New Condo Sales Hit a Four-Year High in 2025 — But Here’s Why 2026 Will Be Different For Buyers

January 16, 2026

The final tally for the performance of the new launch market in 2025 is in – and it was a bumper year for developers and private home buyers.

In total, developers sold 10,821 new condominium units in 2025, and this is a 67% y-o-y jump compared to the 6,469 units sold in 2024, according to statistics published by URA on Jan 15.

The latest developer sales figure is the highest annual new private home sales in four years, and it is markedly higher than the 10-year average annual developers’ sales – which is 8,768 units (excl. Executive Condos) from 2015 to 2024.

The rally in the new launch market was buoyed by easing interest rates, improved buyer sentiment, and the injection of more new launches in 2025, says Wong Siew Ying, head of research and content at PropNex.

Developers also reined themselves in and largely kept prices in tandem with buyer’s budgets. About 66% of the new condos sold last year (excl. ECs) were priced at below $2.5 million, based on transaction data. Generally, this has been the affordable ‘sweet spot’ for most new condo buyers over the past year.

This year, buyers will still have plenty of projects to scrutinise, picking from about 24 new condos and five EC projects. About 57% of the new condo units expected to launch this year are in the suburbs, or Outside Central Region (OCR).

Coupled with nearly 2,300 EC units in the launch pipeline, there’ll be more options for mass-market homebuyers like HDB upgraders and families. Developers will likely take cues from each other in the coming months to pace out their launches, and moderate price increases to avoid buyers flocking to competing projects.

“We expect private home sales to remain driven by Singaporeans, and developers will likely keep launch prices competitive, in view of price sensitivity and affordability concerns among local buyers,” says Wong.

She adds that relatively stable interest rate expectations in 2026 may also lead to a more steady property market, one that is less fueled by rate-cut optimism and hype.

December’s seasonal lull saw developers sales plunge

The latest sales figures for the new launch market also reveal that December 2025 recorded the lowest monthly developer sales volume in nearly two years.

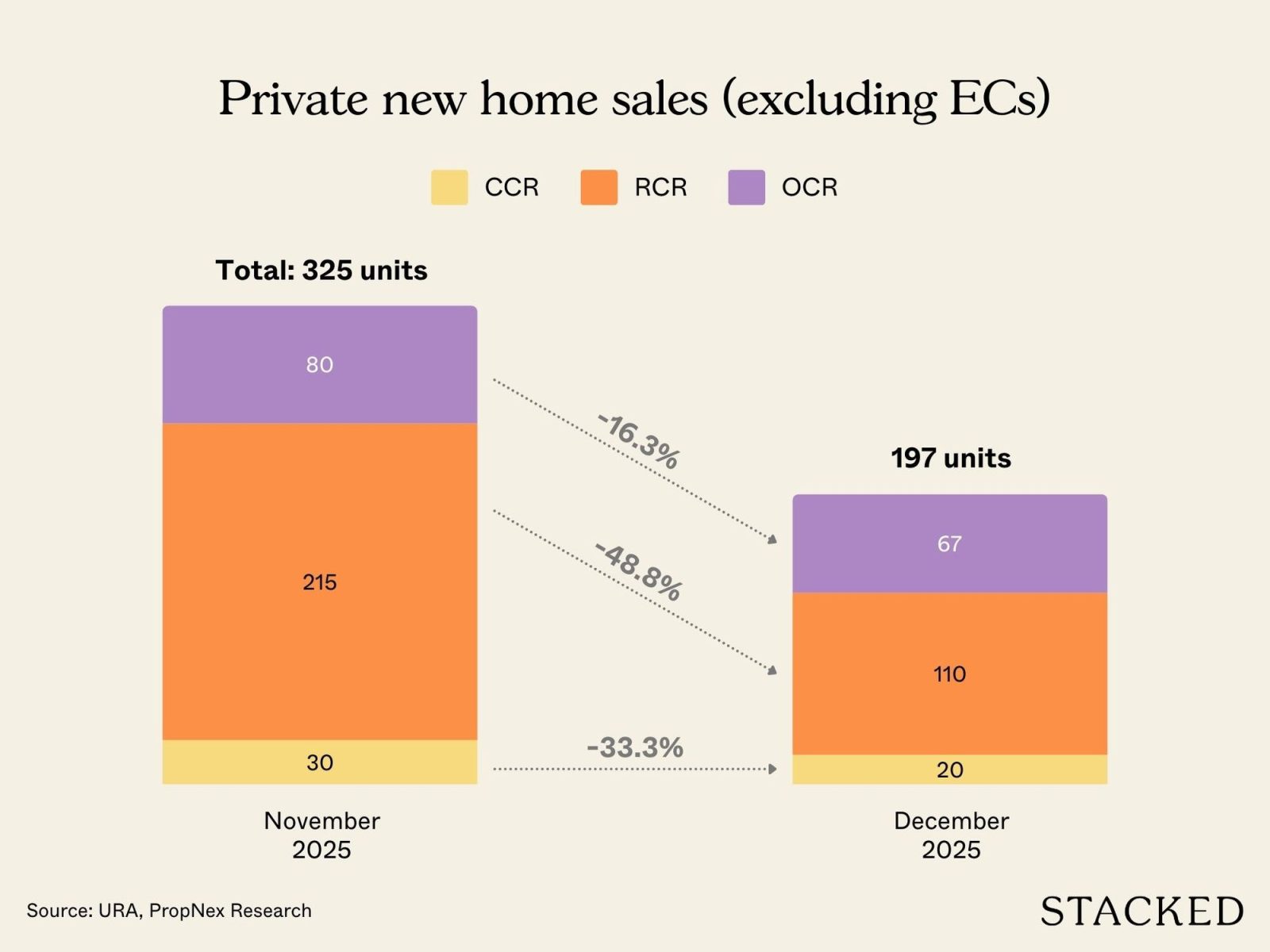

Only 197 new private homes (excluding Executive Condos (ECs) were sold last month, a monthly decrease of 39% compared to the 325 units sold in November 2025. It is also a 3% y-o-y decrease compared to the same period a year ago when 203 units were sold in December 2024.

But this was expected given the year-end holidays in December and the lack of any major new launches last month. The only new project put on the market last month was Pollen Collection II, a 99-year leasehold landed housing project in Seletar Hills developed by Bukit Sembawang Estates.

Pollen Collection II sold 17 out of the 52 landed homes that Bukit Sembawang launched for sale, and the units sold set a median price of $2,599 psf. This made it the leading project in the Outside Central Region (OCR), in terms of the number of units sold last month.

The upcoming launch of Narra Residences, a 552-unit project by an Apex Asia-led consortium in Dairy Farm, is expected to flip the performance of this submarket when the 99-year leasehold project launches on Jan 31.

Coupled with the launch of Newport Residences, a luxury project by City Developments in the Central Business District (CBD), which will also launch on Jan 31, it looks like the new launch market will dramatically rebound in January.

“We anticipate buyers could respond positively to Narra Residences and Newport Residences, with prices starting from $998,000 and $1.298 million for one-bedroom units, respectively,” says Wong of PropNex.

She singles out the expected buying interest for Newport Residences since there hasn’t been a new freehold condo launch in District 1 and 2 since Sky Everton in 2019.

Best-selling project in Dec 2025: The Continuum

The Continuum, a 816-unit development on Thiam Siew Avenue in District 15, was the best selling new project last month, in terms of total number of units sold. The freehold development, jointly developed by Hoi hup Realty and Sunway Developments, sold 31 units at a median price of $2,498 psf.

This means that The Continuum has sold 673 units (82%) to date since it launched in 2023, and the average selling price is about $2,788 psf, based on caveats. Of the 31 units moved last month, 22 were relatively smaller unit types of about 560 sq ft, this is the size of the one-bedroom plus study unit.

More from Stacked

5 Reasons Why Parktown Residence Sold A Record 1,041 Units During Launch

Parktown Residence is set to change Tampines North, and it has two qualities Singaporeans love: it’s a mega-development, and it’s…

The pick up in sales at The Continuum makes sense after learning that the developer offered a sales promotion for the one-bedroom plus study units, with prices starting at $1.338 million, or about $2,393 psf.

According to CBRE, this is a 10-15% discount from its launch price of $2,800 psf. “The price looks attractive for a freehold project in a RCR location, comparable to most of the 99-year leasehold projects in an equivalent location,” says Tricia Song, head of research, Singapore and southeast Asia, at CBRE.

The Continuum, which is located in the Rest of Central Region (RCR), was not the only project that fared well last month. Nava Grove, a 552-unit development in Pine Grove, sold 15 units at a median price of $2,641 psf. The 99-year leasehold project has sold 519 units (94%) at an average selling price of $2,483 psf, just over a year since it launched in November 2024.

Top-selling new private residential projects (ex EC) in December 2025

| Project | Region | Units sold in Dec 2025 | Median price in Dec 2025 ($psf) |

| The Continuum | RCR | 31 | 2,498 |

| Otto Place | OCR | 28 | 1,751 |

| Pollen Collection II | OCR | 17 | 2,599 |

| Nava Grove | RCR | 15 | 2,641 |

| Canberra Crescent Residences | OCR | 8 | 2,008 |

| Pinetree Hill | RCR | 8 | 2,593 |

| Upperhouse at Orchard Boulevard | CCR | 7 | 3,410 |

| Bloomsbury Residences | RCR | 6 | 2,542 |

| One Marina Gardens | RCR | 6 | 3,066 |

| The Sen | RCR | 5 | 2,341 |

| Chuan Park | OCR | 5 | 2,754 |

| The Orie | RCR | 5 | 2,727 |

| 8@BT | RCR | 5 | 2,624 |

| Lentoria | OCR | 5 | 2,439 |

Over in the EC segment, there are no more unsold EC units left in the market after 37 units were snapped up last month and the last 17 unsold units have been sold since the start of this year.

“Aspiring EC buyers will now have to look towards the next EC launches in 2026, namely Coastal Cabana and Rivelle Tampines. Thus, these two EC launches are expected to attract strong demand amid limited new EC supply,” says Marcus Chu, CEO of ERA Singapore.

Most EC buyers last month flocked to Otto Place, a 600-unit project in Plantation Close, which resulted in the project moving 28 units at a median price of $1,751 psf last month. The development, which is jointly developed by Hoi Hup Realty and Sunway Developments, is nearly fully sold with about eight unsold units. The average selling price at the EC is about $1,758 psf.

Each of the 37 EC buyers last month must have good reason to snap up their units, perhaps they found that the offerings at Coastal Cabana, a new EC that previewed last month, were not to their liking.

For the rest of the buyers waiting in the wings for a new EC unit, many will flock to Coastal Cabana when it goes on sale this weekend. The 748-unit development is located on Jalan Loyang Besar in District 17, and indicative pricing starts from $1.44 million ($1,649 psf) for a 872 sq ft three-bedroom Deluxe.

Will buying momentum carry on?

This will still be a good year for the private residential property market, although cumulative sales volumes in the new launch market will be less than what we saw in 2025, says Song. She says this stems from fewer projects in the launch pipeline and as interest rate declines taper.

“2025 was a strong year for Singapore’s private residential market, underpinned by resilient demand, steady economic conditions and renewed confidence as global risks eased. Attention now turns to how much of this momentum can be carried into 2026,” says Chu.

The good news is that the heady days of soaring condo prices are mostly behind us, which is a good thing considering that private home prices have soared 42.4% cumulatively since the property market hit a trough in 1Q2020 during the Covid-19 pandemic.

CBRE forecasts that condo prices will grow 2-4% this year, in line with Singapore’s forecasted GDP growth of 1.3% this year.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How many new condos were sold in 2025?

Why was 2025 a good year for new condo sales?

What is expected for condo prices in 2026?

Are there still many new launches coming in 2026?

What was the best-selling project in December 2025?

Timothy Tay

As Editor-in-Chief of Stacked, Timothy leads the newsroom and shapes our editorial direction, ensuring readers receive timely, thoughtful, and well-researched news and analysis. He brings over eight years of experience as a business and real estate journalist, with a strong track record across both print and digital platforms. His reporting spans luxury residential, commercial real estate, and capital markets, alongside in-depth coverage of sustainability and design.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Latest Posts

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Pro Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

0 Comments