4 Hidden Risks To Avoid When Buying Property In Malaysia (A Guide For Singaporeans)

August 12, 2025

Malaysia is still the top overseas property destination for Singaporeans, and it’s not hard to see why. For what you pay for a four-room flat here, you could be living in a spacious condo with a pool, gym, and maybe even a view of the Straits. But don’t let the proximity fool you. The Malaysian property market is not just a cheaper, bigger version of ours. While it can be a lucrative venture, the rules of the game can be rather different, and first-time buyers often find that out only after signing. So if you’re looking to buy across the Causeway, here are some of the less obvious restrictions and risks you should know:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Don’t assume you can rent and commute indefinitely

One of the most common tactics Singaporeans try is to rent or buy in Johor to escape our higher costs, then commute to Singapore every day. The thing is, no one in the Malaysian government has ever explicitly said this is okay.

Douglas Chow from Empower Advisory, a scam-avoidance consultancy, shared the story of a friend who rented a unit at Princess Cove and commuted daily into Singapore for work:

“A few years ago, a friend – a Singaporean working in Singapore – rented a condo unit at Princess Cove to escape the high rent here. He commuted regularly in and out of Singapore. Eventually, Malaysian immigration officers flagged his travel patterns. They found out he was working in Singapore and staying in Malaysia without a valid visa or pass. The officers warned him that he could face a fine, imprisonment, and even a ban from re-entering Malaysia. He stopped immediately.”

Yes, you could try the “reset” by hopping back to Singapore every month and re-entering. But that’s also considered abuse of the system, and if the Malaysian authorities catch on, the penalties are the same. Douglas says that: “The onus is on Malaysian immigration officers to flag you for abusing the 30‑day visa‑free stay.” So in a sense, you’re rolling the dice every time you do it.

If your plan is to use your Malaysian home as a primary residence while working in Singapore, the best way to do this is to sort out the appropriate long-term permit, such as by using the MM2H (Malaysia My Second Home) programme.

2. Infrastructure and access may be less reliable in some areas

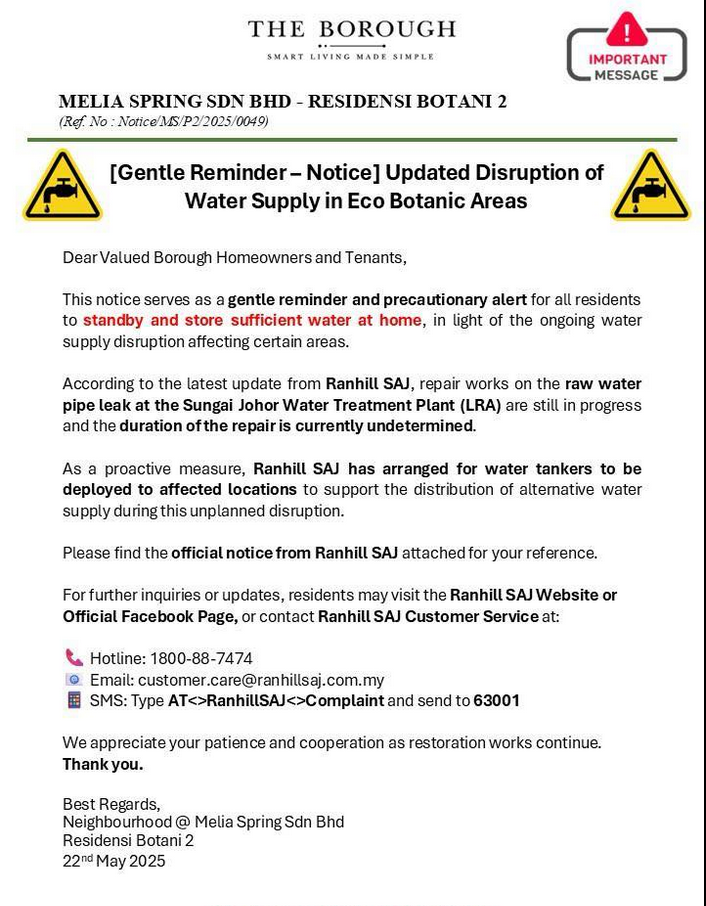

Back among earlier Iskandar-region investors, one of the complaints we heard on the ground was of infrastructure issues. There were cases where, after key collection, owners still had to wait some time before water was available. Here’s an example that was sent to us, from someone in the Eco Botanic project in Iskandar:

This isn’t to say the infrastructure is unreliable everywhere, of course, and periodic disruptions happen in every country. But you need to check the frequency of this in a particular project or area, just so you’re prepared if it happens.

The same goes for roads, as some buyers have told us they needed to use alternate routes or diversions for quite some time, when developers don’t complete access roads near or around the project. Some investors in Malaysia suggested the following:

- Drive to the site at different times of the day on weekends or weekdays. See if roads are paved and open, and check for residents or move-in activity.

- Request proof from your agent or lawyer that the development has full “occupation certificate” status, and that water, electricity, and sewerage approvals have been issued.

- Search local news or municipal notices for any infrastructure issues, road complaints, or construction delays affecting the area.

While the road probably will be completed at some point, it can be quite irritating to take long diversions for a period of months or – if you’re unlucky – years.

3. Not all condo projects are competently managed

We’re used to relatively high standards of condo upkeep in Singapore, and we struggle to think of the last time a residential condo actually went bust. But Malaysia is a much bigger country with many more condo projects and property managers; and condos can range from meticulously maintained to poorly run.

More from Stacked

Shoebox Units: A Performance Review Over The Past 10 Years

Go into any showflat as a single, and the first unit you’ll be guided to is the shoebox units; more…

In 2017, a joint management committee (JMC) in Klang Valley was so cash-strapped, with over RM2 million in debt, that they didn’t even have funds to repair the swimming pool. With only 48 per cent of the 2,500‑plus units paying maintenance, lifts, pools, and common areas suffered from neglect and disrepair.

Remember this happens downstream, and possibly decades after the initial launch; so former “luxury” amenities can degenerate into broken lifts, stagnant pools, and sometimes even absent security guards, if the security provider isn’t paid. From word on the ground, one tenant in a JB property (we won’t point fingers) complains that the main gate of their condo has been left unmanned for over a year, as the management couldn’t afford guards due to low fee collection. This has resulted in outsiders sometimes sneaking in to park their motorcycles or cars, with zero enforcement against them.

Investors in JB advised the following before you buy:

- Visit at different times, like weekday mornings versus weekends, rainy versus dry days, and observe the state of lifts, pools, walkways, and security. A particularly good sign is if you see actual security guards or cleaners there each time.

- Check forums like PropertyGuru Malaysia or Facebook groups for discussions on maintenance or defaults.

- Ask your agent or lawyer for copies of recent MC account statements or AGM minutes, which can reveal budget deficits, large-approved fees, or delayed repairs. You don’t need to be an expert and decipher the financial figures on your own, just ask your conveyancing firm to walk you through it.

One other issue to watch for is the attendance at AGMs, which is usually documented. Projects with many vacant or absentee owners are a red flag, as this often has correlations with low fee collections.

4. Don’t overlook the cumulative, long-term effects of currency risk

Yes, Malaysian property is often cheaper in an absolute sense; but remember that currency movements can quietly eat into your returns over the years.

During 2015 to 2016, for example, the ringgit fell to then-historic lows against the Singapore dollar. Great if you were buying at the time – but what if you already bought and are renting out the unit? Your rental income is collected in MYR while your loan or other costs are in SGD, so you need to factor in the currency exchange loss. During the 2015 to 2016 period, some investors in Malaysia told us that – after converting rent to SGD – it barely covered even half their monthly loan repayments.

The pain also cuts both ways: if you borrow in MYR to hedge your rent but the ringgit strengthens, your debt obligations can balloon in SGD terms.

Bottom line: what looks like a modest risk in year one can compound into a serious drag on your yield, if exchange rates move against you for a prolonged period. Factor this in when you plan your financing, and don’t assume that a weak ringgit today will stay that way forever.

To be clear, we’re not trying to dunk on Malaysian property investment here; it is a lucrative opportunity that has benefited many. But like all property investment, the devil is in the details – and when it’s happening across the causeway, where the rules may be different, you need to be extra diligent.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Can I rent out my Malaysian property and commute to Singapore regularly without issues?

What should I check regarding infrastructure when buying property in Malaysia?

How can I tell if a Malaysian condo project is well-managed?

What long-term risks does currency exchange pose when investing in Malaysian property?

Are there any restrictions on how long I can stay in Malaysia if I own property there?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Overseas Property Investing

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Overseas Property Investing What Under $200K Buys In Malaysia Today — From Freehold Apartments to Beachfront Suites

Overseas Property Investing A London Landmark Is Turning Into 975-Year Lease Homes — And The Entry Price May Surprise Singapore Buyers

Overseas Property Investing This Overlooked Property Market Could Deliver 12–20% Growth — But There’s a Catch

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

2 Comments

That is why buying a property in Malaysia or Batam is not in my likings lists ..it’s a very high risky

Singaporean love to compliant, we already have very efficient goverment, yet they have lot’s to compliant. By staying in JB is a good chance you can make compliant more offen, yet nobody is taking action for you. such as licking ceiling,the unit above will not cooperate with the lower floor for repair,in the long run with the licking ceiling you can imagine your unit has end up like batu cave.Think about it don’t cheap cheap all the time .. end up with sleepless night.Good Luck to those who have own a unit.