One of Singapore’s Biggest Property Agencies Just Got Censured

January 18, 2026

For only the second time in our history, a whole property agency has received a censure from CEA.

I’m not talking about one rogue agent here, I mean the entire firm of ERA, according to a recent report.

This is a little more significant when you consider we’re in something of an oligopoly: Singapore’s property firms mostly come down to the “big three” of PropNex, ERA Realty Network, and Huttons Asia. So when one of the big three gets censured, well, you begin to run out of places to shift your trust.

In any case, the issue involved an agent who repeatedly posted listings with misleading or inaccurate information (i.e. incorrect prices and details that did not match the actual properties being offered.) Buyers complained, and CEA stepped in.

The agency was told to monitor this salesperson’s listings before they went live. But even after that warning, more misleading ads continued to appear. The salesperson was fined and suspended, returned to work, and then committed further breaches, leading to a second suspension and heavier penalties.

At which point, the focus went from said agent, to whether the agency had effective systems to stop the behaviour.

While this is just one incident, it may reflect an inherent issue in the business model

Major property agencies don’t function like traditional firms. If I had to use an analogy, I’d say it’s really more like a platform. Thousands of self-motivated, commission-driven salespeople who work under a single brand: they’re running their own marketing, and chasing their own leads. The agency provides training, systems, and branding, but day-to-day behaviour is largely decentralised.

This is familiar to anyone in a sales line. This model allows agencies to scale quickly, dominate portals, and (theoretically) respond faster to market shifts. But it also creates an uncomfortable tension: a potentially greater disparity in service quality. Some will be ethical and careful, others will be aggressive and cut corners.

The big difference, when it comes to property, is that it involves the biggest purchase most people will ever make in their lives. The consequences of one failed service can be life-altering; and that isn’t just down to issues during transactions. Fake property listings are used to distort a buyer’s sense of affordability, create artificial urgency, and nudge someone into a decision that will shape their life for decades.

The finance industry learned this a bit earlier, and we can see compliance is tight for any insurer. But CEA can be considered a more recent regulatory arrival; it was established on 22nd October 2010. The finance industry, on the other hand, has seen regulations by MAS since the 1970s.

Property agencies, I suspect, are just now approaching that same crossroads.

As much as property agents need to be agile and independent, the consequences may be too significant to permit the amount of “give” they have today. There’s also the issue of asymmetry of information: some of us follow the property market closely, and know all the nuances. But the larger part of the population only looks this up when they need to, which may be once every few decades when they move.

Even with all the resources of property sites, most buyers can be hoodwinked with selective presentation of transaction histories. Issues like pre- and post-GFA harmonisation, upcoming nearby projects, the real (or purely imagined) significance of being freehold, etc. are quite opaque unless you’re keeping up every year.

So I suspect the time is coming when regulations won’t stop with “monitor this rogue agent.” At some point, compliance could mean:

- Standardised listing formats, limiting how prices, availability and unit details can be presented

- Mandatory verification of price, floor level, size and images, before a listing goes live (either imposed on the property portal or the agency)

- Required log of when a listing was edited after posting, and which parts

All this coupled with the usual threat of steeper fines, or easier loss of licenses.

More from Stacked

An Inside Look Into The “Shady” Renovation/ID Industry In Singapore: Here’s How It Really Works

We recently wrote about a horrible renovation story in Singapore, and it was clear it struck a chord with many…

It may also be far more efficient for the regulator to go after the big agencies themselves, rather than chasing individual agents one by one. When the agency itself feels threatened, that pressure naturally cascades down to every (bad) realtor operating under their brand.

Since this is an industry dominated by a few large players, disciplining the core players is more effective than trying to police everyone. As such, it wouldn’t surprise me if we see more censures and penalties directed at the whole agency in future.

What this means for buyers, for now

It just means that checking for an agent’s license is only the first place to start. You still need to assume what you see online, and the information you’re presented with, is possibly marketing first and information second.

(Emphasis on the “possibly,” as there are actual good agents who use proper data. It’s just that a license is not what shows that.)

The difference shows up in the details. Good agents know which stacks face the road and what that means. They understand why certain floor bands in the same project transact differently. They go down to the site and measure noise, or hang around the lobby to gauge interest.

Check for your agent’s license first, but make sure that’s only their foot-in-the-door.

Meanwhile in other property news…

- What should property investors keep in mind before venturing into Malaysia? We got some key insights from Samuel Tan, founder & CEO of Olive Tree Property Consultants.

- Newport Residences is a freehold condo in the CBD, that starts from just $1.29 million. Check out the review here.

- If you’re nearing retirement, how should you plan what to do with your property assets? Check out our detailed answer to a reader’s question here.

- D’Leedon was called expensive when it launched, especially for being a leasehold condo amid freehold ones. But check out the ironic twist that saw it become one of the top performing condos of 2025.

Weekly Sales Roundup (05 – 11 January)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $5,011,000 | 1539 | $3,255 | FH |

| GRAND DUNMAN | $4,497,000 | 1787 | $2,517 | 99 yrs (2022) |

| NAVA GROVE | $4,145,200 | 1550 | $2,674 | 99 yrs (2024) |

| ARINA EAST RESIDENCES | $3,888,000 | 1389 | $2,800 | FH |

| THE CONTINUUM | $3,736,000 | 1249 | $2,992 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE LAKEGARDEN RESIDENCES | $1,260,000 | 592 | $2,128 | 99 yrs (2023) |

| OTTO PLACE | $1,483,000 | 872 | $1,701 | 99 yrs (2024) |

| UPPERHOUSE AT ORCHARD BOULEVARD | $1,545,000 | 474 | $3,262 | 99 yrs (2024) |

| TEMBUSU GRAND | $1,557,000 | 646 | $2,411 | 99 yrs (2022) |

| CANBERRA CRESCENT RESIDENCES | $1,621,300 | 797 | $2,035 | 99 yrs (2024) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE MARQ ON PATERSON HILL | $37,000,000 | 6232 | $5,937 | FH |

| REGENCY PARK | $7,120,000 | 3175 | $2,242 | FH |

| NASSIM JADE | $6,800,000 | 2260 | $3,008 | FH |

| THE DRAYCOTT | $5,818,000 | 2637 | $2,206 | FH |

| GRAMERCY PARK | $5,200,000 | 2153 | $2,415 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SUITES @ PAYA LEBAR | $666,588 | 377 | $1,769 | FH |

| EVERITT EDGE | $720,000 | 484 | $1,486 | FH |

| CARDIFF RESIDENCE | $720,000 | 420 | $1,715 | 99 yrs (2011) |

| REZI 3TWO | $739,888 | 463 | $1,599 | FH |

| HILLSTA | $740,000 | 527 | $1,403 | 99 yrs (2011) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE MARQ ON PATERSON HILL | $37,000,000 | 6232 | $5,937 | $5,599,300 | 19 Years |

| NASSIM JADE | $6,800,000 | 2260 | $3,008 | $3,170,000 | 26 Years |

| NASSIM JADE | $6,668,000 | 2260 | $2,950 | $2,487,000 | 30 Years |

| TIARA | $3,288,000 | 1302 | $2,524 | $2,058,000 | 19 Years |

| REGENCY PARK | $7,120,000 | 3175 | $2,242 | $1,770,000 | 16 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE SCOTTS TOWER | $1,830,000 | 850 | $2,152 | -$1,332,900 | 13 Years |

| REFLECTIONS AT KEPPEL BAY | $1,650,000 | 786 | $2,100 | -$157,800 | 14 Years |

| CITY GATE | $988,888 | 484 | $2,042 | -$89,112 | 11 Years |

| EVERITT EDGE | $720,000 | 484 | $1,486 | $30,000 | 11 Years |

| SPOTTISWOODE SUITES | $970,000 | 452 | $2,146 | $47,000 | 13 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| ASTOR GREEN | $2,350,000 | 1528 | $1,537 | 215% | 19 Years |

| TIARA | $3,288,000 | 1302 | $2,524 | 167% | 19 Years |

| PARC EMILY | $2,620,000 | 1206 | $2,173 | 163% | 20 Years |

| PRIVE | $2,350,000 | 1442 | $1,629 | 151% | 15 Years |

| ESPARINA RESIDENCES | $1,780,000 | 1001 | $1,778 | 138% | 15 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| THE SCOTTS TOWER | $1,830,000 | 850 | $2,152 | -42% | 13 Years |

| REFLECTIONS AT KEPPEL BAY | $1,650,000 | 786 | $2,100 | -9% | 14 Years |

| CITY GATE | $988,888 | 484 | $2,042 | -8% | 11 Years |

| THE LINE @ TANJONG RHU | $2,450,000 | 1066 | $2,299 | 3% | 4 Years |

| EVERITT EDGE | $720,000 | 484 | $1,486 | 4% | 11 Years |

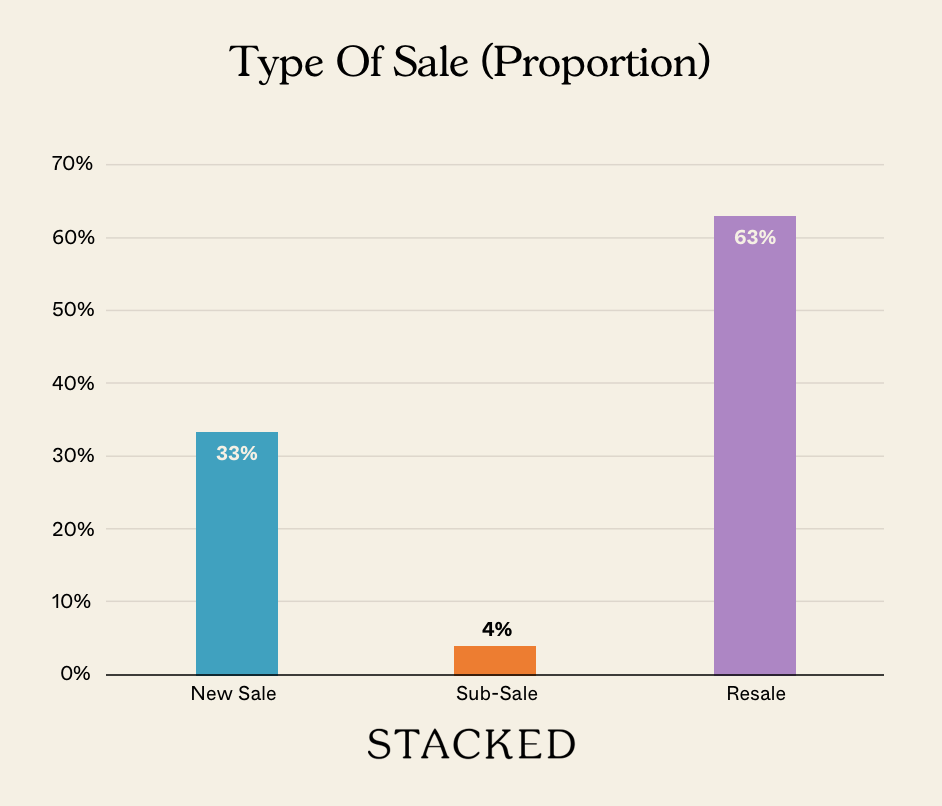

Transaction Breakdown

Follow us on Stacked for news and reviews in the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What does it mean if a property agency gets censured in Singapore?

How can I tell if a property listing is accurate?

What might future property regulations in Singapore look like?

Why is the property agency model in Singapore considered risky?

What should buyers do to avoid fake or misleading property listings?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Singapore Property News Three Very Different Singapore Properties Just Hit The Market — And One Is A $1B En Bloc

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Latest Posts

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments