“I Never Thought I’d Be Sued by a Tenant.” What Long-Time Landlords in Singapore Miss

January 4, 2026

The irony is that some long-time landlords can be more exposed to rental troubles compared to first-time landlords.

It’s a topic I think is worth considering as we enter the new year and a season when most leases are renewed, or some of us meet the Minimum Occupancy Period (MOP) and can start to rent out our flat.

What brought this topic to mind is a recent conversation with a reader who, after nine years of renting out her one-bedder, is now facing legal action from a former tenant.

In our conversation, she mentioned that during her early days as a landlord she was quite meticulous. She and her son (a co-owner) would spend hours considering the tenants their property agent found, and in the days before the standard CEA template, she made sure to understand the terms of the lease drafted by her lawyer.

Incidentally, the Council for Estate Agencies (CEA) introduced standardised tenancy agreements for HDB and private residential properties in 2019.

(For reference, you can see the standard CEA template here)

But before this was rolled out, it was all the more important for landlords to understand the exact terms and conditions of the leasing agreements their lawyers drafted. Today, I’ve noticed landlords, even experienced ones, tend to gloss over the standard tenancy agreement like it’s the legal agreement on an iPhone app. Just click accept and get on with it.

The assumption is that “it’s done by the government so it must be okay, just use it.” This was exactly how our said reader acted. In assuming it would be similar to her prior leases, she missed that:

- The agreement strongly implies that without a signed, dated inventory which includes the condition of items, it will be very difficult to prove damages later.

- Even though many landlords allow late payment informally, there’s no provision for this. So, once you repeatedly accept late payments without objection, you may weaken your position later if you try to enforce penalties or terminate the agreement.

- The agreement is quite clear that deposits are not automatic compensation pools. Landlords are expected to provide itemised justifications, return undisputed portions, and avoid withholding the full amount pending minor disagreements.

As our reader would prefer not to disclose the full details, I can only tell you that the above became very pertinent to her legal entanglement.

There were other issues as well, other areas where she let her guard down. When the tenant was late with rent, she shrugged it off – not just once, but five or six times. When the inventory list was made with the latest tenant, photos to prove it weren’t taken properly. As for the air-con maintenance, she chose to take the tenant’s word whenever they said they had it checked or fixed.

None of these felt like serious issues at the time. Until they were.

By the end of the last tenancy, there was extensive damage to the furnishing in the unit, and required a complete replacement of the air-conditioning system, and her tenant still wasn’t willing to part with anything from the security deposit.

But I’ve made the same mistakes as her and I have a sense of how it happens

It boils down to time, assumptions, and too many years of smooth sailing. It’s an ironic thing to complain about, I know – but there is a tendency to get a bit lax, especially in her case, when there were no major issues across five different tenants.

In my case, it was about a master tenant who had things well under control in the earlier years, but who was subsequently ignored and, I daresay, even bullied by subtenants later on. But due to the degree of trust formed in earlier years, I was mostly “hands-off” as long as the rent came in.

By the time the master tenant left, the accumulated damage throughout the unit was so extensive that it was far beyond what the security deposit could cover. To their credit, the master tenant didn’t challenge it and covered the costs. Even so, it meant months of vacancy while the damage was repaired.

More from Stacked

Selling HDB flat without agent – How should I price my home?

With HDB's resale portal successfully launched this year, it has made the process much easier for anyone looking at selling…

In my early years as a landlord, I would have been far more hands-on. I would have checked in more frequently, asked more questions, and kept better records. Experience, ironically, made me more relaxed – and that relaxation came at a cost.

My point isn’t that landlords should become paranoid.

It’s that familiarity and assumptions come very easily for landlords who are lucky enough to get a string of good tenants. But tenancy agreements don’t protect you just by existing, rather they work if you maintain the same sense of diligence and see that all parties execute the agreements.

You don’t need to turn into some 1980’s style disciplinary head, checking in on the tenant all the time. But you do need to stay consistent, and you should keep receipts and a proper paper trail, even when dealing with tenants who have stayed without issues.

If you’ve had the same tenant for a long time, and you haven’t really checked in, the start of the coming year may be a good time to catch up.

Meanwhile in other property news…

- We may finally be seeing a return to normalcy in 2026; which is a relief since the past few years have packed a little too much excitement. Here’s a little more on what’s to come.

- On that note, let’s bid farewell to 2025 with the year-end in numbers. Check out our wrap-up on a very unusual, CCR-centered year.

- Are you making the big leap toward home ownership this year? If so, here’s some experiences to brace for in the first 12 months or so, according to other homeowners.

- Big changes are coming to the Bayshore area, but what gets many residents is how fast it’s all happening. Here’s a look on the ground, including both excitement and in some few cases, a bit of resentment.

- Meanwhile for those of you who missed it, check out how Kovan Melody quietly became one of the top performing resale projects of 2025, with our Stacked pro readers.

Weekly Sales Roundup (22 – 28 December)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $5,063,000 | 1539 | $3,289 | FH |

| NAVA GROVE | $4,119,500 | 1550 | $2,658 | 99 yrs (2024) |

| ONE MARINA GARDENS | $3,817,000 | 1238 | $3,084 | 99 yrs (2023) |

| AMBER HOUSE | $3,762,402 | 1216 | $3,093 | FH |

| THE ORIE | $3,738,000 | 1367 | $2,734 | 99 yrs (2024) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| TEMBUSU GRAND | $1,437,000 | 527 | $2,725 | 99 yrs (2022) |

| OTTO PLACE | $1,449,000 | 872 | $1,662 | 99 yrs (2024) |

| RIVER GREEN | $1,517,000 | 452 | $3,356 | 99 yrs (2024) |

| HILL HOUSE | $1,527,000 | 452 | $3,378 | 999 yrs (1841) |

| KASSIA | $1,572,000 | 753 | $2,086 | FH |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| WALLICH RESIDENCE | $5,700,000 | 1722 | $3,310 | 99 yrs (2011) |

| THE VERMONT ON CAIRNHILL | $3,650,000 | 1442 | $2,531 | FH |

| SIXTH AVENUE VILLE | $3,508,000 | 1755 | $1,999 | FH |

| ONE HOLLAND VILLAGE RESIDENCES | $3,500,000 | 1098 | $3,188 | 99 yrs (2018) |

| D’LEEDON | $3,420,000 | 1582 | $2,161 | 99 yrs (2010) |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| SUITES 28 | $662,000 | 431 | $1,538 | FH |

| SUITES @ GUILLEMARD | $685,000 | 388 | $1,768 | FH |

| KINGSFORD WATERBAY | $688,000 | 474 | $1,453 | 99 yrs (2014) |

| THE TENNERY | $800,000 | 614 | $1,304 | 99 yrs (2010) |

| FORTE SUITES | $802,000 | 441 | $1,817 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| SIXTH AVENUE VILLE | $3,508,000 | 1755 | $1,999 | $2,100,000 | 25 Years |

| BUTTERWORTH 8 | $2,588,000 | 1313 | $1,971 | $1,537,600 | 16 Years |

| CHANTILLY RISE | $2,700,000 | 1733 | $1,558 | $1,477,320 | 29 Years |

| THE CHAMPAGNE | $2,100,000 | 1873 | $1,121 | $1,300,000 | 23 Years |

| THE WHARF RESIDENCE | $2,790,000 | 1066 | $2,618 | $1,090,000 | 14 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| WALLICH RESIDENCE | $5,700,000 | 1722 | $3,310 | -$700,000 | 4 Years |

| THE JOVELL | $950,000 | 678 | $1,401 | -$36,400 | 4 Years |

| FORTE SUITES | $802,000 | 441 | $1,817 | $22,500 | 11 Years |

| ICON | $1,008,000 | 570 | $1,767 | $23,000 | 7 Years |

| SUITES DE LAUREL | $1,038,880 | 614 | $1,693 | $38,881 | 4 Years |

Top 5 Biggest Winners (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| MELVILLE PARK | $1,480,000 | 1453 | $1,018 | 233% | 20 Years |

| PALM GARDENS | $1,580,000 | 1432 | $1,104 | 163% | 27 Years |

| THE CHAMPAGNE | $2,100,000 | 1873 | $1,121 | 163% | 23 Years |

| SIXTH AVENUE VILLE | $3,508,000 | 1755 | $1,999 | 149% | 25 Years |

| BUTTERWORTH 8 | $2,588,000 | 1313 | $1,971 | 146% | 16 Years |

Top 5 Biggest Losers (ROI%)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | ROI (%) | HOLDING PERIOD |

| WALLICH RESIDENCE | $5,700,000 | 1722 | $3,310 | -11% | 4 Years |

| THE JOVELL | $950,000 | 678 | $1,401 | -4% | 4 Years |

| ICON | $1,008,000 | 570 | $1,767 | 2% | 7 Years |

| FORTE SUITES | $802,000 | 441 | $1,817 | 3% | 11 Years |

| THE ANTARES | $1,380,000 | 732 | $1,885 | 4% | 4 Years |

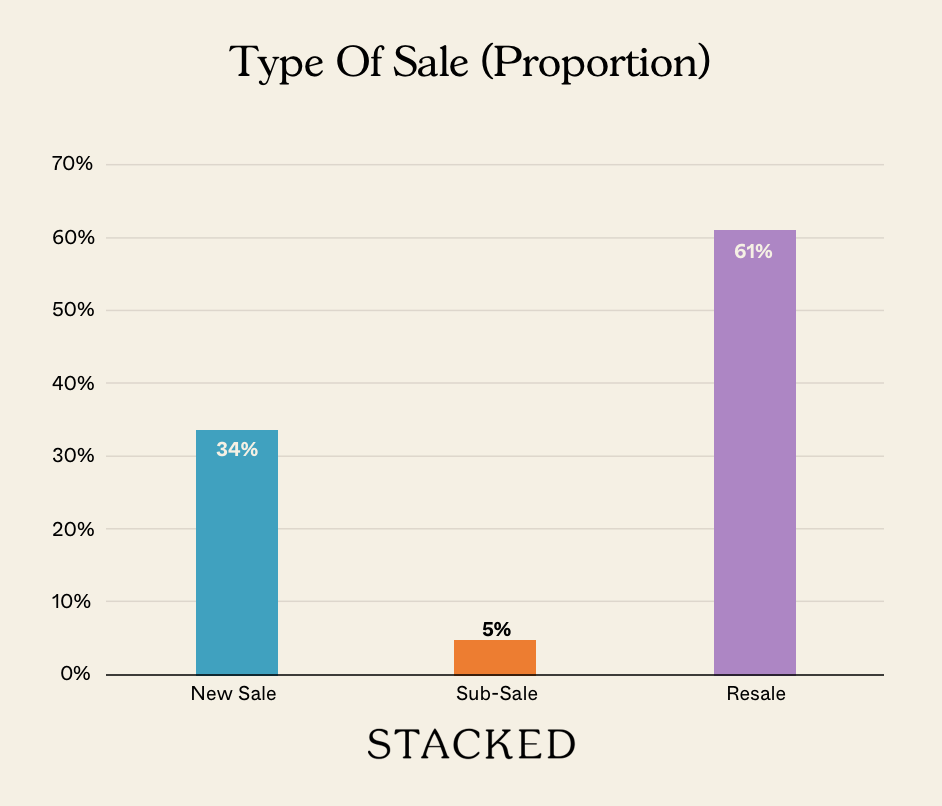

Transaction Breakdown

Follow us on Stacked for news and insights into the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

How old is the flat I want to rent out in Singapore?

What should I watch out for in a tenancy agreement?

Can I accept late rent payments without consequences?

What happens if the tenant damages the property?

How often should I check on my long-term tenants?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

Singapore Property News Executive Condo Prices Have Doubled In A Decade — Raising New Questions About Affordability In 2026

Singapore Property News River Modern Sells Over 90% Of Units At Launch — Here’s What Buyers Paid

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Latest Posts

Overseas Property Investing In Niseko’s Booming Property Market, Investors Are Buying Individual Hotel Rooms

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

0 Comments