The First New Condo In Science Park After 40 Years: Is LyndenWoods Worth A Look? (Priced From $2,173 Psf)

June 26, 2025

If there’s one phrase that reliably piques a Singaporean’s interest, it’s “first-mover advantage”, especially when a project launches in (somewhat) an unconventional but promising location (just look at Chuan Park and One Marina Gardens).

By that logic, LyndenWoods ticks both boxes.

It’s the first residential project in Science Park in over 40 years, a precinct more synonymous with research labs and innovation hubs than home ownership.

After all, how many people do you know who live in areas like this? It’s typically expats or academics tied to nearby institutions like National University of Singapore (NUS) or National University Hospital (NUH).

Still, we won’t be so quick to dismiss this CapitaLand-led project as just another one-north or Kent Ridge oddity. As the master planner of the precinct, CapitaLand is threading it into a larger precinct vision, so it feels less like a standalone condo and more like part of something bigger.

The goal? To turn Science Park into a self-contained “mini city” where research, work, and residence all converge.

Whether that vision materialises as intended is still up in the air. But the intent is clear, and the fundamentals are already in place. Kent Ridge MRT is nearby. NUS and NUH provide steady demand. And for families, it might even fall within 1km of Fairfield Methodist Primary School.

For those willing to look beyond the usual heartland Westie suspects (e.g. Clementi, Holland Village or Queenstown), LyndenWoods presents an interesting early play.

Here’s what we know so far.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Overview of LyndenWoods

| Project Name | LyndenWoods |

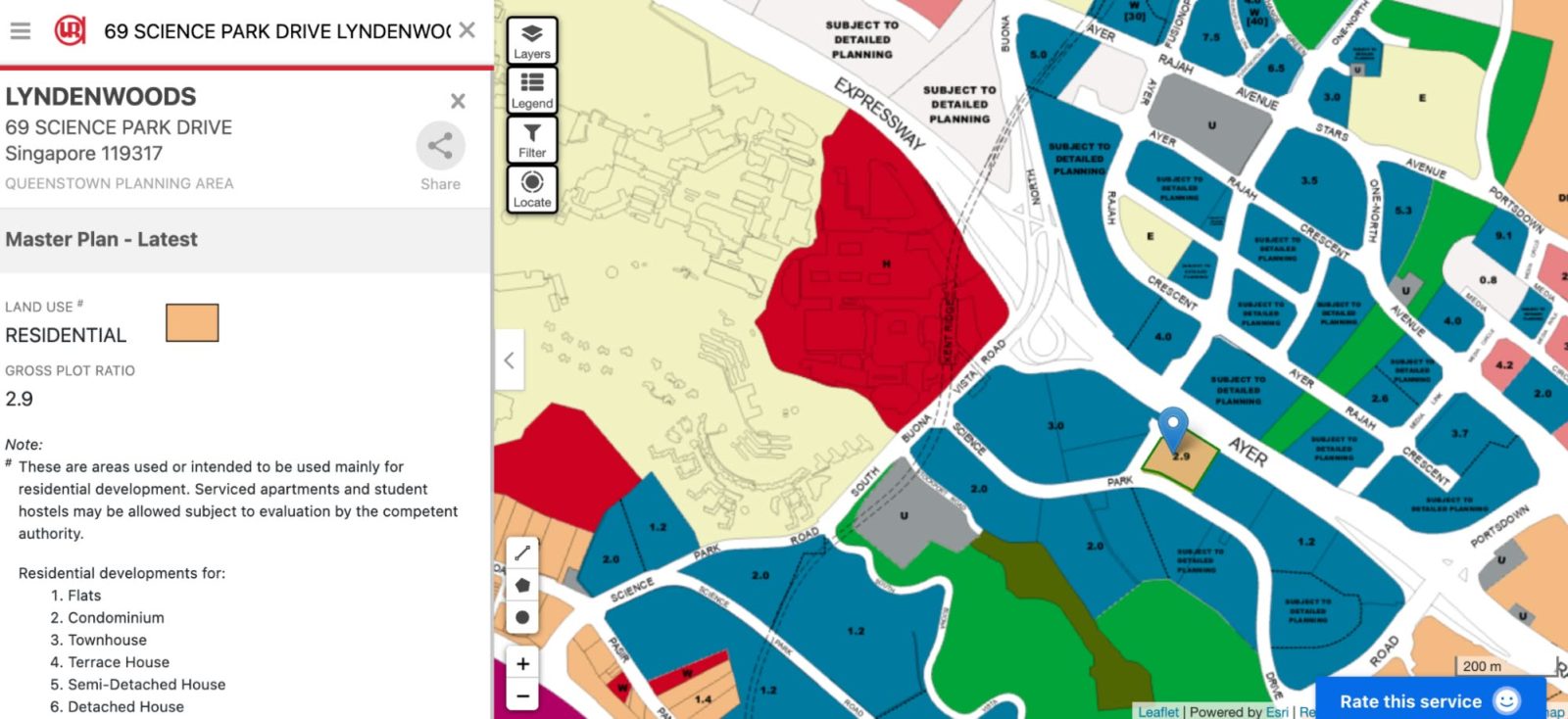

| Location | 69 & 71 Science Park Drive |

| Developer | CapitaLand Development (CLD) |

| Tenure | 99-year Leasehold from 28 April 2025 |

| Site area | 11,556.9 sqm (Approx. 124,350 sq. ft.) |

| GFA Harmonised? | No |

| No. of Units | 343 Units |

| Est. TOP | Q2 2029 |

LyndenWoods is a 343-unit, 99-year leasehold condominium led by CapitaLand Development, which, notably, also serves as the master planner for the wider Science Park precinct.

The development spans two 24-storey blocks, supported by a two-storey basement car park. More significantly, it holds the distinction of being the first residential project within Singapore Science Park, which is a shift that signals CapitaLand’s ambition to bring long-term liveability into an area traditionally known for R&D.

To most Singaporeans, CapitaLand needs little introduction.

Beyond its portfolio of iconic malls like ION Orchard, Jewel Changi Airport, Tampines Mall, and Bugis Junction, it’s also behind a string of notable residential developments like Bedok Residences, Sky Habitat, Cairnhill Nine, CanningHill Piers, J’den, and most recently, being a part of the mega launch of Parktown Residences at Tampines North.And unlike typical GLS sites, the land for LyndenWoods wasn’t acquired through a public tender, so there’s no published $PSF PPR benchmark. However, the most comparable activity nearby would be the launches at Bloomsbury Residences and the Media Circle sites.

Here’s how the numbers look:

| Land Parcel | Tenure | Winning Tenderer | Winning Bid ($PSF PPR) |

| Bloomsbury Residences | 99-year | CNCQ | $1,191 |

| Media Circle (Parcel A) | 99-year | CNCQ | $1,037 |

| Media Circle (Parcel B) | 99-year | NIL | No Bids |

So far, Bloomsbury has sold 146 out of its 358 units (roughly 40%), with 2-bedroom layouts being the more popular unit type. And if you’re wondering why there were no bids for Parcel B, Ryan’s breakdown offers a more detailed take here.

Which brings us to the next point: the unit mix at LyndenWoods.

Unit Mix and Configurations

At LyndenWoods, the unit mix spans from 2- to 4-bedroom premium units. Here’s a quick overview:

| Unit Type | Est. Size (SQFT) | Total Units | Unit Breakdown |

| 2 Bedroom | 635 – 721 | 137 | 66.8% |

| 2 Bedroom + Study | 850 – 883 | 92 | |

| 3 Bedroom | 1,023 – 1,066 | 45 | 26.5% |

| 3 Bedroom + Guest Premium | 1,292 | 46 | |

| 4 Bedroom Premium | 1,647 | 23 | 6.7% |

| 343 | 100% | ||

It’s a fairly straightforward mix, heavily weighted toward 2-bedders, which make up more than two-thirds of the project. Naturally, that suggests a more investor-leaning strategy.

What stands out, though, is the absence of 1-bedders. For a project in a location like Science Park (often seen as renter-heavy), it’s an unusual omission. That said, it mirrors what we saw at Bloomsbury Residences, which had a similar mix.

For context, here’s how Bloomsbury’s layouts compare:

| Unit Type | Est. Size (SQFT) |

| 2 Bedroom | 568 |

| 2 Bedroom + Flexi | 687 |

| 3 Bedroom + Study | 900 |

| 3 Bedroom Premium + Flexi | 1,095 |

| 4 Bedroom Premium + Study | 1,175 |

There are some key differences, though. Bloomsbury is a post-GFA harmonisation project, so AC ledges aren’t included in the stated unit sizes. LyndenWoods follows the pre-harmonised rules, meaning the stated sizes include AC ledges. So while the units here appear bigger on paper, part of that is mechanical space.

That said, LyndenWoods still offers slightly larger layouts overall, which might reflect its positioning (after all, Bloomsbury Residences is not within a 1-km radius of any Primary School, while LyndenWoods might be within a 1-km radius of Fairfield Methodist Primary).

We’re told that all units here adopt a point block concept, which is a big plus on the liveability scale. Even the compact 2-bedders have natural ventilation in the kitchen, which is very rare in today’s new launches.

It ties into a broader shift, too: more families are starting to view 2-bedders as viable homes, especially when they’re well-designed. With liveability, accessibility, and a lower entry price point, this seems to be the positioning CapitaLand is aiming for.

And one last thing: we’re also hearing that some stacks could enjoy partial sea views, though it’s unclear yet which floors will get the clearance.

Before we move on, here’s a look at the site of LyndenWoods.

At around 124,350 square feet, LyndenWoods offers a fairly respectable range of facilities, especially when you consider that some of the nearby condos in One-North are known for skimping on the full works. From a liveability standpoint, that’s already a mark in its favour.

Some highlights include a 50m infinity lap pool, function room, tennis court, pickleball court (a trending addition of late), an amphitheatre lawn, and a dedicated pet park. CapitaLand also has a solid track record when it comes to landscaping, so expectations will naturally be high on that front.

Another interesting detail: the site sits on naturally hilly terrain, with a gradual slope running through the grounds. How the architects and landscape team navigate this elevation change remains to be seen, which we’ll cover more of in our full review.

Also worth noting is the car park provision. LyndenWoods offers a 70 per cent unit-to-lot ratio, including 35 EV lots, which is a noticeable upgrade from the 40 per cent ratio that’s become standard in car-lite one-north. And this, despite Kent Ridge MRT being just a short walk away (more on that later).

More from Stacked

I’ve Lived At Kentish Lodge In Farrer Park For 5 Years: Here’s My Review Of This Small But Convenient Condo

District 8 has always been a melting pot of cultures (especially with the vibrant Little India area), so it's not…

LyndenWoods is currently expected to TOP in 2029.

CapitaLand’s Role: The Master Developer for Singapore Science Park

In the case of LyndenWoods, CapitaLand isn’t just the developer behind the condo. It’s also the long-time steward of Singapore Science Park, having guided its evolution over the past four decades.

While it might look like another new launch at first, this is the first residential project in a precinct that CapitaLand has been gradually shaping, much like how GuocoLand has taken on a place-making role in areas like Lentor and Beach Road, where homes, offices, and public spaces are designed as part of a more cohesive urban whole.

Naturally, it raises the question: why introduce housing only now?

From what we hear on the ground, the decision is largely a deliberate one. Instead of building homes in anticipation of future amenities, the plan was to wait until the supporting infrastructure (e.g. offices, transport, F&B, and basic conveniences) was already in place.

In other words, lay the groundwork first, then bring in the residents.

It’s a strategy that runs counter to what we’ve seen in newer towns like Tengah or early-phase Punggol, where residents often moved in well before the amenities caught up (thus, having to deal with teething issues of a burgeoning town).

For buyers considering LyndenWoods, that might come as a welcome shift.

The Location of LyndenWoods

Even with the progress made over the past few decades, Science Park Drive still feels like a neighbourhood in transition. While it’s modernised considerably, it doesn’t quite have the texture or maturity of a fully established residential estate (at least, not yet).

That may well change by the time LyndenWoods reaches completion around 2029–2030. But as of now, the area still reads more like a business park than a place people call home.

Case in point: here’s a Google Street View screenshot of the immediate vicinity, dated March 2025, just three months ago. You’ll see ongoing construction and a streetscape that feels more like a commercial campus than a residential enclave.

Still, it’s come a long way, especially with the recent launch of Geneo, a mixed-use development by CapitaLand located directly across from LyndenWoods.

Geneo brings in a range of dining options, daily conveniences, and shared amenities, and perhaps more importantly, it sets the tone for how this area could evolve into a more integrated, liveable hub.

What stands out most, though, is the connectivity.

LyndenWoods is a short, fully sheltered walk from Kent Ridge MRT on the Circle Line (which is also the closest station to the main NUS campus).

It’s also adjacent to NUH and One @ Kent Ridge, a complex that primarily serves the university and hospital crowd (so for amenities, think eateries, cafes, and academic spaces rather than typical heartland conveniences).

From a planning perspective, LyndenWoods is currently the only residential plot in the Science Park precinct with walkable, direct access to an MRT station, and that’s not insignificant.

For families, there’s also the possibility that it falls within 1km of Fairfield Methodist Primary School. That said, OneMap doesn’t confirm this from the LyndenWoods site itself (though it does from Geneo). If proximity to the school is a key factor, it’s worth double-checking before making any decisions.

Facing the AYE: A Possible Trade-Off?

Like many condos in the West, some units at LyndenWoods are expected to face the Ayer Rajah Expressway (AYE). Based on site plans, the nearest residential block sits about 41 metres from the expressway.

On the flip side, residents will have direct access to Kent Ridge Park, which would be a welcome addition for those who want to live in a relatively central, well-connected area without giving up access to green space.

For now, we hear that prices start from $2,173 PSF

At the time of writing, prices at LyndenWoods will start from $2,173 PSF. Here are the indicative guide prices by unit type:

- 2 Bedroom: From $1.39M ($2,188 PSF)

- 2 + Study: From $1.95M ($2,249 PSF)

- 3 Bedroom: From $2.35M ($2,297 PSF)

- 3 + Guest: From $2.88M ($2,229 PSF)

- 4 Bedroom: From $3.58M ($2,173 PSF)

As the first residential launch in this enclave in over four decades, LyndenWoods is likely to set the tone for future developments in the area. That said, it also means there are few direct comparables at this point.

Bloomsbury Residences launched at an average of $2,474 psf on its first weekend. While that provides some reference, the two projects differ in terms of scale, layout sizes, and surrounding amenities.

Now, here’s a look at how the nearby resale market has performed recently, using Normanton Park as a reference point:

| Contract Date | Address | Unit Area (SQFT) | Price (S$ PSF) | Price (S$) |

| 6 Jun 2025 | 45 Normanton Park #16-XX | 1,313 | 2,193 | 2,880,000 |

| 30 May 2025 | 57 Normanton Park #13-XX | 936 | 2,131 | 1,996,000 |

| 27 May 2025 | 59 Normanton Park #23-XX | 635 | 2,060 | 1,308,000 |

| 23 May 2025 | 49 Normanton Park #22-XX | 517 | 1,912 | 988,000 |

| 20 May 2025 | 47 Normanton Park #21-XX | 527 | 2,370 | 1,250,000 |

| 16 May 2025 | 61 Normanton Park #12-XX | 936 | 1,976 | 1,850,000 |

| 13 May 2025 | 57 Normanton Park #05-XX | 527 | 1,797 | 948,000 |

| 9 May 2025 | 55 Normanton Park #24-XX | 1,475 | 2,021 | 2,980,000 |

| 9 May 2025 | 57 Normanton Park #21-XX | 936 | 2,120 | 1,985,000 |

| 8 May 2025 | 61 Normanton Park #20-XX | 657 | 1,993 | 1,308,888 |

| 16 Apr 2025 | 59 Normanton Park #17-XX | 527 | 2,086 | 1,100,000 |

| 10 Apr 2025 | 61 Normanton Park #07-XX | 915 | 1,989 | 1,820,000 |

| 7 Apr 2025 | 57 Normanton Park #10-XX | 527 | 1,880 | 991,500 |

| 7 Apr 2025 | 55 Normanton Park #15-XX | 958 | 2,192 | 2,100,000 |

| 27 Mar 2025 | 61 Normanton Park #10-XX | 915 | 2,151 | 1,968,000 |

Resale prices here span from around $1,800 psf to $2,370 psf, though it’s clear that the $2,000 psf mark has become an accepted norm in this part of the RCR.

Meanwhile, Blossoms by the Park, which is closer to One-North and daily conveniences, has seen even higher prices:

| Contract Date | Address | Unit Area (SQFT) | Price (S$PSF) | Price (S$) |

| 19 May 2025 | 9 Slim Barracks Rise #14-XX | 1,507 | 2,323 | 3,500,000 |

| 21 Apr 2025 | 9 Slim Barracks Rise #26-XX | 1,507 | 2,475 | 3,730,000 |

| 19 Feb 2025 | 9 Slim Barracks Rise #15-XX | 1,507 | 2,362 | 3,560,000 |

| 21 Jan 2025 | 9 Slim Barracks Rise #17-XX | 1,507 | 2,394 | 3,608,000 |

While it remains to be seen how much prices could stage upwards (depending on demand), LyndenWoods starts at a competitive $2,173 psf, right within the sweet spot for the neighbourhood where prices have already been hovering north of $2,000 psf.

But beyond price, buyers today will also be eyeing the layout, and we think this is where Lyndenwoods can – and should – try to make the strongest case for itself. As much as affordability is a key consideration, layout has crept up the priority list; this is going to be the case for buyers who are choosing a two-bedder not as a stepping stone, but as a long-term home.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Cheryl Teo

Cheryl has been writing about international property investments for the past two years since she has graduated from NUS with a bachelors in Real Estate. As an avid investor herself, she mainly invests in cryptocurrency and stocks, with goals to include real estate, virtual and physical, into her portfolio in the future. Her aim as a writer at Stacked is to guide readers when it comes to real estate investments through her insights.Need help with a property decision?

Speak to our team →Read next from New Launch Condo Analysis

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

New Launch Condo Analysis This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

New Launch Condo Analysis This Freehold New Launch Condo In The CBD Is Launching From Just $1.29M

New Launch Condo Analysis I Reviewed A New Launch 4-Bedroom Penthouse At Beauty World

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

2 Comments

Thought GFA harmonisation starts from 1st June 23? Appreciate it you can clarify, thanks.

Hi Bas! You’re right that new projects launched after 1 June 2023 are subject to GFA harmonisation. However, in the case of LyndenWoods, the land wasn’t recently acquired – instead, it underwent a change of use. As a result, it follows the pre-harmonisation rules.