We Are In Our Early 30s & Making $300k Per Year. Should We Buy Another HDB Or Upgrade To A Condo?

November 25, 2022

Hello there!

love your content and articles, they are so informative and interesting to read. was trying to find something on clover by the park as it is a condo that I am keen to purchase in the next year or so, wondering if you would do a review on the development please!

some background too, my wife and I are both working professionals and currently have a 12 month old son, and another boy coming in Jan. we have one helper and a medium sized dog and currently live in a 4 room flat at Jalan Rumah Tinggi. we have just passed out 5 years MOP and can sell our unit now. the 4 room flat we live in originally had 3 bedrooms but due to poor planning when we were married 5 years ago, we decided to combine 2 bedrooms and also shrink one of the rooms to make the living room larger. we now find ourselves with insufficient rooms for our kid(s) in the future and have decided to move to Bishan, where we intend for them both to attend Cat High primary. we have been working for several years and earning comfortably around 300-350k a year combined (incl bonus).

our top choice so far is clover by the park which is near to the school and also one of the newer condos in the area, but we are also open to other developments or a hdb EA/EM nearby.. however, since we will likely be living in the next home for a good 17-18 years (6-7 years before pri sch 6 yrs + sec sch 4 yrs), many friends have advised us that altho a EA/EM would suit our needs well (with 2 kids), we will most definitely lose money by the time we sell it in our 50s. our end goal is to retire comfortably in a condo so perhaps this next purchase will very likely be our retirement home. priority at the moment is to have size that is sufficient, yet not lose money as an “investment”.

we are currently still living in this hdb which is our first home and have considered a 2 step (hdb-hdb-condo) but feel that it might set us back financially in the long run (due to Reno costs), compared to a 1 step (hdb-condo) which might be a little financially tight at the start for us. we think that we will likely want to make the move between mid-end 2023, after our second child is born and slightly older. worth noting that our house is not really baby friendly and therefore not very appropriate for our infants/toddlers to grow up in.

we would love to have your opinion and thoughts on what should be our next step or if there are other things we should consider before we take the next big step in life, which is the home or homes that our kids will grow up in. also, if there are other alternatives in the bishan St 22/24 area worth considering.

thank you for reading this and look forward to your insights and suggestions

forgot to mention that my wife and I are 31 and 32 respectively, have moderate savings so downpayment probably not huge issue.

We listed our house and already received an offer for 700k and got the $1000 deposit from the buyer today

So the sale is expected to proceed, we might need to rent somewhere while we arrange for viewing at clover by the park

(This is part of an ongoing series where we answer reader questions about the property market. If you have one of your own, send it to stories@stackedhomes.com.)

Hi there,

We’re happy to hear you enjoy our content! Clover By The Park is a development that has been quite hotly requested so hopefully, we can get to it sooner rather than later.

It’s interesting to hear from you about regretting your decision of combining 2 rooms and shrinking a room to make the living bigger. It’s something that we’ve seen quite a lot in homes these days through our home tours, and if it’s any consolation, at least you had 5 good years of living in a space that was catered to your lifestyle!

This is somewhat also in relation to your later question on what should be the next step with regards to your home. If only homes were an easy malleable thing that you can shape as and when you like to fit your requirements! Just as you faced the issue of your initial layout not fitting what you needed for a home, the same issue would come up when a home doesn’t fit what you need from it (whether it’s the facilities or the location being too far from a new workplace or school).

There’s only so much you can plan ahead for, such is life!

From what you’ve mentioned, it seems like your plan is to stay in this next property for the long term, at least until your kids have finished secondary school and there is also a possibility of keeping the property as your retirement home.

We will run through the following and hopefully, this can help you make a more informed decision:

- Your affordability

- Overview of Clover By The Park

- Overview of Bishan Executive HDBs

- Your holding period

- Other options within 1KM of Catholic High School

- Should you do a 1 or 2-step move?

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

Let’s look at your affordability first.

After selling

| Description | Amount |

| Sale price | $700,000 |

| Outstanding loan | $377,000 |

| CPF refund | $272,000 |

| Estimated cash proceeds | $51,000 |

For buying a private property

| Description | Amount |

| Maximum loan based on a combined monthly income of $27K and ages 31 and 32 | $3,110,499 (30-year tenure) |

| CPF funds | $392,000 |

| Cash (cash on hand $300K + sales proceeds $51K) | $351,000 |

| Maximum affordability based on 25% downpayment of $743,000 (CPF + cash) | $2,972,000 |

| BSD based on $2,972,000 | $103,480 |

| Estimated affordability | $2,868,520 |

For buying an HDB

| Description | Amount |

| Maximum loan based on a combined monthly income of $27K and ages 31 and 32 | $1,534,565 (25 year tenure) |

| CPF funds | $392,000 |

| Cash (cash on hand $300K + sales proceeds $51K) | $351,000 |

| Total loan + CPF + cash | $2,277,565 |

| BSD based on $2,277,565 | $75,702 |

| Estimated affordability | $2,201,863 |

Now that we have your affordability out of the way, let’s take a look at the different housing options that you can consider.

Since you asked about Clover By The Park first, we shall start with that.

Clover By The Park

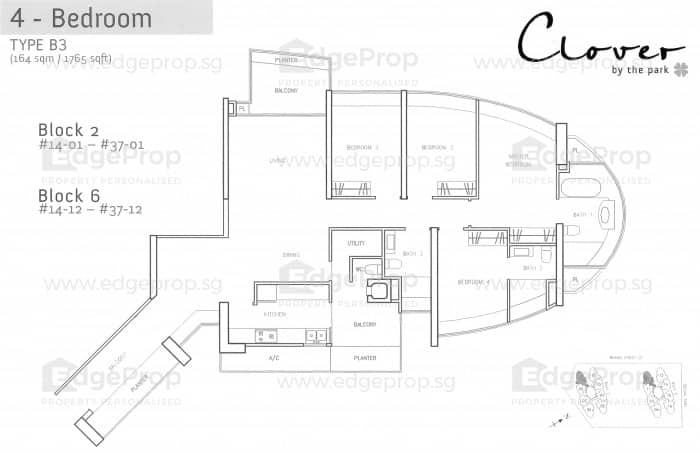

Clover By The Park is a 99 years leasehold development that was completed in 2012 (although its lease started in 2007). It is a mid-sized development with 616 units spread across two 39-storey tower blocks made up of 3 to 6-bedroom unit types.

The development is conveniently located within 15 minutes walk to the dual line Bishan MRT station and Junction 8 which has a variety of food and retail options. It is also just a 2-minute walk from Bishan North Shopping Mall which is an HDB cluster with a wet market, a 24 hours Fairprice and numerous eateries. For outdoor lovers, the project is just a 2-minute walk away from Bishan Ang Mo Kio Park and there are certain stacks with an unblocked view overlooking the park if you’re lucky enough to find one on the market!

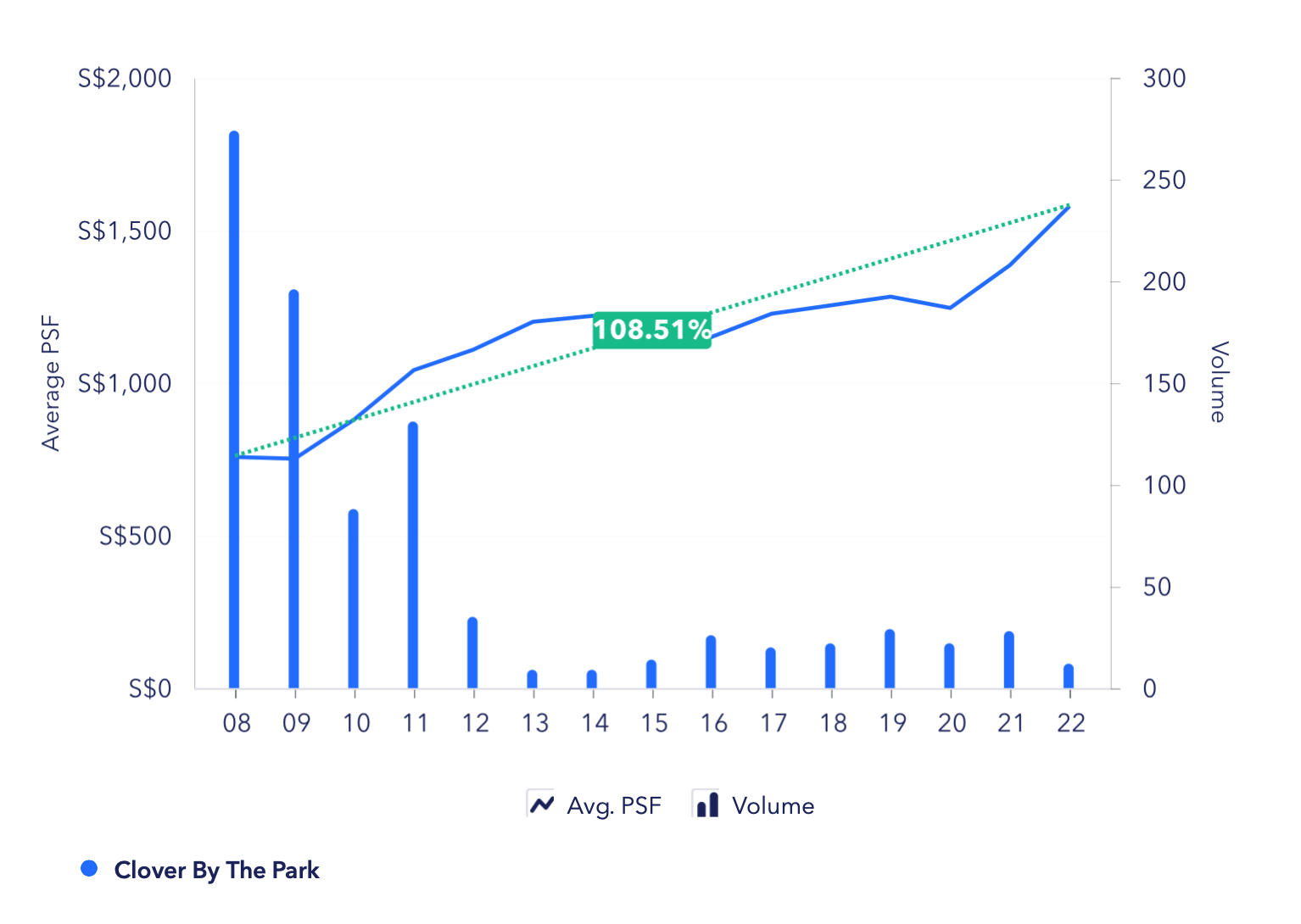

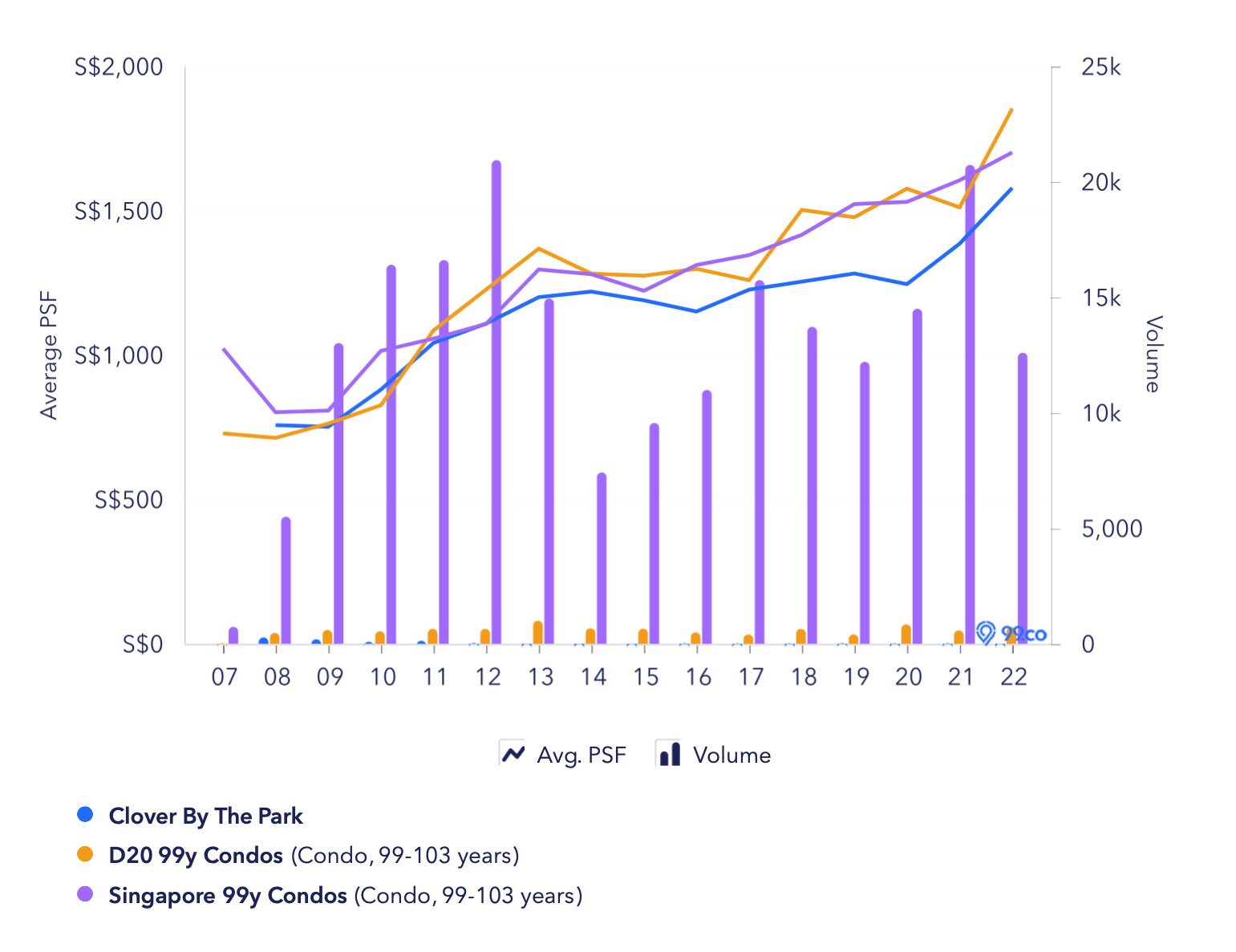

The project has appreciated very well since its launch in 2008 by 108.51%.

It is also moving in tandem with the overall market for 99-year leasehold developments in Singapore. Compared to 99-year leasehold projects in District 20, it may look like there is a growing gap but this is due to new launches such as Jadescape (launched in 2018) and AMO Residences (launched in 2022) that pushed up the overall average PSF for D20 in certain years.

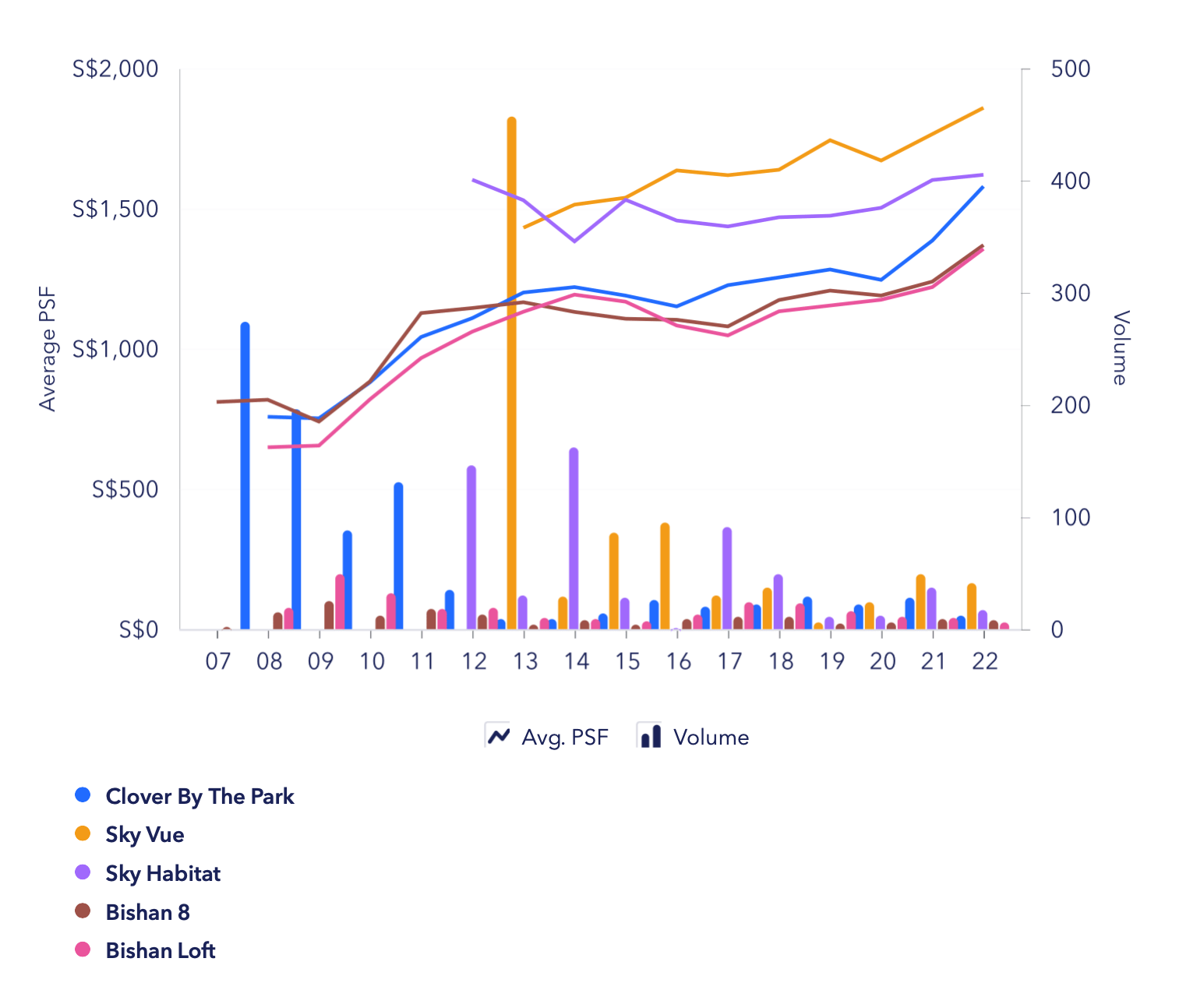

| Project | Tenure | Completion year | No. of units | Avg PSF (past 1 year) |

| Clover By The Park | 99 years from 2007 | 2012 | 616 | $1,521.26 |

| Sky Vue | 99 years from 2013 | 2016 | 694 | $1,856.69 |

| Sky Habitat | 99 years from 2011 | 2015 | 509 | $1,670.5 |

| Bishan Loft | 99 years from 2000 | 2003 | 384 | $1,358.82 |

| Bishan 8 | 99 years from 1996 | 2000 | 200 | $1,359.31 |

If we were to compare it with projects in the vicinity, Clover By The Park is the third youngest development and the furthest from the MRT station, but its prices have grown the most since the pandemic, closing the gap with the prices of Sky Habitat which is 4 years younger.

The increased demand could be due to Clover By The Park having bigger-sized units and demand for such unit types was on the rise during the pandemic as more people were working from home. From January 2020 till date, there have been 54 transactions in the development, out of which 38 were 3-bedders, 14 4-bedders, and 2 5-bedders.

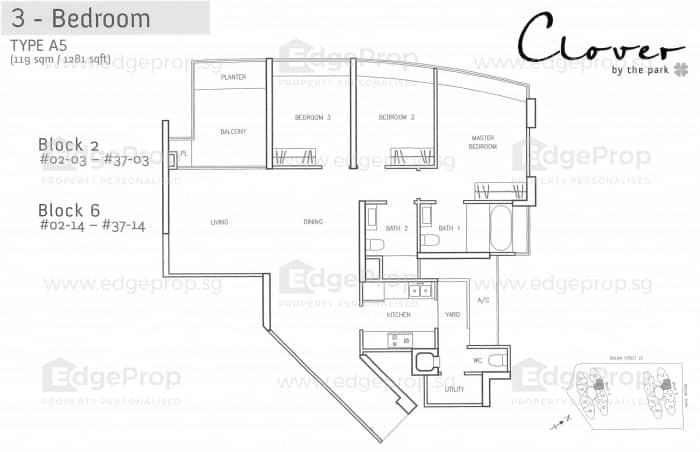

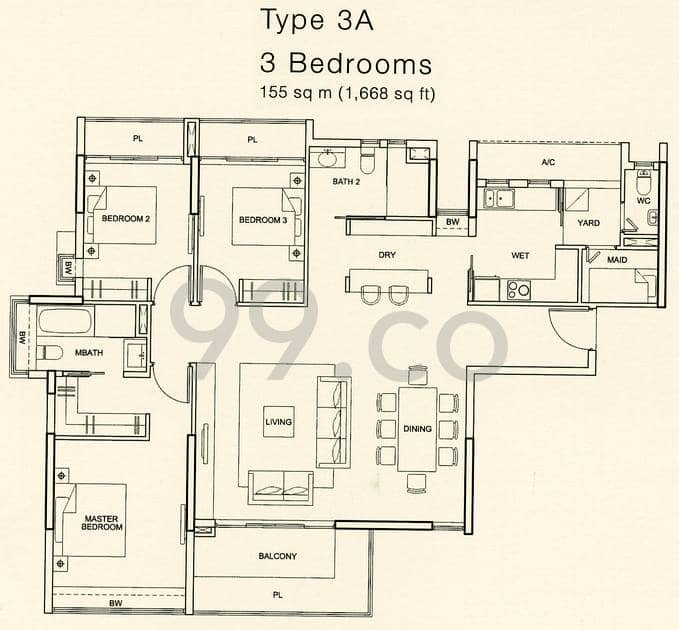

Given that you’ll soon be a family of 4 with a helper and a dog, we presume you’re looking at a 3-bedder with a utility or a 4-bedder. The layouts at Clover By The Park, although spacious, do have a little bit of a waste of space such as the long entryway into the unit and the bay windows and planters. It’s not too bad given the size of the unit, and if privacy is a real concern to you, but this is just something to note. Also, due to the rounded shape of the development, some of the rooms are not regularly shaped which can make furniture placements difficult.

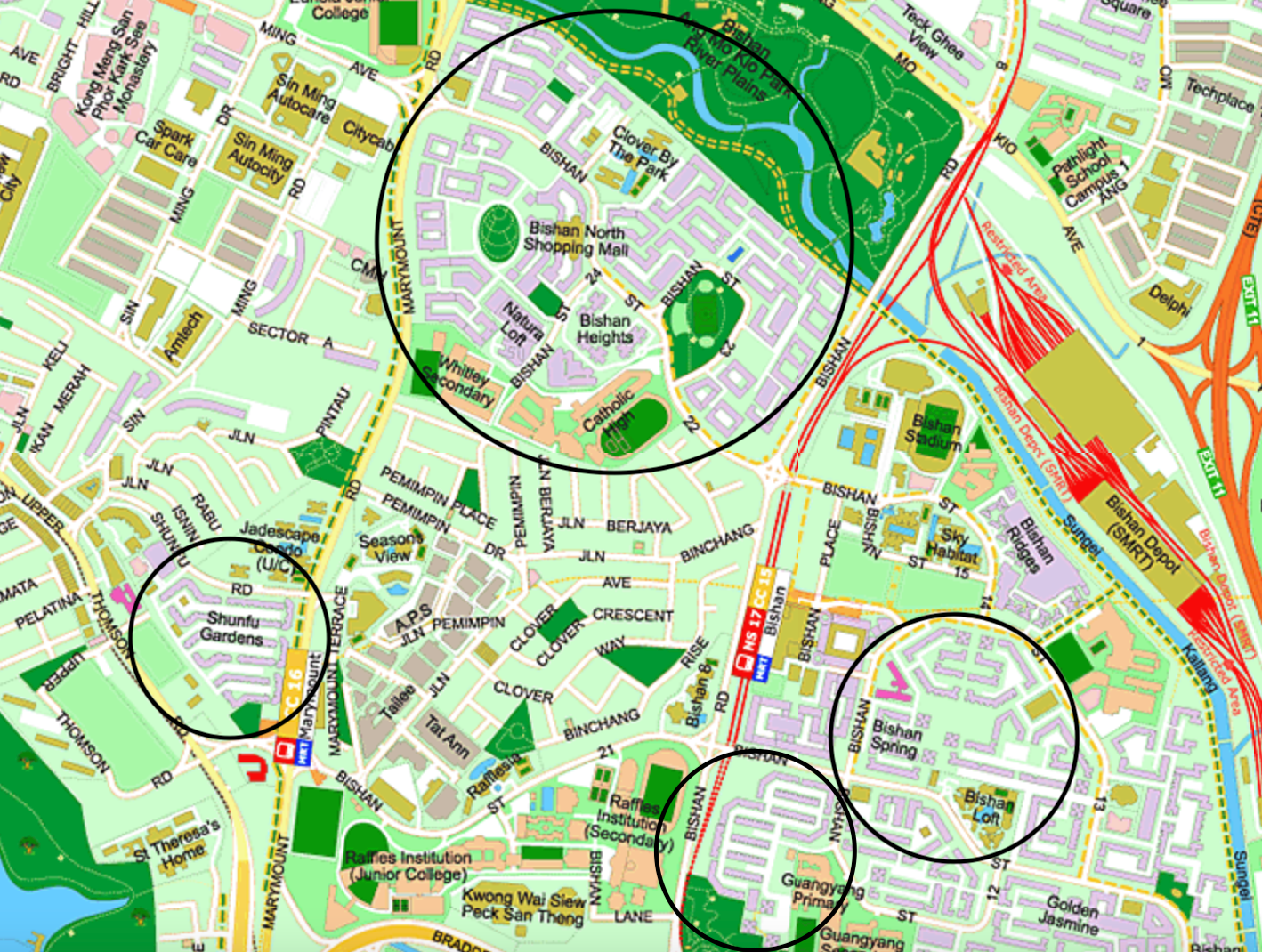

Bishan HDB EA/EM

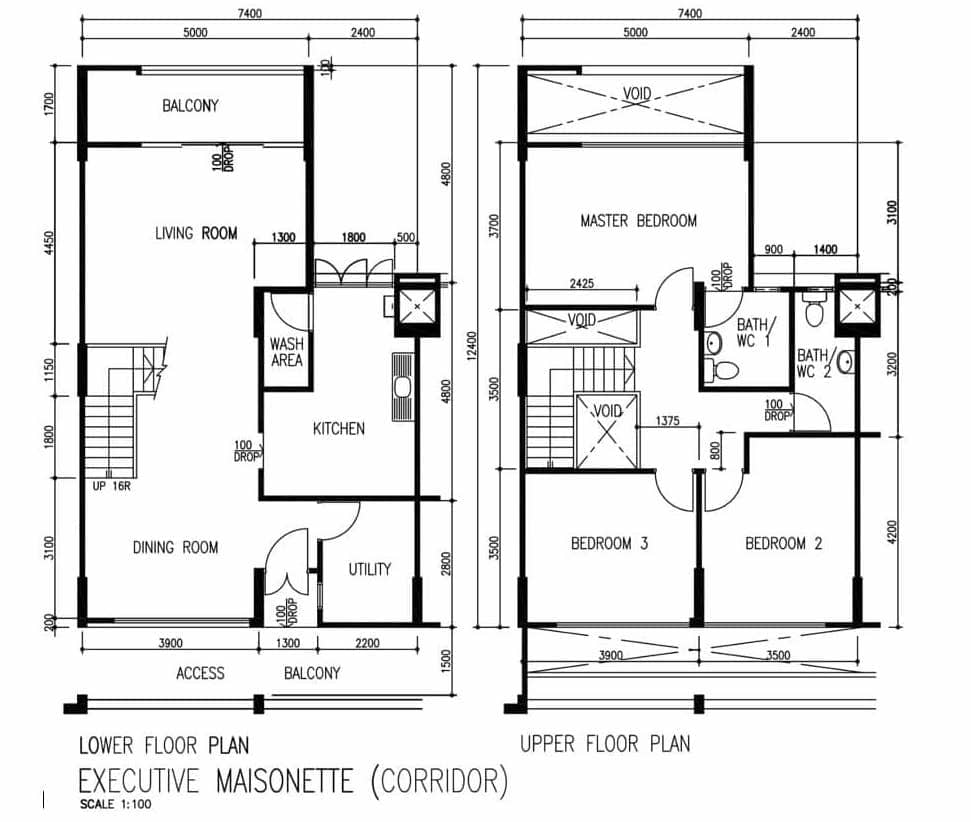

Naturally, this would be the more affordable option. There are a handful of HDB clusters in Bishan that houses EAs and EMs which were built between 1985 to 1992, making them 30 – 37 years old now. Most of them are within 1KM of Catholic High and within walking distance to either Bishan, Marymount, or Bright Hill MRT station.

Depending on what you value, some of these locations could be even better placed given you are located closer to an MRT station.

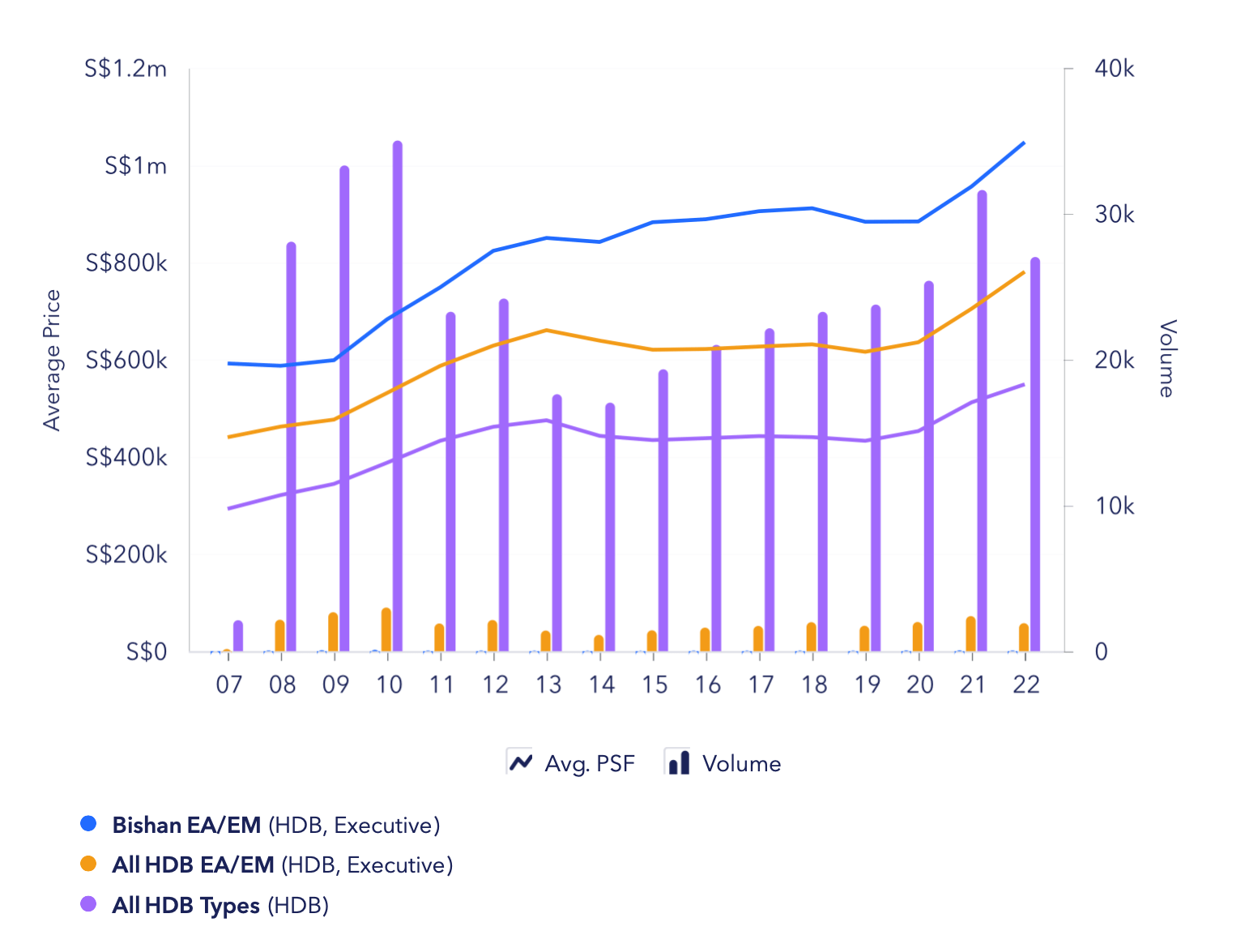

We can see from the graph above that despite the ages of the EAs and EMs in Bishan, their prices are still growing and moving in line with the overall market. With demand for larger unit types rising since the pandemic, given that these are the biggest HDBs you can find and they are no longer being built, demand and prices have naturally gone up in spite of their age.

In the last 10 months of 2022, there were 55 HDB executive units transacted in Bishan at an average price of $1,047,125.

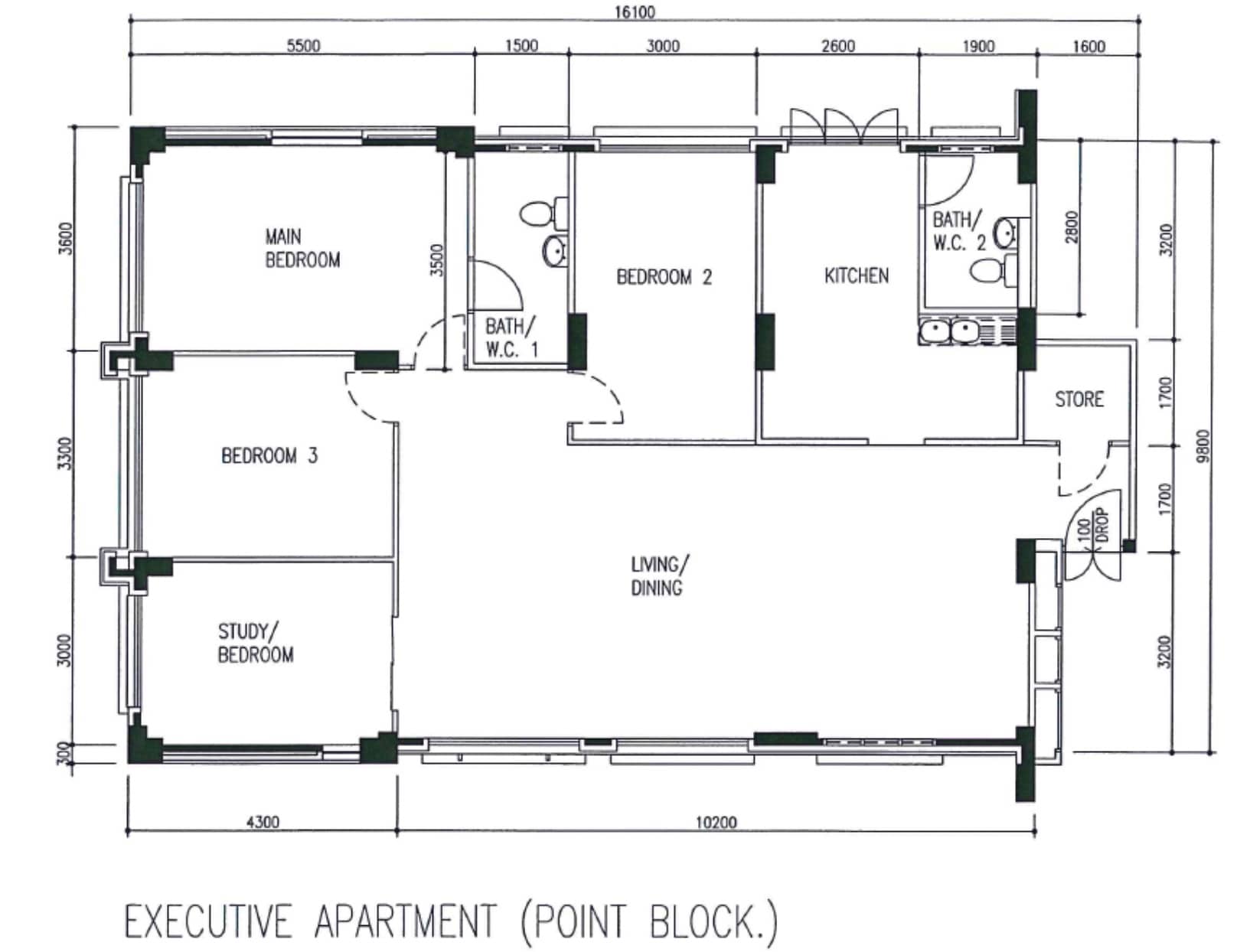

Generally for most EAs and EMs, their layouts are efficient with minimal wastage of space. It’s also flexible (as you have experienced with your own home), so if you have the budget this can be better renovated to suit your living requirements.

Holding period

You mentioned that you will be staying in the next property for at least 17 – 18 years until your kids finish secondary school, which is a considerably long period of time.

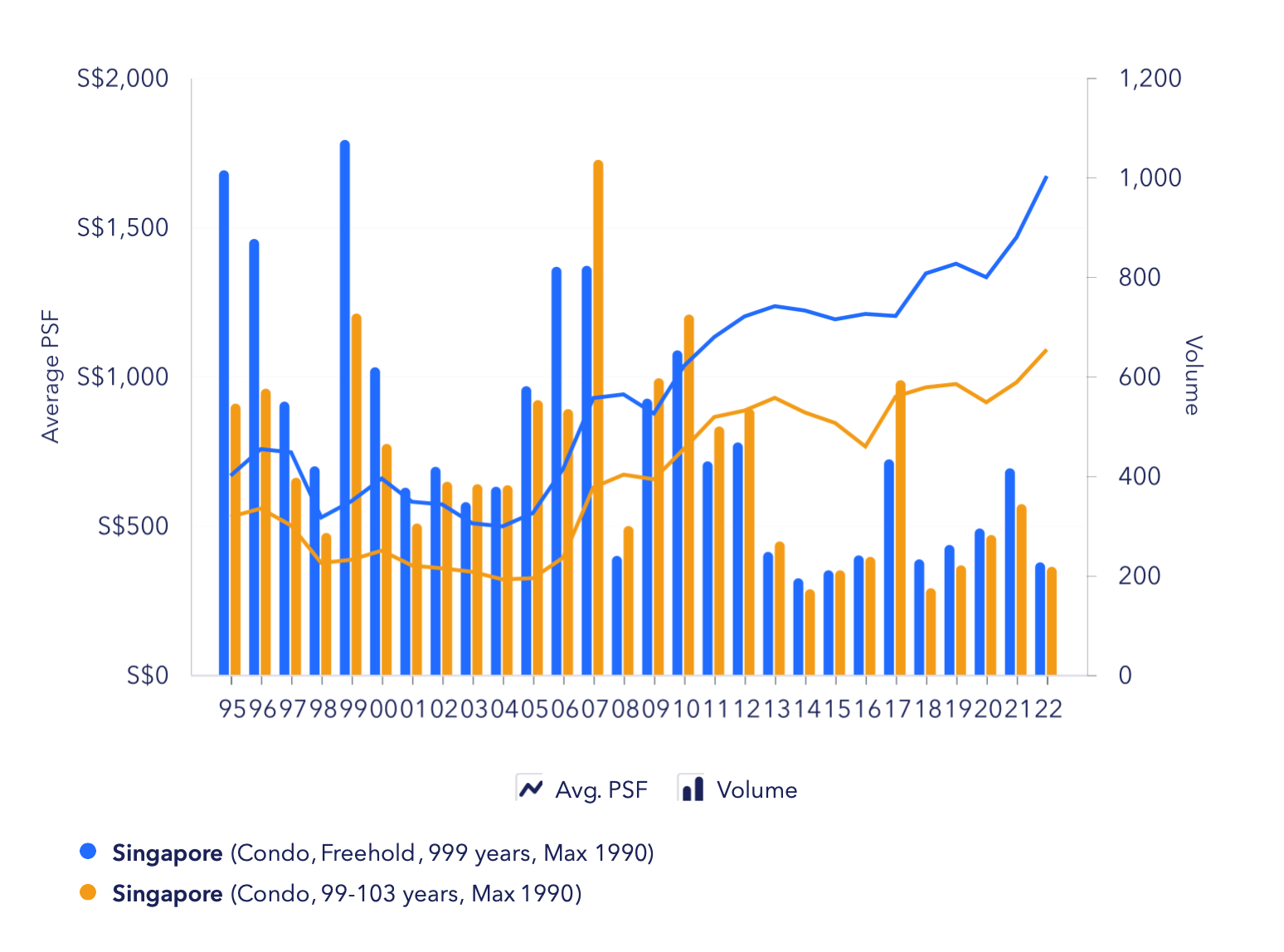

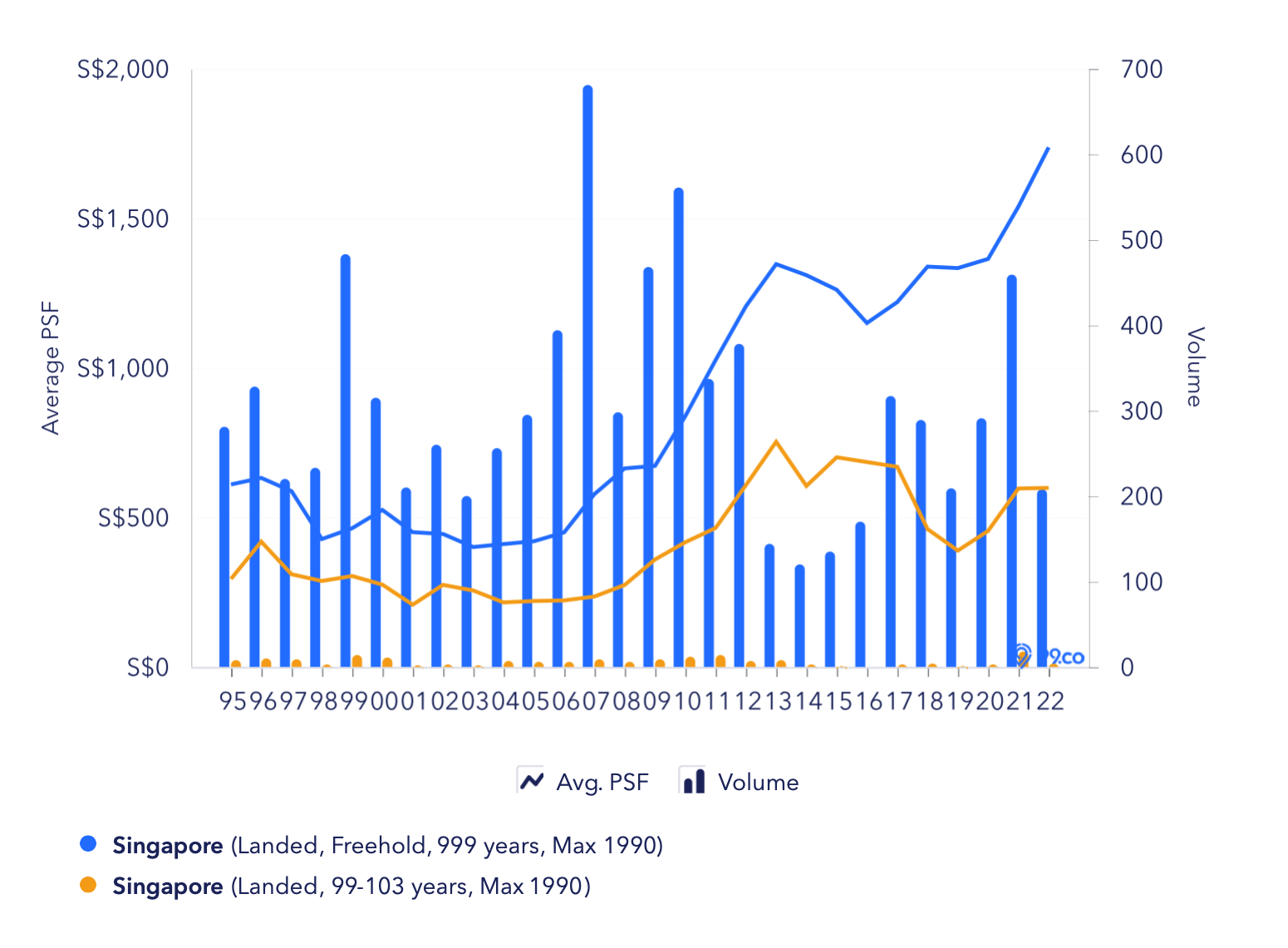

Due to lease decay, prices of leasehold properties generally may decline as they age. The graphs below are comparisons between freehold/999 years leasehold condominiums & landed versus 99-year leasehold condominiums & landed homes that were completed before 1990, making them at least 32 years old.

We can see from the above graphs that the price disparity between freehold/999 years leasehold properties and 99 years leasehold properties grew wider as the years go by.

| Avg PSF in 1995 | Avg PSF in 2022 | |

| Freehold/999 years leasehold condo | $667 | $1,671 |

| 99 years leasehold condo | $529 | $1,089 |

| Avg PSF in 1995 | Avg PSF in 2022 | |

| Freehold/999 years leasehold landed | $610 | $1,737 |

| 99 years leasehold landed | $294 | $598 |

If you were to purchase a unit at Clover By The Park which is now 15 years old, and stay for another 18, the project will be 33 years old by then. As for the HDB, if you were to purchase the youngest block which is currently 30 years old, it will be 48 years old by the time you plan to sell it. At 33 and 48 years old, prices of these units may already start to stagnant or decline so chances of making a profit are slim especially when buying in at a time when prices are at an all-time high.

Given your long holding period, perhaps looking at freehold options would be a safer approach

Firstly, you won’t have to worry about the issue of lease decay, and secondly, should you decide to keep the property as your retirement home, it is an asset you can still pass on to your children in the future.

Here are some of the freehold options that are within 1KM of Catholic High and under $2.8M.

Tresalveo

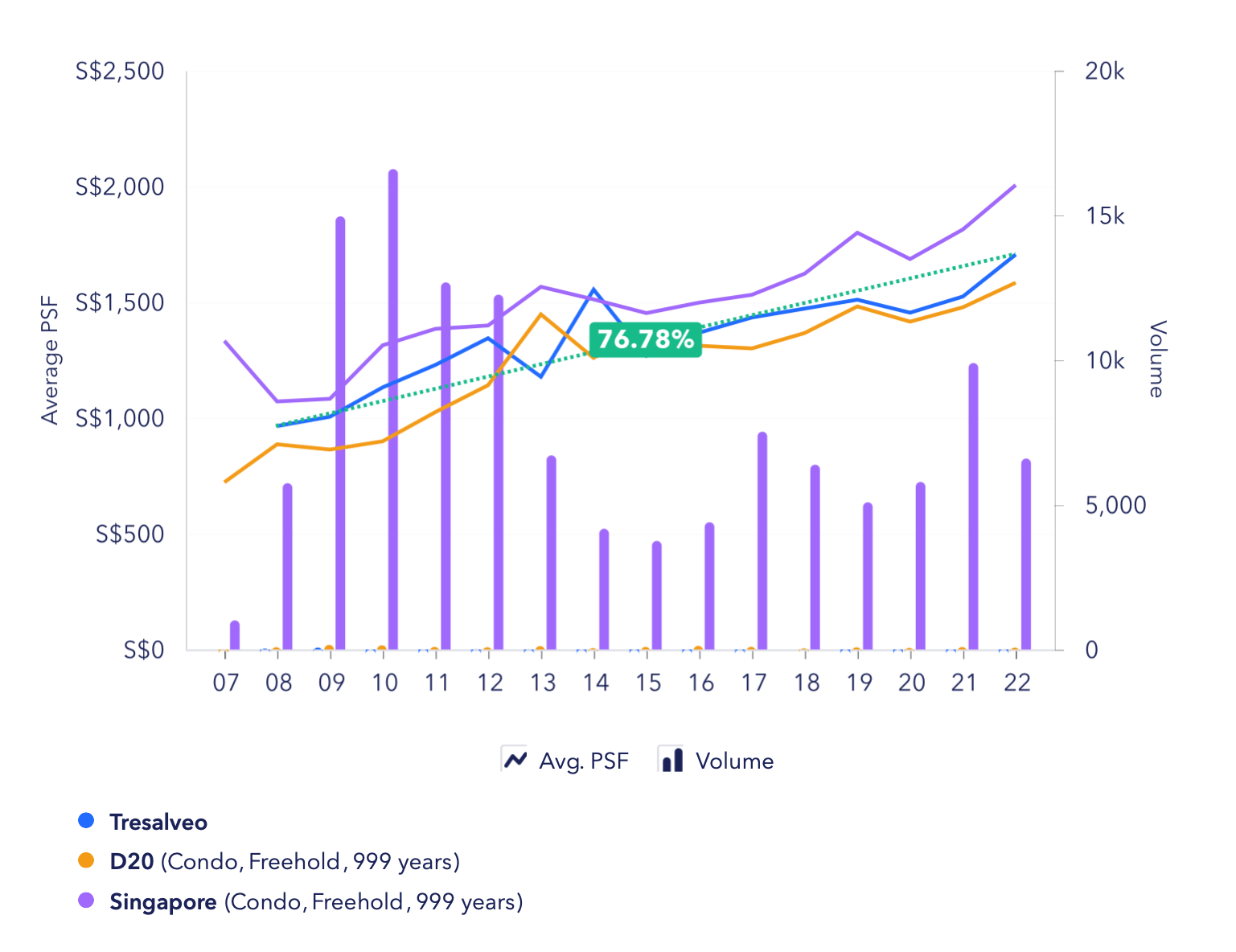

Tresalveo is a small freehold development completed in 2012 and consists of 176 units. There are two 21-storey blocks made up of 1 – 4 bedders.

It’s a 5-minute walk away from Marymount MRT station and Shun Fu Mart which has a variety of eateries as well as a Sheng Siong supermarket. For retail options, Junction 8 and Thomson Plaza are less than 10 minutes drive away.

Project performance

The development has appreciated by 76.78% since its launch and is moving in line with the overall market.

There are no transactions in 2022. These are the most recent 3 bedder transactions which were done in 2021:

| Date | Size (sqft) | PSF | Price | Level |

| Dec 2021 | 1,550 | $1,613 | $2,500,000 | #04 |

| Feb 2021 | 1,550 | $1,439 | $2,230,000 | #09 |

There has been no 4 bedder resale transaction to date (or it could also be the case that no caveat was lodged). One issue with smaller developments is that transaction volumes are usually low. So if you want to purchase a unit here, you may have to be very patient.

Layout

In terms of layout, it’s similar to Clover By The Park where there are bay windows and planters in all the rooms and the balcony so the liveable space is not fully maximised. Other than that, the layouts are pretty spacious and functional. All the bedrooms can comfortably fit a double bed with ample space to move around. There is a wet and dry kitchen that comes attached with a yard, maid’s room, and WC which is great for your family profile.

Boonview

Boonview is also a small freehold development with 120 units and was completed in 2003. It is made up of 1 and 3 bedders in a single 20-storey tower.

The development is located right next to Tresalveo so in terms of accessibility and amenities, they are similar. It’s a 6-minute walk away from Marymount MRT station and Shun Fu Mart, with retail options at Junction 8 and Thomson Plaza.

Project performance

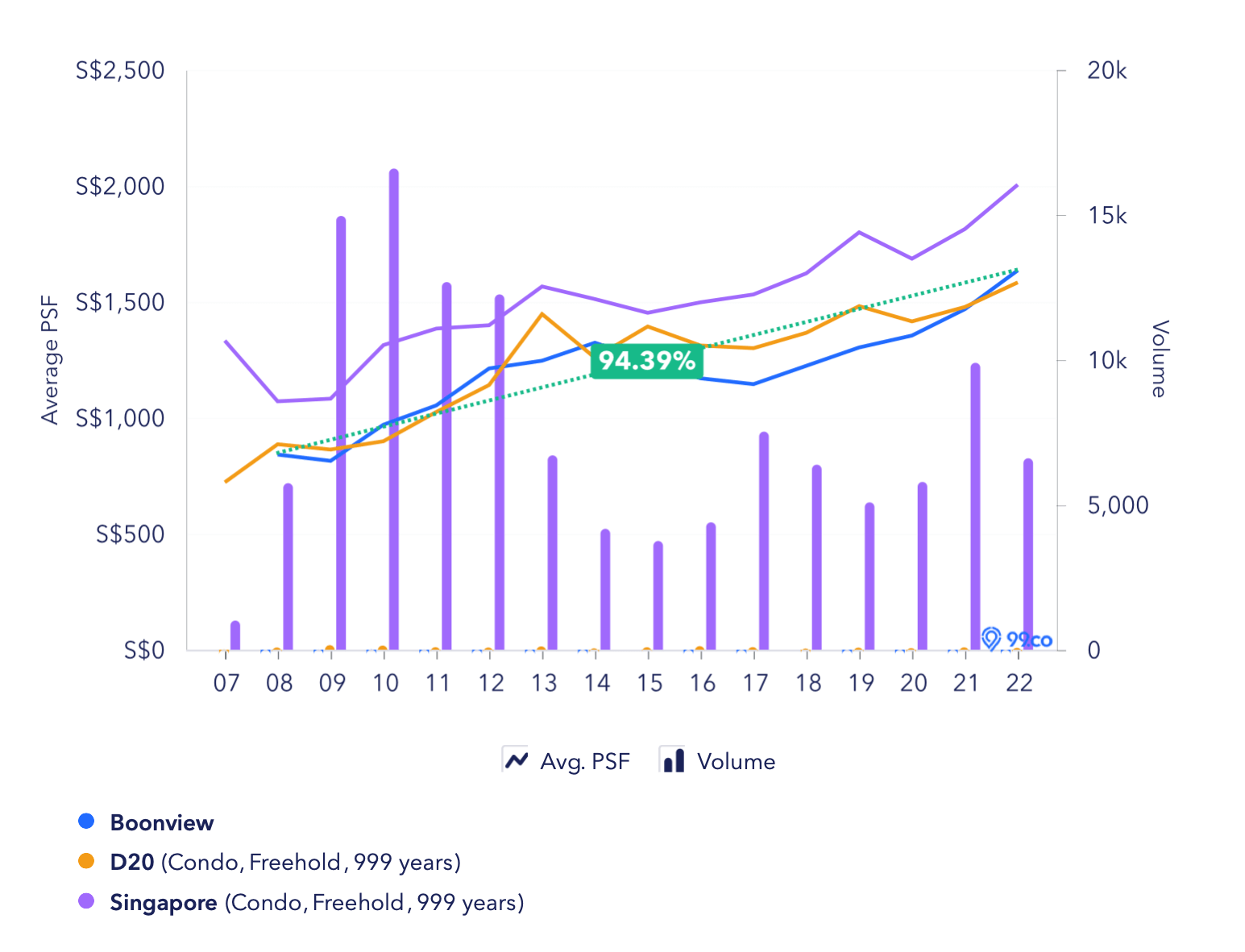

Prices at Boonview have appreciated by 94.39% since its launch and are moving in line with the overall market.

There were two transactions in the last 10 months of 2022, with the 3 bedder transacting at $2.09M:

| Date | Size (sqft) | PSF | Price | Level |

| Sep 2022 | 646 | $1,654 | $1,068,000 | #04 |

| Jan 2022 | 1,292 | $1,618 | $2,090,000 | #06 |

Just as with Tresalveo, the transaction volume at Boonview is also low.

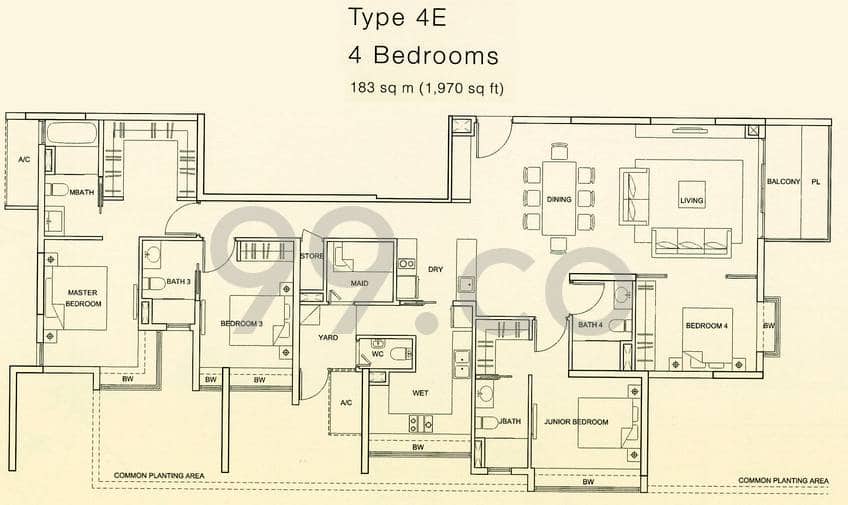

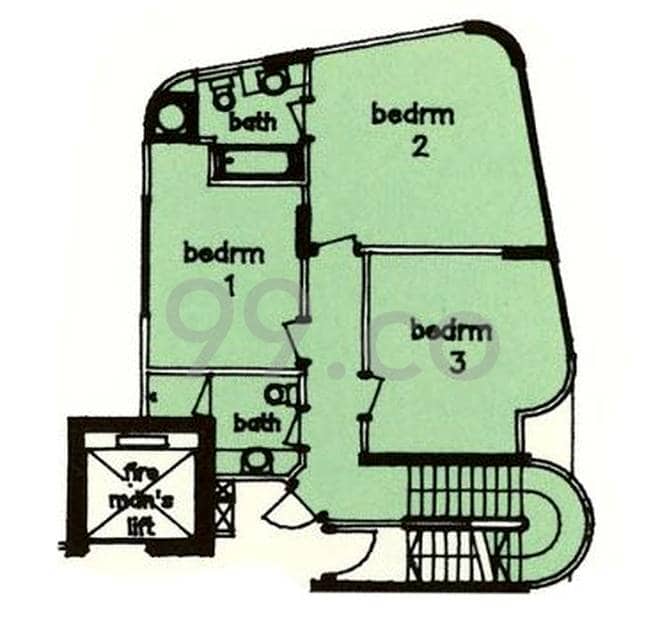

Layout

There are 2 different 3-bedroom floor plans in Boonview, one single storey, and one double storey. The layouts are spacious and functional but due to the shape of the building, certain parts of the unit are not regularly shaped. They do come with a ventilated store that can double as a helper’s room. However, there are no balconies which might be a drawback for individuals who prefer some outdoor space.

Now that we’ve gone through the freehold private property options, there is still one that you could consider – a freehold landed home at Thomson Garden Estate.

Before we get there, there are a couple of things we have to caveat.

First, going by recent transacted prices, it does seem possible based on your estimated affordability. However, we don’t have a way of knowing the conditions of these landed homes (unless you make a trip down to individually suss out each). Unlike condos, each landed home can be in wildly different states, and the lower prices that you see may just be due to these being older and in poorer condition. As such while you can afford the home on paper, with the addition of any renovation or A&A costs, it may no longer be suitable.

It’s also hard for us to determine what is considered to be a suitable condition of a home for you. For example, some people may be okay with a dated exterior as long as the interior is done up, while others may be more insistent on the exterior being modern as well.

Also given the prices, don’t be expecting that these landed homes offer the same perks as bigger landed homes. There’s often little to no garden space for the kids or your dog to run around (let alone park the car sometimes). And there are little inconveniences to think about if you can’t park the car on your own grounds (when it rains etc).

There’s also more maintenance costs and upkeep to possibly think about depending on the age and condition of the space, and more to baby proof in the early years (with the staircases and such).

Nevertheless, it could be worth exploring this option as the perks of acquiring such an asset could make sense if you find the right property.

Thomson Garden Estate

Thomson Garden Estate is a freehold landed enclave located 5 minutes away from the Upper Thomson MRT station. Shunfu Mart, Thomson Plaza, and the numerous eateries along Upper Thomson Road, are all less than 10 minutes walk away so you’re well covered in terms of accessibility and amenities.

The enclave is within 1KM of two renowned primary schools Ai Tong and Catholic High so we can imagine this is a potential draw for families with children.

Project performance

In the last 15 years, prices at Thomson Garden Estate have appreciated by over 200%. Its growth rate in the past two years has been more rampant than the overall market.

| Market Segment | No. of Units In Stock |

| CCR | 12,045 |

| OCR | 46,636 |

| RCR | 14,503 |

| Total | 73,184 |

Given the limited supply of landed properties in Singapore, it is only natural that prices are continuously on an uptrend, especially for those that are freehold/999 years leasehold.

| Date | Address | PSF | Price | Property type | Land size (sqft) |

| Oct 2022 | 33 Jalan Hari Raya | $2,138 | $3,630,000 | Terrace House | 1,697 |

| Sep 2022 | 46 Jalan Chegar | $2,661 | $2,435,000 | Terrace House | 915 |

| Aug 2022 | 30 Jalan Chempah | $2,698 | $2,410,000 | Terrace House | 893 |

| Aug 2022 | 63 Jalan Kuak | $3,165 | $2,800,000 | Terrace House | 885 |

| Jul 2022 | 28 Jalan Chegar | $2,492 | $2,280,000 | Terrace House | 915 |

| Jul 2022 | 20 Jalan Isnin | $1,610 | $3,100,000 | Terrace House | 1,926 |

| Apr 2022 | 98 Jalan Pintau | $2,558 | $2,263,000 | Terrace House | 885 |

| Apr 2022 | 34 Jalan Hari Raya | $1,912 | $3,450,000 | Terrace House | 1,804 |

| Mar 2022 | 24 Jalan Chegar | $1,824 | $4,900,000 | Terrace House | 2,687 |

There were 9 transactions in the last 10 months of 2022 with an average PSF of $2,340 and an average price of $3,029,778. Given its smaller land plots, the overall quantum for Thomson Garden Estate is lower compared to other landed properties in the vicinity.

Finally, should you do a 1 or 2-step move?

Regarding if you should buy another HDB first to save up more before making the jump to a private property, here’s what you have to keep in mind.

As you’ve rightly pointed out, renovation costs are a big factor to think about here. Buying an older HDB in Bishan would likely require major renovation, which is also a concern at this point when renovation costs are still high. There’s also the stamp duty, and costs of selling another home to consider.

It also depends on what property you are planning to move to next, and how much prices could potentially move in the next 10 years.

From a bigger picture, there have been steps taken in 2022 that will probably lead to HDB prices coming down in the next few years. Measures such as faster building times of 3 years for some Tengah BTOs, more BTO supply coming up, and what happens when the older generation passes on means that we can’t be expecting what has happened in the last 2 years to continue.

Especially if the math works out for a landed home in Thomson Garden Estate right now, it’s also worth considering that even though the prices are at a high right now – the supply of freehold landed homes are scarce and will never increase in supply – it’s only going to get more expensive over time.

It’s not an easy question to answer right now given the high-interest rate environment, and what looks to be an uncertain economic situation. Ultimately, this would be down to the security of your jobs, and also the future progression of it – something that you will have to balance the risk vs reward for yourselves.

Conclusion

Despite the good performance of Clover By The Park and Bishan HDB executive units thus far, lease decay is a concern given your holding period of 17 – 18 years. With such a long holding period, a freehold property might be a better store of value whether you’re planning to sell it down the road or keep it as a retirement home and pass it on to your kids.

Of course, it will definitely be less straining on your finances initially if you were to purchase an HDB first before moving to a private property. However, you may eventually be paying a higher mortgage for the private as prices increase while your loan tenure decreases. Moving directly to a private property will allow you to maximise your loan tenure of 30 years currently.

So which would be a better choice?

Tresalveo and Boonview are both small developments with low transaction volumes. Both projects have appreciated well since their launch but generally, prices of small developments like these tend to grow slower because a healthy turnover rate is required in order for their valuation to go up. Also, you will not know how long you’ll have to wait until a unit comes up on the market.

The same issue applies to buying a landed home, you’ll never quite know when a suitable one would pop up.

That said, we do think a freehold landed home makes sense for your requirements right now. Besides the convenient location, being within 1km of Cat High Primary, it fulfills your primary objective of value retention over a long holding period.

Being a freehold landed enclave, we can expect prices of Thomson Garden Estate to continue staying on the uptrend and it also has a healthy number of transactions. Freehold landed homes are limited in supply, and will continue to be so well into the future, thus giving it some form of defensive pricing. Its lower entry price compared to the surrounding landed properties today, as well as its proximity to 2 renowned primary schools, are possible contributing factors to its price stickiness.

Have a question to ask? Shoot us an email at stories@stackedhomes.com – and don’t worry, we will keep your details anonymous.

For more news and information on the Singapore private property market or an in-depth look at new and resale properties, follow us on Stacked.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Property Advice

Property Advice These Freehold Condos Near Orchard Haven’t Seen Much Price Growth — Here’s Why

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Property Advice We Can Buy Two HDBs Today — Is Waiting For An EC A Mistake?

Property Advice I’m 55, Have No Income, And Own A Fully Paid HDB Flat—Can I Still Buy Another One Before Selling?

Latest Posts

Singapore Property News This 88-Year Leasehold HDB Shophouse on Bedok Reservoir Rd Is on Sale for $4M

Singapore Property News We Toured A New Co-Living Space In Bugis With Ice Baths, Gyms And Chef Dinners

On The Market Here Are Some Of The Cheapest Newly MOP 4-Room HDB Flats You Can Still Buy

0 Comments