Humility Is The Greatest Investment Strategy. Here’re 5 Reasons Why.

February 24, 2021

I listened to the story with fascination as the property agent shared with me the story about how his seller turned down a record price for his unit.

Why? Because the buyer had remarked that “the kitchen was ugly”.

I asked the agent – “So did you try to convince him to take up the offer?”

He replied – “Yes I did! I pointed out this offer will be a record price for the development but he was adamant.”

Me – “Then what happened next?”

The agent – “I continued marketing the unit. Offers came in… But we had to wait 9 months before another buyer matched the same offer.“

I was amazed. To think that some people are willing to wait 9 months – just to stick it to the buyer who offended him.

True, the seller was not in a hurry and probably did not mind waiting.

But it also illustrates another important factor – how emotions can get easily involved in our investment decisions.

In today’s disrupted world where we have to learn how to make smart decisions regularly, it is interesting to observe how we trip over things such as our feelings, emotions and ego.

Yes, it is all part of being human. This is also our known weakness.

But if we apply a framework of having humility and discipline – it can also provide a way to securing our financial well-being in this uncertain world.

Here are 5 reasons why you should apply humility as part of your investment strategy:

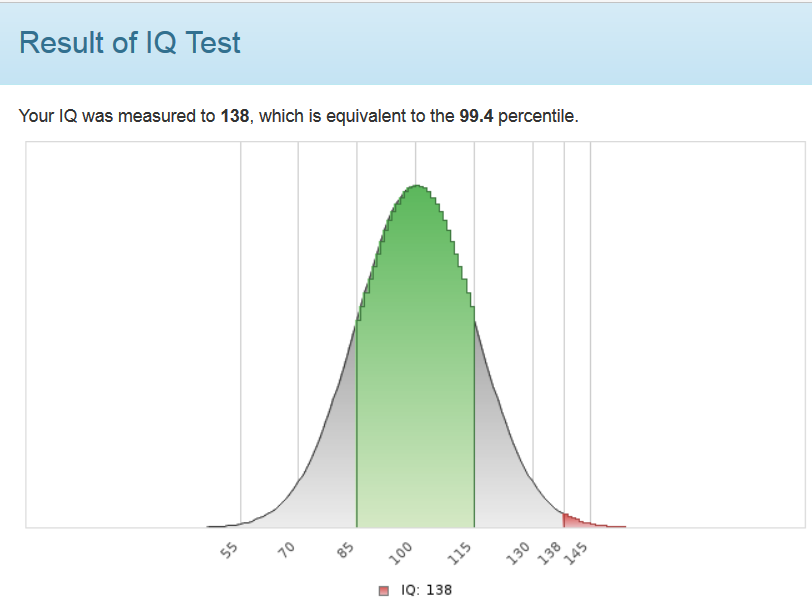

#1: IQ Is Overrated

Have you ever heard of Mensa? This society welcomes people from all walks of life, provided their IQ is in the top 2% of the population.

But unfortunately, these folks are not that smart when it comes to investment.

During a 15-year period when the S&P 500 had average annual returns of 15.3%, the Mensa Investment Club’s performance averaged returns of just 2.5%.

As Warren Buffett famously said, “Investing is not a game where the guy with the 160 IQ beats the guy with the 130 IQ.”

We assume that smarter people are less prone to error.

But greater education and expertise can often amplify our mistakes while rendering us blind to our personal biases.

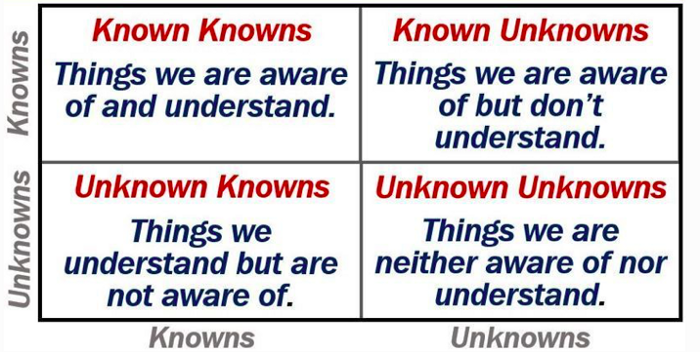

#2: We Don’t Know What We Don’t Know

One of the biggest danger to ourselves is our own blindspots.

These blindspots can be in the form of our own biases that stems from our belief systems, social conditioning or simply a lack of knowledge.

Have you heard of the sunk cost fallacy? This is when people continue on a course of action because they have already invested time and energy into it.

For example, you might keep holding on to a losing investment when you should really have cut your losses and moved on.

But because you have already put a lot of money in, you refuse to listen to other opinions and you ride all the way down.

If you keep making decisions that way and you don’t adjust your process, you will keep losing.

But if you have the humility to seek out opinions and other multiple perspectives – you might be able to save yourself some pain in the future.

In this new disrupted century, it is vital to understand the complexity and value of multiple perspectives. No one has the ability to see it all.

Multiple perspectives layered together reduce blind spots and offer us a more textured and truer sense of the underlying reality.

As an external consultant at various SMEs, I have seen the impact when the “I know better” perspective take center-stage.

Believing that you’ve got it all figured out can be a shortcut to disaster, not financial security.

#3: Humility and Discipline Leads To Freedom

Consider a person possessing deep engineering skills with an ability to explain ideas clearly. To an employer’s perspective, they are more valuable than someone with just pure engineering skills.

Now add empathy, humility, resilience, and drive. Now this person becomes incredibly valuable.

In any corner of the world, humility and discipline is highly prized.

In listing the personal qualities it takes to succeed in his book, One Up On Wall Street, investor Peter Lynch does not mention being smart or being right.

Instead, he lists things like patience, persistence, humility, flexibility, and a willingness to admit to mistakes.

One of the best ways to frame this is by viewing yourself as though you are in a constant state of being a work-in-progress.

To maintain that state requires a certain level of discipline as you regularly acknowledge your own weaknessess and strengths.

In order to make that shift from concentrating on being right and towards making money instead, we have to learn discipline.

Thinking we are right is a feeling. And feelings are fickle, they come and go. But discipline keeps us on the right path.

And if we wish to continuously evolve and keep levelling up, we will need to abandon our ego.

The trick is not to learn to trust your gut feelings, but rather to discipline yourself to ignore them.

Market survival requires humility and respect for an entity – the market – which can demonstrate an amazing ability to surprise those who dare to challenge it.

More from Stacked

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Why July 2025 Could Be the Best Time Yet for Singles and Second-Timers to Apply for a BTO

By now, it’s pretty well established that being single in Singapore doesn’t go hand-in-hand with being a homeowner. It’s not…

Time and time again.

#4: Reframing Your Investment Assets As Stewardship

One of the ways to disconnect your emotions from your investment decisions is to view your investment assets as NOT belonging to you.

Instead, you can view them as belonging to someone else – a legacy you can leave behind for the future.

As a parent, I do hold the view that I am merely a guardian who has the responsibility to ensure that my child receives a legacy from me. Of course – the legacy can be both tangible or intangible.

By viewing this as a “burden” of stewardship – where you realize the responsibility to do well lies within you – you realize that you might not always be the smartest person in the room.

And that “burden” of responsiblity will force you to seek out better informed opinions on your investment choices. Because you want to do your best – not for yourself, but for others.

In order to do that well, you will need to assume the identity of the humble steward.

#5: The Future Is Informal

This 2020 article from Bloomberg is about a college dropout who has captured the attention of Wall Street economists and economic think-tanks.

A 28-Year-Old With No Degree Becomes a Must-Read on the Economy

To me, this was further proof that the future is informal and even uncredentialed.

While some might think that billionaires being college dropouts as just an internet meme, I think there might be some truth in it.

Credentials used to be a shortcut way to determine someone’s knowledge and expertise.

But with the rise of the uncredentialed experts means we have to be more open-minded on those who might lack the paper certificates but might have the requisite experience and context.

I seen this often with the property agents who works with Stacked – their knowledge of what is going on the ground with owners, investors and tenants beats any property investment books I can read.

For example, the current news of HDB price index going up was observed many months ago by agents themselves who noticed the willingness of buyers to pay ever-increasing sums of Cash Over Valuation (COV).

Those agents who have a good read on the market quickly capitalized on behalf of their sellers and helped to negotiate higher COVs – which years ago was a pain to deal with and turned off buyers.

While some people might have disdain for agents or salespersons of any kind, it is crucial to to be able to resist your human nature and your “gut feelings.”

Instead ask yourself these 2 questions:

- What are you trying to accomplish?

- What is the functional outcome you are looking to achieve?

Optimise for the function.

Ignore the form of how it appears.

A Simple Strategy In A Complex World

Understand that humility is correctly seeing yourself, not seeing yourself lower than you are. If you are the best at something, you can admit gracefully and still be humble.

We live in an uncertain world, especially when it comes to securing our financial well-being. The economy expands and contracts. Jobs are created and destroyed. Inflation ebbs and flows. Stocks rise and fall.

And then there is the occasional unexpected crises. Companies collapse. Governments fail. Markets crash.

Pandemics arise.

It’s a bit unnerving for those of us seeking a bit of financial security and the peace of mind that comes with it.

Solving new problems with old ways of thinking are no longer useful in the new world.

For me, the humility framework provides a way for me to be exposed to new ways of thinking.

By conceding about how much I don’t know, it can protect me from making decisions that are driven by ego and internal biases.

In the real world – there is no red pen to tell us we’re wrong and remind us of the mistakes that are best avoided.

So our best tool is intellectual humility – an awareness of the limits of our knowledge, and inherent uncertainty in our judgment; essentially, seeing inside of our bias blind spot.

Being humble doesn’t mean you should not become confident. But that confidence should not turn into arrogance.

Humility is a character we love in others. But despite our admiration and longing for humility and modesty, how many of us can say we are truly humble?

The ultimate lesson is simple: None of us is perfectly rational. We all make mental mistakes.

The only way to rise above them, and to start to minimise them, is by recognising our own human frailty.

Having the humility to recognise that human frailty is the best way to get started.

Cover image by Francesco Ciccolella.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why is humility considered important in investment strategies?

How does intelligence or IQ relate to successful investing?

What is the significance of viewing investment assets as stewardship?

What role does discipline play in successful investing according to the article?

Why should investors consider seeking multiple perspectives?

Aidah

Aidah Omar is a marketing consultant and digital strategist for various SMEs in Singapore for the past 8 years. Over the last 5 years, she has worked with property agents from various agencies. She has a 2-year old daughter who is obsessed with dinosaurs and Peppa Pig.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Property Market Commentary We Analysed HDB Price Growth — Here’s When Lease Decay Actually Hits (By Estate)

Latest Posts

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

0 Comments