We Compared Old vs New Condos in One of Singapore’s Fastest-Growing Districts — Here’s What We Found for Small Units

November 6, 2025

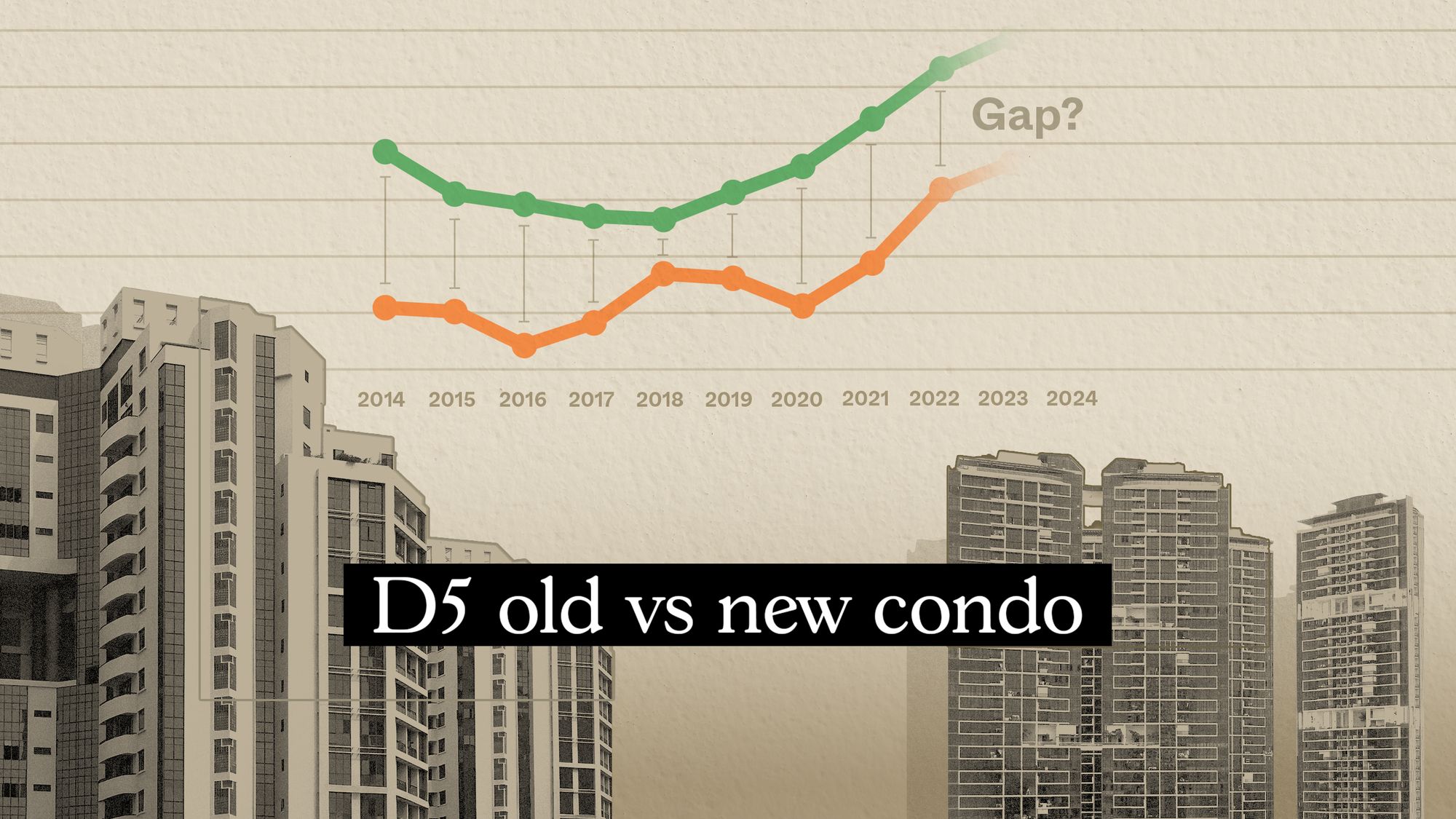

District 5 (D5) is often considered the “education belt” of Singapore, thanks to the presence of NUS, SIT, UniSIM, etc. But with the advancement of the One North tech and media hub, it’s also become a lot more popular in recent years. From a start-up enclave (read: great for rental prospects) to a hybrid of luxury and practical housing, this is now one of the more closely watched residential districts in Singapore. But how does lease decay impact properties here, and are older D5 properties at a serious disadvantage to newer ones? In this article, we look at the effects of age in condos across D5, and see if you should consider its older options:

And if this made you curious about whether older condos in D5 are really at a disadvantage, you’re not alone. Tell us what kind of property you’re considering and we’ll connect you with one of our trusted partner agents who can show which older developments are still holding up well, and where the newer ones may not justify their premium.

So many readers write in because they're unsure what to do next, and don't know who to trust.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments