Love It Or Hate It: Singaporeans Weigh In On Common HDB Rules

January 12, 2023

HDB flats are a staple of Singapore living; but amid the rules and regulations to create a harmonious estate, some things aren’t well received. This week, we want to find out the main likes – and dislikes – of existing HDB rules. Here’s some of the feedback we got; and we’d love for readers to join in the conversation too:

Table Of Contents

- HDB rules that Singaporeans seem to hate:

- 1. Having to ballot for a flat

- 2. Sellers allowed to charge whatever they like after MOP

- 3. The difficulty for singles, especially lifelong singles

- 4. The weird refusal to accept cats

- HDB rules that Singaporeans seem to love:

- 1. You can get an HDB loan

- 2. Minimum Occupancy Period to prevent quick flipping

- 3. No major businesses run from flats

- 4. First-timer advantages when balloting

- 5. Housing Grants

HDB rules that Singaporeans seem to hate:

- Having to ballot for a flat

- Sellers allowed to charge whatever they like after MOP

- The difficulty for singles, especially lifelong singles

- The weird refusal to accept cats

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

1. Having to ballot for a flat

This is largely in line with what we mentioned above. While everyone seems appreciative of having more ballots, a common thread of complaints involves the difficulty of getting flats; and how it’s clear that flats are increasingly oversubscribed.

One reader we met had a radical alternative:

“Assign flats to first-timers and families, then assign any remaining flats to be balloted among other groups. The priority should be for those who need their first home. That is what priority actually means. Why must we make them ballot with the other groups?”

Another reader felt that the uncertainty of getting a flat also stood in the way of starting a family, as it’s not practical to get married or have a first child without a home of the couple’s own. She said that:

“It’s very awkward to have to move into an in-law’s home for either side. I would never do it, my fiancé would never do it. So unless we go to the expense of renting a place, the only option is we have our own flat first, then we get married.”

2. Sellers allowed to charge whatever they like after MOP

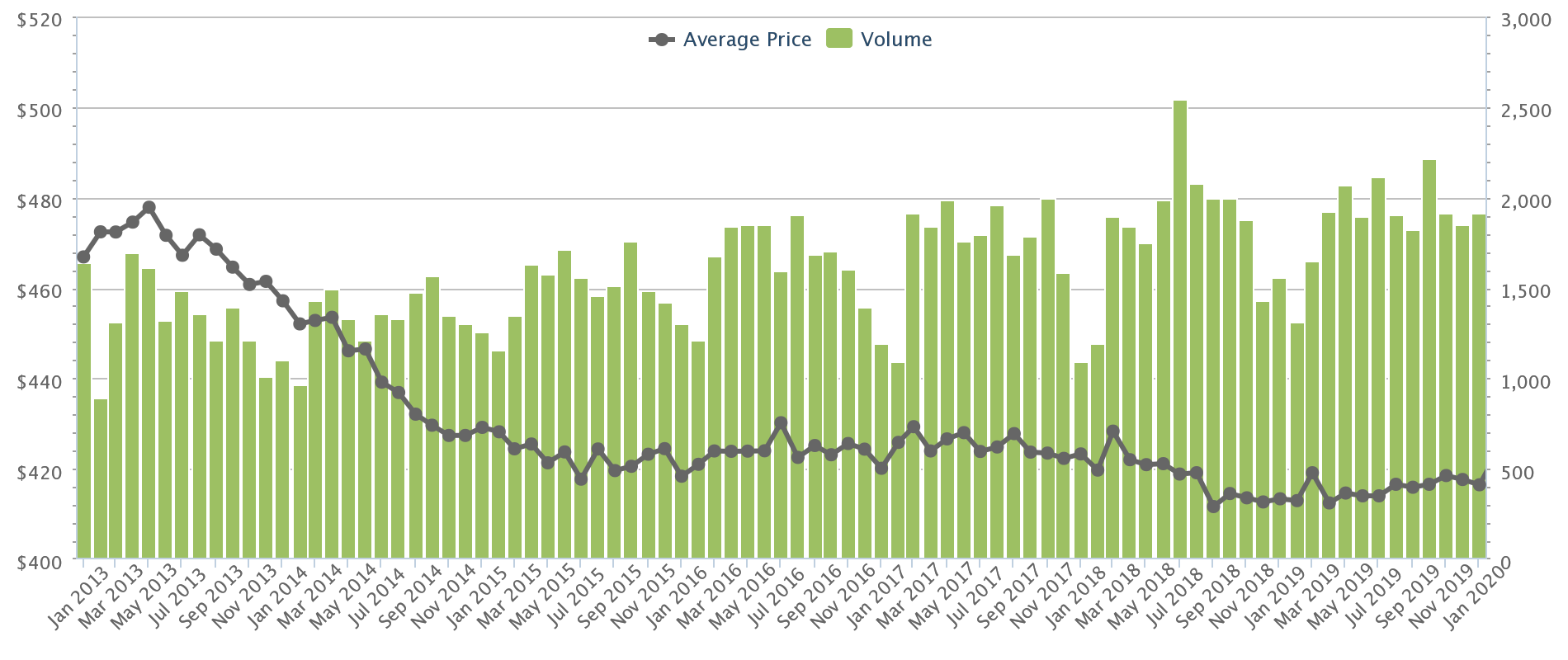

To be clear, HDB has taken action against Cash Over Valuation (COV) before. This was back in 2013, when COV prices were no longer published; and right after that resale flat prices did fall for seven straight years.

Also in September 2022, cooling measures imposed a 15-month waiting period on buying resale flats, for those who had just sold their private property. This is an indirect move to prevent resale flat prices from climbing too high.

Still, we’ve heard increasing calls for tighter measures, as the volume of million-dollar flats hit record numbers last year. One reader felt that even allowing free market transactions is going too far:

“Housing is a need, not a privilege. A flat provided at taxpayer expense should go back to the government, at the price it was bought but adjusted for inflation, when it’s no longer needed. It should not be an asset to get rich off.”

3. The difficulty for singles, especially lifelong singles

A common complaint came from singles, including LGBTQ couples who cannot be legally married and are hence deprived of some eligibility schemes. One reader said that:

“We shouldn’t overly-politicise basic living issues like home ownership, and we should recognise that singles also pay taxes and fulfil other requirements of citizenship. They shouldn’t form an underclass of people when it comes to getting their flat.”

Several complaints also involved the recent PLH scheme, with reader Matthew being particularly amused because:

“Look at all the PLH locations so far. A lot of them are far from schools, they have no 5-room flats for big families, and they’re in the most heavily built-up areas. The PLH flats are actually better for those without families than with!”

This is an old complaint though, and has been brewing for a long time; we can’t say we’re surprised it surfaced.

4. The weird refusal to accept cats

HDB still doesn’t technically allow cats as pets; although an approved list of dogs exists. If someone does complain about your cat, then – by law at least – you do have to get rid of it.

This is the official stand:

“Cats are not allowed in flats. They are generally difficult to contain within the flat. When allowed to roam indiscriminately, they tend to shed fur and defecate or urinate in public areas, and also make caterwauling sounds, which can inconvenience your neighbours.”

(Emphasis from HDB)

Some cat owners, however, have noted that dogs have equal capacity to act the same way; and that simple steps can be taken to contain the cats.

So far though, efforts to get the rules changed haven’t seen much success.

There are several other rules that have fallen into a grey area, with some people loving and others hating them. This includes, for instance, rules that prevent ball games or hanging out in void decks (which some say destroys communal spirit).

HDB rules that Singaporeans seem to love:

- You can get an HDB loan

- Minimum Occupancy Period to prevent quick flipping

- No major businesses run from flats

- First-timer advantages when balloting

- Housing Grants

1. You can get an HDB loan

We think this has come to the fore due to rising bank interest rates; but many homeowners are grateful for HDB loans right now.

The HDB loan rate is pegged to 0.1 per cent above the prevailing CPF rate, and has managed to stay at 2.6 per cent for close to two decades – as of 2023, it remains unchanged even as bank loan rates climb to an average of three per cent.

More from Stacked

“I Regret Spending $11,000 On My Kid’s Bedroom” 6 Painful Renovation Regrets Shared By Homeowners

Just like buying a home, the renovation process is one that is hard to reverse. It can be extremely costly…

(We should note though, that HDB rates used to be higher than bank rates between 2009 till around late 2022; so this is a recent development).

Perhaps the biggest boon to Singaporeans though, is the potential to buy a new flat while paying nothing out of pocket. One of the readers we spoke to, Liza, said she was pleasantly surprised to find out that even the $2,000 initial deposit could be returned:

“We applied for a flat in 2019, and we put down $2,000 for the deposit. I thought there would be other costs, but that was it. And when we confirmed everything, we were given the option to either put the $2,000 into our initial down payment, or to take it back.

We opted to have it back because times are quite tight right now, and there was no issue getting it. Besides that our CPF could cover the entire down payment, so we didn’t have to pay anything ourselves.”

(Note: as of September 2022, the minimum down payment is now 20 per cent of the flat price, which is an increase from 15 per cent previously. It is still possible to cover the full 20 per cent with CPF if you have enough though).

This is in contrast to bank home loans, where an absolute minimum of five per cent has to be paid in cash, regardless of how much CPF money you have saved up.

2. Minimum Occupancy Period to prevent quick flipping

While the Minimum Occupancy Period (MOP) is one of the main restrictions on HDB ownership, we found that the majority are supportive of it. The MOP requires that you inhabit your flat for a minimum of five years (or 10 years from Prime Location Housing flats), before you can resell it on the open market.

Some readers even suggested more extreme versions than the existing MOP, such as outright preventing flat owners from selling on the open market. One reader, Jin, said that Singapore’s model has been more successful than most housing projects overseas. Jin notes that:

“Having lived in a few countries, I have seen other policies like rent control which don’t work as well. MOP is fair, and it prevents house-flipping while also providing an appreciating asset.”

3. No major businesses run from flats

HDB has restrictions on which businesses can be from home, and these are quite protective of the peace and quiet. Even if you give tuition, for example, the number is restricted to three students at a time.

Most people we spoke to were supportive of this; and one person – who used to live in a condo – commented that:

“When we stayed in the condo the management didn’t really take action against people who ran businesses from home. Like in my last place, I had a neighbour who was catering from home, and it was not a small amount of food either – you could even hear the noise as she clearly had workers over to help. And they would cook until midnight or later.

I think in HDB there are more people to each floor, so besides being more strict, you’re more observed. So people are more on good behaviour.”

4. First-timer advantages when balloting

HDB balloting does favour First Timers (FTs), under its priority scheme. There are more flats set aside for FTs, and FTs have twice as many ballot chances as a second-timer.

We should point out though, that this also comes with another complaint: many FTs, while appreciative of the better odds, have also said it’s still hard to find a flat. One recently married couple, who failed to get a flat for all of 2022, said that:

“There should be more chances for first-timers, probably three-to-one or even four-to-one, rather than two-to-one odds, because if you look at all the recent BTO exercises everything is oversubscribed. Even a non-mature BTO is so hard to get.

HDB should be more flexible in times when housing supply is limited and resale prices are so high. But it’s of course good that they favour first-timers if not it will be even worse.”

5. Housing Grants

You can see the full list of grants here. But in general, it’s agreed that grants are pretty generous and easy to get. Under the Proximity Housing Grant (PHG), for example, you get $20,000 (or $10,000 for singles) just for living within four kilometres of your parents. It doesn’t even matter if your parents live in a private or HDB property.

You do have to pay resale levies if you buy a second subsidised flat; but most readers feel this is fair – otherwise, we’d have a subset of people who get outsized grants (in total) by buying a subsidised flat more than once.

We’re interested in knowing more about which rules you love or hate about HDB to get a more concise view; so do write in to us, or write in the comments below and let us know.

In the meantime, you can follow us on Stacked for the latest news on housing in Singapore; as well as details on the private and public housing scene alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why do some Singaporeans dislike having to ballot for an HDB flat?

What are the concerns about sellers charging high prices after the minimum occupancy period?

Why do some singles in Singapore find it hard to buy HDB flats?

Why does HDB not allow cats as pets in flats?

What are some HDB rules that Singaporeans generally appreciate?

How do HDB housing grants benefit buyers in Singapore?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Market Commentary

Property Market Commentary A 60-Storey HDB Is Coming To Pearl’s Hill — The First Public Housing Here In 40 Years

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Property Market Commentary We Review 7 Of The June 2026 BTO Launch Sites – Which Is The Best Option For You?

Property Market Commentary Why Some Old HDB Flats Hold Value Longer Than Others

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

0 Comments