Why 2026 May Be a Good Year to Buy an EC — With an Important Caveat

January 19, 2026

It was an interesting year for the private residential market in 2025, but unfortunately, less so for the executive condominium (EC) segment. Apart from Aurelle of Tampines and Otto Place, the EC buyers were short on choice when it came to this type of subsidised residential project. The good news is that 2026 is shaping up to be quite different.

The EC market kicked off in a big way this year with the sales launch of Coastal Cabana, a 748-unit EC project in Pasir Ris, over the Jan 17 and 18 weekend. The project sold a total of 498 units (66.5%) at an average price of $1,734 psf.

With approximately four more EC projects expected this year, the launch pipeline has more varied options for hopeful buyers. This could offer a much-needed opening for HDB upgraders, who face some affordability challenges when it comes to finding similarly sized replacement homes.

But the EC market has undergone some changes in recent years, and buyers today face a different market landscape compared to buyers in the past. Some of the prevailing market conditions and project dynamics are not all positive.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

A quick rundown of upcoming ECs in 2026

For Coastal Cabana, which is the first EC launch of the year, you can read our full review of the project here. We also have a more in-depth analysis of the upcoming EC projects, which you can check out here.

In summary, here’s what to expect:

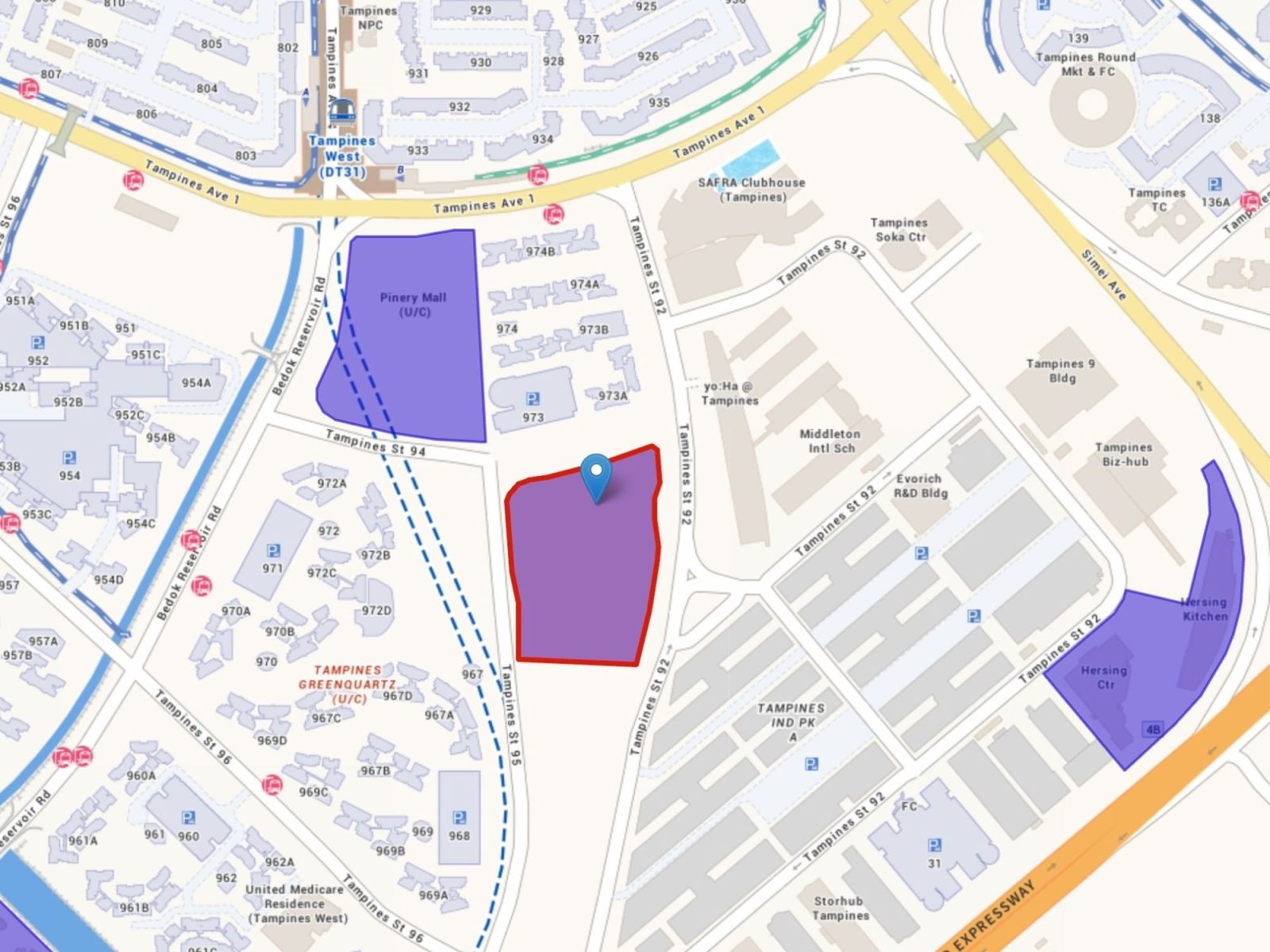

1. Rivelle Tampines

Tampines will see another EC project enter the market this year after Aurelle at Tampines, a 760-unit development at Tampines St 62, sold out within a month of its launch last March.

The next key EC project in the Tampines area is Rivelle Tampines, a 572-unit project at Tampines Street 95. The site was awarded to Sim Lian Group when they put in a winning bid of $465 million ($768 psf ppr) in Oct 2024 – at the time, this land price set a new record.

This site benefits from proximity to Tampines West MRT on the Downtown Line (DTL). Rivelle is likely to appeal to buyers who prefer a home within an established residential town and its conveniences.

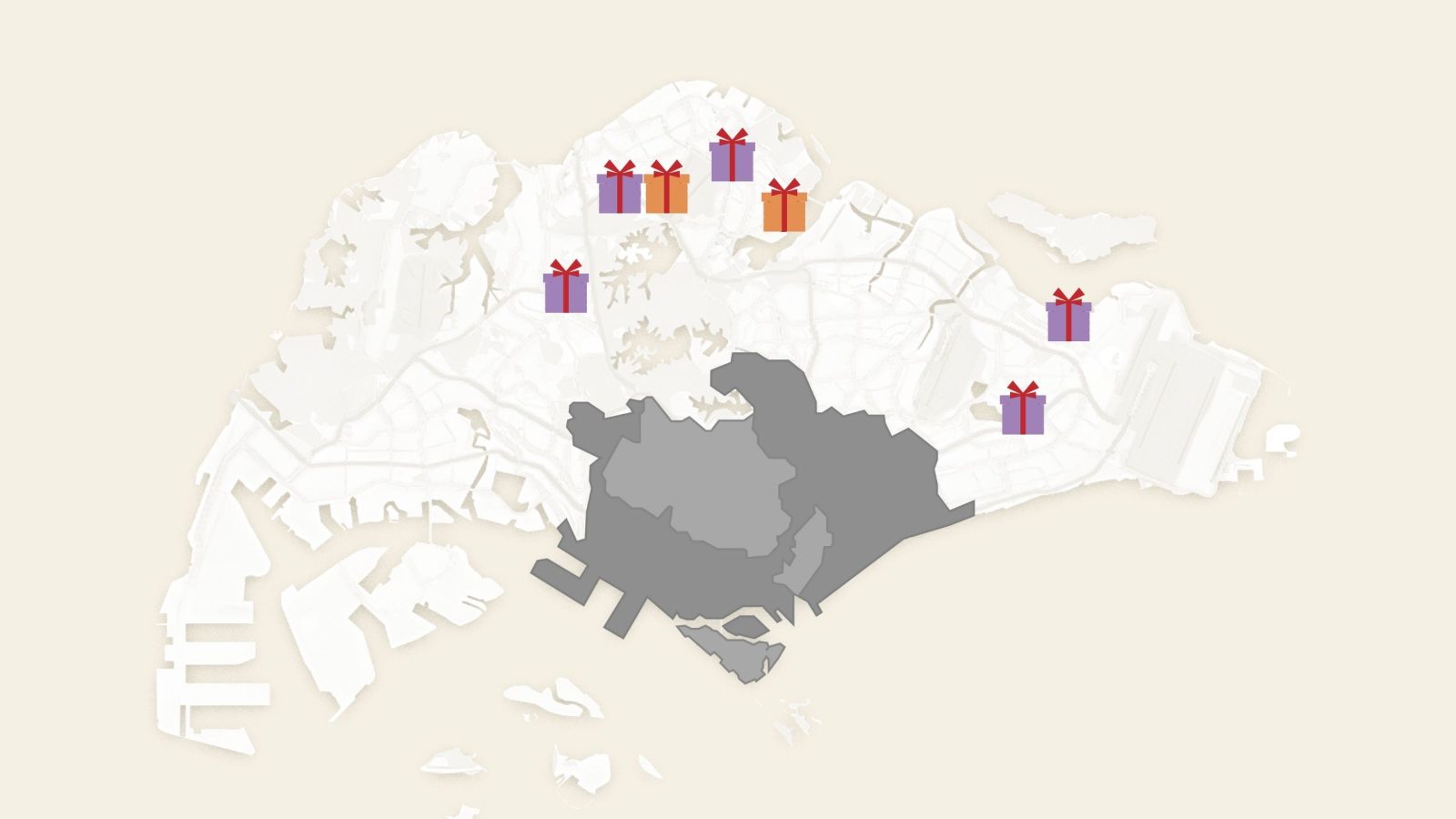

2. Senja Close

In the west, buyers who are considering the Senja Close EC site in District 23 should be aware of its slim public transport connectivity. It will likely resonate with families who value a quieter, heartland environment.

While the site isn’t within walking distance of an MRT station, it sits within an existing HDB neighbourhood with its usual slew of neighbourhood shops, hawker centres, and community amenities. The nearby Senja LRT connects to Bukit Panjang MRT on the DTL, and there’s good general access to Hillion Mall, Bukit Panjang Plaza, and other retail options.

This EC project will be developed by City Developments (CDL), which won the site after putting in a $252.89 million ($771 psf ppr) bid when the tender closed last August.

3. Woodlands Drive 17 (Two EC sites)

Further north, Woodlands Drive 17 stands out because the area will see the launch of two different launch-ready EC projects this year. Both are next to Woodlands Health Campus and close to Woodlands South MRT on the Thomson-East Coast Line (TEL).

Here, we see CDL’s active participation in the mass market segment, with the developer winning the first site on the back of a $360.9 million ($782 psf ppr) bid last August. The second site will be developed by Sim Lian Group and was recently awarded to them after they put in a $484 million ($794 psf ppr) bid for the site on Jan 13.

Sim Lian’s land bid of $794 psf ppr is also the reigning record price for a EC site.

The introduction of these two new EC projects will be significant in meeting the significantly underserved demand for new EC homes in the north.

The proximity to healthcare services, employment opportunities, and the development of a master planned regional centre makes these upcoming projects particularly relevant for buyers with a long term holding horizon, including those considering the potential uptick in rental demand from healthcare and education-related industries in the area.

4. Sembawang Road

Keeping our sights on the north region, new EC supply this year could also come from a site at Sembawang Road. This is a unique plot because it sits next to a low-density landed enclave near the fringe of Yishun.

Unlike Woodlands, this location relies more heavily on bus connections to reach MRT stations such as Yishun or Canberra, but it will draw those who like the quiet feel of landed areas.

This site is likely to attract buyers who prioritise privacy and a calmer neighbourhood over immediate transport convenience, particularly HDB upgraders from the surrounding estates.

The new development will be interesting to keep an eye on since the developer behind it is not one we have seen often in the market. The site went to Oriental Pacific Holdings, a business unit of JBE Holdings, after they put in the winning bid of $198 million ($692 psf ppr) last September.

5. Miltonia Close

Finally, the upcoming EC at Miltonia Close rounds out the pipeline with another northern option, this time near the Lower Seletar Reservoir. We don’t know clearly where this project might sit in terms of pricing because the tender will only close in April.

But this site is close to previously launched ECs such as The Criterion, which completed in 2018, and Skies Miltonia, which completed in 2016. Based on resale transactions over the past two years, the average price at The Criterion is about $1,296 psf, while it is $1,232 psf at Skies Miltonia.

When the latest EC site here is awarded, the character of the new project will likely echo the nearby greenery and exclusive enclave along Miltonia Close. The lack of convenient public transport options might be a no-go for some buyers, and MRT access requires a bus connection to Khatib station. While accessibility is a challenge in this area, it’s also a rare opportunity at a (semi)private waterfront option.

The market sentiment on ECs going into 2026

Market sentiment surrounding ECs remains strong as ever as we head into 2025, and EC launches last year show that demand is persistent.

More from Stacked

I’ve Been A Landlord For 18 Years: Here’s Why I Don’t Rent To Singles And Only Families

Co-living has been a roaring trend since last year, with many landlords adding rooms to get as many tenants as…

In 2025, new EC launches saw nearly all units snapped up: about 1,600 units were sold across two projects – Aurelle of Tampines and Otto Place in Tengah – which collectively moved around 97% of their inventory.

“As the price gap between ECs and new private homes continues to widen, demand from HDB upgraders has remained resilient,” says Eugene Lim, key executive officer of ERA Singapore.

Commenting on the sales result of Coastal Cabana, he adds that it is one of the few opportunities to purchase a new EC in the eastern region for the next few years. “In a market where buyers are increasingly aware of future supply, locational scarcity matters,” he says.

Developers are also quite confident about sustained EC demand. In January 2026, a Sim Lian–led consortium set a new benchmark by bidding $484 million for one of the Woodlands Drive 17 EC sites (see above). By our estimates, this implies potential future selling prices of around $1,850 psf. If so, this would surpass earlier benchmarks set by Aurelle of Tampines and Otto Place.

This has fanned the flames of competition for new EC sites. Given the expected level of private residential new home prices in 2026, ECs look even stronger as a value buy. Take Coastal Cabana as an example – the Jalan Loyang Besar site was secured at $729 psf, a record at the time of bidding.

Despite this, sales at Coastal Cabana closed last weekend at an average of $1,734 psf.

Now consider the pricing of several resale, private OCR projects: Provence Residence (around $1,616 psf), Parc Central Residences (around $1,560 psf), and Parc Greenwich (around $1,466 psf) are all EC, and yet their price point is already close to the brand new (and post-GFA harmonisation) Coastal Cabana.

“At current price levels, ECs continue to offer a more accessible entry point compared to new private condominiums, especially for families seeking their first home or upgrading from HDB flats,” says Lim. He points out that for many buyers, purchase decisions today are driven by absolute price, which remains the key affordability benchmark for upgraders.

So, even if developers are paying higher prices for EC land plots, the end product is still a strong value proposition.

Regarding upgraders, we’ve pointed out before how some families are now settling on two-bedders, when it comes to fully private condos. This is because a two-bedder unit is often the most affordable option, falling into the quantum range of $1.8 million to $2 million. But consider that four-bedroom units start from about $1.623 million in Coastal Cabana, with sizes beginning at 990 sq ft (four-bedroom classic).

Among those unwilling to squeeze into two-bedders, but still willing to upgrade, ECs are going to be the prime choice in 2026.

That being said, a continuing issue in 2026 will be the Loan To Value (LTV) ratio when buying an EC

Based on the $16,000-per-month household ceiling on ECs, you can’t actually get full financing (usually 75% of the price or valuation, whichever is lower).

To put this into perspective, take Coastal Cabana’s indicative four-bedroom pricing of around $1.623 million.

While buyers may assume a 75% loan is possible on paper, the Mortgage Servicing Ratio (MSR) caps monthly repayments at 30 % of income, or $4,800 for a household at the income ceiling.

Using a floor interest rate of 4%* and 25-year loan tenure, this supports a loan of only about $900,000 to $920,000. In practical terms, that means buyers need to fund roughly $700,000 upfront, pushing the effective down payment closer to 40+% rather than the usual 25%.

*While real interest rates are falling, this is not relevant to the MSR or Total Debt Servicing Ratio (TDSR) frameworks. The floor rate of 4% is used to calculate MSR or TDSR, regardless of your actual loan rates.

Falling home loan rates are also a boon to EC buyers

Home loan interest rates are at three-year lows, although whether it stays that way depends on the volatile US economy. What matters though, is that sub-2% interest rates are now possible again.

This is especially relevant to EC buyers, because there are no HDB loans for ECs. Some HDB upgraders who make the jump to an EC will be taking on a private bank loan for the first time; so lower interest rates ultimately mean they pay less for their homes. Here’s an older explanation on the numbers which is still relevant.

What can we expect from the EC market in 2026

The EC segment in 2026 is poised to remain a sweet spot in Singapore’s property market. Prices of new ECs will likely edge upward (and could set new records in select locations), but they’re still comfortably below equivalent private condo prices.

A larger launch pipeline in 2026 means buyers can afford to be more selective, potentially easing some of the urgency seen in recent years. Barring unforeseen cooling measures or economic shocks, ECs should continue fulfilling their role as the affordable condominium alternative for the middle class, with steady demand and gradual price growth.

Lim points out that an increasingly prominent segment of EC buyers are young couples and families whose incomes exceed the BTO income ceiling. “We are seeing growing demand from buyers earning above the BTO income threshold but not yet comfortable stretching to private condominiums. For this group, ECs represent a natural middle ground,”he says.

However, it is important to consider that this outlook is tempered with some minor issues, such as the interaction between the income ceiling and the MSR; but this is not a new revelation. We would also expect some complaints about the gap between the floor rate of 4% for MSR calculations, and the actual interest rates to date; but we haven’t yet heard of any plans to change the floor rate.

“From a pricing standpoint, ECs continue to offer a compelling entry point, coupled with long-term value. Historically, this pricing gap has translated into stronger upside when they are up for resale, particularly for ECs located in mature towns,” says Lim.

Overall, we think that for most households that can navigate prevailing constraints, ECs in 2026 are still likely to offer the most balanced combination of affordability, liveability, and long-term upside for buyers.

Follow us on Stacked, and we’ll give you the latest information and reviews on the year’s ECs as they become available.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Market Commentary Singapore’s Tallest HDB Yet: A 60-Storey Project Is Coming To Pearl’s Hill

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Latest Posts

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

0 Comments