Have you ever held a seat for a friend in a crowded food court?

You know, the type of buddy who tells you “I’ll come back in a few minutes,” so you chope their seat despite the grumbling of people standing around, waiting for a seat.

Then you wait. And wait. And feel more like a jerk each passing minute, as a whole host of people who need the seat glare at you.

But your buddy comes back half an hour later, and says “Let’s go, I’m not hungry after all.” And you need to quickly rush off, because the people you deprived of a seat look ready to stick their chopsticks in your eyeballs.

It’s kind of been that way with HDB and BTO launches.

As it turns out, a lot of people have been applying for flats just to try their luck; then backing out at flat selection. They weren’t all that serious to begin with, they just wanted to “chope” their place while they browsed for better options. Nevermind if it deprives someone else of a flat, because hey, they’d do it to me too.

We can see how prevalent this attitude is from the October 2023 launch. Now that there are penalties for forfeiting your flat at selection, BTO application rates have dropped faster than my IPPT scores after I turned 38. There were a mere 9,800+ applicants, compared to over 20,000 in February this year; and this is despite Kallang/Whampoa being on the list.

It just goes to show: balancing out the supply of flats isn’t just about birth rates and numbers of units. Psychology and a keen grasp of crowd mentality also play a role. If there’s one thing our government understands well, it’s that housing issues seem to be 80 per cent mind games, and 20 per cent actual math.

Maybe we should have more penalties, for those who apply without serious intent. If anyone forfeits at flat selection, they don’t just become second-timers: they need to do community service, and become mediators between the most annoying neighbours in any block. That ought to drive home a message about being considerate.

Meanwhile, I see some people are still trying to list flats that haven’t fulfilled the MOP

We had two cases of this in the news, with agents listing flats that hadn’t been physically occupied by the owners. Just to clarify:

The MOP is not just about the duration of ownership. You also have to live in the flat for the duration of the MOP. So if you owned the flat for five years, but didn’t live in it for one year (e.g., you were abroad), then your MOP would effectively end after six years.

Still, some sellers are willing to try their luck, and hope HDB won’t notice they haven’t actually been residing in the flat. But what’s bewildering is that they somehow find property agents who are willing to help them. It’s really amazing.

More from Stacked

GuocoLand Wins The Lentor Site; But Is It Worth Waiting For (At Potentially $2,000 PSF)?

The Lentor Central site, which was on the Government Land Sales (GLS) list this year, has been awarded to GuocoLand.…

But then I read about the penalty imposed, and then I sort of got it. A fine of $1,000 and $500 respectively, for the two cases.

I mean, look, a $1,000 fine will stop me from chucking a Yeo’s packet drink on the sidewalk; but it’s barely a disincentive when the potential payoff is $8,000 to $10,000 (assuming around two per cent of a $400,000 flat.)

Maybe the penalties need more bite, is what I’m saying.

In other serious property news…

- What are the most profitable BTO projects out there? Here’s a look, some of the names may surprise you. I mean, Pinnacle @ Duxton never will, but the others might.

- Resale one-bedders can sometimes bring nice resale gains, on top of their rental yields. Here are some of the better performing ones.

- Check out a new review of Clementi Towers, an integrated HDB project in one of Singapore’s most developed estates.

- What do you do when condo prices are too high? Check out EC options, of course. Here’s the full list of every EC to date, with a look at some that just reached MOP.

- Freehold landed homes starting from below $4 million? These still exist along Countryside Road (starting from $3.38 million, to be exact).

Weekly Sales Roundup (02 October – 08 October)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MIDTOWN MODERN | $6,537,000 | 1808 | $3,615 | 99 yrs (2019) |

| KLIMT CAIRNHILL | $5,750,000 | 1496 | $3,843 | FH |

| THE RESERVE RESIDENCES | $5,514,140 | 2185 | $2,524 | 99 years |

| PULLMAN RESIDENCES NEWTON | $4,245,000 | 1281 | $3,314 | FH |

| LIV @ MB | $3,893,000 | 1518 | $2,565 | 99 yrs (2021) |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE ARDEN | $1,214,000 | 657 | $1,849 | 99 years |

| THE MYST | $1,539,000 | 700 | $2,200 | 99 years |

| THE SHOREFRONT | $1,560,000 | 883 | $1,767 | 999 yrs (1937) |

| MIDTOWN BAY | $1,644,400 | 484 | $3,316 | 99 yrs (2018) |

| LENTOR HILLS RESIDENCES | $1,665,000 | 721 | $2,309 | 99 years |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| CAMELOT BY-THE-WATER | $6,710,000 | 3035 | $2,211 | 99 yrs (1996) |

| OCEAN PARK | $5,270,000 | 3261 | $1,616 | FH |

| RIVERGATE | $5,150,000 | 1776 | $2,900 | FH |

| THREE THREE ROBIN | $4,350,000 | 1948 | $2,233 | FH |

| YGK GARDEN | $4,280,000 | 2067 | $2,071 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE TAPESTRY | $723,000 | 474 | $1,527 | 99 yrs (2017) |

| KINGSFORD WATERBAY | $730,000 | 484 | $1,507 | 99 yrs (2014) |

| STUDIO8 | $800,000 | 538 | $1,486 | FH |

| RANGOON 88 | $820,000 | 581 | $1,411 | FH |

| 10 SHELFORD | $840,450 | 431 | $1,952 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| CAMELOT BY-THE-WATER | $6,710,000 | 3035 | $2,211 | $1,930,000 | 15 Years |

| KING’S MANSION | $3,050,000 | 1604 | $1,902 | $1,460,000 | 20 Years |

| BISHAN PARK CONDOMINIUM | $1,780,000 | 1292 | $1,378 | $1,320,000 | 11 Years |

| RIVERGATE | $5,150,000 | 1776 | $2,900 | $1,300,000 | 17 Years |

| THREE THREE ROBIN | $4,350,000 | 1948 | $2,233 | $1,250,000 | 4 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| 1 DRAYCOTT PARK | $2,278,000 | 732 | $3,112 | -$360,000 | 0 Years |

| 55 DEVONSHIRE ROAD | $1,120,000 | 506 | $2,214 | -$148,600 | 13 Years |

| 2 GILSTEAD ROAD | $1,700,000 | 775 | $2,194 | -$80,000 | 13 Years |

| 10 GOPENG STREET | $2,380,000 | 1119 | $2,126 | -$46,700 | 13 Years |

| 88 RANGOON ROAD | $820,000 | 581 | $1,411 | $6,021 | 13 Years |

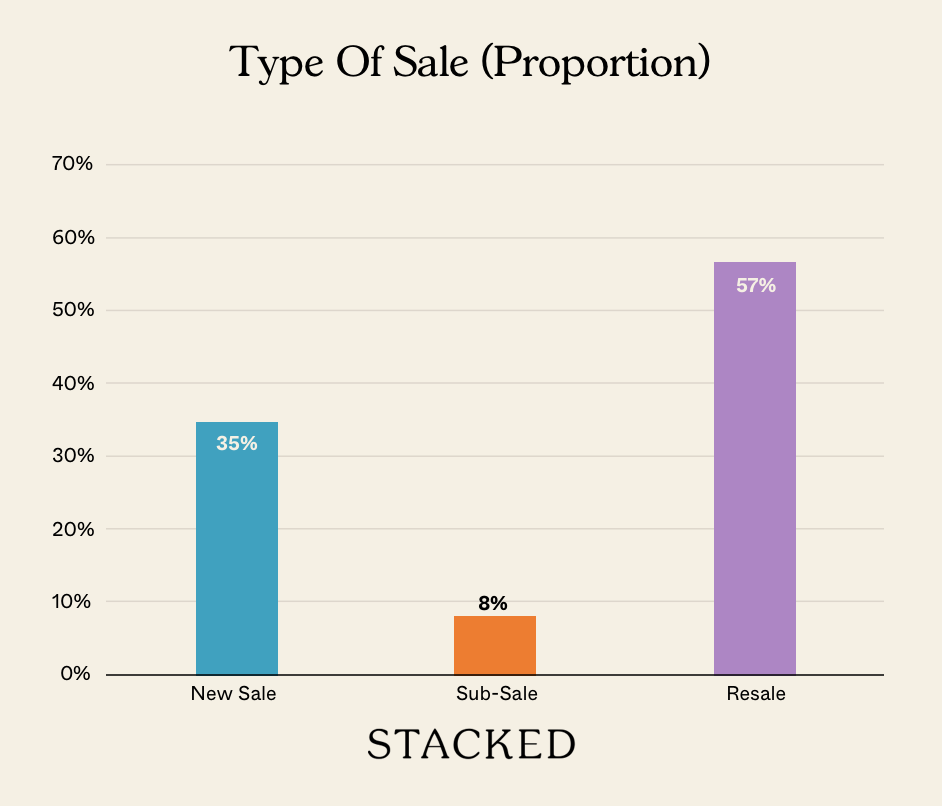

Transaction Breakdown

Follow us on Stacked for more news and reviews in the Singapore property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the new penalty for forfeiting a flat at HDB's BTO selection?

How has the new penalty affected BTO application rates?

Can owners sell flats they haven't lived in for the entire MOP period?

What are the penalties for listing flats that haven't fulfilled the MOP?

Why do some sellers try to list flats before fulfilling the MOP?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

Singapore Property News You Can Now Buy Part Of A $300M Singapore Bungalow — But You Can’t Live In It

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

2 Comments

Hi Ryan , I totally disagree that BTO response for the recent exercise was due to the new penalties. HDB is just covering their own cock up in HFE issues. I m one such case whereby my HFE appln was pending for about 5 to 6 weeks and then totally disappeared without a reply; which means I have to send in a new appln. This issue also affects resale which was correspondingly down as reported. SIMPLE REASON – HDB DID NOT GET THEIR HOUSE IN ORDER FOR HFE APPLN

I hope HDB read your article.