HDB seems locked in a constant battle with what Singaporeans call “the rich people areas.”

HDB seems to view enclaves – be it ethnic enclaves, or areas defined by a certain socioeconomic strata – as areas that need to be broken up. It’s like whack-a-mole for them: all the flats are pricey and centralised? Put in rental flats. There are exclusive landed properties nearby? Put up a block across from it. For the most part, I love it.

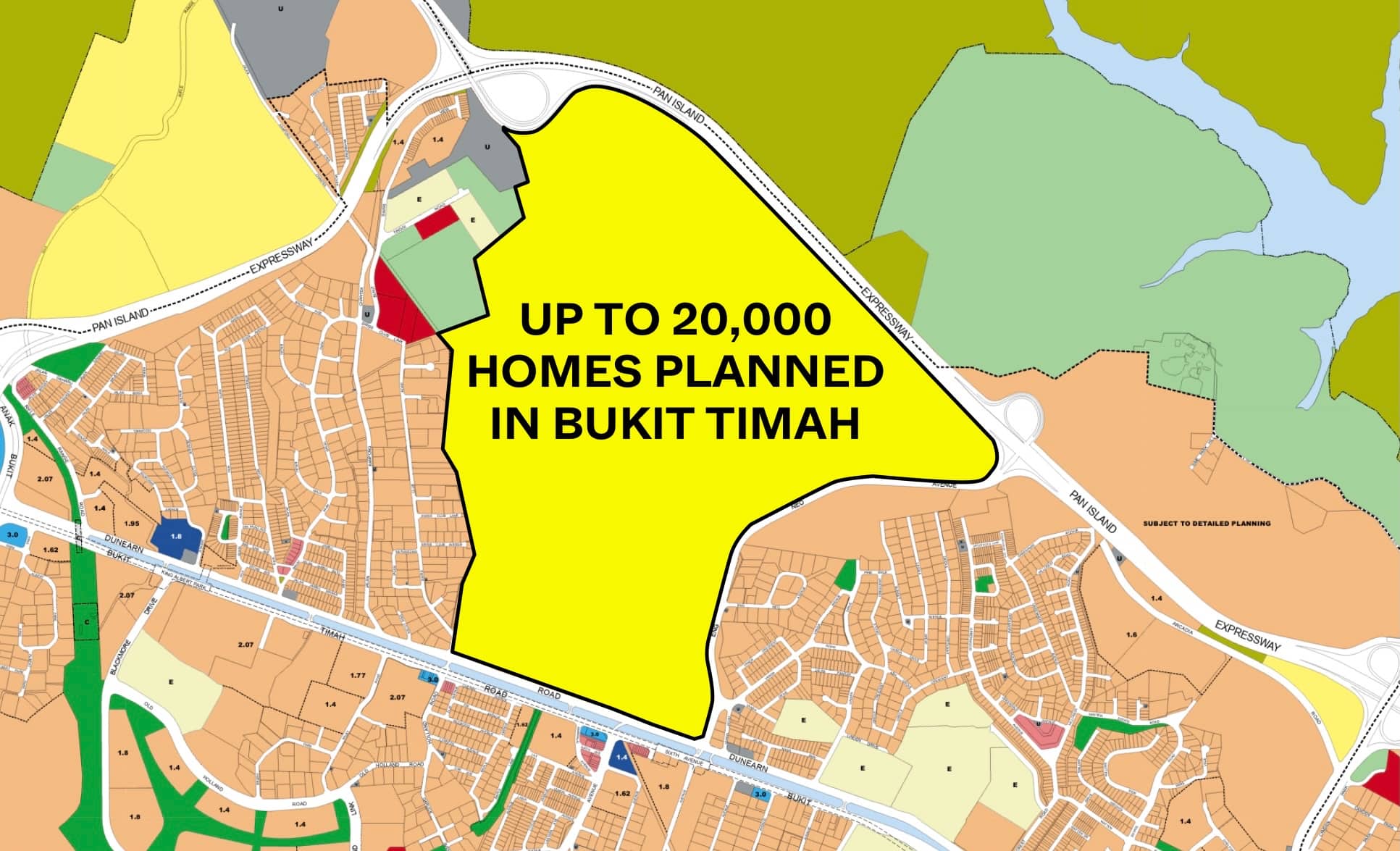

I get that some homeowners don’t, but it’s needed to prevent widening class divisions. We already have such strong stratifications (your social class is obvious from condo, HDB, or landed ownership), the least we can do is to try and make everyone get along. And I think the upcoming housing estate in Bukit Timah is going to be the very icon of this intent.

There are going to be up to 20,000 new homes on the Turf City site, which is directly facing Binjai Park, one of our pricey landed enclaves in Bukit Timah. Even the government’s statements on this upcoming estate, like calling it “inclusive and highly accessible,” hint at an underlying motive:

To break up the sense that Bukit Timah – or at least this part of it – is some kind of elite community separate from the rest of Singapore.

It’s some great imagery: the Turf Club embodies a sport that was, primarily for the wealthy (the F1 races of their day I guess). It was also closely tied to Singapore’s colonial past; and by proximity or otherwise, it remains an area frequented by more affluent expatriates. So reclaiming this area for HDB flats is more than practical; it becomes a metaphor for Singaporean unity, which ideally transcends class.

And as skeptical as some of us may be about that, I’m sure the intent of the message is clear.

Meanwhile in other property news…

One of the things you learn in property is that “grey areas” can turn black-and-white very suddenly.

I’m referring to the crackdown on the property owners who used the “99-to-1” arrangement. Using this method, a property owner is given only a one per cent share in a second property they buy, thus paying ABSD only on the one per cent. Later they can sell the one per cent back to their co-owner.

From word on the ground, this was sometimes touted as a “grey area” to property buyers; some of whom claim they were taught to do this by their property agents. Out of 187 cases reviewed by IRAS, 166 of them were found to have avoided taxes this way; and property agents in at least 10 of these cases are under review.

This isn’t the first time misinformation has cost property owners, by the way. Sometime back, I recall some flat owners claiming they’d been advised to just lock up one room in their flat and rent out the rest. This would count as “not renting out the whole flat” so it could be done before the Minimum Occupancy Period.

More from Stacked

New OTP Re-issue Restrictions: What Does It Mean For Property Buyers?

As of today (28th September 2020), the URA has put a stop to the re-issuing of an Option To Purchase…

I also recall, a few years back, some new launch buyers being told it’s okay to receive “furniture rebates,” which were essentially a sort of cashback scheme: the idea was to inflate the price for a bigger bank loan, after which a portion would be paid back to the buyer.

So now who do we listen to?

For starters, we should probably talk more to our conveyancing firms. Many buyers treat the conveyancing firm as little more than an overpaid form-filler.

And perhaps the most important thing we can do is to be fully aware that things described as “grey areas” can change in a hot minute. Nothing should be scarier than phrases like “the government knows people do it,” or “everyone does it.” Or that most loaded line of all, “It’s an industry practice.”

Those lines suggest it’s time to get a bit paranoid, and seriously consider not doing it (i.e., whatever is being suggested).

Meanwhile in other property news:

- HDB units with high ceilings? Yes, these condo-like public housing units do exist.

- Do condos in ulu places make money? The answer will surprise you.

- Property is a long term investment…unless you’re this guy who made $3.5 million in six months.

- The first condo in Science Park may soon be up for grabs. Yes, that Science Park, the one that looks more like a business incubator than an actual estate.

Weekly Sales Roundup (13 May – 19 May)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MIDTOWN MODERN | $6,370,000 | 1808 | $3,523 | 99 yrs (2019) |

| BOULEVARD 88 | $5,202,600 | 1313 | $3,962 | FH |

| 19 NASSIM | $5,070,000 | 1475 | $3,438 | 99 yrs (2019) |

| J’DEN | $3,588,000 | 1485 | $2,415 | 99 yrs |

| ENCHANTE | $3,163,000 | 1087 | $2,909 | FH |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| HILLHAVEN | $1,363,060 | 678 | $2,010 | 99 yrs (2023) |

| GRAND DUNMAN | $1,390,000 | 549 | $2,532 | 99 yrs (2022) |

| THE LANDMARK | $1,531,000 | 495 | $3,092 | 99 yrs (2020) |

| LENTORIA | $1,594,000 | 732 | $2,178 | 99 yrs (2022) |

| LENTOR HILLS RESIDENCES | $1,786,000 | 753 | $2,370 | 99 yrs (2022) |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| ST REGIS RESIDENCES SINGAPORE | $14,000,000 | 6684 | $2,094 | 999 yrs (1995) |

| N.A. | $5,800,000 | 2874 | $2,018 | FH |

| ORCHARD SCOTTS | $4,500,000 | 2282 | $1,972 | 99 yrs (2001) |

| AMBER 45 | $4,260,000 | 1593 | $2,674 | FH |

| OCEAN PARK | $3,920,000 | 2110 | $1,858 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| EDENZ SUITES | $682,888 | 441 | $1,547 | FH |

| GUILLEMARD EDGE | $722,000 | 409 | $1,765 | FH |

| HILLSTA | $735,000 | 570 | $1,288 | 99 yrs (2011) |

| RESIDENCES 88 | $790,000 | 506 | $1,562 | FH |

| SEAHILL | $818,000 | 506 | $1,617 | 99 yrs (2011) |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| KING’S MANSION | $3,300,000 | 1604 | $2,058 | $2,455,000 | 19 Years |

| PEBBLE BAY | $3,750,000 | 2336 | $1,605 | $2,192,000 | 25 Years |

| KIM KEAT LODGE | $2,650,000 | 1830 | $1,448 | $1,900,000 | 20 Years |

| OCEAN PARK | $3,920,000 | 2110 | $1,858 | $1,720,000 | 14 Years |

| BLOSSOMS @ WOODLEIGH | $3,750,000 | 3035 | $1,235 | $1,643,040 | 12 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| REFLECTIONS AT KEPPEL BAY | $2,150,000 | 1119 | $1,921 | -$68,500 | 14 Years |

| THE FLORENCE RESIDENCES | $830,000 | 484 | $1,714 | $29,000 | 3 Years |

| KINGSFORD WATERBAY | $1,030,000 | 689 | $1,495 | $32,921 | 6 Years |

| THE FLORENCE RESIDENCES | $830,000 | 484 | $1,714 | $33,000 | 4 Years |

| KANDIS RESIDENCE | $1,070,000 | 775 | $1,381 | $44,500 | 5 Years |

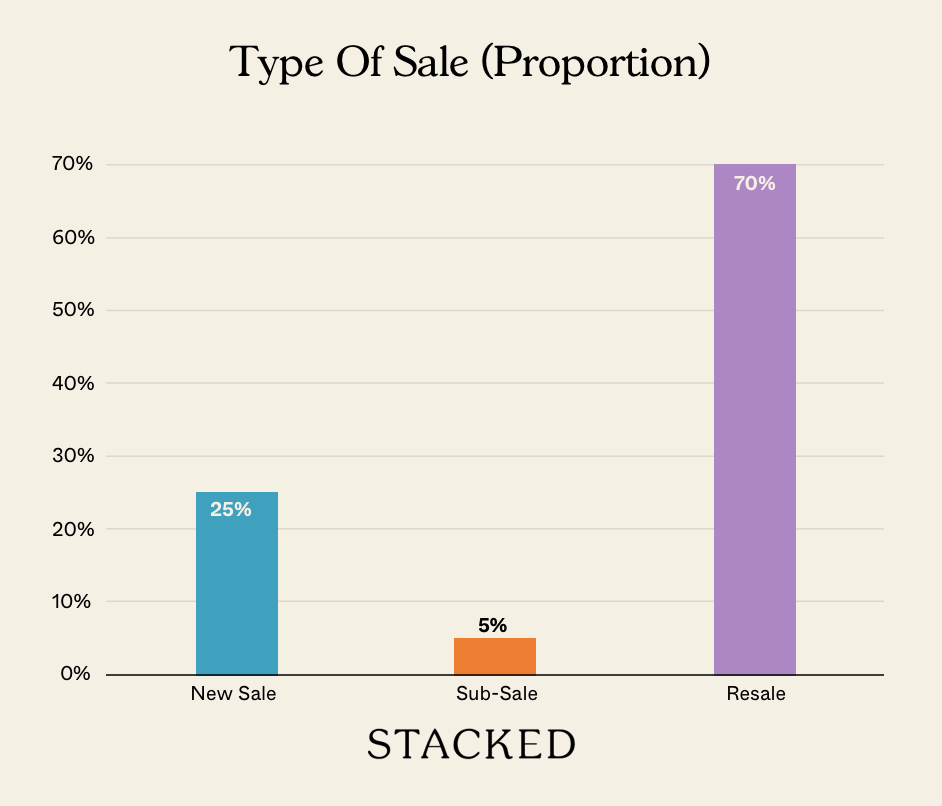

Transaction Breakdown

For more news on the Singapore property market, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What is the significance of the new housing estate in Bukit Timah?

Why is the government building more HDB flats in areas like Turf City?

What is the '99-to-1' property ownership arrangement, and why is it being scrutinized?

What should property buyers be cautious about regarding 'grey areas' in property transactions?

Are high-ceiling HDB units and properties in less popular areas profitable investments?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Singapore Property News

Singapore Property News Two New Prime Land Sites Could Add 485 Homes — But One Could Be Especially Interesting For Buyers

Singapore Property News Why Some Singaporean Parents Are Considering Selling Their Flats — For Their Children’s Sake

Singapore Property News Nearly 1,000 New Homes Were Sold Last Month — What Does It Say About the 2026 New Launch Market?

Singapore Property News The Unexpected Side Effect Of Singapore’s Property Cooling Measures

Latest Posts

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Pro This 130-Unit Condo Launched 40% Above Its District — And Prices Struggled To Grow

Property Investment Insights These Freehold Condos Barely Made Money After Nearly 10 Years — Here’s What Went Wrong

3 Comments

It was my grandfather house near old Turf club. The govt took away from us. Our village. V gd memory. Sadly to say

I think the Turf City BTO is a bad idea. Rich people aren’t comfortable with the poor nearby, and vice versa. Many nations also have wealth enclaves. As long as everyone can get housing, its fine. No need to force the super rich to mix with the poor