Making $1 Million Dollars In Profit From An HDB: Why Pinnacle @ Duxton May Be The Most Unique Property In Singapore

September 25, 2023

Pinnacle@Duxton remains the poster child of the “lottery effect” – the proof that certain desirable BTOs go on to make a killing for their lucky owners. In fact, it is probably Singapore’s most profitable HDB project (for its residents).

When this iconic HDB was launched, prices of 4-room flats ranged from $289,200 to $380,900 for 4-room flats and $345,100 to $439,400 for 5-room flats (source).

Recently, a 4-room flat at Pinnacle@Duxton broke a new record, selling for $1.41 million.

At a $1.3/4 million average price for the 4-rooms today, owners who snagged this HDB in 2004 would have made a cool million dollars from their HDB.

Exciting? Certainly, if you’re new to Singapore’s property market scene. Maybe even shocking.

But among longtime market watchers, this was greeted with nothing more than a nod of acknowledgement. It’s partly because of Pinnacle’s long record of million-dollar flats, and partly because expectations for this HDB project have never wavered.

So if you’re wondering what makes the Pinnacle @ Duxton so special, here are some of its more interesting points:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Why is Pinnacle @ Duxton so different and important?

Pinnacle has more than architectural significance – it was also a sort of bellwether, showing the effect of new flats in highly mature locations. It can be thought of as a possible forerunner, which indirectly influenced schemes like today’s Prime Housing Location (PLH) model. It doesn’t help that, with the new classification system, Pinnacle is set to become even more valuable.

HDB ReviewsPinnacle@Duxton Review: More Liveable Than You Might Think

by Reuben DhanarajSome of the key things to note are:

1. Pinnacle isn’t retroactively penalised by Prime and Plus classification

HDB has done away with mature versus non-mature classifications. Instead, flats are now classed as Prime, Plus, or Standard. This new approach works in favour of high-demand projects like Pinnacle, which existed before the new system.

Subsequent buyers of Prime or Plus flats are faced with a 10-year MOP, while the first batch of buyers also face Subsidy Recovery (SR) costs. The offset to this is supposed to be a superior location.

However, existing projects like Pinnacle are already in high-demand hot spots; and units here can be bought without requirements like a longer MOP or SR. Units here can also be fully rented out after five years, something that’s not possible for Prime or Plus flats. As such, we may see Pinnacle prices go even higher (or at least maintain their sky high values) over the coming years.

2. Pinnacle is a hotbed of rumours and a political talking point

There are few HDB projects that generate as many rumours as Pinnacle.

One of these, which has persisted for a long time, is that Pinnacle was an indirect “reward” for Grass Roots Leaders (GRL). Here’s a conversation on Reddit to show you what we mean:

Comment

byu/FitCranberry from discussion

insingapore

As well as:

Comment

byu/FitCranberry from discussion

insingapore

So it seems that to some Singaporeans, Pinnacle is representative of unfairness and cronyism. But these rumours are unverified, and just as many might accuse these people of simply being envious.

If nothing else, it demonstrates the social rifts that can emerge from the HDB windfall effect. And notice that, while the same rumours could circulate about almost any desirable HDB project, they almost always centre on Pinnacle.

This is likely because Pinnacle is so prominent, and keeps breaking transaction records.

Another ongoing rumour about Pinnacle is that it was a “testbed” for the short-lived DBSS initiative.

More from Stacked

We all want buying/selling a home to cost less, and there’s a much better way.

Imagine this: Buying or selling your home in Singapore – Easier, fuss-free, does not cost you an arm or a…

Pinnacle launched in May 2004, before the existence of DBSS. It was much pricier than other BTO flats, and had higher quality finishing, but didn’t have the typical full suite of condo facilities. On top of that, Pinnacle was specifically targeted at young urban professionals, who were likely to have higher incomes.

Sounds a lot like a DBSS right? Well, consider that DBSS then appeared on the scene in March 2005, very soon after the response to Pinnacle could be measured. You can probably see why there’s a persistent rumour that Pinnacle was an “unofficial pilot” for the scheme, and that DBSS may not have existed without the strong reception to Pinnacle.

But this rumour is also impossible to prove, unless someone privy to the internal discussions comes out with it.

3. Pinnacle is quite revolutionary in terms of layout

Most discussions of Pinnacle highlight its location, sky bridges, 50-storey height, etc. But what a lot of people may not realise is that the layout is much more versatile than previous flats.

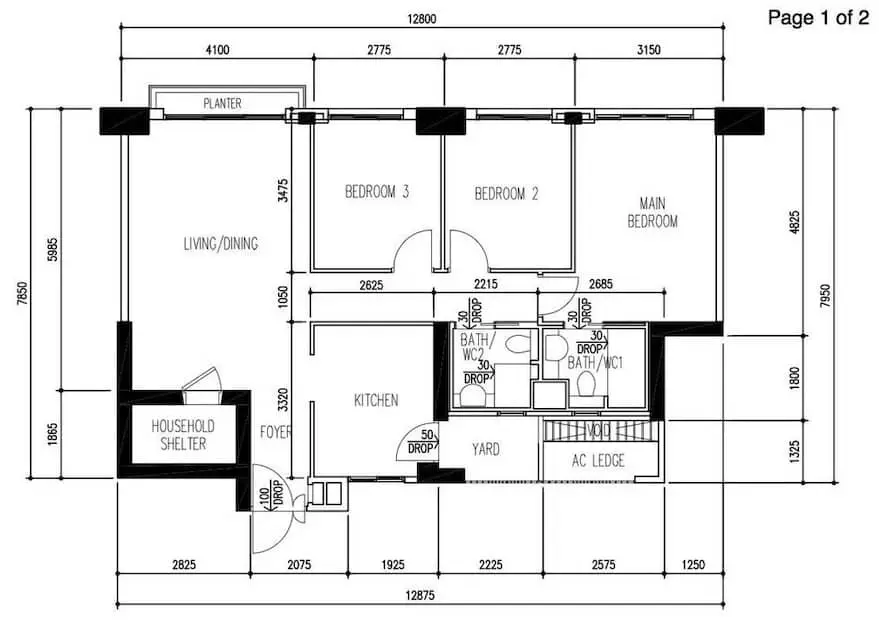

The living spaces in each unit can be widened or shrunk more easily, because many of the walls are just light-weight placements; not load-bearing walls. This was also the first HDB project where the buyers could choose between features like planter boxes, bay windows, or balconies (granted, many of those aren’t popular today, but they were marketed as plus points in the early 2000s).

This flexibility means that most units at Pinnacle are easy to customise, and adapt to different design themes. We do wonder if this was an experimental effort, and if the good reception will prompt HDB to apply it to future flats.

4. The high-end food court at Pinnacle is quite unique among HDB projects

If you haven’t been before, check out the food court at Pinnacle, which is quite unique. The food and furnishing are definitely more high-end than your regular mall food court; and it’s way more impressive than the occasional cafe in a condo.

Barring some mixed-use or integrated developments, this sort of high-end food court hasn’t been tried in other condos before; and it’s definitely different from the usual kopitiams you’ll find at HDB blocks.

This is an interesting study in amenities: if this can work, why not a few higher-end cafes as part of standard HDB blocks too? We have started to see pricier food options in heartland areas; and they can co-exist with regular, affordable food stalls.

Pinnacle @ Duxton may technically be an HDB project; but it’s so unique it doesn’t really fit well into any property segment. It has DBSS-like features but is not itself a DBSS flat. It’s also not an EC, but has facilities and quality that rivals ECs, or even private developments. And as far as property values go, it’s established as being the project to beat.

Beyond the realm of real estate, Pinnacle is also going to be at the centre of housing policy discussions; and it’s going to be a part of Singapore history in more ways than just architecture.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Latest Posts

Singapore Property News These 4 Freehold Retail Units Are Back On The Market — After A $4M Price Cut

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

0 Comments