrast this to a tight dim working space in a traditional construction setting and you can quite easily see the advantages.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

We Spent $36k On Our 4-Room BTO Renovation: Here’s Our Scandi-Boho Result

Perhaps because of the increasing home renovation costs, or maybe it's because of how easy it is to get interior…

Now, as much as I’ve glorified PPVC construction so far, it is always prudent to give a balanced viewpoint – so let me now talk about the bad and the ugly.

The Bad – Shorter ceiling height and limited room sizes

You’ve probably heard a common criticism of new launch condos in Singapore today.

They all look the same.

Well, in some sense that could be due to the introduction of PPVC in Singapore.

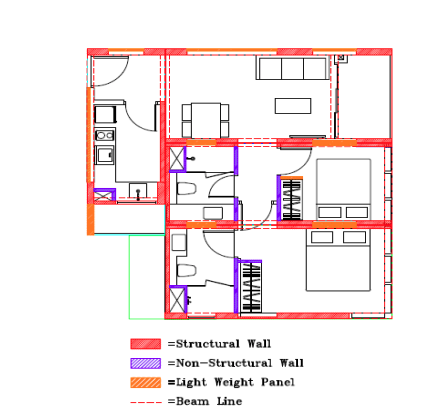

Typically, PPVC units have a 2.75m ceiling height and 2.8m room width.

In contrast, conventionally built condos can afford higher ceiling heights ranging from 2.9m to 3.3m and are not limited in room widths.

So this means you are able to get more flexible layouts with traditional construction.

To give you some context, the restriction in size all boils down to limitations in transporting the modules.

In compliance with traffic regulations, transporting trucks must be shorter than 4.5m to be allowed on public roads without police escorts.

The room ceiling height is therefore what remains after subtracting the truck platform height and the module’s floor or ceiling slab thickness.

As for room widths – it is limited to a maximum vehicular width of 3m minus wall thickness.

So does this mean you cannot have high ceilings anymore?

Well, while PPVC is increasingly a GLS requirement, developers can still build via the conventional methods up to a limited percentage.

So not all unit types will have to be subjected to the constraints.

Developers can essentially allocate these areas to larger unit types to raise the ceiling to 2.85m, or perhaps even more for units with strata voids.

The Ugly – Limited renovation options

With conventionally built units, you can allow for hacking of walls to some extent.

This gives you the freedom to edit unit layouts to suit different lifestyles – either by resizing or even combining rooms.

Which leads me to another hindrance – the walls of PPVC units are not hackable due to its structural nature.

Personally, it isn’t a dealbreaker – but you can see where the limitations lie more clearly when it comes to the PPVC method.

With all said and done…

As with most things in life, there are definitely pros and cons to the PPVC method of construction.

Given the modular nature, PPVC condo units will often have efficient layouts – regular shaped rooms that are large enough for a queen sized bed.

In comparison, conventionally built condos can sometimes end up with odd-shaped layouts and unusable spaces due to a small site or poor design planning.

Both of which you would rarely come across in a PPVC condo.

But, given the “set” construction method of a PPVC condo, you can say that there might be limitations to the overall uniqueness of a home.

As always, there are many considerations to choose from when it comes to buying a property. Deciding to go for a PPVC condo or a traditionally built one should not be the be all and end all to make your decision – but just one that you need to know especially where timelines are concerned.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is PPVC construction in property development?

What are the main advantages of buying a PPVC condo?

What are the common drawbacks of PPVC construction?

How does PPVC construction affect renovation options?

Are all new condos in Singapore built using PPVC technology?

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

On The Market Here Are Hard-To-Find 3-Bedroom Condos Under $1.5M With Unblocked Landed Estate Views

5 Comments

May I also add on that the usable area you are getting is smaller because of the increased thickness in walls.

Ageee

Your table calculation isn’t intuitive. What are you comparing in the left and right columns. Why do you have differing figures for 2019 vs 2020.

Thank you! This is very useful. Does the size limitation mean that the bigger rooms, e.g., master bedder, living room, etc, are built the conventional way even in a ppvc project?

The Stacked Homes article provides a comprehensive analysis of PPVC construction, highlighting its potential to revolutionize the building industry.The emphasis on faster project completion and enhanced quality control underscores PPVC’s appeal to investors seeking efficiency and reliability.However, the discussion on challenges like design limitations and higher initial costs offers a balanced perspective, aiding investors in making informed decisions.Overall, this piece is an insightful resource for understanding the multifaceted impacts of PPVC on real estate investment.‚Äã