Can you afford a condo in Singapore as a fresh graduate?

November 16, 2017

Can a fresh graduate starting their career afford a condo / apartment? If you are an undergraduate or fresh graduate thinking of buying a private home, then you have come to the right place! In this article, we look at what fresh graduates can afford in the private home sector across all the districts in Singapore (excluding landed homes).

Click / tap the picture to view it separate. Zoom in if necessary.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

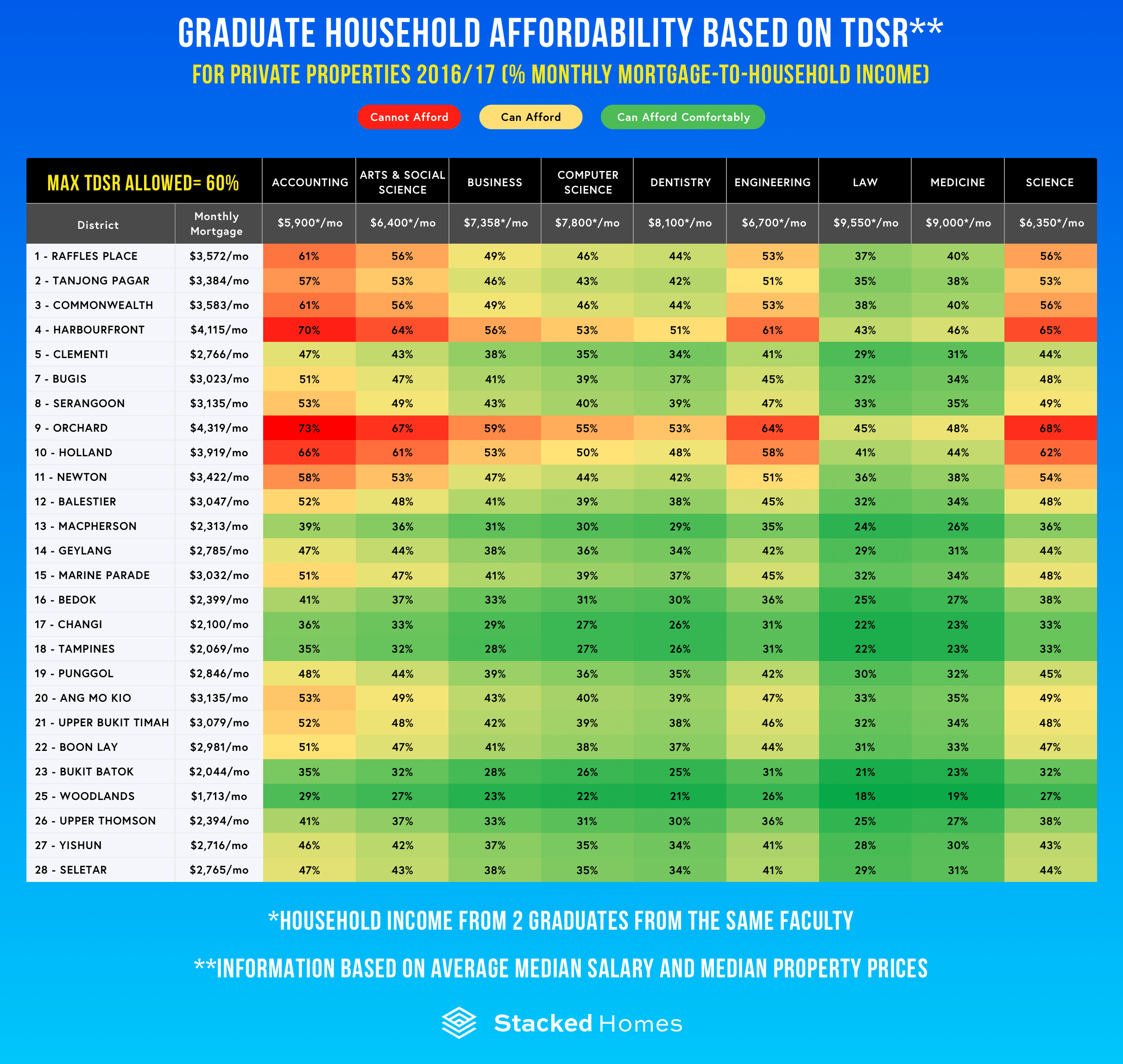

What the table above means

The median graduate salary for each faculty can be seen on the 2nd row

The median monthly mortgage payment required for each district is listed in the 2nd column To simplify things, we assume a household income of 2 graduates from the same faculty and together, they form a household. Median prices are obtained from URA and we only consider homes that are 100 Sqm / 1076 Sqft or less to remove large homes that graduates are unlikely to purchase, and the prices of which may skew our data.

To determine if they can purchase the home, we assume that they can pay the necessary upfront costs (e.g. taxes and the 20% down payment). With that out of the way, their affordability is determined by whether they can fulfil the Total Debt Servicing Ratio (TDSR). As of October 2017, the TDSR stands at 60%. We assume that the household has no other debt (e.g. personal loan, car loans, credit cards etc.)

Finally, we only cover graduates from the following faculties: Accounting, Arts & Social Science, Business, Computer Science, Dentistry, Engineering, Law, Medicine and Science.

Graduate income data is obtained from NUS.

The resulting figures show the monthly mortgage payments as a percentage of household income. Anything above 60% has breached the TDSR limits and is not allowed.

New Launch Condo ReviewsParc Clematis Review: An Astounding 400,000 sqft of Facilities At Your Doorstep

by Reuben DhanarajIt’s green for us, so we can afford it!

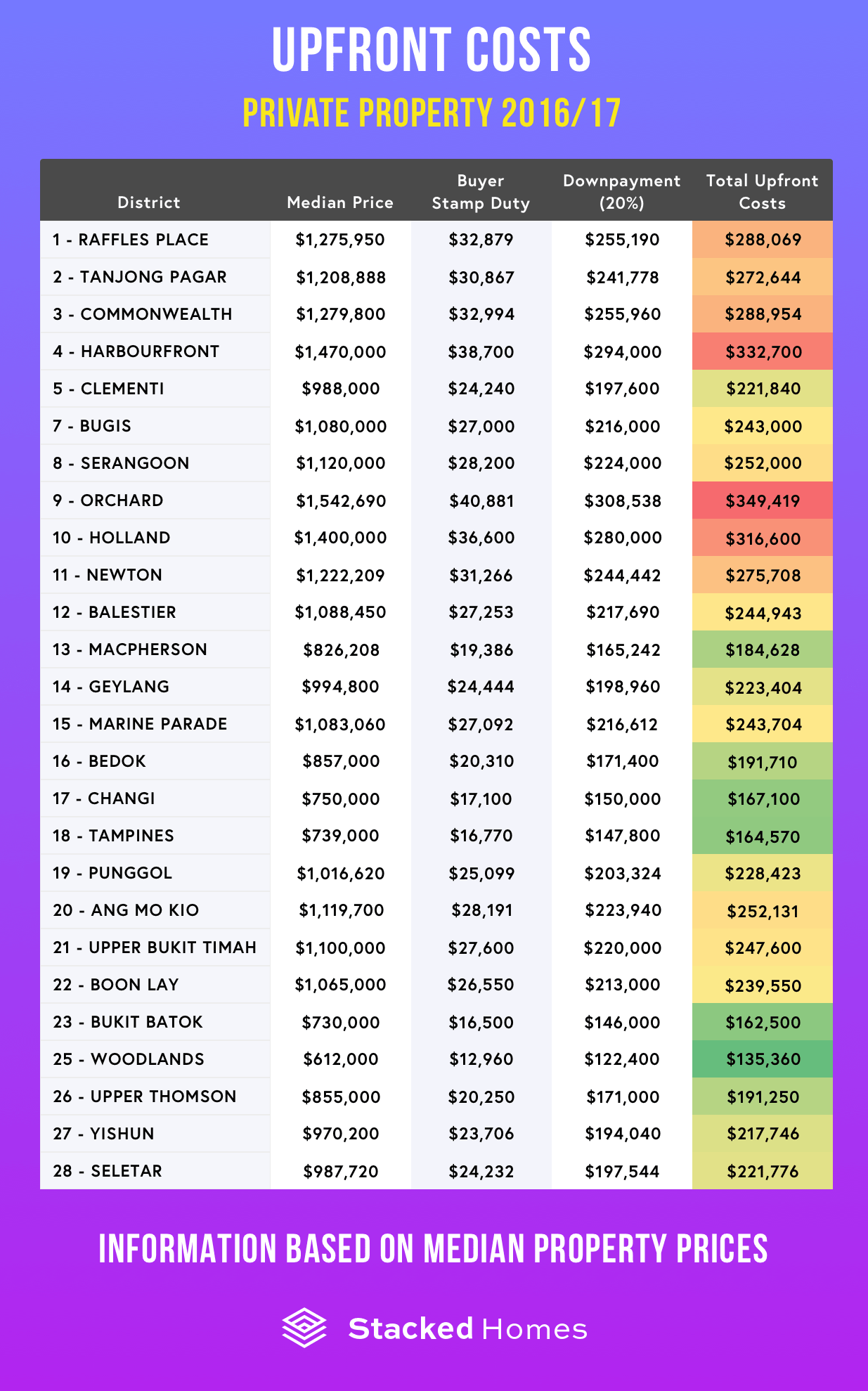

Now before you think about splashing around the condominium pool on the weekends, take note that the table above only shows whether you qualify under the TDSR rule. Qualifying does not equate to having the ability to purchase a private home – the upfront costs for private homes are off the charts to a fresh graduate!

Apart from having little to no savings (like most fresh graduates) and an overhanging student loan, owning a condominium incurs other costs like legal fees, maintenance and higher taxes. This reduces your cash flow early on in life that can potentially be used to invest for higher returns, or saved up to start a business someday.

Here’s the cash you need upfront to buy a condominium / apartment:

So, most graduates can technically afford a loan, but unless you strike the lottery or have parental blessings, it could take a long time to save up for that down payment.

As always, if you have any questions feel free to reach out to us at stories@stackedhomes.com! If you want to read more about buying a condo you can do so here: 10 things a first time condo buyer should look out for to avoid regret

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Property Advice We’re Upgrading From A 5-Room HDB On A Single Income At 43 — Which Condo Is Safer?

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments