Are you able to afford an average HDB resale flat?

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

So, how much do you need to earn to afford that resale flat? Singapore’s HDB affordability has been put into question time and time again.

This article is meant to give you an overview of the minimum gross household income needed to purchase a resale flat. In producing the figures, we had to make several assumptions which cover most HDB resale flat buyers.

- Assumption 1: Only the down payment of 10% of the purchase price is made and a HDB loan is taken for the remaining 90%

- Assumption 2: The HDB loan charges an annual interest of 2.6%

- Assumption 3: The loan tenure is 25 years

- Assumption 4: No CPF Housing Grants are considered here

- Assumption 5: The HDB median resale flat prices in September 2017 is taken as the cost of purchasing a resale flat for that month

The steps taken to derive the gross household income are:

Step 1: Determine the median resale prices in September 2017.

Step 2: Calculate the monthly payments based on a 90% HDB loan at an 2.6% interest rate per annum and a 25-year loan tenure.

Note to step 2 – As taking a HDB loan requires that the monthly payments should not exceed the Mortgage Servicing Ratio of 30%, the result from step 2 is assumed to represent 30% of the gross household income.

Step 3: Multiply the result from step 2 by 3.33 (100% / 30%) to obtain the minimum household income needed to fulfill this MSR. This is the minimum household income you need to have to quality for the loan needed to purchase the flat.

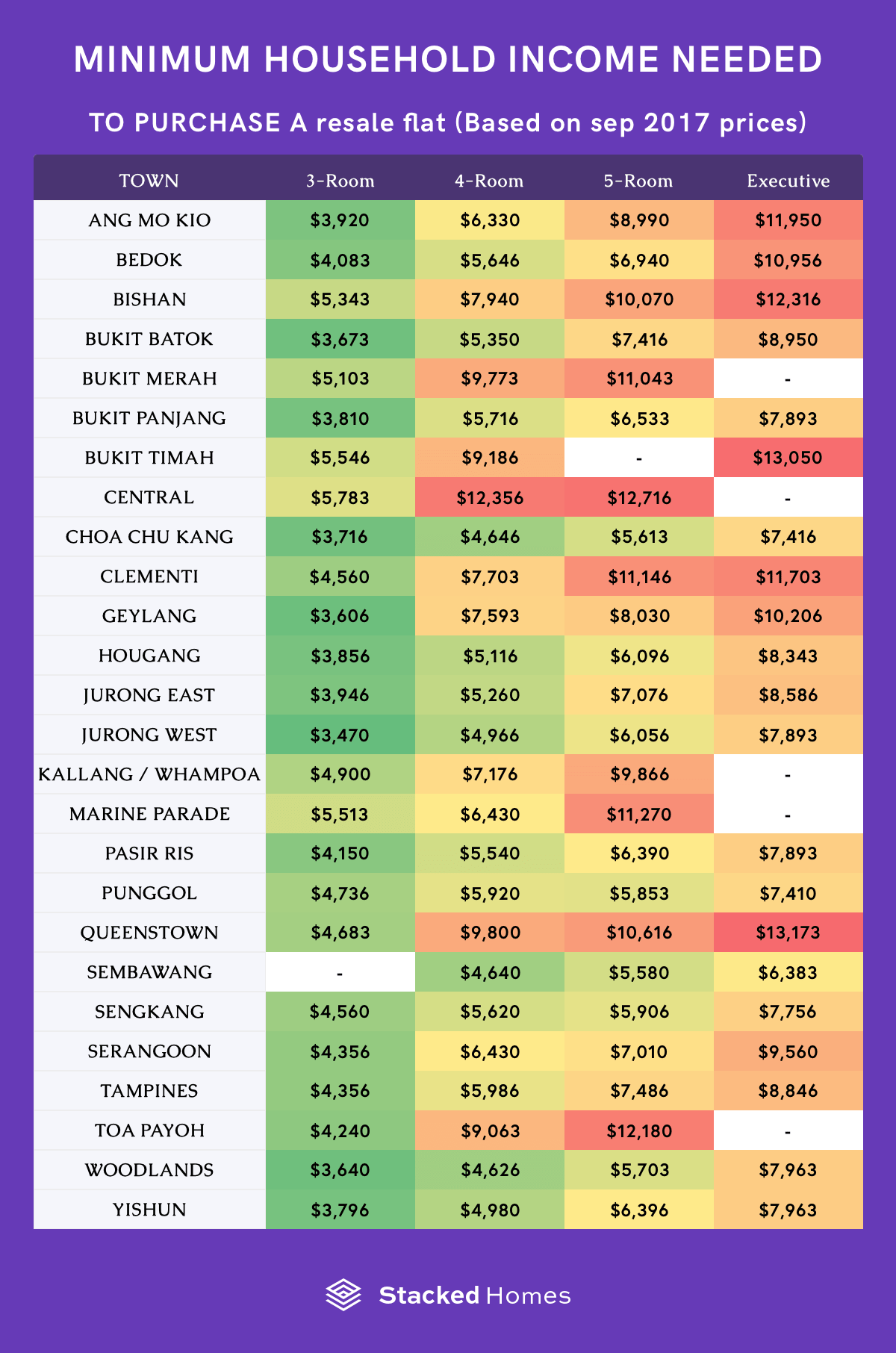

So diving straight into it, here are the gross household incomes needed for each estate and each flat type based on the median resale flat prices in September 2017:

These gross household income figures will only tell you how much HDB loan you qualify for, and does not account for the CPF Housing Grants you may receive, or the cash you have sitting in the bank. In other words, even if you had a million dollars in cash, applying for the HDB Loan does not take into account your hidden fortune. It only considers your household income.

Since these income figures were derived solely looking at the MSR, be mindful of other fees (see our first FAQ on estimated fees) you’ll need to pay such as the valuation fee, resale application fee, mortgage and fire insurance, so be sure to have cash lying around for these expenses too!

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Sean Goh

Sean has a writing experience of 3 years and is currently with Stacked Homes focused on general property research, helping to pen articles focused on condos. In his free time, he enjoys photography and coffee tasting.Read next from Property Advice

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Property Advice We’re In Our 50s And Own An Ageing Leasehold Condo And HDB Flat: Is Keeping Both A Mistake?

Property Advice Should We Buy An Old 99-Year Leasehold Condo To Live In: Will It’s Value Fall When The Lease Runs Out?

Latest Posts

Pro We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Singapore Property News Tanjong Rhu’s First GLS In 28 Years Just Sold For $709M — Here’s What The Next Condo May Launch At

BTO Reviews February 2026 BTO Launch Review: Ultimate Guide To Choosing The Best Unit

Singapore Property News Singapore’s CBD Office Rents Have Risen For 7 Straight Quarters — But Who’s Really Driving The Demand?

Singapore Property News 19 Pre-War Bungalows At Adam Park Just Went Up For Tender — But There’s A Catch

Pro Why Buyers in the Same Condo Ended Up With Very Different Results

Singapore Property News February 2026’s BTO Includes Flats Ready in Under 3 Years — With Big Implications for Buyers

Singapore Property News 1,600 New BTO Flats Are Coming To These Areas For The First Time In Over 40 Years

Property Market Commentary Why Early Buyers In New Housing Estates May See Less Upside In 2026

Singapore Property News Why ‘Accurate’ Property Listings Still Mislead Buyers In Singapore

Editor's Pick Narra Residences Sets a New Price Benchmark for Dairy Farm at $2,180 PSF — and the sales breakdown offers

Editor's Pick This Overlooked Property Market Could Deliver 12–20% Growth — But There’s a Catch

Singapore Property News Newport Residences Sells 57% at Launch Weekend — But the Real Surprise Came From the Large Units

Property Market Commentary Landed Home Sales Hit a Four-Year High — Here’s What That Could Mean for Prices in 2026

Singapore Property News A Rare Freehold Mall Is Up for Sale At $295 Million: Why the Market Is Paying Attention