Beware Rising Home Loan Rates In 2022: We Breakdown Exactly How Much It Will Cost You As Interest Rates Increase

November 3, 2022

The era of cheap home loan rates has ended. From the Global Financial Crisis, through the turbulent Trump administration, and through Covid, Singaporeans have managed to enjoy low-interest loans for over a decade; but what are the practical implications of rate hikes? This week, we take a close-up look at the dollars and cents involved, as well as changing borrower trends:

Table Of Contents

- How much more will you pay for your home?

- In the short term, borrowers probably won’t feel the sting of a single percentage point increase

- 1. Rising interest rate floor

- 2. Refinancing risks for borrowers

- 3. Impact on rental rates and tenants

- 4. Risk of reaching CPF withdrawal limits for 99-year properties and bank loan HDB

- Finally, remember that you need to refund the CPF monies used when you sell your home

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

How much more will you pay for your home?

In terms of percentage points, it may not seem like much, but you’d be surprised at how it can really add up when it comes to your monthly repayments.

This table shows the projected differences in monthly payments, based on a loan tenure of 25 years.

| Loan Amount | 1.00% | 1.50% | 2.00% | 2.50% | 3.00% | 3.50% | 4.00% | 4.50% | 5.00% | 5.50% | 6.00% | 6.50% | 7.00% |

| $300,000 | $1,131 | $1,200 | $1,272 | $1,346 | $1,423 | $1,502 | $1,584 | $1,667 | $1,754 | $1,842 | $1,933 | $2,026 | $2,120 |

| $400,000 | $1,507 | $1,600 | $1,695 | $1,794 | $1,897 | $2,002 | $2,111 | $2,223 | $2,338 | $2,456 | $2,577 | $2,701 | $2,827 |

| $500,000 | $1,884 | $2,000 | $2,119 | $2,243 | $2,371 | $2,503 | $2,639 | $2,779 | $2,923 | $3,070 | $3,222 | $3,376 | $3,534 |

| $600,000 | $2,261 | $2,400 | $2,543 | $2,692 | $2,845 | $3,004 | $3,167 | $3,335 | $3,508 | $3,685 | $3,866 | $4,051 | $4,241 |

| $700,000 | $2,638 | $2,800 | $2,967 | $3,140 | $3,319 | $3,504 | $3,695 | $3,891 | $4,092 | $4,299 | $4,510 | $4,726 | $4,947 |

| $800,000 | $3,015 | $3,199 | $3,391 | $3,589 | $3,794 | $4,005 | $4,223 | $4,447 | $4,677 | $4,913 | $5,154 | $5,402 | $5,654 |

| $900,000 | $3,392 | $3,599 | $3,815 | $4,038 | $4,268 | $4,506 | $4,751 | $5,002 | $5,261 | $5,527 | $5,799 | $6,077 | $6,361 |

| $1,000,000 | $3,769 | $3,999 | $4,239 | $4,486 | $4,742 | $5,006 | $5,278 | $5,558 | $5,846 | $6,141 | $6,443 | $6,752 | $7,068 |

| $1,100,000 | $4,146 | $4,399 | $4,662 | $4,935 | $5,216 | $5,507 | $5,806 | $6,114 | $6,430 | $6,755 | $7,087 | $7,427 | $7,775 |

| $1,200,000 | $4,522 | $4,799 | $5,086 | $5,383 | $5,691 | $6,007 | $6,334 | $6,670 | $7,015 | $7,369 | $7,732 | $8,102 | $8,481 |

| $1,300,000 | $4,899 | $5,199 | $5,510 | $5,832 | $6,165 | $6,508 | $6,862 | $7,226 | $7,600 | $7,983 | $8,376 | $8,778 | $9,188 |

| $1,400,000 | $5,276 | $5,599 | $5,934 | $6,281 | $6,639 | $7,009 | $7,390 | $7,782 | $8,184 | $8,597 | $9,020 | $9,453 | $9,895 |

| $1,500,000 | $5,653 | $5,999 | $6,358 | $6,729 | $7,113 | $7,509 | $7,918 | $8,337 | $8,769 | $9,211 | $9,665 | $10,128 | $10,602 |

| $1,600,000 | $6,030 | $6,399 | $6,782 | $7,178 | $7,587 | $8,010 | $8,445 | $8,893 | $9,353 | $9,825 | $10,309 | $10,803 | $11,308 |

| $1,700,000 | $6,407 | $6,799 | $7,206 | $7,626 | $8,062 | $8,511 | $8,973 | $9,449 | $9,938 | $10,439 | $10,953 | $11,479 | $12,015 |

| $1,800,000 | $6,784 | $7,199 | $7,629 | $8,075 | $8,536 | $9,011 | $9,501 | $10,005 | $10,523 | $11,054 | $11,597 | $12,154 | $12,722 |

| $1,900,000 | $7,161 | $7,599 | $8,053 | $8,524 | $9,010 | $9,512 | $10,029 | $10,561 | $11,107 | $11,668 | $12,242 | $12,829 | $13,429 |

| $2,000,000 | $7,537 | $7,999 | $8,477 | $8,972 | $9,484 | $10,012 | $10,557 | $11,117 | $11,692 | $12,282 | $12,886 | $13,504 | $14,136 |

| $2,500,000 | $9,422 | $9,998 | $10,596 | $11,215 | $11,855 | $12,516 | $13,196 | $13,896 | $14,615 | $15,352 | $16,108 | $16,880 | $17,669 |

| $3,000,000 | $11,306 | $11,998 | $12,716 | $13,459 | $14,226 | $15,019 | $15,835 | $16,675 | $17,538 | $18,423 | $19,329 | $20,256 | $21,203 |

| $3,500,000 | $13,191 | $13,998 | $14,835 | $15,702 | $16,597 | $17,522 | $18,474 | $19,454 | $20,461 | $21,493 | $22,551 | $23,632 | $24,737 |

| $4,000,000 | $15,075 | $15,997 | $16,954 | $17,945 | $18,968 | $20,025 | $21,113 | $22,233 | $23,384 | $24,563 | $25,772 | $27,008 | $28,271 |

| $4,500,000 | $16,959 | $17,997 | $19,073 | $20,188 | $21,340 | $22,528 | $23,753 | $25,012 | $26,307 | $27,634 | $28,994 | $30,384 | $31,805 |

| $5,000,000 | $18,844 | $19,997 | $21,193 | $22,431 | $23,711 | $25,031 | $26,392 | $27,792 | $29,230 | $30,704 | $32,215 | $33,760 | $35,339 |

| $6,000,000 | $22,612 | $23,996 | $25,431 | $26,917 | $28,453 | $30,037 | $31,670 | $33,350 | $35,075 | $36,845 | $38,658 | $40,512 | $42,407 |

| $7,000,000 | $26,381 | $27,996 | $29,670 | $31,403 | $33,195 | $35,044 | $36,949 | $38,908 | $40,921 | $42,986 | $45,101 | $47,265 | $49,475 |

| $8,000,000 | $30,150 | $31,995 | $33,908 | $35,889 | $37,937 | $40,050 | $42,227 | $44,467 | $46,767 | $49,127 | $51,544 | $54,017 | $56,542 |

| $9,000,000 | $33,919 | $35,994 | $38,147 | $40,376 | $42,679 | $45,056 | $47,505 | $50,025 | $52,613 | $55,268 | $57,987 | $60,769 | $63,610 |

| $10,000,000 | $37,687 | $39,994 | $42,385 | $44,862 | $47,421 | $50,062 | $52,784 | $55,583 | $58,459 | $61,409 | $64,430 | $67,521 | $70,678 |

At the time of writing, the HDB Concessionary Loan rate is 2.6 per cent*, while most floating rate home loans are at around three per cent.

Fixed-rate loans range between 3.6 to 3.85 per cent; but mortgage brokers inform us that some banks have pulled their fixed-rate products from the market altogether.

*The HDB loan rate is technically 0.1 per cent above the prevailing CPF rate, and the CPF rate is revised on a quarterly basis (although it has not changed from 2.6 per cent in over two decades).

In the short term, borrowers probably won’t feel the sting of a single percentage point increase

Consider a borrower with a loan of $1 million, over a 25-year period. At two per cent per annum, which would have been the likely rate back in 2020/21, they would have paid $4,239 per month.

Assuming a single percentage point increase this year, they would be paying $4,486, or $247 more per month. This is probably not “crisis” territory for most borrowers; and those who are using their CPF to service the loans probably won’t even notice.

But over a long period, there can be a sizeable impact on property gains.

An interest rate of two per cent, over 25 years, comes to around $271,563 spent on interest repayments alone. At three per cent, the cost of interest repayments reach $442,634; a difference of $171,071 to eat into your net gains.

Coupled with other recurring costs, such as property taxes and maintenance fees, owner-investors might feel the pain further down the road.

Pure landlords in theory feel less pain, as they can raise rental rates to keep pace; also because mortgage interest rates are tax-deductible for rental properties. But some landlords reading this will probably scoff at how over-simplified that is (it’s not so easy to just “raise rental rates”).

However, let’s look at the practical impact on a wider scope, over longer periods:

- Rising interest rate floor and loan applications

- Refinancing risks for borrowers

- Impact on rental rates and tenants

- Risk of reaching CPF withdrawal limits for 99-year properties and bank loan HDB

1. Rising interest rate floor

The interest rate floor, or “stress test” rate, is necessarily pegged above the market rate for home loans. The whole point is to ensure that, if interest rates rise, borrowers won’t be over-leveraged.

Hence before September 2022, the interest rate floor for the Mortgage Servicing Ratio (MSR) and Total Debt Servicing Ratio (TDSR) was at 3.5 per cent, despite real loan rates being at around two per cent.

Since the September cooling measures, the floor rate has been raised to four per cent for the TDSR, and three per cent for the MSR.

If home loan rates continue to rise, the interest rate floor will have to rise along with them. This means greater difficulty in qualifying for home loans, as buyers will need increasingly higher incomes to meet TDSR and/or MSR limits.

Buyers who cannot meet the rising debt servicing ratios will need to lower monthly repayments, by stretching out loan tenures or borrowing less. This can lead to higher upfront payments for property ownership, and in some cases longer periods in debt.

This is likely to slow the number of buyers entering the market; even if demand remains high, buyers may find they lack eligibility for financing.

2. Refinancing risks for borrowers

Between 2008/9 all the way till 2021, a common assurance from mortgage bankers was that “you can always refinance if the interest rate rises”. Some borrowers may now pay the price for that dubious bit of advice.

Borrowers who got their loans in the past decade, when lending was more liberal, may find there is no cheaper loan to refinance into.

For example, consider a home buyer with an income of $7,000 per month, who back in 2010 secured a home loan at $4,300 per month, at a rate of two per cent (this was possible because TDSR limitations were not introduced until 2013).

At the current rate of three per cent, their loan repayment now spikes to about $4,700 per month. This is a perilous 67 per cent of their monthly income.

Should this home buyer attempt to refinance, they will find that almost every other loan package is also at three per cent or higher.

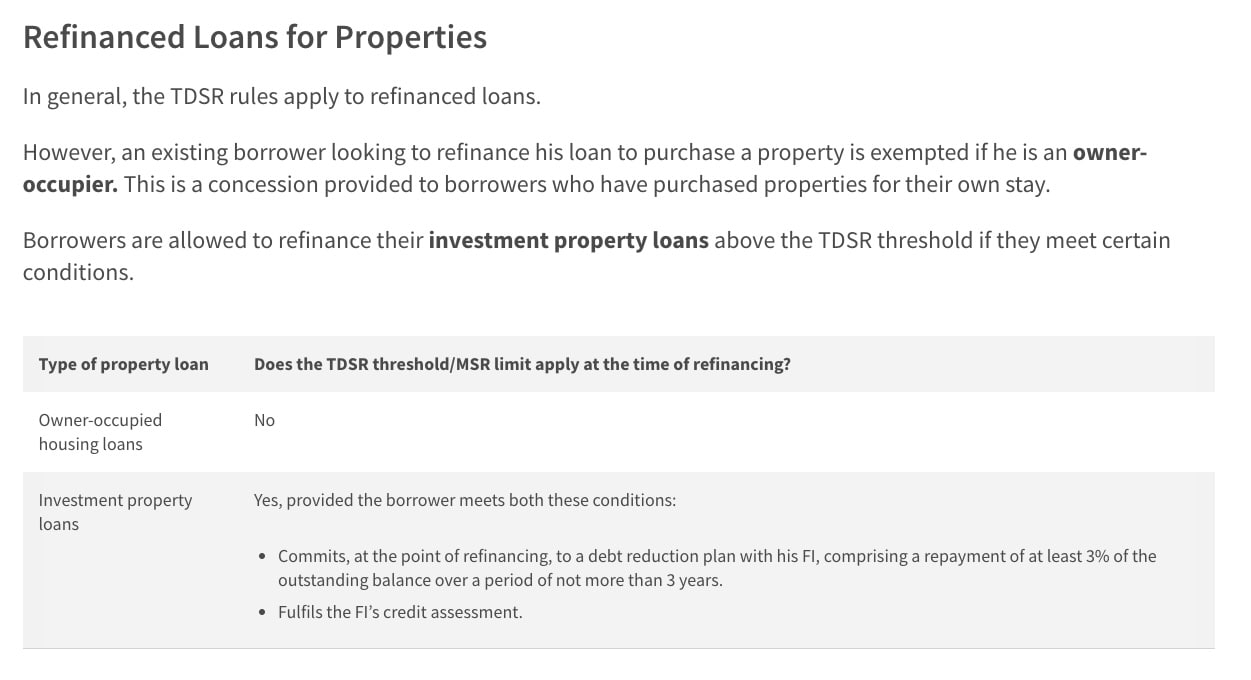

If you are an owner-occupier, the TDSR limits may not apply to you.

So far, it seems Singaporean home buyers have been prudent, and there doesn’t appear to be many of these cases (or perhaps they’ve all managed to sell and right-size in a hot market!)

But it is an important lesson going forward. The next time we’re told we can “refinance later” we should remember the events of this year.

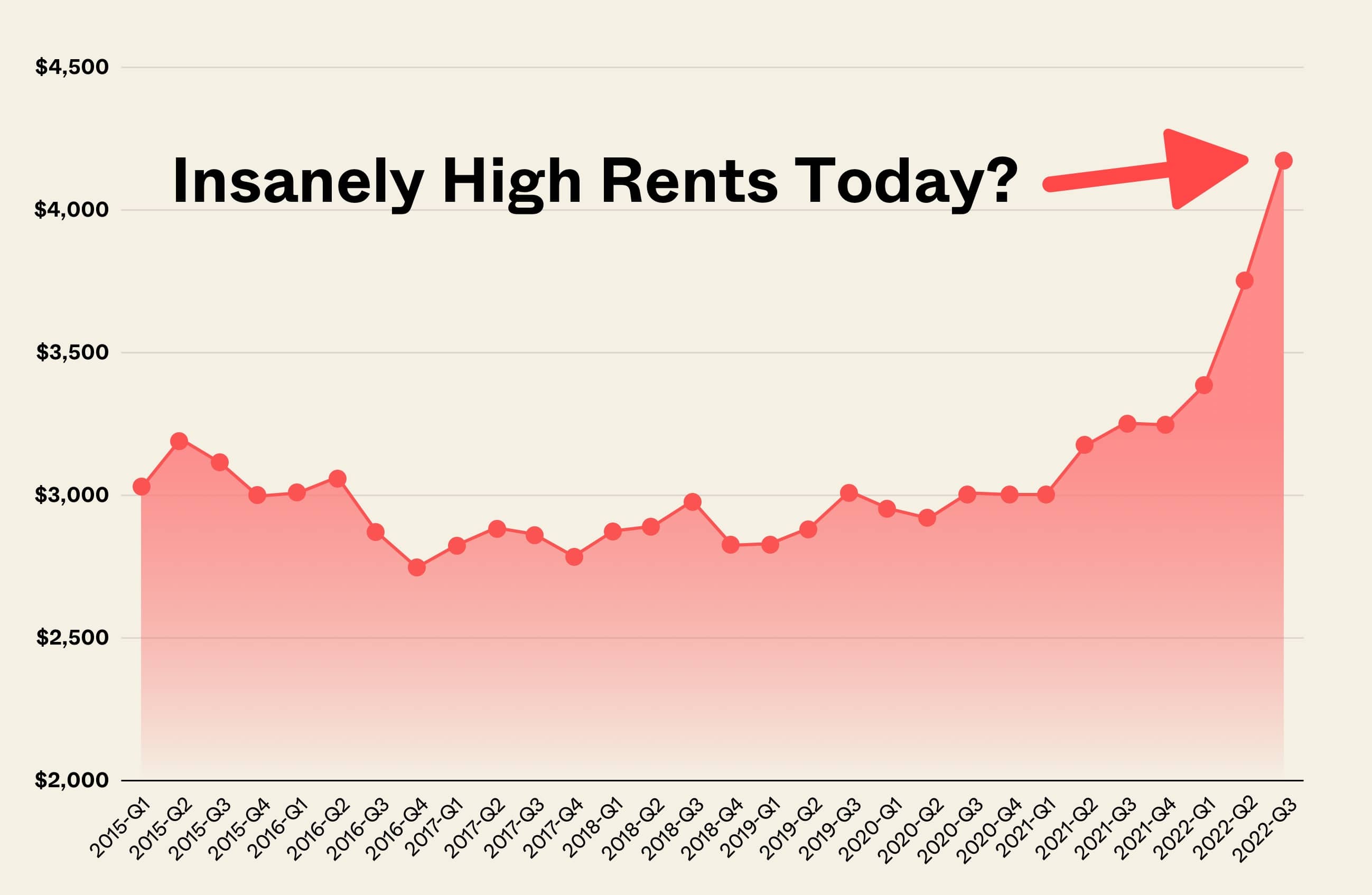

3. Impact on rental rates and tenants

For properties that are pure investments, the owners will be eyeing their bottom line. Given that the rental market in Singapore is at a six-year peak with no sign of cooling, the current response to rising interest rates is predictable: most landlords will ramp up their prices, and pass down the cost to tenants.

There’s no escaping the wave of rising interest rates, even if you’ve elected not to be a homeowner.

4. Risk of reaching CPF withdrawal limits for 99-year properties and bank loan HDB

The current CPF withdrawal limit is 120 per cent of your property value. Rising interest rates will mean deducting more from CPF to service your home loan, so you could reach the limit sooner.

Bear in mind that, besides servicing the home loan, CPF monies are also often used for the initial down payment (up to 20 per cent), as well as legal fees and stamp duties like the ABSD. So if you also service your loan with CPF, on top of those expenses, you may find you reach the withdrawal limit at a very inconvenient time (e.g., when you’re in your mid-50s, or just before retirement). Switching to cash at that point can be painful.

We can’t give you exact numbers here, as everyone’s CPF usage differs; but you can log on to the CPF website to track your current usage. If it looks like you’re nearing the withdrawal limit, you may want to switch to partial home loan repayments in cash, to prevent cashflow disruptions when you’re older.

Finally, remember that you need to refund the CPF monies used when you sell your home

Whether it’s to upgrade, right size, etc., you need to pay back the CPF you used, with the accrued interest. Higher home loan repayments mean you use more of your CPF, so your eventual CPF refund will be much higher.

As with the withdrawal limit, we can’t give any specific numbers here, as it varies based on your existing CPF usage – but do reach out to us at Stacked, if you’re worried about a shortfall after your CPF refund. We have expert consultants who can review your situation, and guide you through it.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How will rising interest rates affect my monthly home loan payments?

What is the impact of higher interest rates on property buyers and refinancing?

How do rising interest rates influence rental prices and tenants in Singapore?

What risks do rising interest rates pose to CPF withdrawal limits for property owners?

What should homeowners consider regarding CPF refunds when selling their property?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Trends

Property Trends The Room That Changed the Most in Singapore Homes: What Happened to Our Kitchens?

Property Trends Condo vs HDB: The Estates With the Smallest (and Widest) Price Gaps

Property Trends Why Upgrading From An HDB Is Harder (And Riskier) Than It Was Since Covid

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

0 Comments