From EC To District 10 Condo: How A Couple’s Property Investment Decision Evolved

July 11, 2022

Would you pay off an Executive Condominium (EC) in full, or buy a District 10 condo on loan? They’re vastly different approaches to real estate, and you might think we’re talking about two different buyer profiles. However, that’s the journey M and her husband went through – from a rather conservative no-mortgage approach to buying an EC, to purchasing a unit at the just recently completed RoyalGreen in District 10. Here’s how it happened:

Deciding to own a second property

At the end of 2021, M and her spouse had reached the end of their five-year Minimum Occupancy Period (MOP). This made it possible for them to sell their flat, and buy a new property.

Early on, the couple decided that the property would be investment-oriented:

“We welcomed two beautiful babies in recent years,” M says, “So made the decision to move in with my in-law, to get all the help we can get.

Also, between privacy and the opportunity to earn more, we chose the latter. So we knew the next property was definitely for investment; but we also wanted something we wouldn’t mind staying in, if the plan turns south.”

M’s first choice was a three-bedder in a particular EC, located in Punggol. This was on the basis that they could afford to pay it off in full; the rental income would then bring positive cash flow.

M sought a second opinion, however, from her cousin that had seemingly done well in the property market:

“My cousin bought a unit in Stirling Residences and made capital gains; he said my plan was not the best idea and introduced me to his agent.

I guess sometimes it is best to leave it to people who know the property market better. Through the agent, I was educated on CCR/RCR/OCR*, the benefits of owning one property per spouse, and other factors like new launch payment structures**”.

It’s tough to decide whether to pay off the property in full. While emotionally reassuring, it’s sometimes less financially prudent to do so. While you might save on the interest, this can lock up your capital, and leave you with limited savings when you need it. We suggest speaking to a financial professional, before you decide to pay for the whole property upfront (we have more details on that in this earlier article).

It can sometimes be a good move, but it’s not ideal for everybody. The couple devised a new plan instead, involving an investment property in District 10.

“My husband did the hardest part, calculating and liaising with many bankers for loans, and I did the research to verify what agent recommended.

It was quite overwhelming, to narrow down on the location we wanted; I knew we had to meet criteria like being under five minutes walk to MRT and Primary schools), the right price differences between projects, and so forth. We kept going back and forth on each project’s pros and cons.”

*Core Central Region, Rest of Central Region, and Outside of Central Region

**See this article for details on the Progressive Payment Scheme for new condos

Picking the investment property, and a lucky encounter

The couple’s first choice was Fourth Avenue Residences. The plan was to get a two-bedder unit. This unit checked all the boxes for MRT and school proximity; and M liked the Bukit Timah area. They settled on a seventh-floor unit, facing the tennis court; this was at around $2,558 psf.

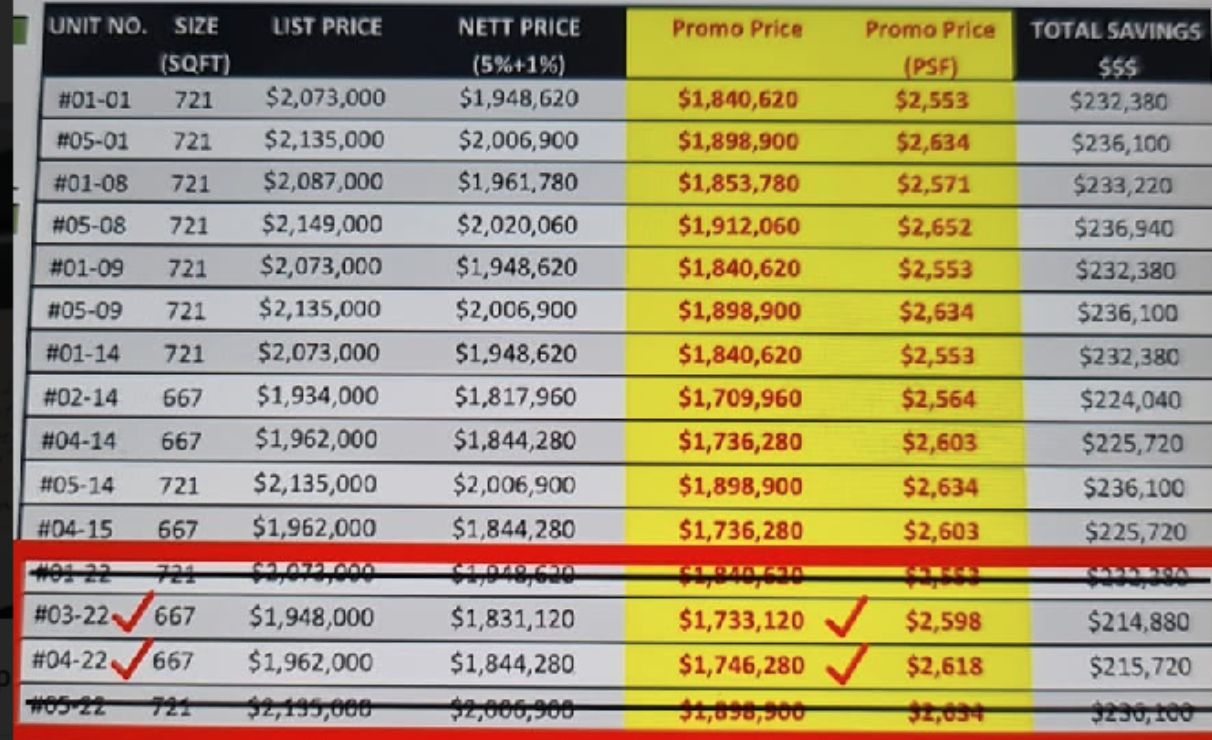

“But on the day I was to drop the cheque for Fourth Avenue, I went to the RoyalGreen show flat, which was opposite Fourth Avenue’s, to use their restroom.

While waiting for me, my husband overheard an agent telling a customer that RoyalGreen was having a fire sale. We never considered RoyalGreen initially, as it’s freehold and marketed at $2,900 psf.

More from Stacked

5 Property Hotspots In Singapore You Did Not Know Were Built Over Graveyards

As a Stacked reader so memorably said to us once: “If we don’t have room for golf and flats, we…

Out of curiosity we checked out the fire sale, and saw prices of $2,598 psf with the same facing. It was close to the price of what I was going to pay for Fourth Avenue, which is leasehold.”

As an aside, most leasehold buyers would face a premium of between 15 to 20 per cent for a freehold counterpart (all other factors being equal).

New Launch Condo ReviewsRoyalGreen Review: Luxury Freehold Condo in Sixth Avenue

by Reuben DhanarajGetting the second property

M says that the second property came “after much calculation, accepting the risk, and getting approval for the loan, which was not easy.”

For couples that are buying a separate property each, loan issues come to more than just interest rates. In these cases, banks will have to determine if each spouse has the financial means to shoulder the entire mortgage on their own. As it’s a higher risk profile, banks tend to be more hesitant (and the bank that grants the loan may not be the cheapest).

For these situations, we suggest buyers talk to a mortgage broker; they can help with the paperwork as well as finding the cheapest loan. You don’t even have to pay them, as they’re paid by the banks.

The couple decided on getting a larger four-bedder in the RCR. M notes that, seeing how well Sims Urban Oasis was doing, they wanted to tap on a similar trend. The condo they picked was Penrose. However, this was not a quick choice.

M notes that the couple went through an intense selection process, during which many projects were considered and dropped. There was even a point where a landed property was in the running. By the time they had decided on the Penrose, options were running low. M says that:

“Penrose was left with very few unit choices. We chose the premium stack with a better layout (in our view), hoping that the future tenant or buyers will also prefer it.

We chose the layout with all rooms facing the pool, instead of those where one bedroom would have no view. It wasn’t the cheapest unit, but we’re happy to have bought it before the developer increased the price during Chinese New Year.”

Developers do tend to raise prices over time, as a way to incentivise earlier buyers. You can find out more about such pricing strategies in this article.

Future plans for Royal Green

The couple hopes for a chance of en-bloc in the far future, which may be possible given the lack of freehold properties close to an MRT station.

In the meantime, M’s in-law is renovating her home. Once that’s ready in 2023, they will be moving there instead; after that RoyalGreen can start generating rental income.

M notes that “So many stars had to align for the two properties to come to pass”, from vetting through so many properties, dealing with multiple banks, and happening upon RoyalGreen’s fire sale by coincidence. In the end, M credits sharing home buying ideas with the right people – otherwise, she would have ended up with just her initial plan to pay off a single three-bedder EC.

For more buyer journeys, or in-depth reviews of new and resale condos alike, follow us on Stacked. We’ll help you make the best-informed decisions, for the Singapore private property market.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Homeowner Stories

Homeowner Stories We Could Walk Away With $460,000 In Cash From Our EC. Here’s Why We Didn’t Upgrade.

Homeowner Stories What I Only Learned After My First Year Of Homeownership In Singapore

Homeowner Stories I Gave My Parents My Condo and Moved Into Their HDB — Here’s Why It Made Sense.

Homeowner Stories “I Thought I Could Wait for a Better New Launch Condo” How One Buyer’s Fear Ended Up Costing Him $358K

Latest Posts

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

0 Comments