Most New Condo Buyers in Singapore Forget to Check This Before Buying (Until It’s Too Late)

October 21, 2025

When you’re shopping for a condo, the checklist usually looks the same: location, facilities, finishing, view. But here’s the part almost everyone forgets: what happens after you move in. Because you’re not just buying four walls and a swimming pool: you’re buying into a shared community.

That means shared spaces, shared bills, and shared responsibilities. If you’re not ready for that, you could find yourself paying more than you expected, or living in a place that feels underwhelming; possibly even less comfortable than the HDB project you theoretically “upgraded” from. This is what Being Condo Savvy is all about: knowing what you’re getting into before you sign the Option To Purchase (OTP), and playing your part once you move in.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Understand what the MCST actually does

The Management Corporation Strata Title (MCST) is the body that keeps things running in the condo; and you also make up a part of it. Every owner has voting rights, so they collectively make decisions regarding their condo.

Decisions on budgets, upgrades, and even the house rules come down to the Annual General Meeting (AGM) of the MCST; and if you don’t show up or vote, someone else could end up making choices that affect you. That might mean by-laws that frustrate you – such as rules on where pets can be walked, or the absence of rules that allow certain groups to monopolise facilities like tennis courts with back-to-back bookings.

Many residents don’t even realise they can request financial statements or AGM minutes or the by-laws. These are always worth looking into early on, so that you have a gauge on the overall unity and general attitudes of the community.

For example, if you see that general meetings push heavily toward creating more play areas, or spaces where children can use their scooters, you can guess the community

is younger and family-oriented. If the focus is on more security patrols, installing CCTVs, or adding accessibility features like ramps, it’s probably a community with more elderly residents or mobility-challenged households.

Looking at where the funds and conversations are going lets you “read the room” before you commit.

It’s also important to remember that the MCST doesn’t work alone: it typically appoints a Managing Agent (MA), who in turn handles the hiring of cleaners, gardeners, security, and other contractors who keep the estate running day to day. If you’re active in the MCST, you’ll have a say in which MA is appointed, how long they’re retained, and whether they’re delivering good value.

Due to the complexity of condo maintenance, and the seriousness of the stakes (the future of your home,) getting a properly accredited MA is important. Accreditation refers to a property management company (or individual) formally recognised by the Association of Property and Facility Managers (APFM) or the Association of Strata Managers (ASM), for the purposes of condos and strata-titled properties.

2. Look at the sinking fund before you buy

In a condo, your monthly contributions go into two accounts: the management fund and the sinking fund.

The management fund covers everyday expenses like security, cleaning, landscaping, etc, while the sinking fund is a long-term reserve for major upgrading works. These are major corrections like facility replacement, lift replacement, or waterproofing. In essence, the management fund keeps things running on a day-to-day basis, while the sinking fund ensures the condo can handle major future works.

The sinking fund – and its effective management – determines whether your condo will look almost new in 20 to 30 years’ time, or whether it’s reduced to an eyesore.

This fund is how big-ticket repairs get paid for: lift modernisation, façade repairs, waterproofing, and other essentials. If the fund is insufficient, you may face higher monthly contributions or even special levies down the line.

Unlike HDB estates – where the Town Council will never shrug and say it’s out of money

– condos don’t have a government safety net.

If your estate runs out of funds, there’s no government body that will rush in to pay for everything. In Singapore we tend to be complacent about this, simply because this hasn’t happened in any major development so far – but the risk is real, and it may happen as our condos age.

So how do you check the sinking fund?

Under the Building (Strata Management) Act, prospective buyers can request to see certain documents from the MCST, including audited financial statements, AGM minutes, and notices of upcoming works.

In practice, this usually means making a written request through the seller or seller’s agent, and paying a small administrative fee. For resale condos, serious buyers can ask their property agent to obtain the latest AGM minutes, as well as check the financial statements on the fund’s balance. This will also reveal whether major repairs are being planned

For new launches, ask the developer about projected maintenance charges, to be prepared for this recurring cost. But be aware: there can be a difference between what you’re told at the time you buy, and what the actual maintenance fees end up being, after the Temporary Occupation Permit (TOP).

When reviewing the sinking fund for resale condos, also take note of what the major costs seem to be. If lifts or pools constantly need fixing, ask why. Is it routine wear and tear, or is it a deeper issue like lifts needing a full overhaul? Or is there an aging pool that requires an expensive pump system replacement? Is the condo setting aside sufficient funds now through regular monthly sinking fund contributions for major expenditure like these? If not, you could be subject to a large contribution through special levies to raise funds should major repair or replacements be needed.

These can hint at future maintenance spikes, and whether fees are likely to rise sharply in the years ahead. Before signing the OTP, insist on this information. It’s one of the best indicators of whether the condo is well-run.

3. Check the developer and builder’s track record

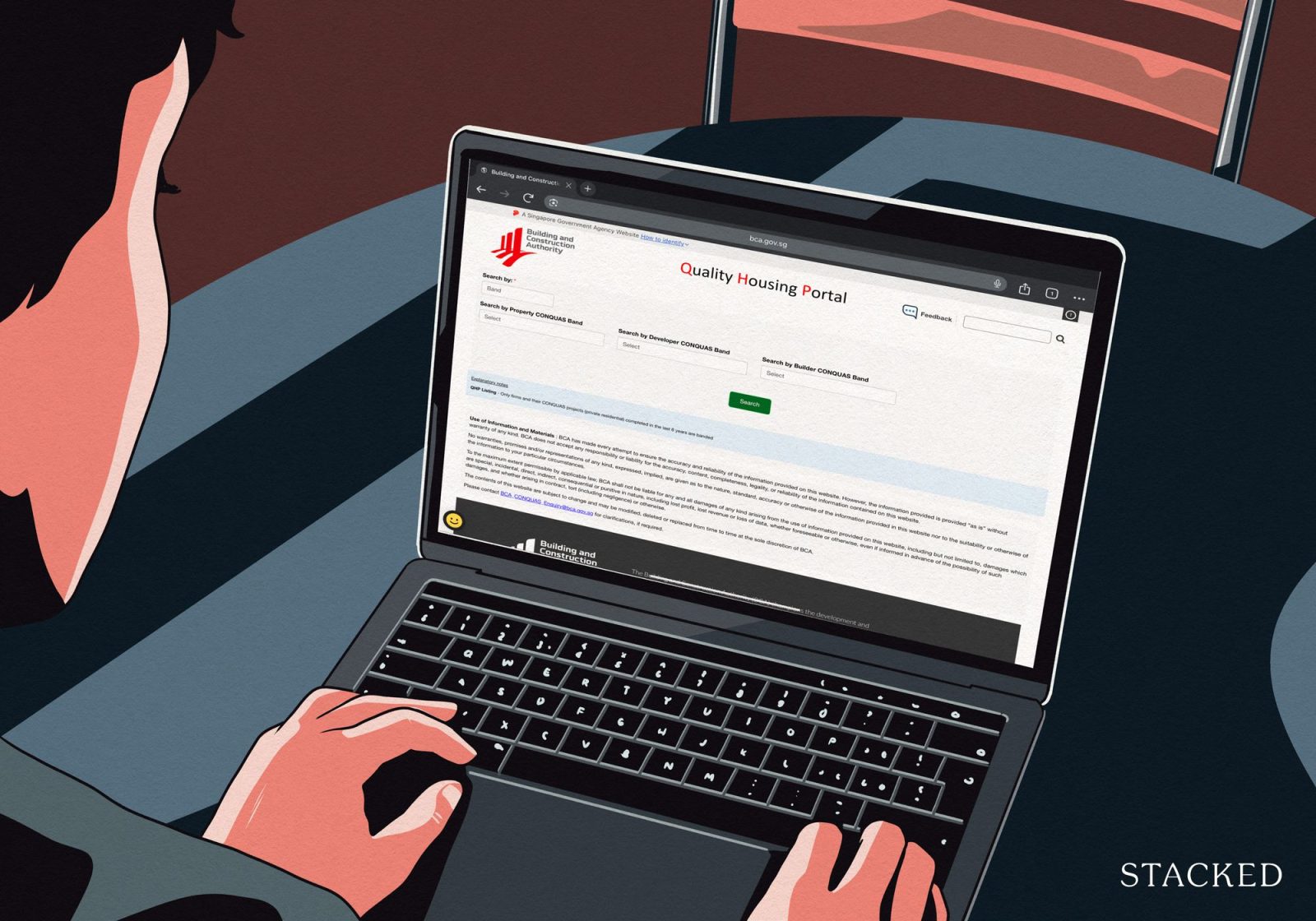

Not all condos are built to the same standard, and that has long-term consequences for defects rectification and maintenance. Today, BCA’s banding system provides a good sense of build quality and liveability. A project with a good band is less likely to saddle you with downstream issues later.

Today, the BCA Quality Housing Portal allows buyers to check developers’ and builders’ CONQUAS banding based on their CONQUAS track records, including bandings of newly completed projects. With the new banding system, you don’t need to manually dig up web pages about the developer and builder anymore – their recently completed projects and bandings are also found here, so you can use it as a one-stop research portal.

(Plus, because BCA is a government body, you know for sure that the developers and builders can’t influence or buy better ratings.)

4. Inspect the facilities and how residents use them

If you’re buying a resale condo, don’t just look at the unit. Spend some time in the common areas to see both the condition of the facilities and the attitudes of the residents who use them.

In the gym, are there missing free weights, broken machines, or sweaty towels left behind? At the pool, do you see chipped tiles that could cause injuries, or signs of pool

maintenance like cloudy water and frequent closures? Around the lifts, are residents dripping wet from the pool and creating slipping hazards?

Don’t forget security too. Check if there’s surveillance at the guardhouse, and whether related security systems such as CCTV surveillance or keycard locks at side gates have been installed. It’s also a good sign if the condo has property vehicle management systems, like RFID car decals and proper surveillance in car parks.

Landscaping and garden areas also reveal a lot about the condo. If you see dead plants everywhere, children or pets trampling through garden beds, or food wrappers, that’s a red flag. Poor landscaping maintenance isn’t just ugly, it creates hygiene and mosquito breeding issues.

Besides the level of management, you’re also looking for a community with a good attitude toward the facilities. Their culture of use matters as much as the condition you see; and living with conscientious residents will shape positive living experiences.

5. Take an active role in your estate

Condo living works best when people pitch in. That doesn’t just mean showing up at AGMs – it also means paying attention to everyday services like security, gardening, and cleaning. These contracts affect both your fees and your quality of life.

Unlike HDB estates, there’s no government agency packed with procurement experts, to ensure the best service providers for you. It’s on you and your neighbours in the MCST to do it yourselves.

Even though condo living involves shared decision-making, owners still have clear rights and avenues when issues arise. For day-to-day concerns, you should first raise them with the Managing Agent (MA), and if unresolved, escalate to the MCST council. For broader policy disagreements, matters can be brought up at the Annual General Meeting (AGM), where you may propose motions and rally support from fellow owners.

In more serious disputes that cannot be settled internally, you have the option of filing an application with the Strata Titles Board, which has the legal authority to resolve conflicts between owners or between owners and the MCST.

Also take note of the unit count before you buy! This can affect the MCST culture. In smaller boutique condos, you may have more of a say than in a larger one as there are fewer Subsidiary Proprietors (SPs) and decision making can be quicker. In bigger developments with a multitude of owners, reaching a consensus can take longer; but that balance of voices also matters in the long run – it means no single owner has disproportionate levels of control.

But none of this matters if you don’t participate. If you never go to the “town hall” meetings, attend AGMs, or vote, then decisions that affect your home and lifestyle will be made without you. Likewise, being very casual – such as agreeing to let someone vote for you by proxy – could mean supporting measures that end up inconveniencing you.

6. Not all condo communities are alike

Every condo has its own unique culture; and if possible, we suggest you talk to residents to get a sense of it before buying.

Some estates are tight-knit, with active participation and lively AGMs; others can feel like a collection of strangers, where you could live for a decade without knowing your neighbours by name. Both have pros and cons (privacy in the case of the latter), but it’s important that the culture of the condo fits you.

While boutique condos may offer smaller, more intimate communities, that’s not always a plus. If there are only 15 units and six are owned by a single wealthy investor, the running of the condo can feel dominated by just one voice.

With larger condos, it may be frustrating to wait for the huge melting pot of cultures and ideas to come down to a single decision – sometimes even over simple ones like whether a side-gate should be opened.

In particular, buyers should take note of a condo’s unit mix: this often clues you in on the nature of the community. If you see a preponderance of compact units (shoebox units and two-bedders), this could mean most of the owners are landlords renting out to

tenants. If you see a bigger preponderance of family-sized units, this implies more owner-occupiers.

The former can seem a bit colder and more business-like, whereas the latter might be more communal.

The bottom line

In short, do your homework before buying by checking the developer’s track record, reviewing AGM minutes and financials, visiting the estate at different times, and understanding the resident mix. After moving in, stay engaged by attending AGMs, keeping tabs on your MA and estate finances, and building good relationships with neighbours – because a well-run condo depends as much on community cooperation as it does on management.

So don’t just buy the pool, gym, and tennis court. Buy with your eyes open to the MCST, the sinking fund, and the realities of estate living. For more information, BCA has prepared guides, checklists, and FAQs that every buyer wishes they knew earlier. Visit BCA’s Be Condo Savvy site and get prepared for the long term.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Property Advice We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

1 Comments

Penrith hot sale 97%, by the time u see all these things, all the units sold out. sensible buyer should focus on ROI. $200k loss is worse than whatever this bca is saying