Why OCR Condos Might Dominate Rental Markets In 2021

January 5, 2021

A short while ago we pondered whether the Singapore rental market could stay its course. Given the impact of Covid-19, our rental market has held up remarkably well; at this point simply maintaining rental income / yields can be considered fortunate.

However, not every segment of the rental market faces an equal challenge. While the Core Central Region (CCR) condos face higher risks of vacancies or falling rental income, the Outside of Central Region (OCR) may be the safe port in the storm for property investors; at least for 2021 and the near term:

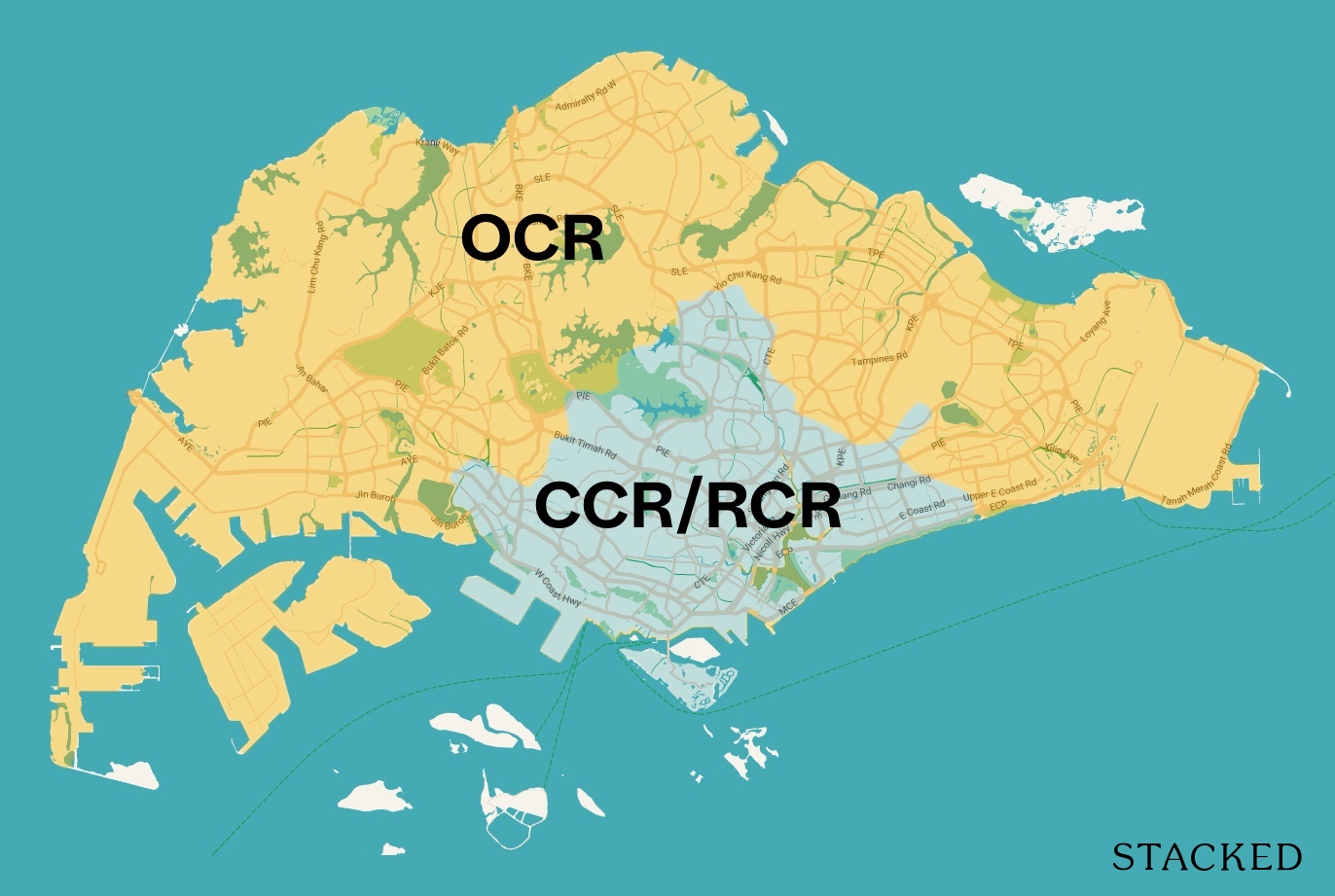

Where is the OCR?

By OCR, we refer to all districts from 16 to 19, and then all districts from 21 through to 28.

The latest health check on Singapore’s rental market

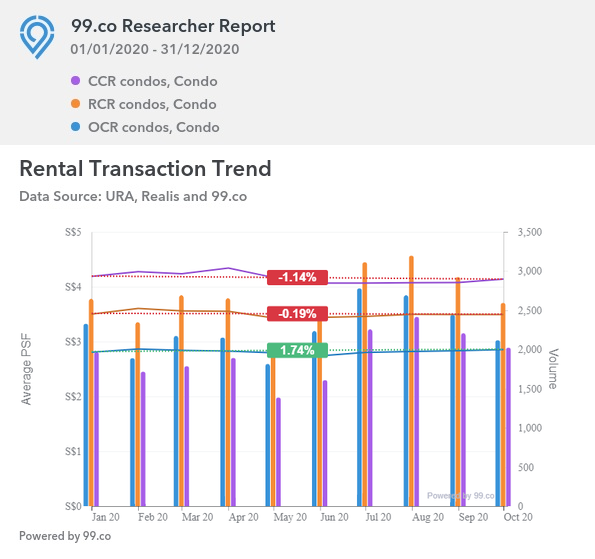

According to 99.co, these are the rental rates up to the latest available date (October 2020):

Rental rates in the CCR fell from $4.19 to $4.14 psf, while rates in the RCR were more or less flat; from $3.50 to $3.49 psf.

Only the OCR managed to see a slight increase, from $2.81 to $2.85 psf.

This coincides with a recent Business Times report, when Savills Singapore predicted a further decrease of three to five per cent in CCR rental rates for 2021.

(Note: Savills Singapore also estimated a much deeper drop in CCR rental rates than the chart above, calling a two to three per cent drop in 2020).

What’s supporting rental rates of OCR condos?

- Fewer prospective tenants

- Tenants downgrading

- Less preference for shared spaces

- Ongoing decentralisation

- Singapore’s transport infrastructure

1. Fewer prospective tenants

It’s foreign workers, not locals, who are seeing the highest rates of job loss. This is intentional, with initiatives such as the Jobs Support Scheme aimed at protecting Singaporeans first. From January to September last year, it was foreigners who made up nine in 10 job losses.

In Singapore, these foreign workers – many of whom are now heading home – made up the majority of prospective tenants in areas like the CCR.

Locals who need to rent, such as when they’re waiting for their home to be built, almost always pick fringe regions such as Jurong, Tampines, Woodlands, etc., for simple reasons of affordability.

As such, the OCR has experienced a smaller reduction in its tenant pool, compared to more expensive areas.

Rental MarketWill Singapore’s Rental Market Maintain Its Resilience In 2021?

by Ryan J. Ong2. Tenants downgrading

During a downturn, companies often cut costs by shrinking expatriate benefits packages. One element of this is housing allowance; tenants may seek shorter leases, and constantly be on the look-out for cheaper alternatives. We already saw a gradual exodus from the CCR to heartland areas, around the middle of 2020. More expats have also lost confidence over job prospects, and may be hesitant about committing to long, expensive leases.

That said, we should point out feedback from real estate agents has been a little bit different. While most we spoke to agree on an exodus from the CCR, their observation is that tenants who work in areas like Marina Bay Financial Centre, Robinson Road etc. tend to move to the RCR, rather than OCR. For example, an expat might consider a move to Bugis, but not as far out as, say, Bedok.

(This may explain why the RCR has managed to better maintain its rates.)

3. Less preference for shared spaces

Also from word on the ground, agents have told us the recent Circuit Breaker has changed attitudes; they are seeing more tenants avoid shared units.

While they may have been happy to live with several unrelated tenants before, the experience became unbearable once they were all stuck in the same unit. Some are also wary of health issues, and don’t want to live in close proximity to others right now.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Are you able to afford an average HDB resale flat?

So, how much do you need to earn to afford that resale flat? Singapore's HDB affordability has been put into…

Renting an entire unit on your own is much more expensive, which often rules out CCR and RCR properties. Based on the numbers above, however, the average 500 sq.ft. An OCR unit would only cost $1,425 a month.

4. Ongoing decentralisation

Singapore is making active efforts to decentralise the CBD. This is the reason for creating separate business hubs, such as Jurong East, Changi Business Park, the upcoming Woodlands North Corridor, etc.

As foreigners increasingly find employment in these areas, rather than the traditional CBD, condos in the OCR become more attractive (e.g. if you were to work in Changi Business Park, you would have better access by renting in Tanah Merah than in Newton).

Note that this also applies to amenities – the new business hubs are often also retail hubs, which makes living in fringe areas almost as convenient as the CBD.

5. Singapore’s transport infrastructure

In the current downturn, newer expats and tenants are likely to expand their search to find cheaper alternatives. This is when they’ll realise an inherent truth: Singapore is so small and well-connected, that they are not punished for seeking cheaper rent on the outskirts.

Unlike other countries where “fringe region” might mean a two-hour bus ride to work, most parts of Singapore are at most an hour from the city centre. “Fringe” also doesn’t mean a serious lack of amenities, as almost every neighbourhood has its own mall, eateries, recreational areas, etc.*

Expats who cast their net wider this year – and we suspect they will – are soon to discover that a $2,700 per month shoebox in the CBD may not offer much more convenience than a $1,425 per month shoebox in the OCR.

*Except Tengah, for now.

Six of the top 10 condos for rental yield are currently in the OCR

The following is from Square Foot Research, and is based on the past 12 months:

| District | Development | Rent (psf) | Leasing volume | Est. rental yield |

| 21 (OCR) | The Hillford* | $4.67 | 118 | 4.8% |

| 1 (CCR) | People’s Park Complex | $3.27 | 82 | 4.2% |

| 18 (OCR) | Melville Park | $2.30 | 322 | 4.1% |

| 25 (OCR) | Northoaks | $1.94 | 107 | 3.9% |

| 5 (RCR) | Viva Vista | $5.06 | 93 | 3.9% |

| 27 (OCR) | Euphony Gardens | $2.14 | 23 | 3.9% |

| 25 (OCR) | Woodsvale | $1.92 | 122 | 3.8% |

| 17 (OCR) | Hedges Park Condominium | $2.90 | 122 | 3.8% |

| 14 (RCR) | The Octet | $3.93 | 29 | 3.8% |

| 12 (RCR) | Skysuites 17 | $4.53 | 53 | 3.8% |

*Rental yield is high due to the unusually low quantum; this is a 60-year leasehold property

Note that Admiralty / Woodlands (District 25) is the only district to have two condos on the top 10 list for rental yields.

But please don’t take this as a suggestion that OCR condos are next year’s “definite goldmine”

We’re only saying OCR rental properties tend to be less affected by the Covid-19 downturn; not that they’re some kind of golden ticket.

In the broader sense, 2021 – and likely the next few years after – will be characterised by more remote-location work, and fewer foreigners coming through our borders. This will make it tough for landlords as a whole; and if there’s a light at the end of this tunnel, it will be past 2021 before we glimpse it.

In the meantime, check out Stacked for in-depth reviews on new and resale condos alike; and follow us so we can keep you updated on the latest news. If you need help specific to your property, you can also drop us a note on Facebook.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why might OCR condos be more stable in Singapore's rental market during 2021?

What areas are included in Singapore's Outside of Central Region (OCR)?

How has the Covid-19 pandemic affected rental rates in OCR compared to other regions?

What are some reasons tenants prefer OCR condos during the pandemic?

Are OCR condos considered a good investment for rental yield in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments