6 Often Overlooked Factors When Upgrading From An HDB To A Condo In 2021

Get The Property Insights Serious Buyers Read First: Join 50,000+ readers who rely on our weekly breakdowns of Singapore’s property market.

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

When it comes to upgrading your HDB, one of the main concerns is whether to buy a new home first, or sell your existing place first. There are pros and cons to both; and while you may have heard the main concerns (e.g., having to service two home loans), there are other, often overlooked details. Here are the issues that most often catch upgraders off-guard:

Common mistakes to watch out for when upgrading:

- Forgetting the OTP is negotiable

- Losing the intended unit because you wait to sell first

- Misunderstanding the terms of ABSD remission

- No preparation for renovation delays and costs

- No contingency plan for staying longer

- Selling first, then realising you have nothing to buy

1. Forgetting the OTP is negotiable

The standard length of the Option To Purchase is between 14 to 21 days. This is how long you have to exercise the Option; failure to do so means forfeiting all or some of the deposit.

Upgraders often forget, however, that the validity period of the OTP can be extended. With URA’s permission, the OTP can be extended all the way to 12 weeks for new launches. This gives you up extra “breathing room” if you expect to face financing difficulties, or want to wait a little longer till your existing home is sold. For resale, it’s really negotiable between buyers and sellers and can even go to 3 years!

There are two people who can help you to negotiate this: the first is your conveyancing lawyer, who can suggest changes to the OTP document. The second is your property agent: ask your realtor to negotiate with the seller, to try and push back the deadline.

2. Losing the intended unit because you wait to sell first

As of 2021, it’s been a common consensus so far that selling is generally easier than buying. Demand is at a peak: while there are probably a lot more people wanting to buy your house, you’re also competing with others for a desirable unit when it is your turn to buy.

If you wait two or three months to sell your flat, you may find the most desirable units or stacks are gone by the time you’re done. Two examples of this would be the recent Pasir Ris 8 launch (415 of 487 units sold over launch weekend), and Midtown Modern (340 of 558 units sold over launch, 90 per cent of the 1/2 bedroom units sold out).

You can see that, with certain high demand projects, there may be no time to sell your flat before buying. So in certain scenarios (if your flat is an easy sale), it may be smarter to look out for an ideal unit first while preparing your unit for sale. You’d want to have a clearly planned out strategy for this, to avoid making hasty decisions later on.

We will also point out that, for properties that are difficult to sell, owners may want to consider really planning out the timelines properly. For example, if you own a resale HDB with very little left on its lease (tough for your buyer to secure financing), it might be best to speak to a property agent who has just made transactions in your desired property; they can give you a reasonable estimate on how long you can afford to wait.

3. Misunderstanding the terms of ABSD remission

ABSD is payable within 14 days of buying your new home, whether or not you’re selling your previous home. This can be paid in cash or CPF.

(An exception is if you’re upgrading from a flat to an EC, in which case there’s no ABSD upfront).

You can apply for ABSD remission afterward if your previous home is sold within six months. Note that this means six months after the TOP date of your new home (if uncompleted), or six months of the date of purchase of your new home, whichever is earlier.

Property Market CommentaryABSD remission in Singapore – Everything you need to know

by Druce TeoDo note that, in the slim chance your new property is sold or changes ownership before the sale of your previous home, you can’t get ABSD remission.

A key detail that some buyers miss is you must remain a married couple, and one of you must be a Singapore Citizen. If both of you are Permanent Residents, for example, or you get divorced before applying for ABSD remission, it won’t be successful.

4. No preparation for renovation delays and costs

Part of the appeal of resale homes, thanks to Covid-19, is that there’s no risk of construction delays.

However, homeowners often jump to the conclusion that they’re “safe” and can move in when they need. It’s often overlooked that contractors are affected by the same issues as the wider construction industry – there’s a shortage of manpower and supplies.

So while there may be no construction delay of six months, you may run into an equally long delay in renovations. On a related note, your contractor may have to use local suppliers and labour, which can run up far higher costs.

This means you need to take into account two issues:

First, the cost of temporary accommodation and storage, in case of delay. Second, you may pay more for carpentry, flooring, or other types of craftsmanship than you’re used to.

One possible alternative is to find a unit where you’re happy with existing renovations. You just need to live with this for a while, and can consider extensive renovation at a later date.

(Though we should point out that, according to some contractors, there’s a good chance prices won’t go back down, now that the market is adjusting to them).

5. No contingency plan for staying longer

One of the benefits of having a (good) real estate agent is that they can effectively negotiate the date of vacant possession.

For upgraders, it can be useful to extend the date before their buyers move in. For example, you might want to stay in your old flat for another month or two after it’s sold, to wait for renovations to be complete. Your realtor can help you to negotiate this with your buyers, thus saving you the cost of temporary accommodation.

As of 2021, the minimum lease is three months – so it might be tough to find accommodation for, say, a four to six-week stretch.

The opposite is also true.

Say you’re buying over a resale condo from its previous owners. If you’re not in a hurry to move in, your real estate agent might be able to negotiate a better deal. There have been cases where the seller agrees to drop the price, in return for being able to stay on for another three to six months.

As the exact timeline varies for each upgrader, it’s good to have someone negotiate this for you, and handle the paperwork. All of these deals should be in the legal documentation, and not by word of mouth.

6. Selling first, then realising you have nothing to buy

One potential hazard is rushing to sell your home first, because you’re being told you can get a good price “right now”.

Then you start looking for a replacement unit, and realise that in 2021, practically all home prices are high. In a worst-case scenario, you could have sold your four or five-room flat, only to find you’re priced out of any condo above 700 sq. ft. It may not feel like much of an upgrade, if your new home is only two-thirds the size of your old one.

This can be mitigated with a more holistic upgrading plan. You should have a good sense of where you intend to buy first, and the likely costs behind it. And to prevent being priced out, you might sometimes have to secure the unit before selling your flat (assuming the financial requirements are all in place).

Recent incidents like the Pasir Ris 8 launch show how fast prices can rise; especially if your intended buy is a popular project. Do have some alternatives lined up, or have your agent work out some contingencies.

Rather than make assumptions about the timeline, get a professional to plan it out for you

The timing of events varies for everyone that is upgrading from an HDB to a condo. We suggest getting a (good) real estate agent to plan the transaction, to avoid having any of the above traps. It just takes a 20-minute conversation to sort out the issue, but it could save you tens of thousands of dollars in lapsed OTPs, or unexpected rental costs. Drop us a message on Stacked, and we can help you with the process.

In the meantime, follow us on Stacked to get the latest reviews of new and resale properties alike.

If you’d like to get in touch for a more in-depth consultation, you can do so here.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Property Advice

Property Advice Most New Condo Buyers in Singapore Forget to Check This Before Buying (Until It’s Too Late)

Property Advice Why I Sold My 40-Year-Old Jurong Flat For A Newer Bukit Panjang One: A Buyer’s Case Study

Property Advice 5 Ways To Get A Better Price For Your Property When The Market Is Changing

Property Advice 5 Telltale Signs to Watch Before Property Prices Move In Singapore

Latest Posts

Editor's Pick Where to Find the Cheapest Landed Homes in Singapore — From Just $888K (Yes, Really)

Property Market Commentary These Condo Owners Lost Up to $1.55 Million — Even During Singapore’s Property Boom. Here’s Why.

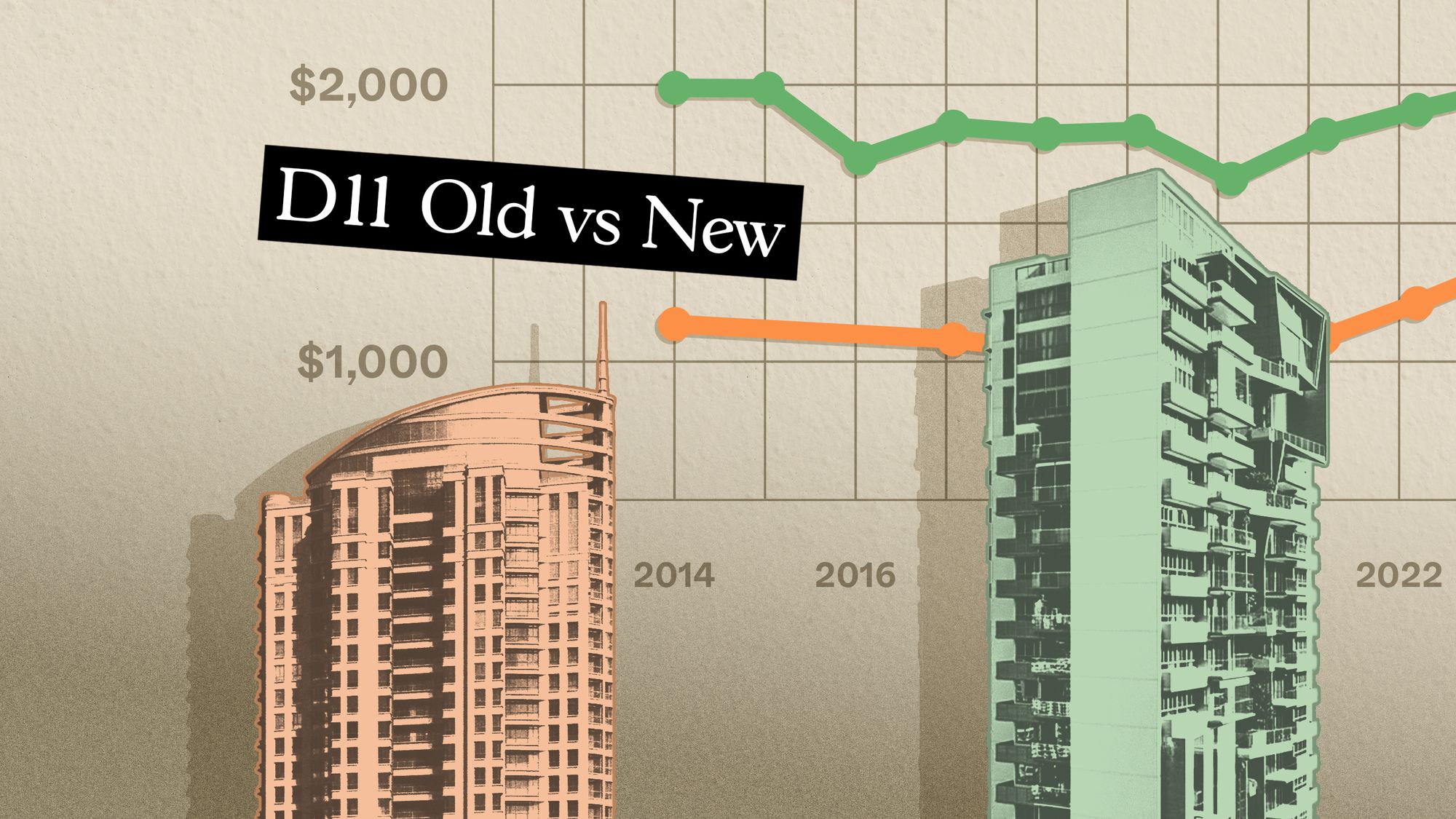

Pro We Compared Family-Sized Units Across Old and New Condos in One of Singapore’s Priciest Districts — Here’s What We Found

Editor's Pick 7 Mega Condos That Are Far From the MRT, Yet Surprisingly Convenient

On The Market We Found 5 of the Cheapest 3-Bedders Near Queenstown MRT Starting Below $2.3M

Landed Home Tours I Toured A Rare Freehold Landed Street In The East Where The Last Home Sold For $4.6M

Singapore Property News Can Singapore Property Prices Really Hit $2,900 PSF By 2030?

Editor's Pick Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

On The Market 5 Spacious Executive Maisonettes Under $850K You Can Still Buy Today

Pro We Compared Old vs New Condos in One of Singapore’s Priciest Neighbourhoods — Here’s What We Found for Smaller Units

Editor's Pick 6 Curiously Abandoned Houses In Singapore And The Stories Behind Them

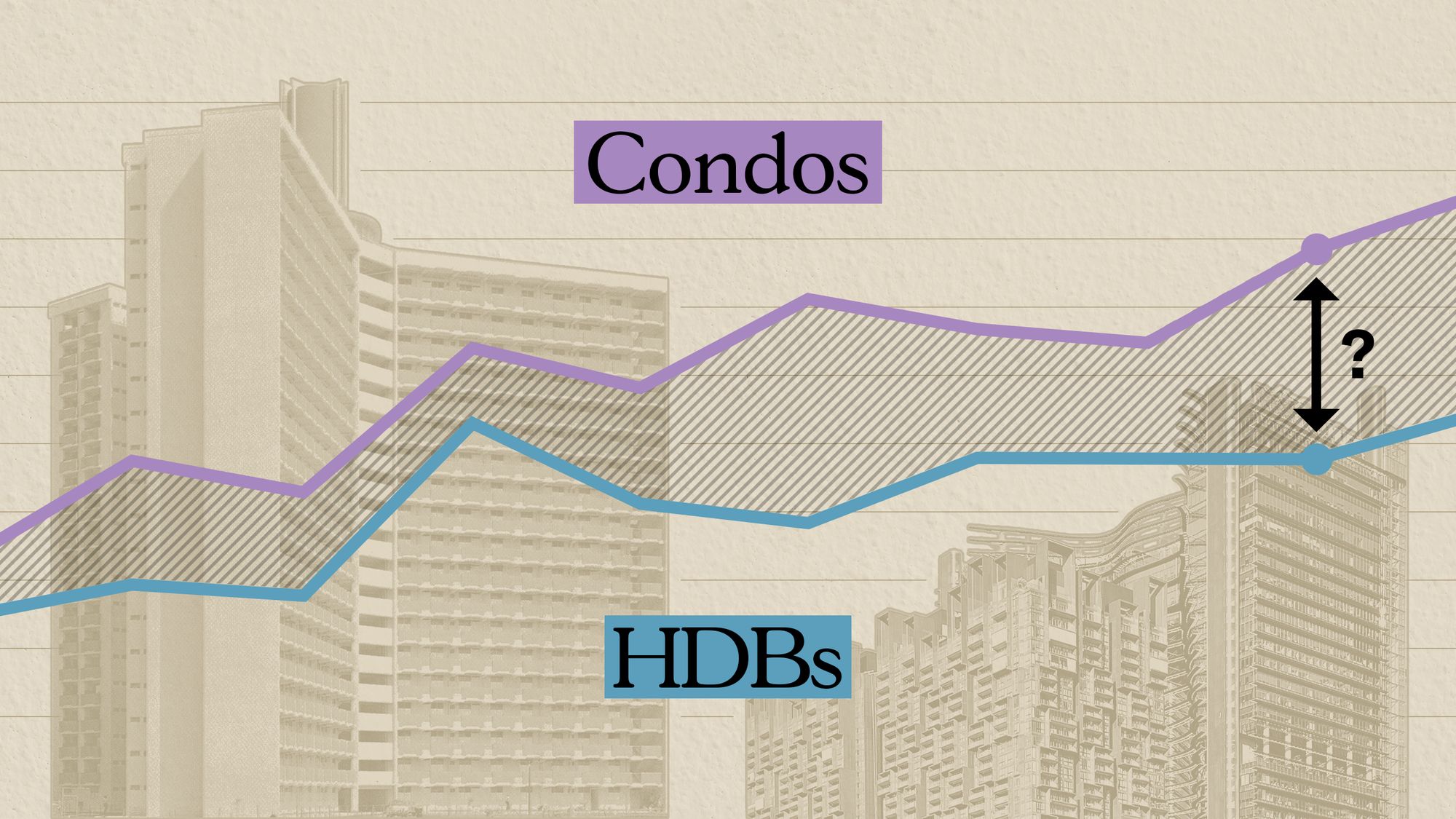

Property Market Commentary Which HDB Towns Are Getting Close To Condo Prices In 2025?

Editor's Pick This New Upper Bukit Timah Condo Starts From $993K: But Would You Trade MRT Convenience for Greenery?

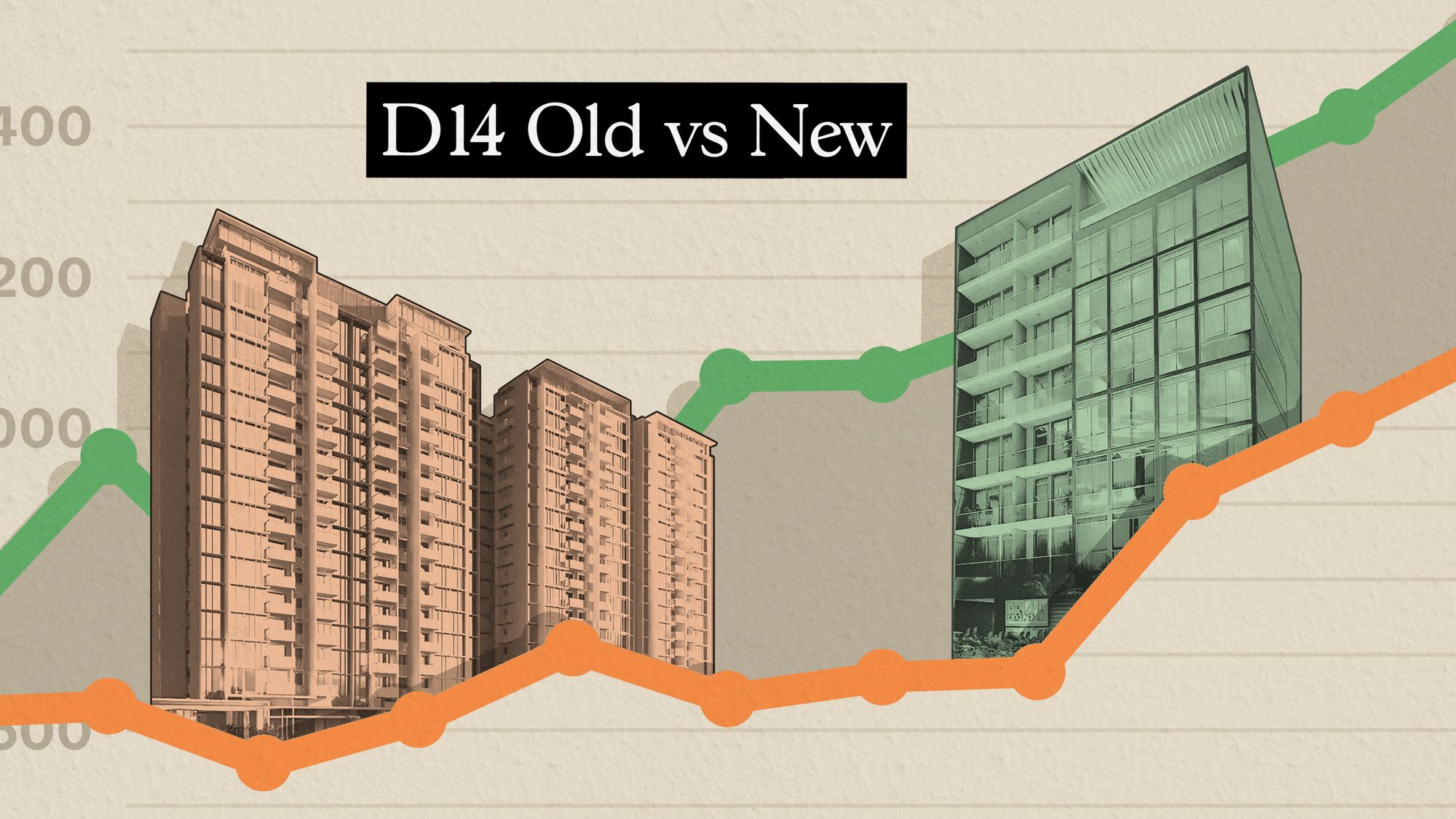

Pro We Compared Old vs New Condos in One of Singapore’s Fastest-Changing Neighbourhoods — Here’s What We Found Out

Editor's Pick “I Didn’t Think Property Prices Could Go Up So Fast Anymore With ABSD” Why One Buyer’s Regret Still Feels Familiar Today