We Tour Jalan Baiduri, Where A Freehold Semi-D Home Just Sold For $4.4 Million In 2025

TJ's interest in property was sparked after returning from the UK- where balconies are not counted in one's square footage!- and finding that the Singapore property had totally changed in the 7 years she was away. When not reading and watching articles & videos about property, she is busy cooking and baking for friends, family & her blog Greedygirlgourmet

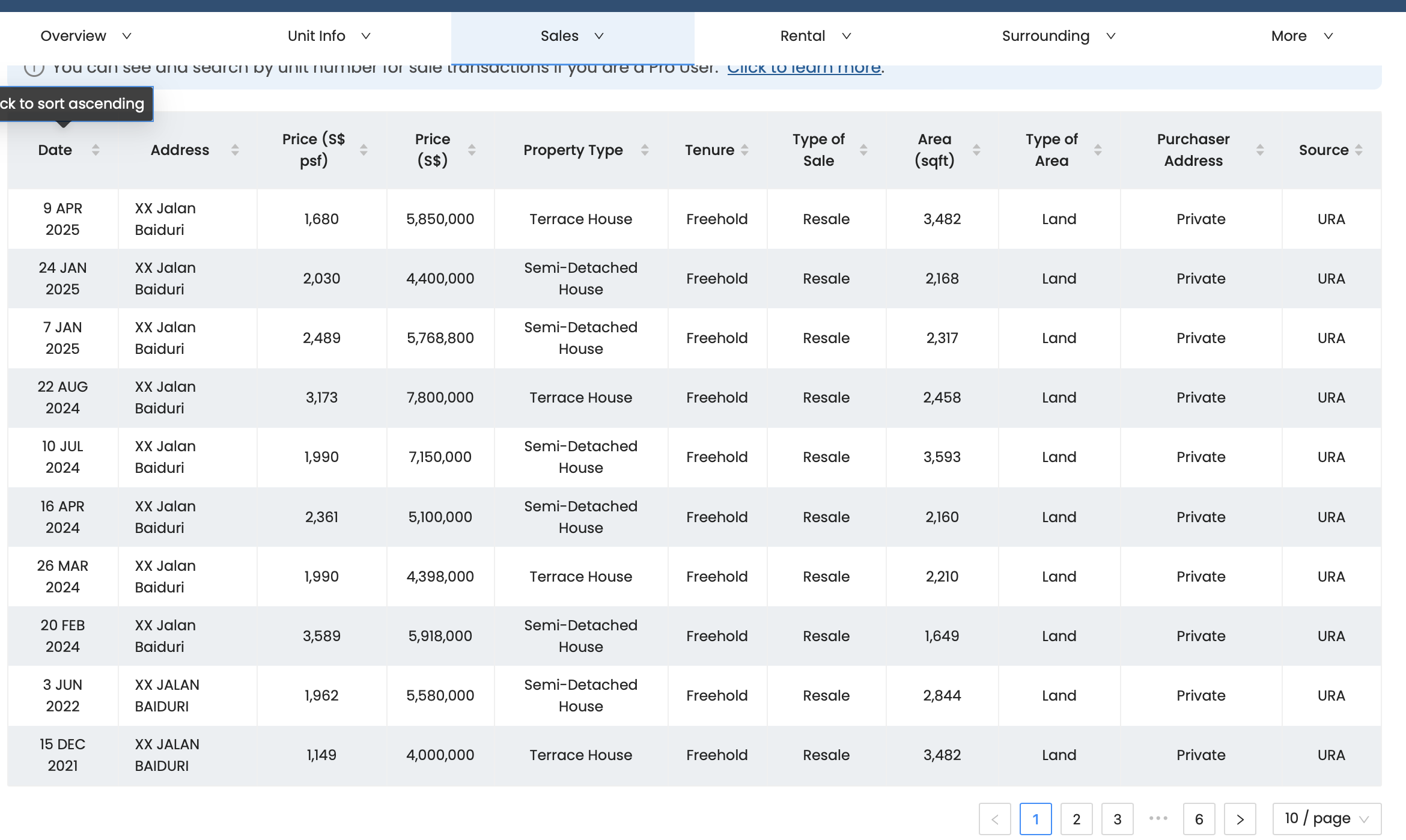

I first heard of Jalan Baiduri when I was writing about Duku Road and Lorong Stangee. The road came up in a list of sales transactions within one-kilometre, and I noticed it because of a semi-detached (semi-D) that sold for $4.4million. While that’s not a record-breaker, it’s still impressive; so I thought it would be interesting to take a look. Here we go.

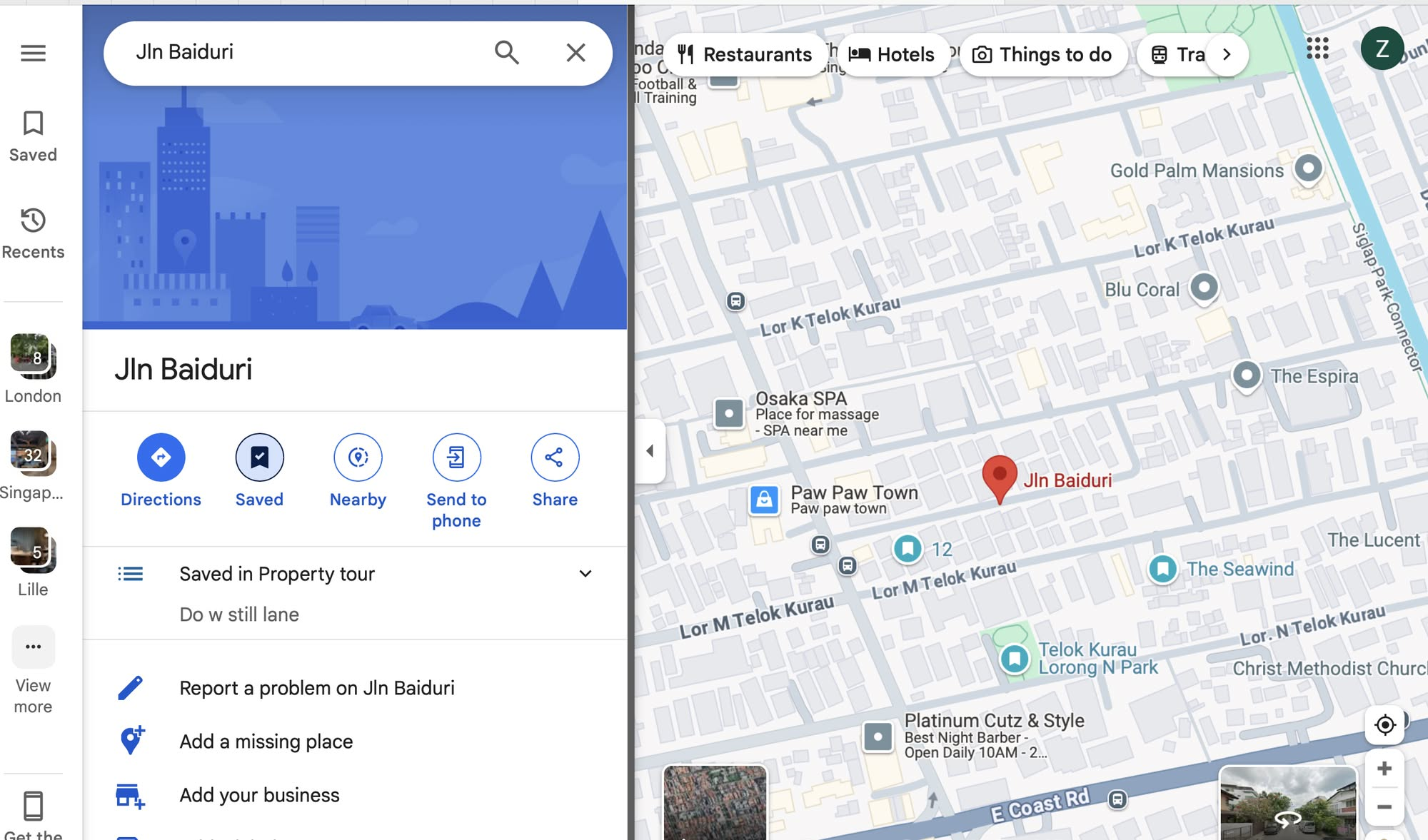

Before we get in deeper, here’s a map for you to get a better sense of the area:

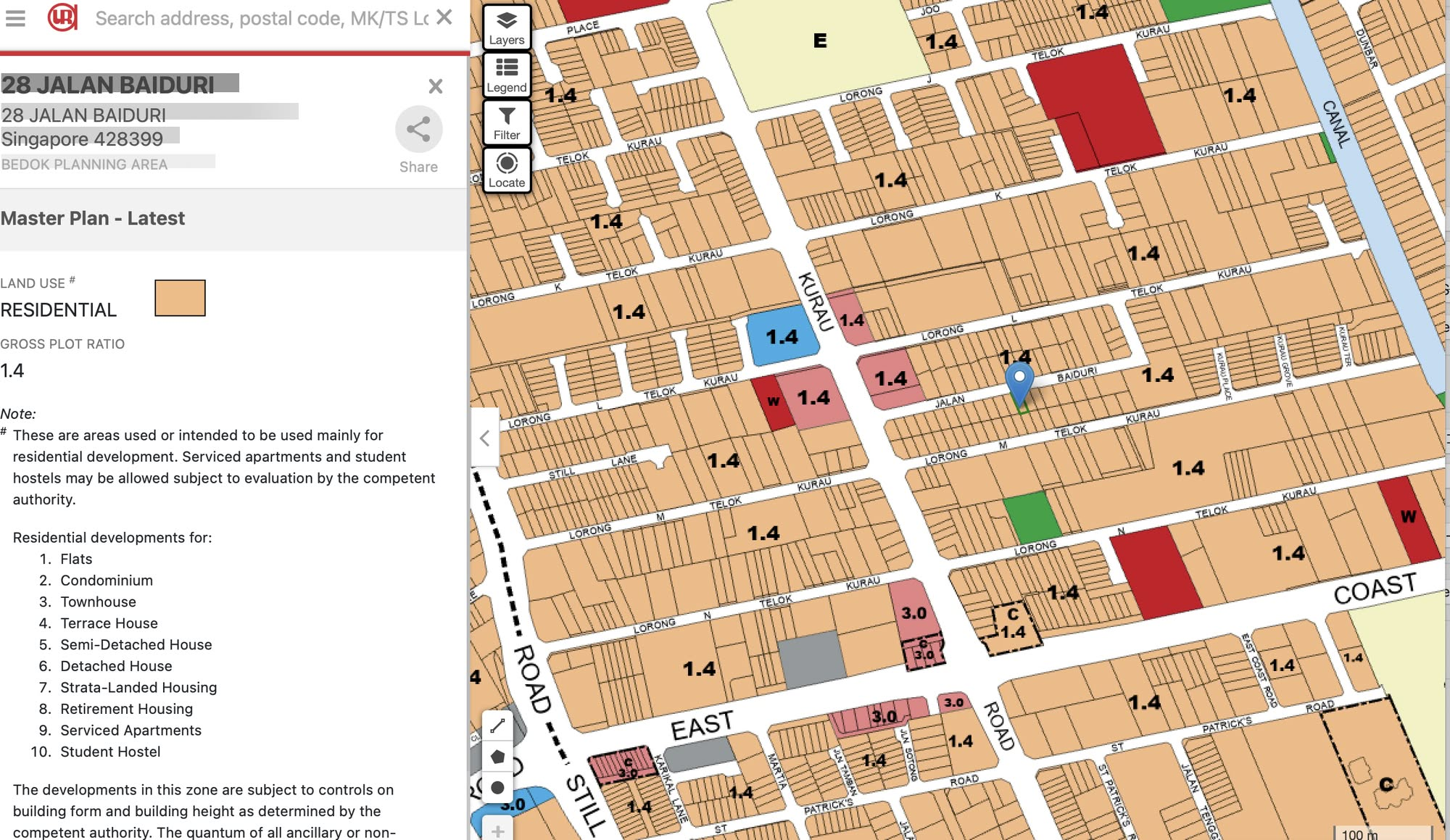

(Well, strictly speaking, there are 2 strata developments here- the 2nd would be Telok Mansion on Telok Kurau Road but I don’t count it as the main entrance isn’t on Jalan Baiduri.)

I visited during the day when most people would have been at work, so I could find street parking. I was quite surprised still, as I’ve been to other landed enclaves nearby where I couldn’t find a single spot on the whole street. However, the situation may change when everyone is home.

More from Stacked

Your East Coast Sea View May Disappear: How The Long Island Reclamation Could Affect You

An old plan resurfaced in a URA exhibit this June, and it’s worth paying attention to – especially if you…

There are a good variety of units here:

I don’t think we need to see every house on this street, so let’s head out to the main street now: Telok Kurau.

This brings us to the end of today’s walkabout. (The area is so small, even though I googled, no news articles came up. I did find this page showing the inside of one of the houses though.)

How did you find the Jalan Baiduri area compared to all the other landed estates in the East that we’ve visited this year? Let me know in the comments! If you have any you want showcased, let me know. I’ll be publishing the previously requested ones soon!

TJ

TJ's interest in property was sparked after returning from the UK- where balconies are not counted in one's square footage!- and finding that the Singapore property had totally changed in the 7 years she was away. When not reading and watching articles & videos about property, she is busy cooking and baking for friends, family & her blog GreedygirlgourmetRead next from Landed Home Tours

Landed Home Tours Inside Balmoral Park: Rare Freehold Landed Homes With 1.6 Plot Ratio In District 10

Landed Home Tours These $4m Freehold Landed Homes In Joo Chiat Have A 1.4 Plot Ratio: What Buyers Should Know

Landed Home Tours A Freehold Landed Estate With A Jumbo Playground In The East: Touring Lucky Gardens (From $3.7m)

Editor's Pick Touring Rare Freehold Conservation Shophouses In Cairnhill (From $7 Million)

Latest Posts

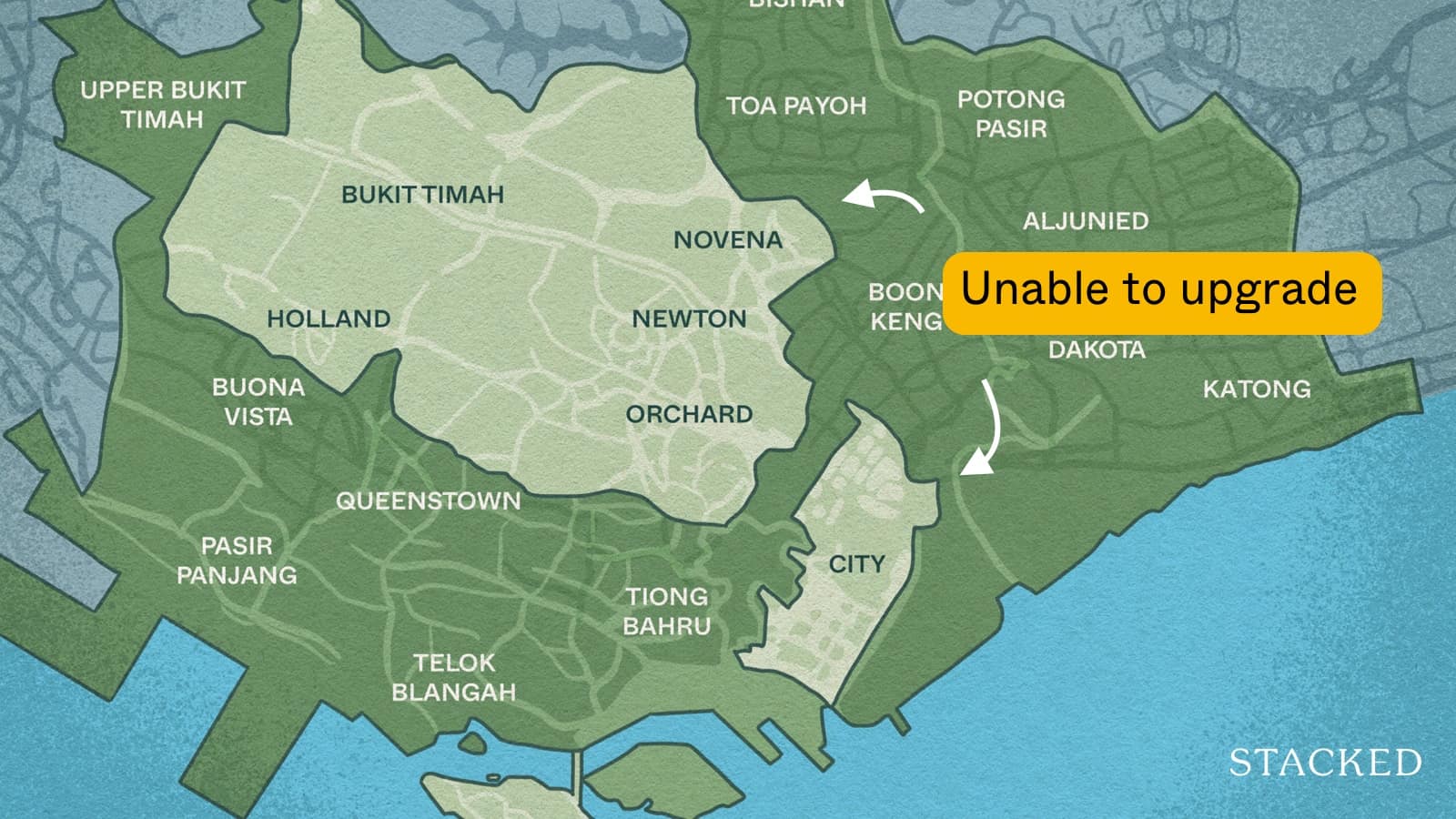

Singapore Property News Why Some Central 2 Bedroom Homeowners In Singapore Are Stuck

Property Market Commentary Looking To Buy Singapore Property In 2025? Here’s What’s Different (And What Could Catch You Off Guard)

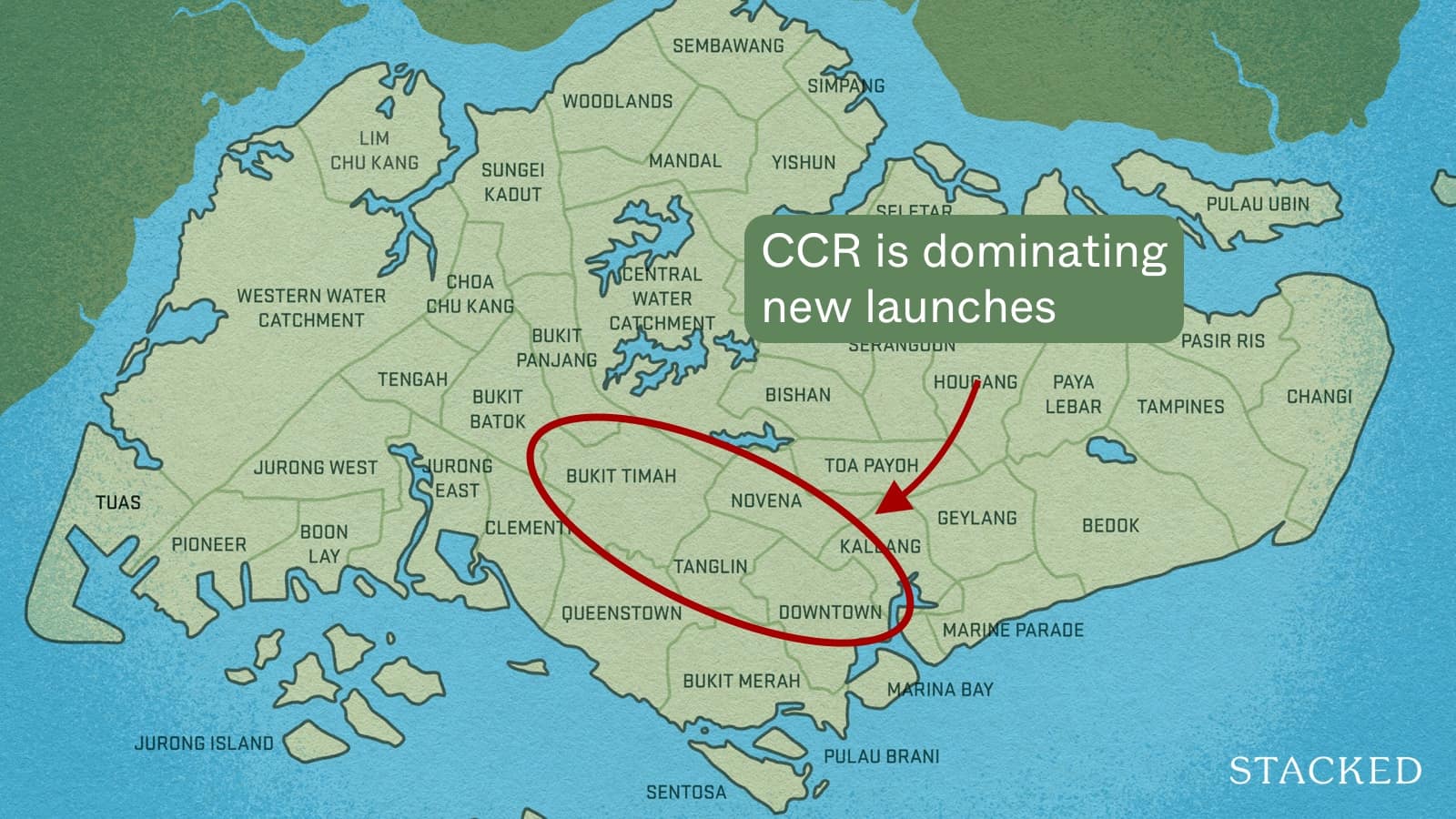

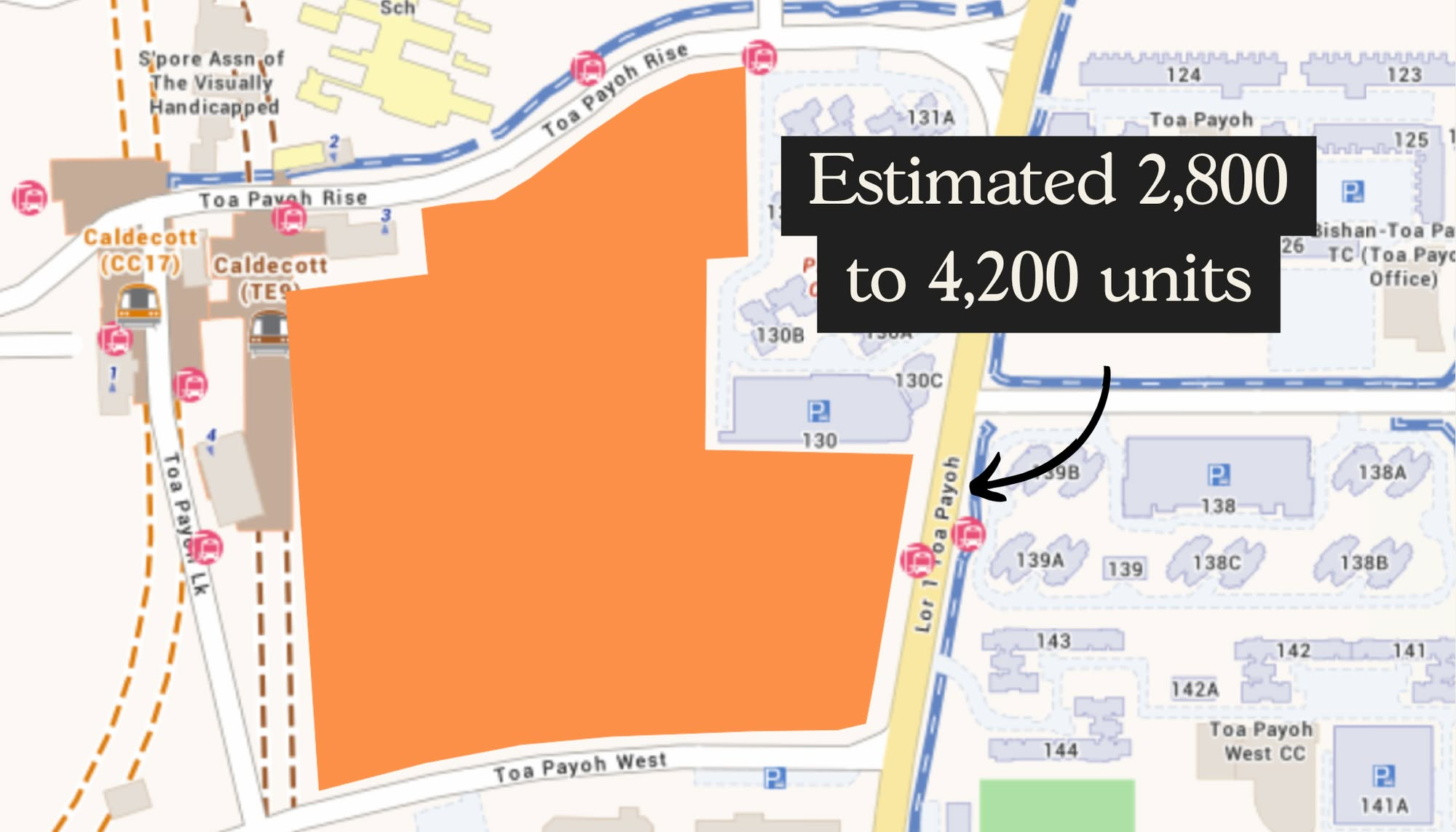

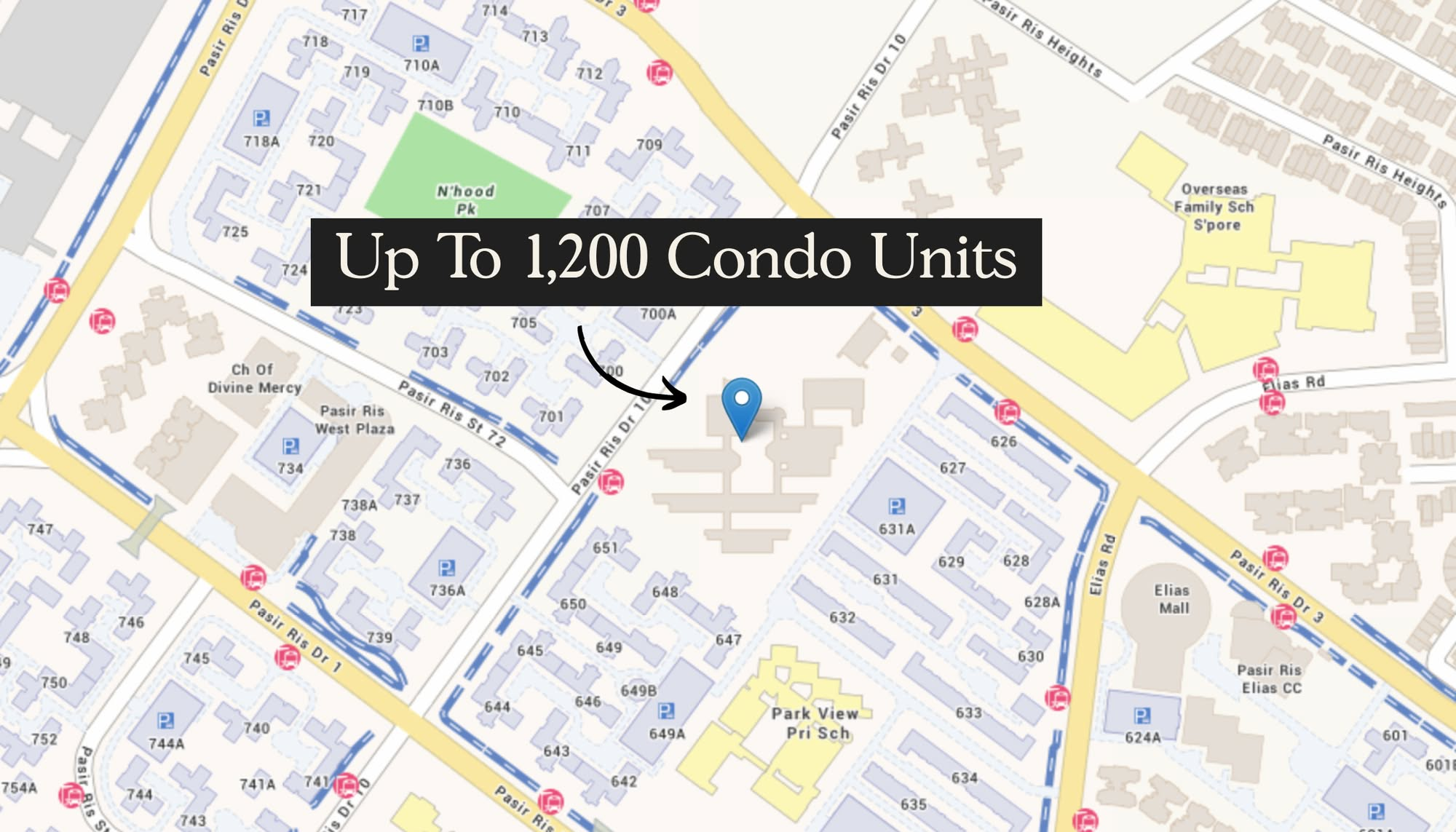

On The Market 7 New Residential Sites Near MRT Stations In URA’s Latest Master Plan Update (And What To Expect)

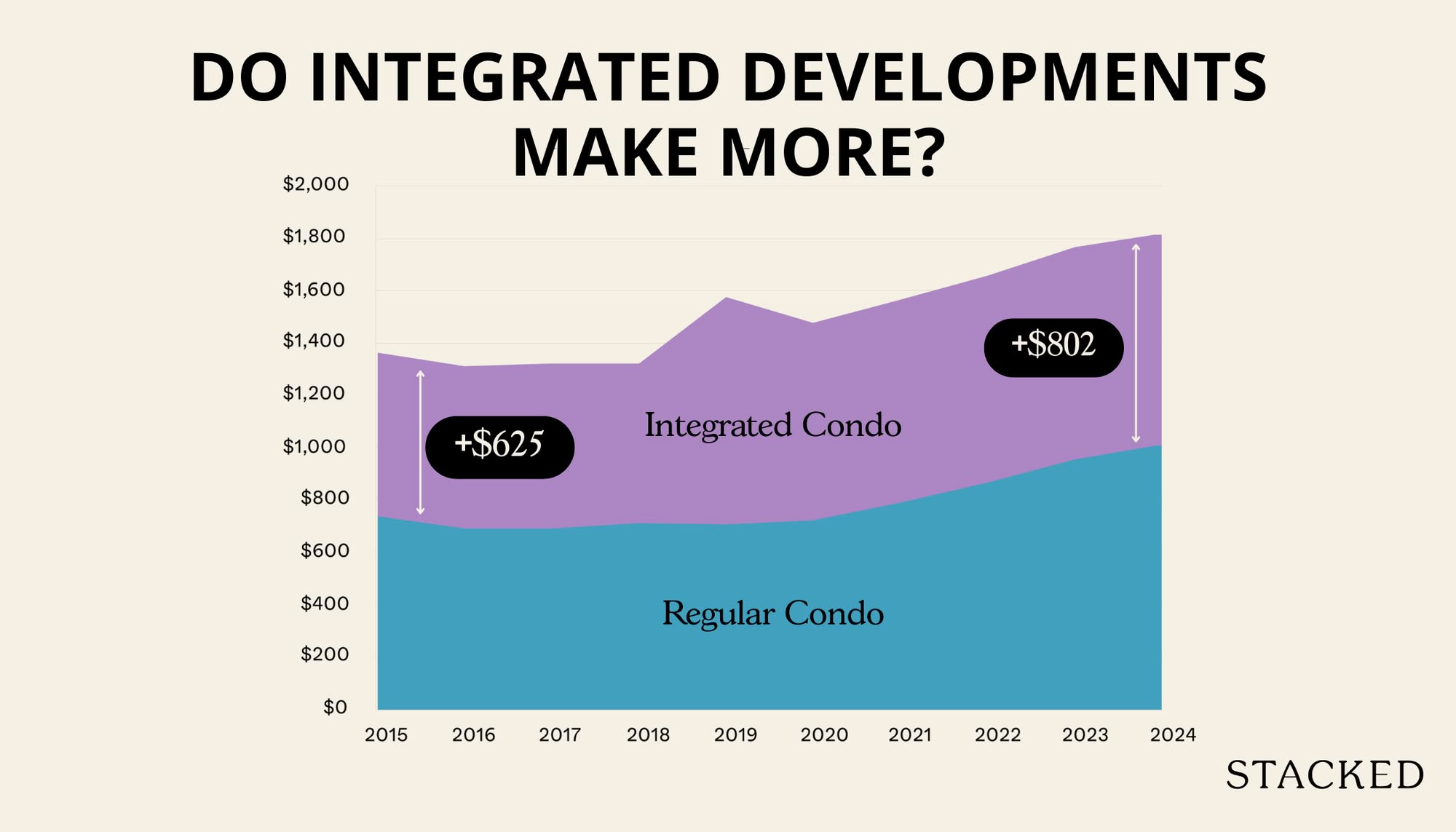

Pro Are Integrated Developments In Singapore Worth the Premium? We Analysed 17 Projects To Find Out

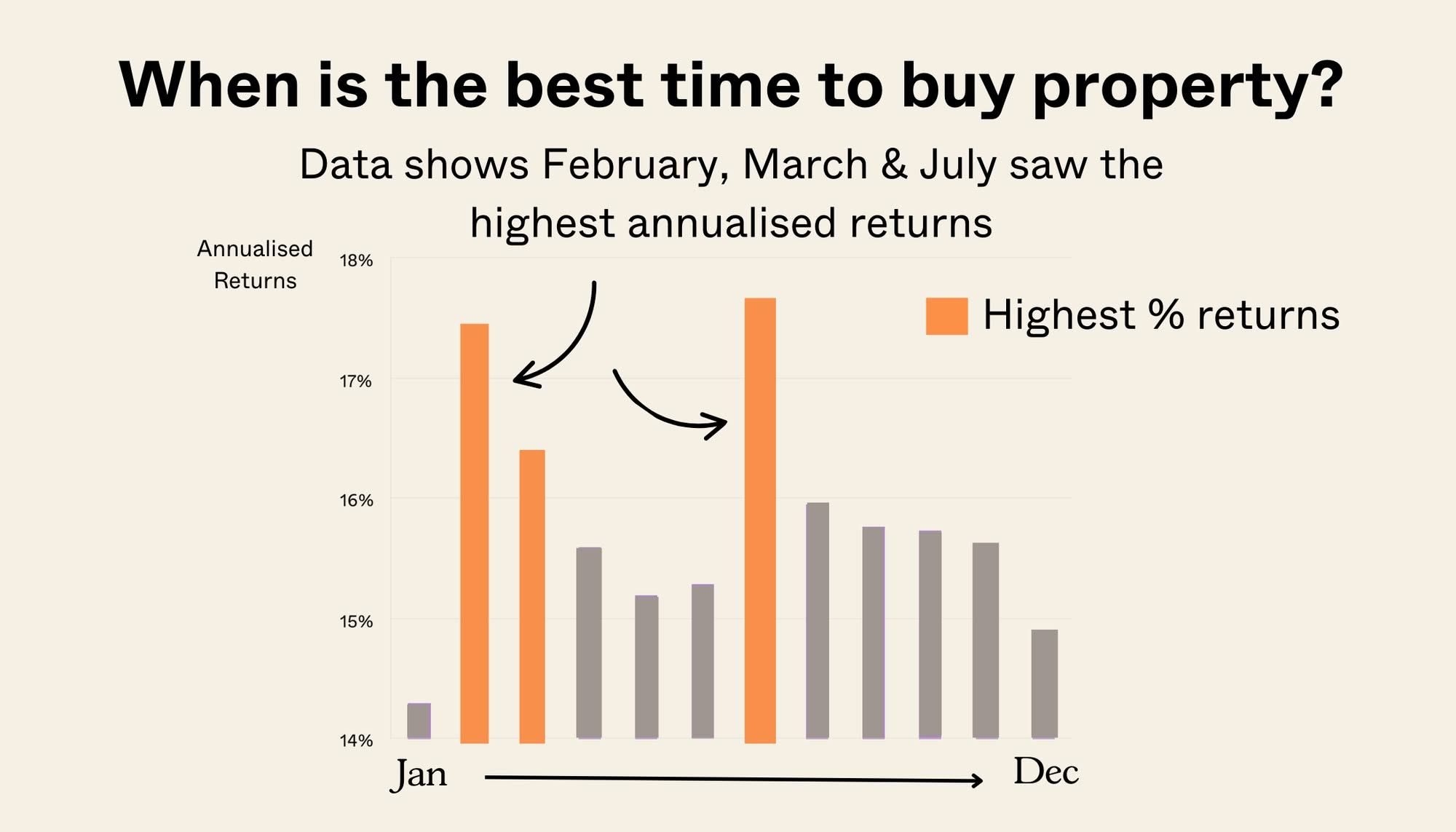

Pro Is There A ‘Best’ Time To Buy (Or Sell) Property In Singapore? We Analysed 56,000 Transactions To Find Out

On The Market 5 Unique High-Ceiling HDB Flats Priced From $650k

Singapore Property News 5 Former School Sites In The East Are Now Zoned For Homes In Singapore: Here’s What We Know

Editor's Pick Six Prime HDB Shophouses For Sale At $73M In Singapore: A Look Inside The Rare Portfolio

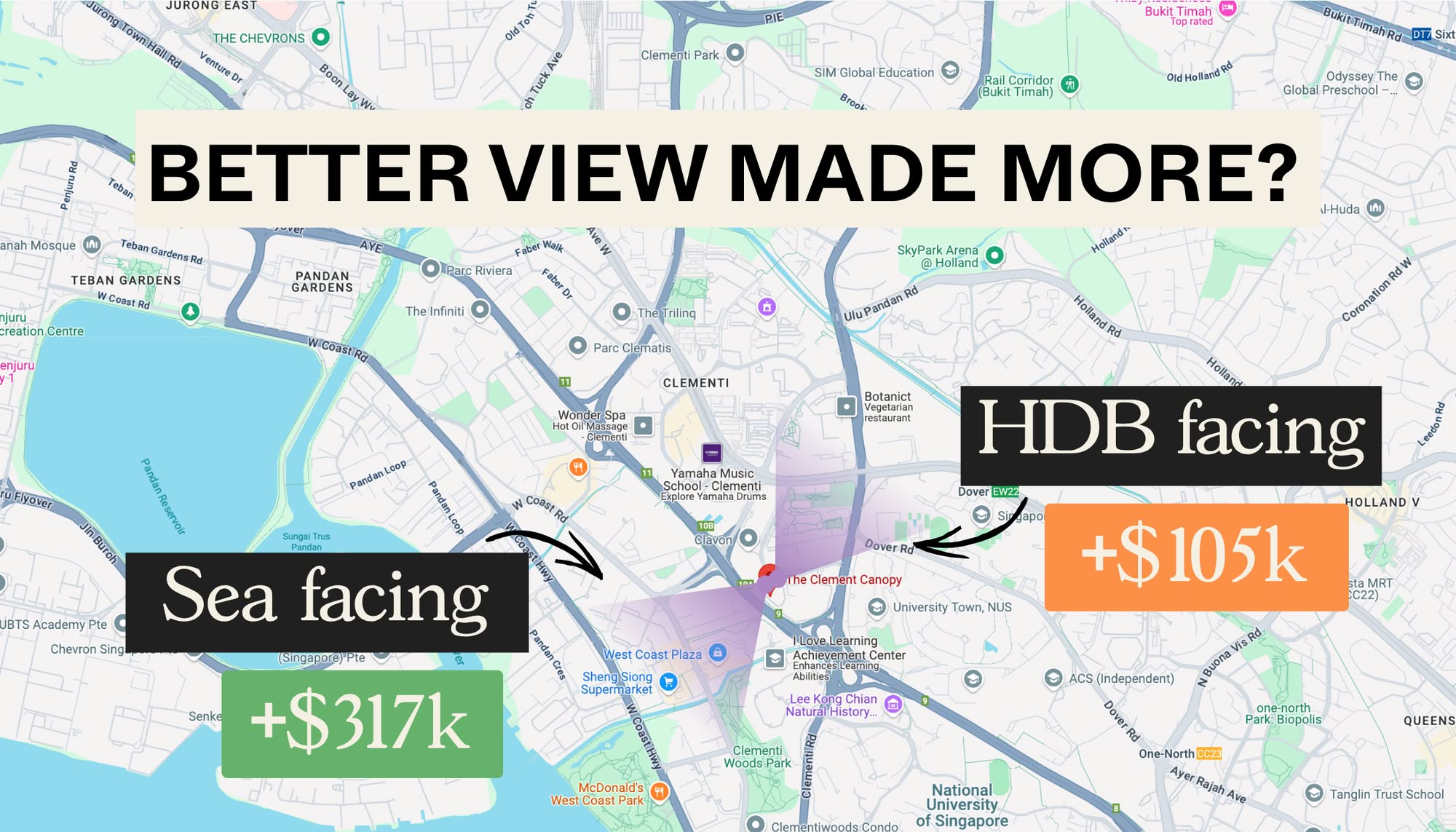

Pro $317K Condo Profit Vs $105K: We Analysed How Views Affected Clement Canopy Resale Gains

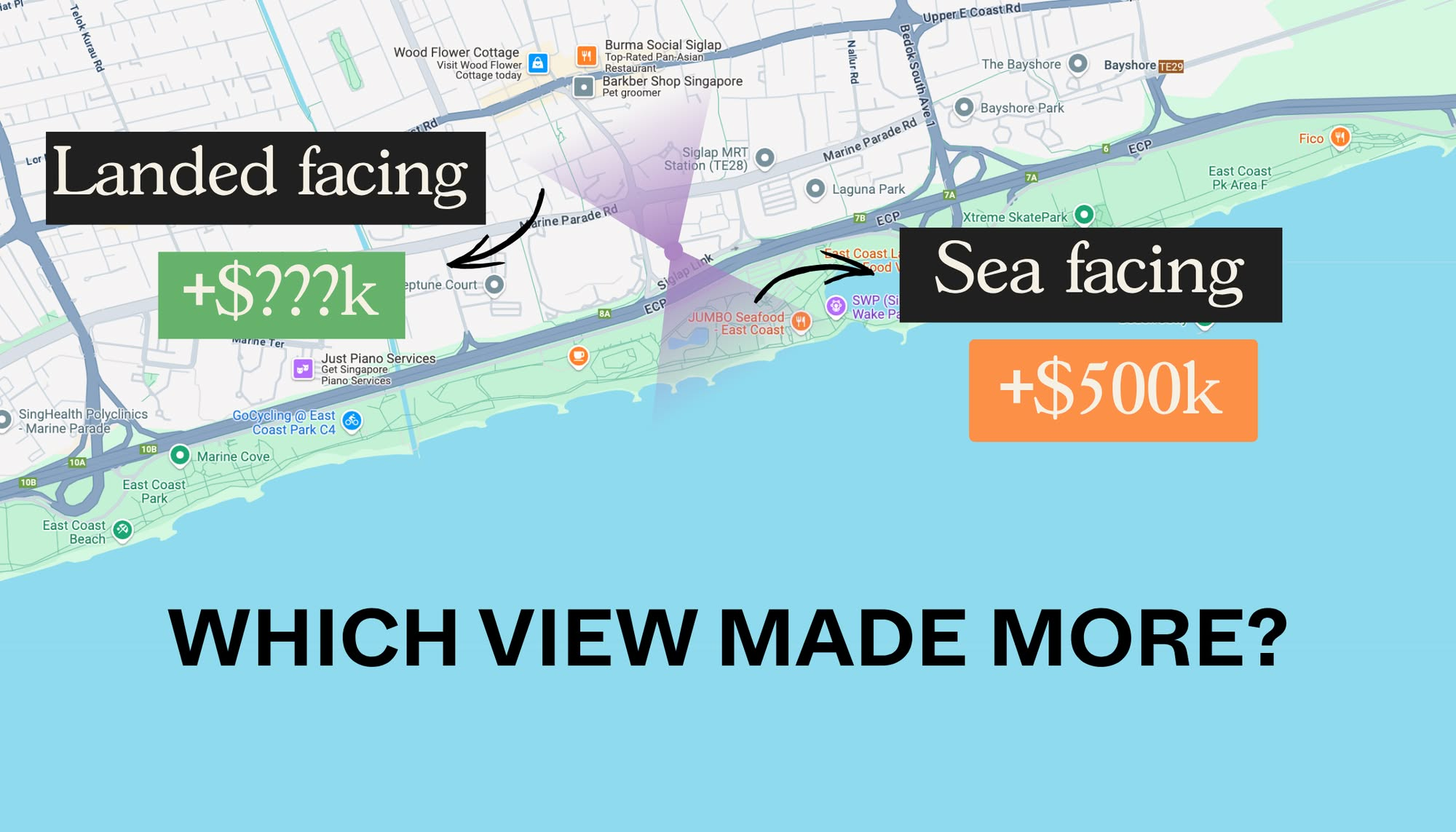

Pro Sea View Vs Landed View: We Analysed Seaside Residences Resale Profits — Here’s What Paid Off

Editor's Pick Selling Your Condo? This Overlooked Factor Could Quietly Undercut Your Selling Price

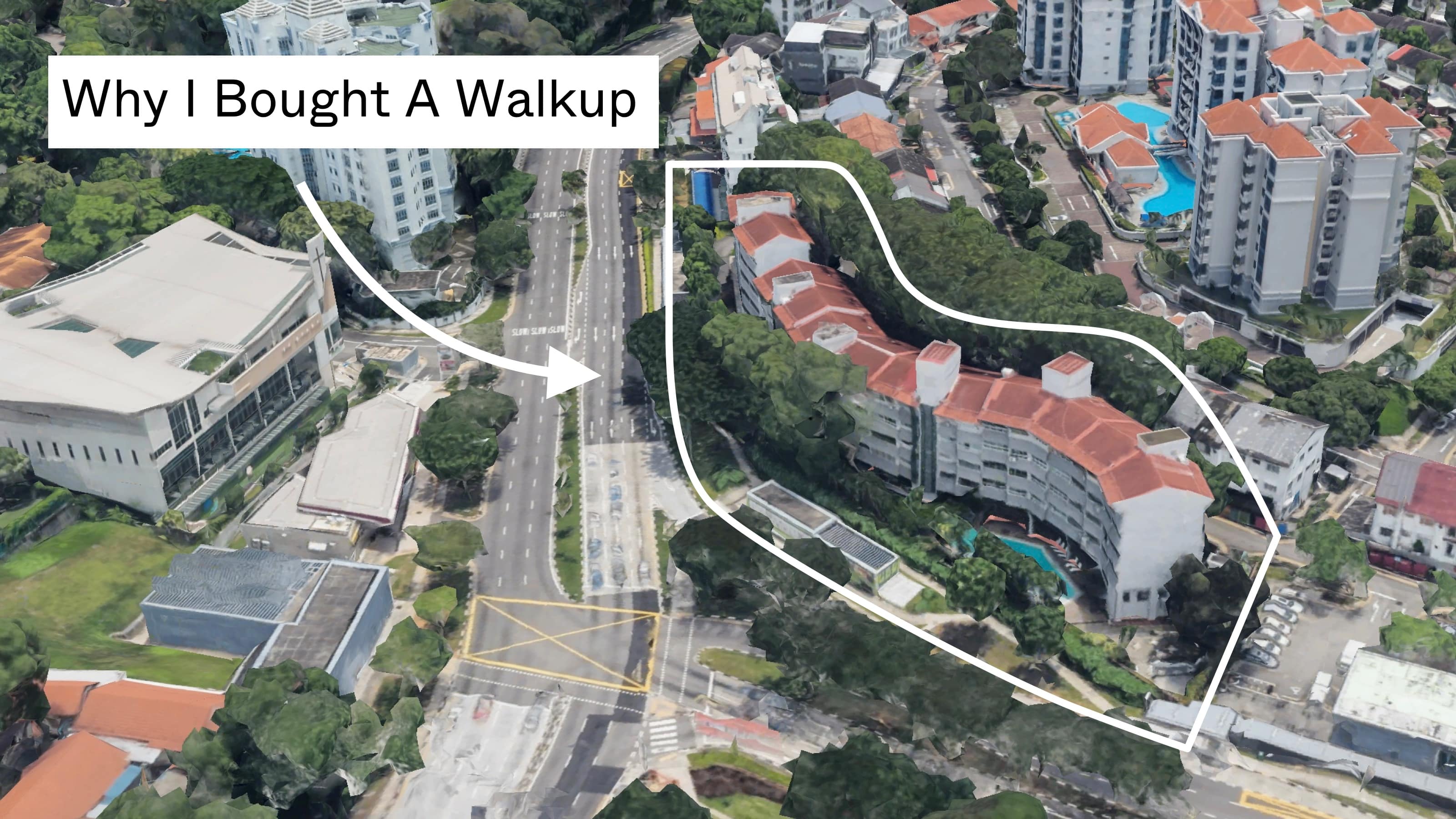

Editor's Pick Why We Chose A Walk-Up Apartment (Yes, With No Lift) For Our First Home

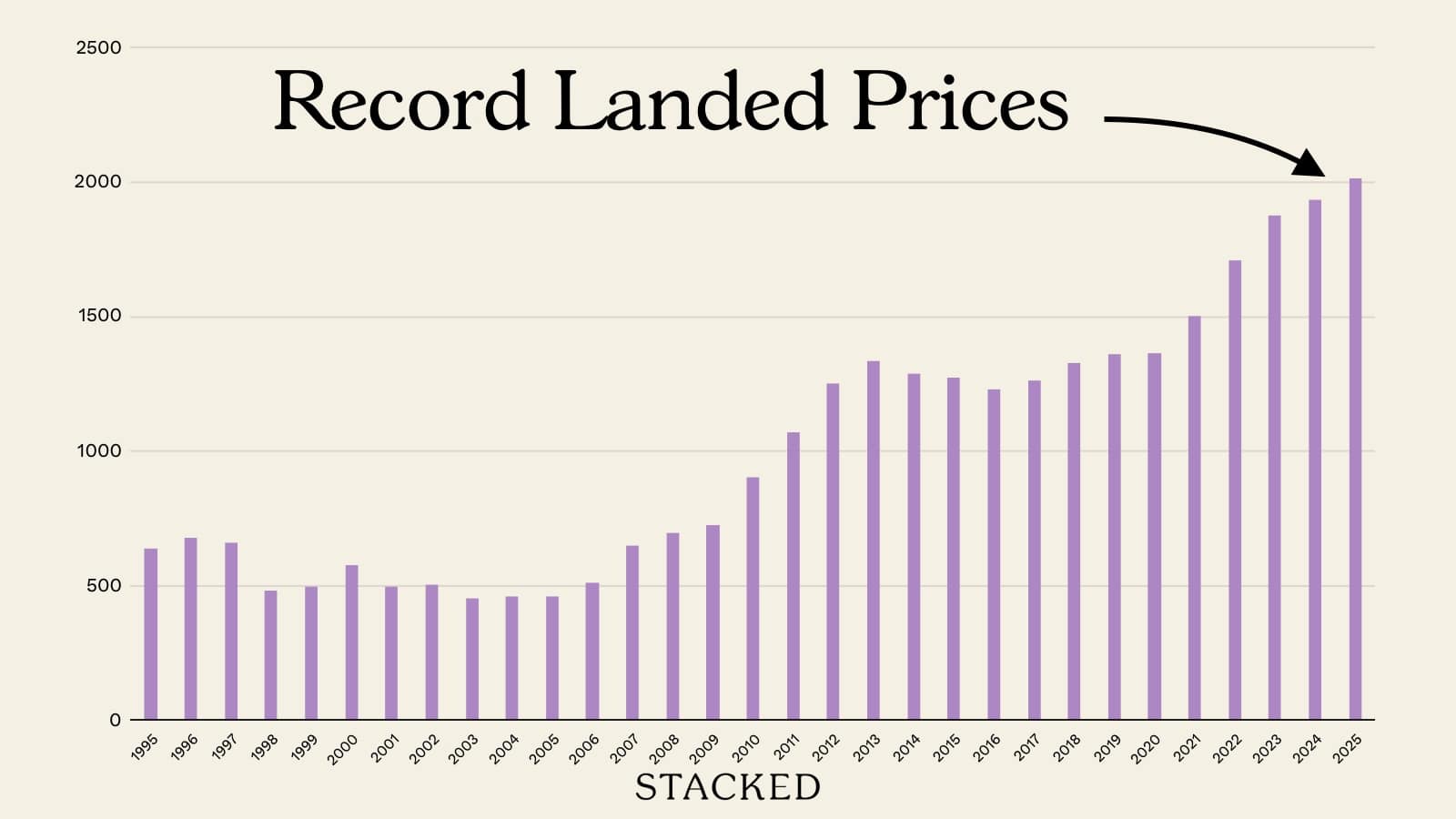

Singapore Property News New Record For Landed Home Prices In Singapore: It’s Like An A+ in The Least Important Exam

Homeowner Stories How a 57% Rent Spike Drove Flor Patisserie Out — And What It Says About Singapore’s Retail Scene

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show