Can a One-Bedder Outperform a Two-Bedder? We Analysed 5 Years of Data

August 19, 2025

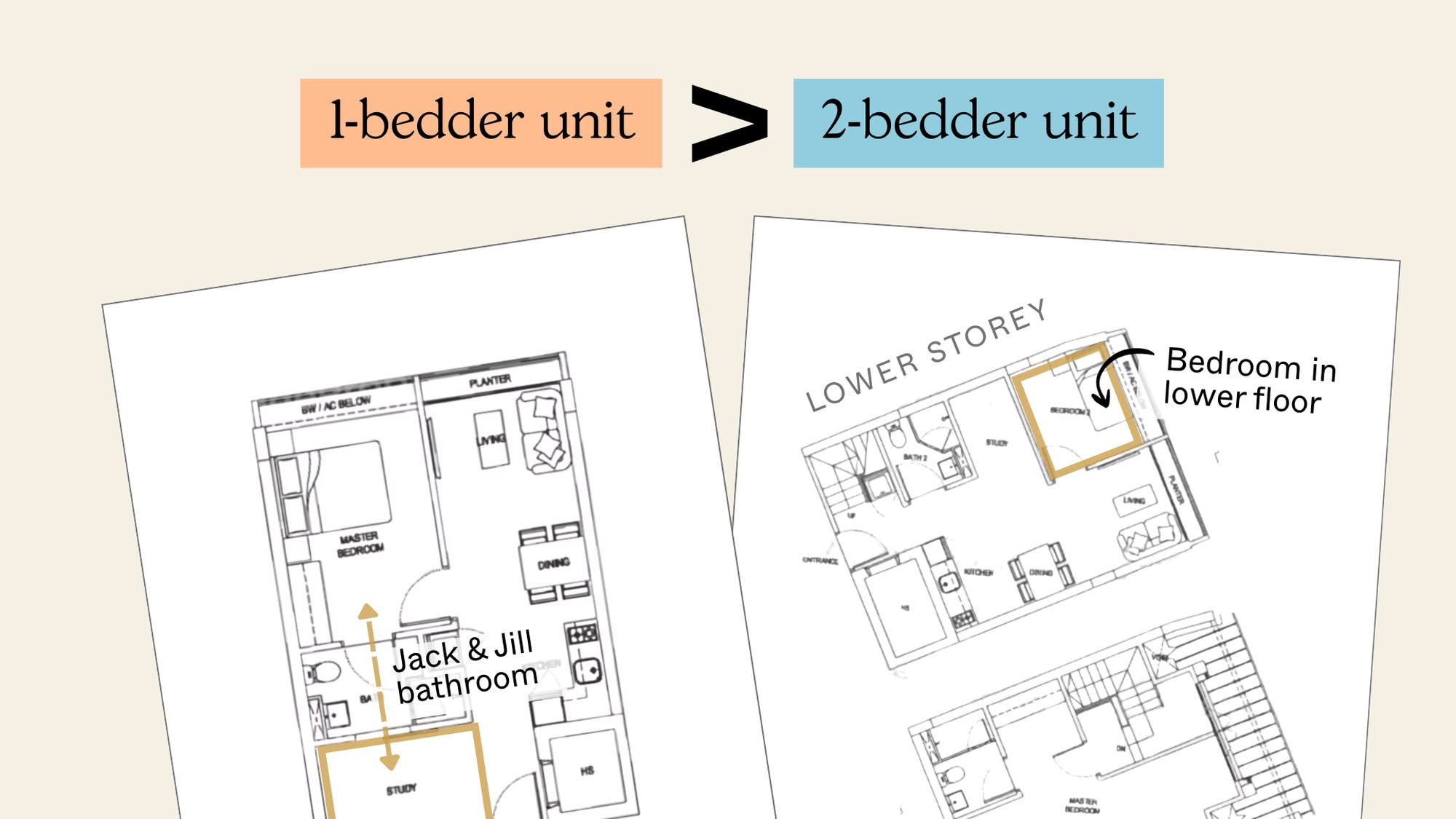

It’s a common saying that if you’re going to buy a smaller unit, you should buy a two-bedder (ideally two-bed, two-bath units). The theory is that two-bedders are more versatile, and hence see wider demand and stronger returns. Ask most people and they’ll tell you it’s “common wisdom.” But after doing some deep dives to try and prove or disprove this, we’ve come across something interesting: a series of projects where the one-bedders managed to outdo the two-bedders, over five years. Here they are:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Property Investment Insights River Modern Starts From $1.548M For A Two-Bedder — How Its Pricing Compares In River Valley

Property Investment Insights This Singapore Condo Has Bigger Units Near The MRT — But Timing Decided Who Made Money

Latest Posts

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

New Launch Condo Reviews River Modern Condo Review: A River-facing New Launch with Direct Access to Great World MRT Station

On The Market Here Are The Cheapest 5-Room HDB Flats Near An MRT You Can Still Buy From $550K

0 Comments