I Like People’s Park Complex For The Space And Location. Is It A Good Choice? (And More On Parc Clematis)

October 29, 2021

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Question 1

Hi Stacked,

Greetings from a loyal follower.

I also take this opportunity to express my sincere thanks for your insightful articles and YouTube videos at Stacked Homes, which I have been reading and watching, and learning from for the past few months.

Now I have the following question and hope to get your professional advice. Your reply would be much appreciated.

I understand People’s Park Complex has got en bloc potential. However, given its current price and the SSD to be payable in the event of an en bloc within 3 years, I wish to know if 2022 is a good time to buy a unit there for own stay. I don’t mind an en bloc after 3 years or staying there for a longer term. It is the big space in its location that interests me.

Thank you in advance for your reply.

Hey there,

Thank you for writing to us and thank you so much for your support and kind words! We appreciate it a lot 🙂

With regards to People’s Park Complex, for en-bloc to kickstart, it has to first gain 80% common consensus from stakeholders, including the commercial strata owners before it can be put up for sale. Hence it really depends on the respective stakeholders.

Adding on, as People’s Park Complex is a mixed-use development with strata title commercial, residential, and car park there may be mixed sentiments on en-bloc. Mixed-use developments tend to be much harder to go en bloc as it also depends on the commercial relevance today.

With the latest news of Far East Organization (FEO) who bought over the strata car park of the complex, FEO now holds a 26% share of the total strata title of the complex and will have a huge say in the en-bloc process.

In recent years, we have also seen mixed development fail in en-bloc attempts as there are mixed sentiments between commercial strata owners and residential owners. The most recent case is Queensway Shopping Centre where it failed to reach the 80% majority vote.

So going forward, the collective sale process will be an interesting one to watch out for as FEO has a big stake in the development.

Nevertheless, do be mindful of the SSD liable if an en-bloc materialises and also the inconvenience to move again. We also foresee more investor profiles for this development, added with its high rental yield of 3.9% gross.

On another note, if it fails, do be mindful of the lease decay and the impending maintenance cost to maintain the development over the years.

All in all; for own stay, it is best to not put so much hope on the en-bloc possibility but more for the convenience to amenities and public transport connectivity, added with its proximity to CBD.

Question 2

Hi team,

I have read your blog post on the development (Parc Clematis). I am interested in 5 bedrooms and keen to hear your view on the relative benefits of 5 bedroom and the premium variant.

Thank you.

Hey there,

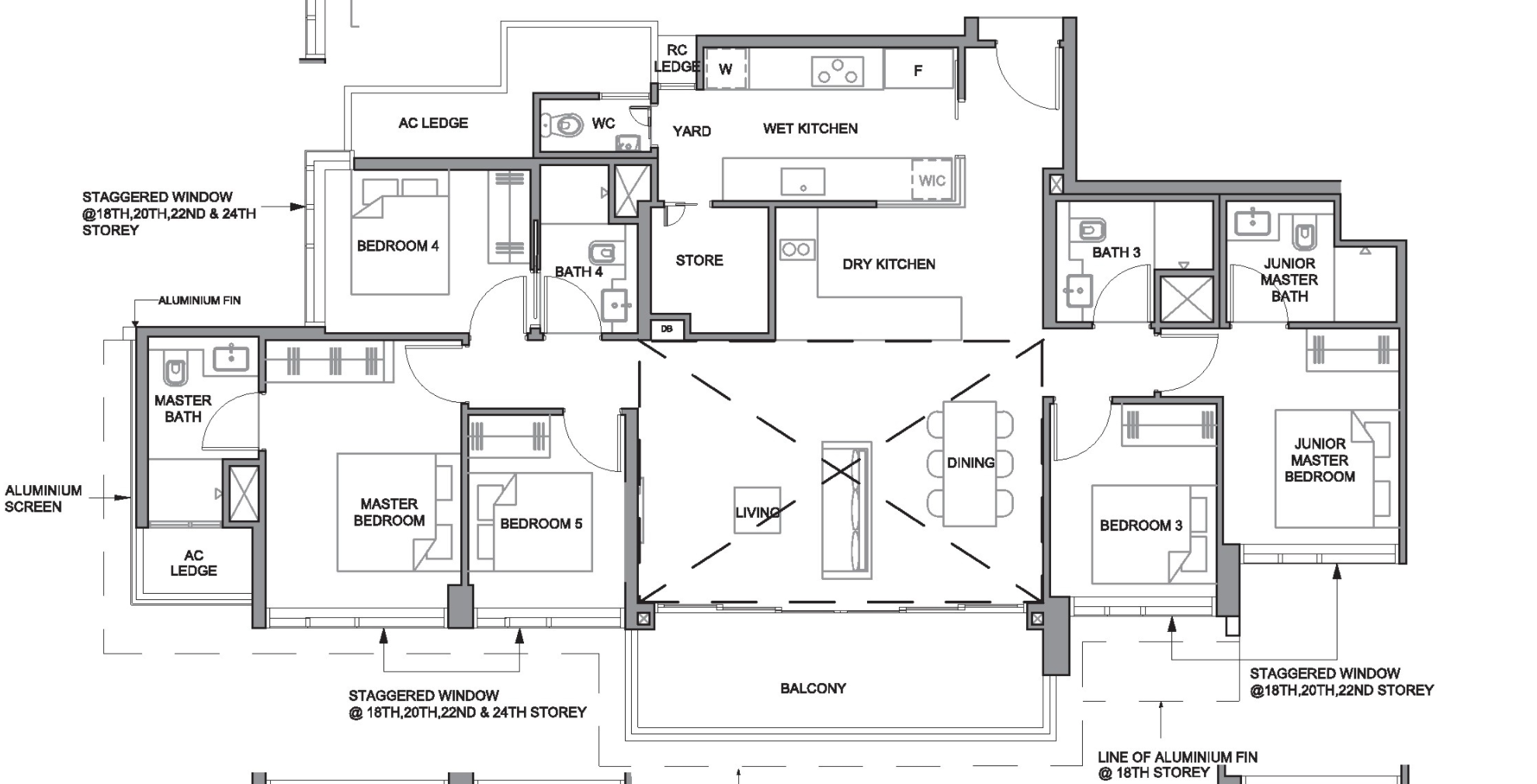

Thank you for writing to us. Parc Clematis offers great facilities which are great for a family’s own stay. The 5 bedders are decent in size with squarish and efficient layouts; especially great for multi-generation living.

Added with its proximity to Nan Hua Primary School, it definitely attracts family own stay profiles. Here are our inputs on the 2 different 5-bedrooms layouts.

Pros:

- Efficient dumbbell layout

- Provision of wet and dry kitchen area with great length of counter top space.

- Decent Bedrooms, living and dining size.

Cons:

- Most bathrooms lacks ventilation windows.

- Lacks a proper yard area for laundry

- A/c ledges takes up unit sqft

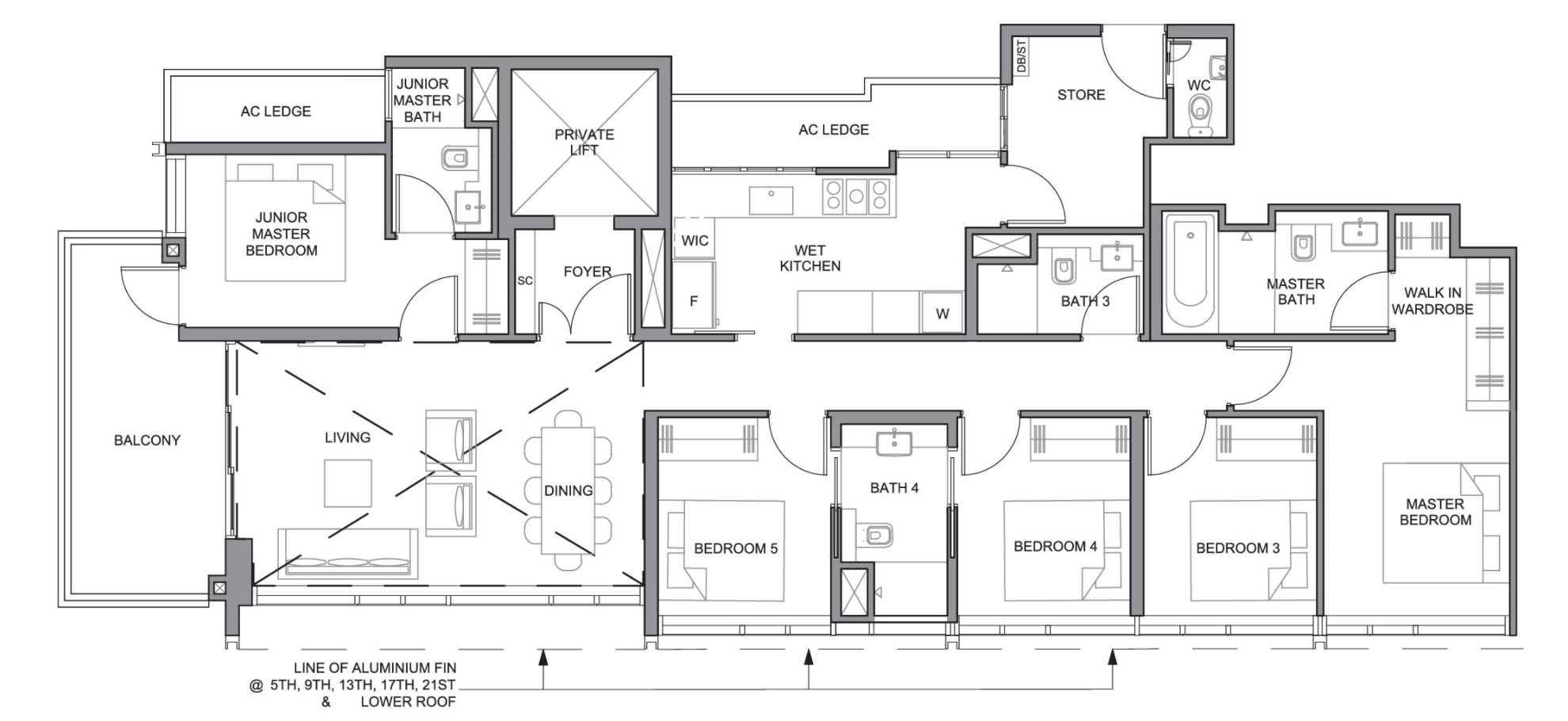

Pros:

- Provision of private lift (Privacy)

- Lots of windows, allows natural light in and great for ventilation

- Walk-in wardrobe and bath tub in main master bedroom.

- Decent bedrooms size

- Spacious kitchen with ample counter space.

Cons:

- Balcony are either direct west or east facing, tend to be hot during day time.

- Too long bedroom hallway (wasted space)

- Lacks separation of west & dry kitchen area.

- Lacks proper yard area for laundry.

- A/c ledges takes up unit sqft.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market, or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Pro This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

0 Comments