Rare Mixed-Use Site At Hougang MRT And New Sembawang EC Plot Just Launched: What You Need To Know

May 30, 2025

The Singapore government has launched two new Government Land Sales (GLS) sites: an Executive Condominium (EC) site in Sembawang and a large mixed-use site in Hougang. Combined, the sites can yield over 1,000 homes. Given the high demand for ECs, and solid performance from mixed-use projects, analysts are already predicting strong bids for the sites. Here’s what we know so far:

A rundown of the two new GLS sites

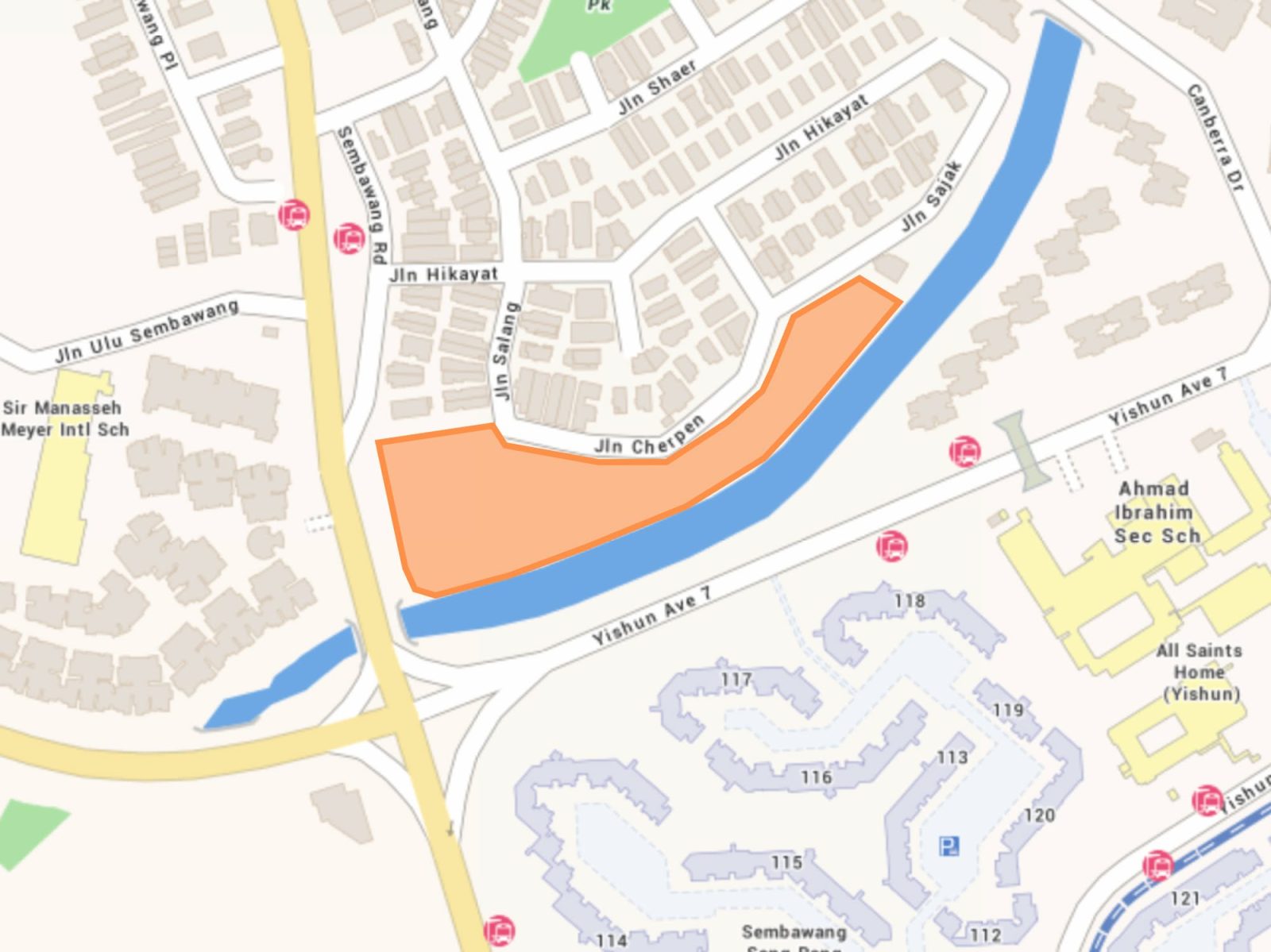

The Sembawang EC site, located along Sembawang Road, is around 18,968 sq m and could yield about 265 homes. According to agents we spoke to, this location is especially significant because, between 2026 and 2029, around 3,500 HDB flats in Yishun and Sembawang are expected to fulfill their Minimum Occupancy Period (MOP).

Due to the price gap between resale flats and private condos in 2025, it’s expected that many HDB upgraders might opt for an EC instead, so this project is likely to see strong demand. Another agent also pointed out that the last EC project in Sembawang – Provence Residence in 2021 – was a top seller; so although Sembawang is a non-mature neighbourhood, this is unlikely to dissuade buyers.

Analysts predict the site could attract bids of around $600 to $700 psf, with up to eight developers anticipated to participate.

Meanwhile, the Hougang site is situated above Hougang MRT station, and is the first GLS offering in this area since 2014. This project will be a mixed-use development with residential and commercial components, including about 40,000 sq m of retail space. This is about double the size of the existing Hougang Mall, and analysts predict bids reaching $800 to $900 psf. It can yield around 835 residential units.

The Sembawang tender will close on 11th September this year, while the Hougang tender closes on 16th December.

A closer look at the Sembawang site

The Sembawang site doesn’t appear to be near an MRT station, but this isn’t uncommon for most ECs.

The Jalan Cherpen facing overlooks low-density landed housing, which some buyers will definitely consider a plus point. The other side faces Yishun Avenue 7 across the canal, but it’s far enough that it shouldn’t be a noise issue; the side facing Sembawang Road (across from Seletaris condo) might need to be set a bit further back to shield from road noise.

The closest hubs of amenities we see here would be Sembawang Shopping Centre or Canberra Plaza, although they seem to be out of walking distance. Ahmad Ibrahim Primary appears to be within one kilometre, but we’re less certain about Yishun and Jiemin Primary; they look a bit beyond one-kilometre, but it remains to be seen.

More from Stacked

What The Future Of Singapore Real Estate Could Look Like: 6 Exciting Predictions

Let’s imagine for a second that you are in art class and the teacher gave you this description to create:

As far as current appearances go, this is a still-developing area, and we’d expect to wait a few more years for amenities to come in. But it will attract those who like being close to a landed enclave. While Sembawang Hot Springs Park is not within walking distance, it will just be a short bus ride from here, so this EC site can be on your list if you like quiet green spaces.

A closer look at the Hougang site

You can check out the site yourself by going to Hougang MRT station, and heading out at Exit B. This is the plot where the new development will be, and it will add to the retail and dining of the nearby Hougang Mall.

There’s good school access here, with Chij Our Lady Of The Nativity, Montfort Junior, and Punggol Primary being within one-kilometre. This area is also broadly the hub of the area’s amenities, so it’s going to be very convenient to get your shopping and dining done (if not at Hougang Mall, then right downstairs).

The nearby Punggol Park provides a green break, but otherwise, there’s a natural tradeoff for being the heart of the neighbourhood. This is quite a built-up area already, so the views are dominated by other HDB blocks or roads.

This will be a preferred location for those who prize convenience over seclusion.

Overall, it’s a nice pairing of GLS sites with good contrast

With limited EC supply in the north and rising demand from HDB upgraders, the Sembawang site will attract attention despite its less central location.

In contrast, the Hougang site offers the opposite: MRT access and an upcoming integrated retail hub. While it’s a more built-up area, the tradeoff is convenience. Both of these sites provide good options, and we’d be very surprised if developers don’t show keen interest.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are the details of the new Sembawang EC site launched by the government?

Where is the Hougang mixed-use development site located and what does it include?

When do the tenders for the Sembawang and Hougang GLS sites close?

What are the expected benefits of the Sembawang EC site for buyers?

What amenities and transportation options are available near the Hougang site?

What are the main differences between the Sembawang and Hougang GLS sites?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News New Lentor Condo Could Start From $2,700 PSF After Record Land Bid

Singapore Property News This Tampines EC Will Preview on Friday — It Is One of Two New ECs in the East in 2026

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

Singapore Property News REDAS-NUS Talent Programme Unveiled to Attract More to Join Real Estate Industry

Latest Posts

On The Market A Rare Freehold Conserved Terrace In Cairnhill Is Up For Sale At $16M

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

0 Comments