I’m A Young Singaporean Who Decided To Buy Property Overseas Instead, Here’s Why

May 18, 2024

I have always dreamed of owning property before I turned 35. As someone huge on personal finance, it was a really big deal to get one of the biggest life purchases out of the way so I could start optimising my money for retirement and other investments.

This is considered a counter-intuitive mindset, where many financial advisors are adamant about investing to be the first step to stable finances in the long term.

“Oh, you’re doing it the opposite way.”, laughed many of my FIRE finance bro friends. Truth be told, I was quite doubtful of my gut feeling that investing was not the right strategy for me. The numbers are better, but trading stocks and ETFs was no longer bringing me the thrill or sense of fulfilment I adored when I first started.

The compound interest isn’t really compounding to me anymore, if you get what I mean.

When I got my job offer to move overseas, I sold my entire portfolio, to the horror of many friends.

It didn’t make sense to keep it anyway, it was a small portfolio I started a few years ago that wasn’t worth figuring out double taxation laws for.

I patted the money in my pocket (our trusty banking app), and went to live overseas.

Now 2 years in, I’ve decided that I probably want to buy something here.

—

Hi, I’m Melody, and I’m one of the new writers at Stacked. I don’t know if it makes sense to do a self-intro, but since we’re going to get very personal with my writing, I figured it’d be good to do virtual introductions so everything makes sense.

I am a professional currently living and working in Europe, and I decided to purchase a place in France. My entire editorial brief is just writing about my overseas real estate journey, and boy, do I have a lot of stories.

I am well aware my situation is quite bizarre, maybe even privileged, but I don’t believe I am an outlier when it comes to Singaporeans who want to own something overseas because we’re not quite satisfied with the options back home.

So with this, I’ll start documenting my journey, but I really like my privacy, so intimate details will be omitted. But I still hope by writing about my journey with transparency, it will be informative overall.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

On the topic of affordability

There would be multiple facets of consideration for young people when it comes to buying property, but affordability has to be one of the biggest considerations.

Is property in Singapore more affordable than Europe? As a Singaporean looking at overseas prices in Euros, Europe is expensive by default due to the exchange rate, lack of housing grants, and the inability to use CPF for a property purchase.

These factors alone make Singapore seem more affordable compared to many major cities here. But as a temporary resident in Europe making the Euro and living in the suburbs, I believe Europe has access to more affordable options compared to our city-state.

But we’re comparing apples and pears as the property markets are on completely two different dynamics. The most objective way to look at whether my thought process isn’t crazy is to look at the numbers, starting with affordability. Keep in mind that these numbers have been validated by banks and mortgage brokers from each country.

| Singapore max affordability | Europe max affordability |

| S$519,500 | €365,000 (~S$529,284) |

Depending on how the exchange rate swings, my affordability for both countries is quite similar. But when interest rates for loans come into play, how would it look?

The current interest rate in Singapore for an HDB loan is 2.6%, while France’s property loans are at 4.05% (at the time of writing). Just on the interest rate alone, Singapore would be more affordable hands down. (Of course, I’m comparing just buying an HDB here, if you are looking at private property, Singapore is also lower at the moment, at around 3%).

But it is important to note how this would affect the difference in monthly mortgage payments, so I crunched the number for a larger loan amount (€300k), and somewhat for a smaller purchase (€150k).

| Singapore (2.6% interest) | France (4.05% interest) | Difference | |

| Monthly mortgage (S$438k / €300k) | S$1,987 | €1,592 (~S$2,324) | S$337 (17%) |

| Monthly mortgage (S$219k / €150k) | S$994 | €796 (~S$1,162) | S$168 (17%) |

With a difference estimated at S$168 – S$337 monthly, I cannot sit here and tell you my reasons for wanting to buy property overseas is because it’s more affordable because it’s not. But at such a small difference per month, I’m willing to take a little gamble to own something overseas.

—

Here’s why I’m gambling:

I don’t want to wait till I’m 35 to own something.

I’m not a very patient person. For many years, I’ve been seeing the property market around the world pass me by. It really irritated me to no end that I had the cash and also a good enough credit to get a loan for affordable housing options in Singapore, but I’m basically not allowed to have a foot in the market because of my age (and the fact that I am not marrying a Singaporean or PR).

More from Stacked

Why It’s Never As Easy As “Just Refinancing” To A Cheaper Home Loan

Your eyes pop out a little when the mortgage banker shows you their rate: 1.2 per cent per annum? That’s…

I managed to save a good amount of cash before 25, and for what? Too poor to risk buying a condo, but too young to buy public housing in Singapore alone. Being in Singapore felt like I had to be a part of the system, and I needed to have faith that the system would work out in order for me to be comfortable.

I didn’t like feeling trapped like this. Sure, Singapore is comfortable for a specific demographic of people; and I currently belong to that said demographic, but I don’t know how my financial situation and career will change as I get older. I also don’t know what the property market will look like in 10 years.

It just felt like I was waiting to lose by doing nothing. So I decided to look outwards for a solution. If I fail, at least I tried. Life is about the “Oh wells” instead of the “What ifs”.

My reasons for wanting to own property are simply based on an emotional pursuit to be in more control of my money and my life during my youth. That’s it. I just want to be treated like an adult who could make responsible decisions by myself.

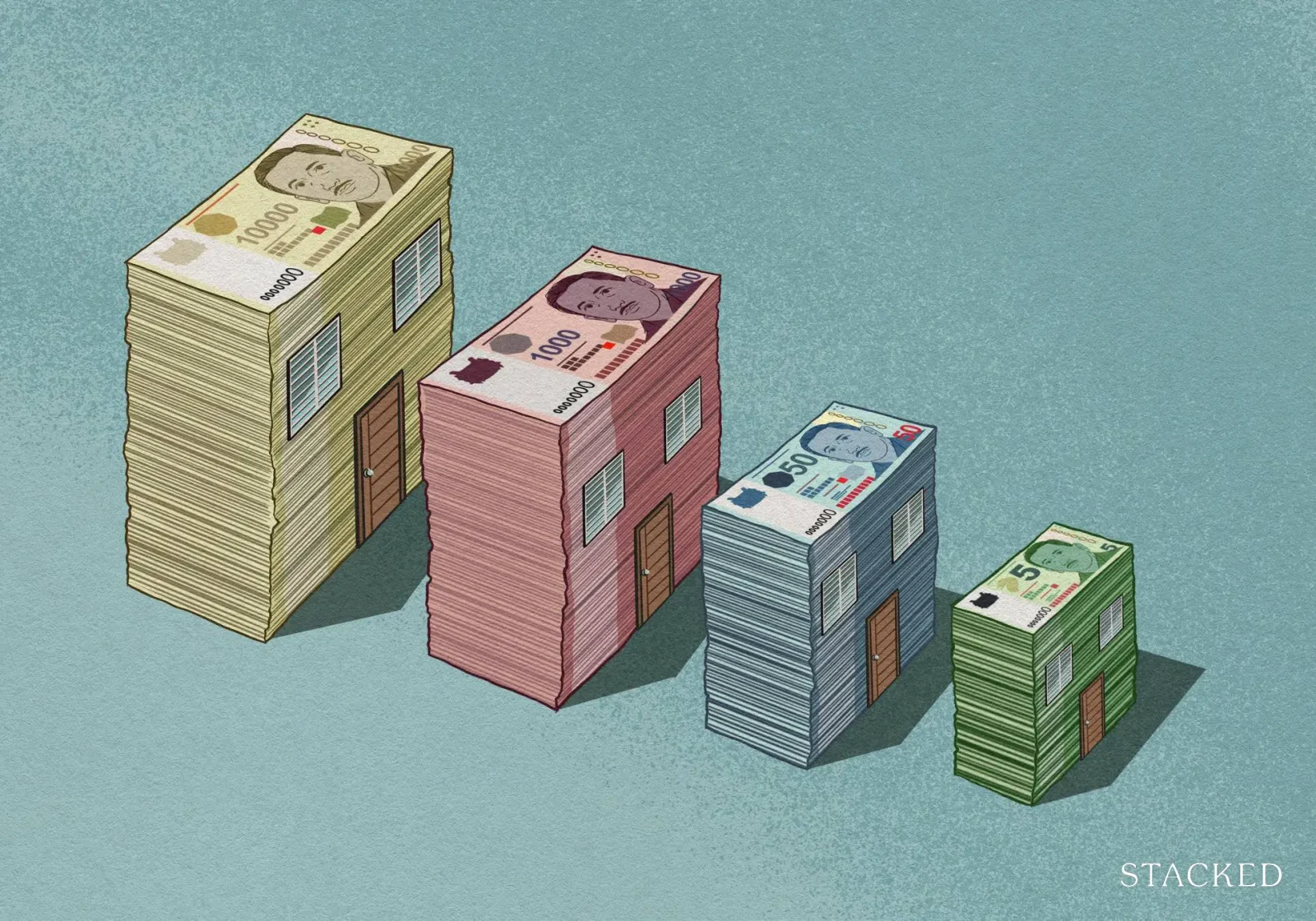

I would like to own multiple properties, but I can’t afford the premium price tags in Singapore.

The next big consideration is the ability to own multiple properties. Singapore is land-scarce, so it is not surprising that Singaporeans can only own 1 property before additional taxes (ABSD), duties, and penalties come to haunt you to discourage you.

If you’re married, you technically only own half a property. That’s funny to think about.

Property in Singapore is quite expensive if you don’t go through BTO exercises; the resale prices aren’t that affordable if you think about socio-economics. My max affordability can only get me one mid-range resale property back home, but it could get me multiple humble properties overseas.

It’s not that I’d like to be a slumlord or a property tycoon, I am just a creative who would appreciate mobility and a change of scenery whenever I want. Summers in the north? Winters in the south? A pied-a-terre in a fun area? In Europe, this is possible. But Singapore? That’s a pipe dream.

I would like my property to not depreciate when the 99-year lease is up.

There, I said it. While I know we’ll never be able to use up a 99-year leasehold in our lifetime, I just don’t like how our homes, that we spend half our lifetimes to pay off, will depreciate just because the lease is running out (although the pandemic has turned that around).

It’s a foreign concept to me still, despite growing up with it.

The point of owning property is the ability to build net worth due to its projected appreciation in value as the years pass (provided that you take care of the property and the location is sought-after). When it’s time for our golden years, we will be able to sell it to secure our retirement, and the property can be enjoyed by the next generation.

It’s just more sustainable this way. I really don’t condone the constant demolishing and construction in modern urban planning. I understand why it’s happening, but that doesn’t mean I approve of it.

And so, while it has been said that “every HDB will be a valuable nest egg for retirement”, I’m not buying it.

Securing retirement aside, having freehold properties to pass down to relatives or descendants down the line is also important to me personally, as property is one of the undeniable ways to kickstart generational wealth.

So three stupid reasons, and I decided to go for it.

—

The first step of my long-term strategy

To start, I’m simply going to look at purchasing a small second-hand studio as a modest “starter home”. I want to spend as little of my affordability as possible, and renovations will only happen once I save up enough for it. No loans allowed for renovations.

This starter home will serve as a lesson for me in terms of understanding the property market in France, experiencing first-hand what it’s like to be a homeowner as a foreigner, and basically being a content mule so you guys have interesting stories to read.

Oh, and did I mention that I’m a designer? Showing you a different world with unique floor plans would be fun.

In purchasing property overseas, I understand that I am basically temporarily banning myself from the public housing market back home. But I’m already not allowed, so I might as well try something different with my life. Even if it doesn’t work out, it’s a learning experience for everyone.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Melody Koh

Melody is a designer who currently works in Tech and writes for fun. Her latest obsession is analysing and writing about real estate affordability for the younger generation. Coming from an Industrial Design background, she has a strong passion for spatial design and furnishing . Having worked in Finance for almost a decade, Melody has a keen interest in sustainable investments and a nose to sniff out numbers that don't make sense.Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

8 Comments

Nice – looking forward to reading the rest of your story. Property news in SG is all cookie-cutter and I applaud your move to step out and take the road less travelled. “Oh well” rather than “What if” !

Hi Melody, how can I get in touch with you to know more about buying a property in France? I am interested to explore a 2 bedder in Paris. Thanks.

Hi, thanks for reading! I’ll be writing articles about the French property market real soon, keep a lookout for that before you decide to invest in Paris.

Thank you for sharing your story and is a true reflection of the challenges faced by young Singaporeans. Indeed the stereotype success story is how u can make money and retire rich. Take a step back and realise there is a God and success doesn’t have to look that way and May your adventure be unique and meaningful.

France: Huge influx of illegal immigrants often from cultures and religions at odds with what we know to be French culture. Political instability leading to frequent rioting, high crime rate, terrorist attacks, out of control inflation, and France’s active participation in the Russo-Ukrainian war…

I disagree with this over-generalisation of France. Europe itself is a very large continent, and France is more than 750 times bigger than Singapore. What you read online does not always reflect the reality on-site. If you follow us on this journey, I do hope you do so with an open mind 🙂