Why Marina Bay Suites May Look Like a Poor Performer—But Its 4-Bedroom Units Tell a Different Story

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

In this Stacked Pro breakdown:

Comparison

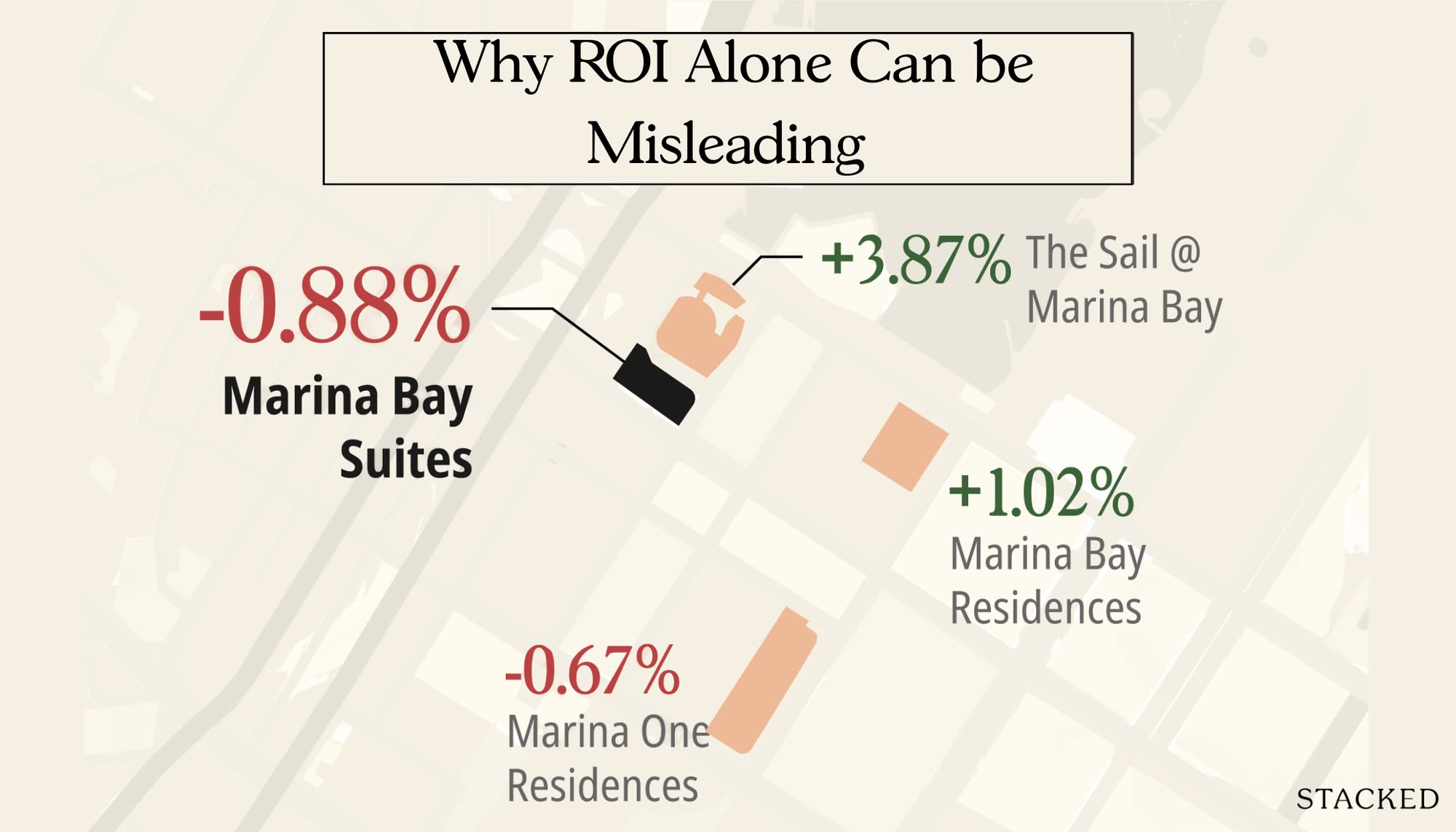

We tracked how Marina Bay Suites has performed over time compared to nearby District 01 condos like The Sail, Marina Bay Residences, and Marina One Residences, breaking it down by unit types and transaction trends from 2019 to 2024.

Key Insight

While overall ROI seems weak, dragged down by a high launch price and tepid demand, the four-bedroom units at Marina Bay Suites tell a different story, showing strong size-to-price value, price resilience, and even outperforming peers in rental yield.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Editor's Pick

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

BTO Reviews February 2026 BTO Launch Review: Ultimate Guide To Choosing The Best Unit

Property Investment Insights Why Buyers in the Same Condo Ended Up With Very Different Results

Latest Posts

Singapore Property News Tanjong Rhu’s First GLS In 28 Years Just Sold For $709M — Here’s What The Next Condo May Launch At

Singapore Property News Singapore’s CBD Office Rents Have Risen For 7 Straight Quarters — But Who’s Really Driving The Demand?

Singapore Property News 19 Pre-War Bungalows At Adam Park Just Went Up For Tender — But There’s A Catch

Singapore Property News February 2026’s BTO Includes Flats Ready in Under 3 Years — With Big Implications for Buyers

Singapore Property News 1,600 New BTO Flats Are Coming To These Areas For The First Time In Over 40 Years

Property Market Commentary Why Early Buyers In New Housing Estates May See Less Upside In 2026

Singapore Property News Why ‘Accurate’ Property Listings Still Mislead Buyers In Singapore

Singapore Property News Newport Residences Sells 57% at Launch Weekend — But the Real Surprise Came From the Large Units

Property Market Commentary Landed Home Sales Hit a Four-Year High — Here’s What That Could Mean for Prices in 2026

Singapore Property News A Rare Freehold Mall Is Up for Sale At $295 Million: Why the Market Is Paying Attention

On The Market Here Are The Rare HDB Flats With Unblocked Views That Hardly Come Up for Sale

Property Market Commentary What A Little-Noticed URA Rule Means For Future Neighbourhoods In Singapore

Singapore Property News Why The Rising Number Of Property Agents In 2026 Doesn’t Tell The Full Story

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

On The Market Here Are The Cheapest Newer 3-Bedroom Condos You Can Still Buy Under $1.7M