An Updated List Of 22 Executive Apartments In 2022: How Much Have Prices Increased & Where To Find Them

September 22, 2022

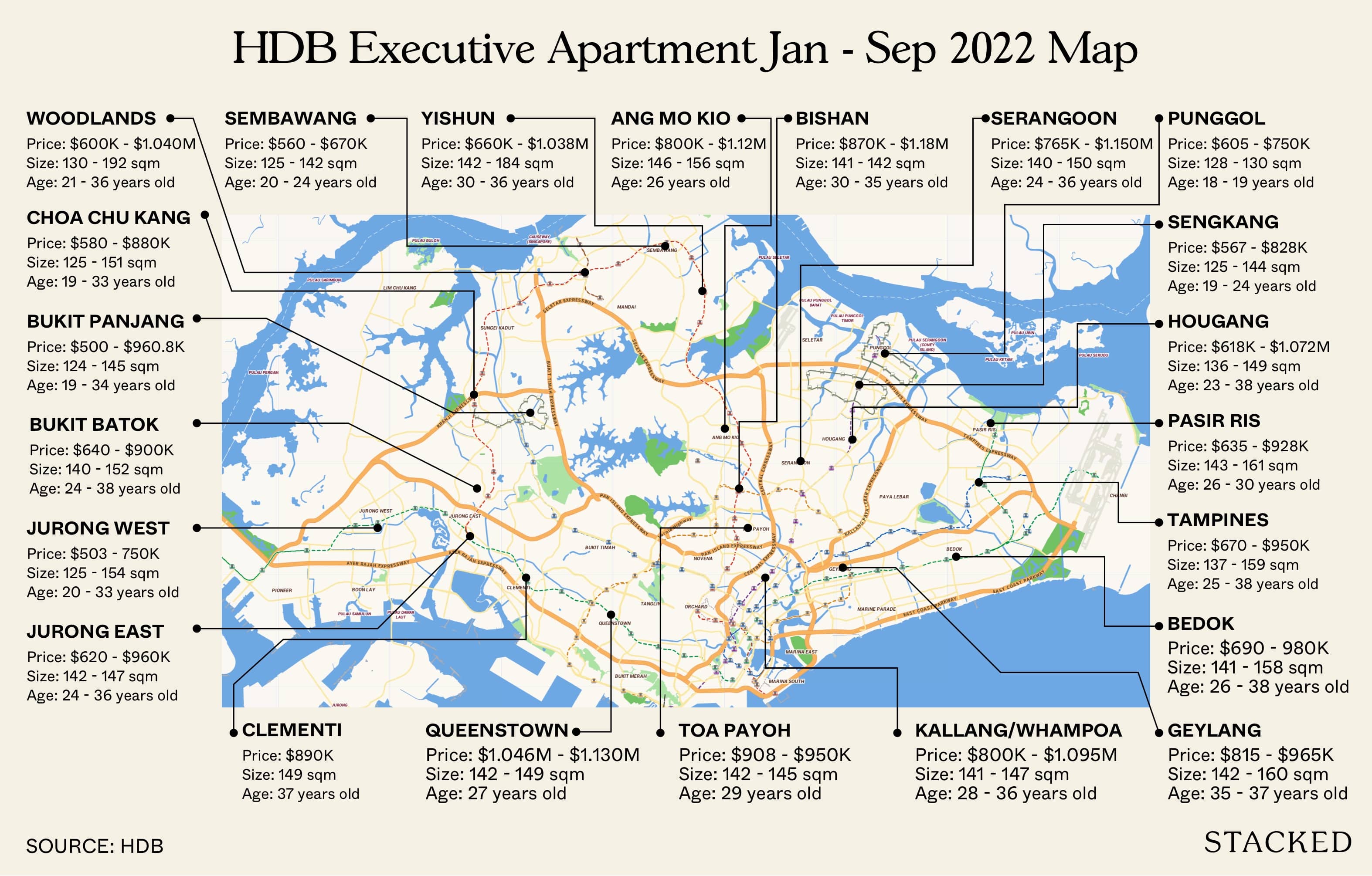

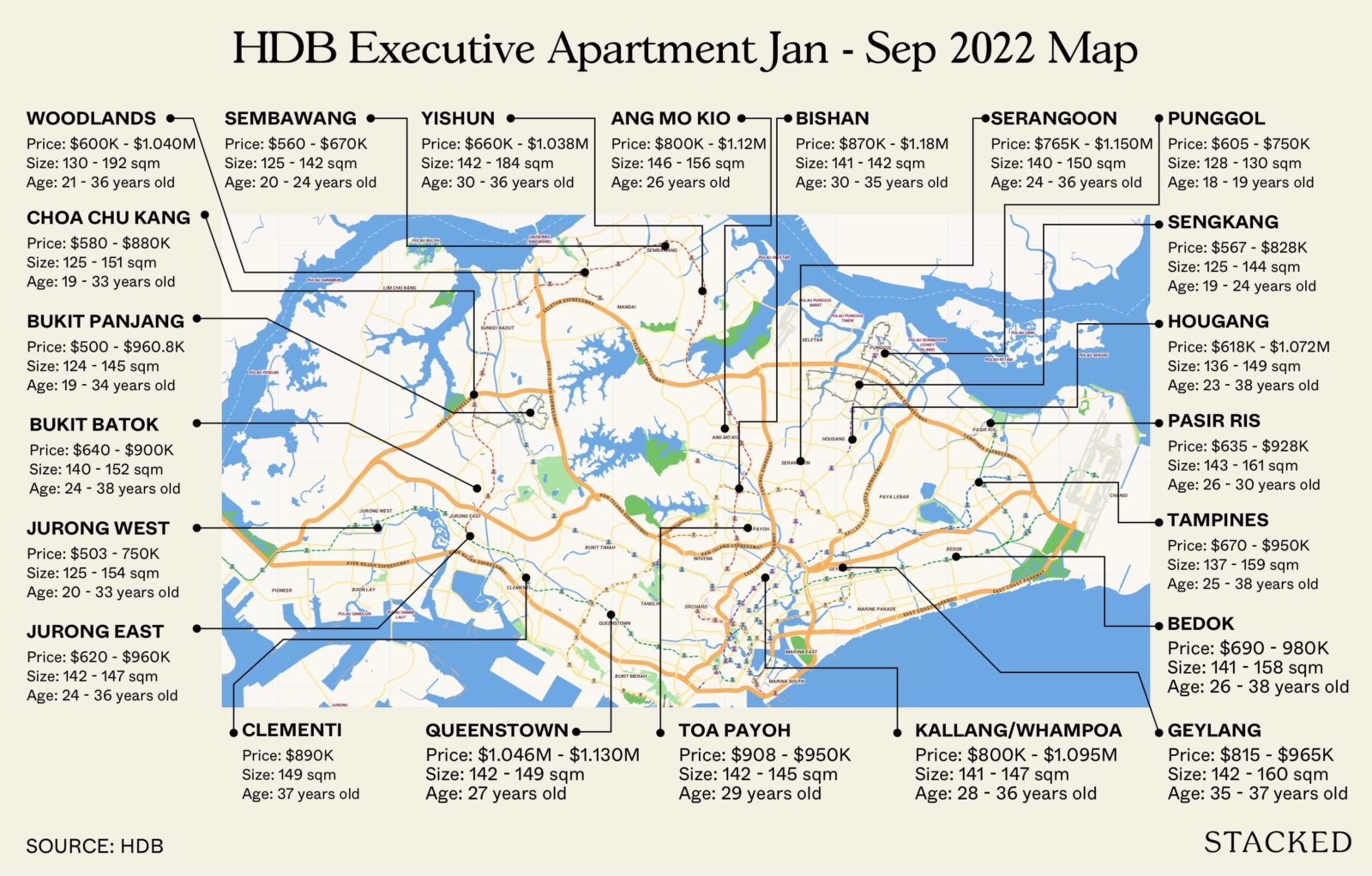

With private housing prices at a new peak, HDB upgraders may find condos are currently out of reach. The next best alternative might be the spacious Executive Apartments (EAs), which go up to a whopping 1,600+ sq. ft. in some areas. At around half the price of a typical new launch condo today, and minus the high maintenance fees, EAs are increasingly on the shortlist of home buyers. Here’s how their prices have moved since last year:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

What are HDB Executive Apartments?

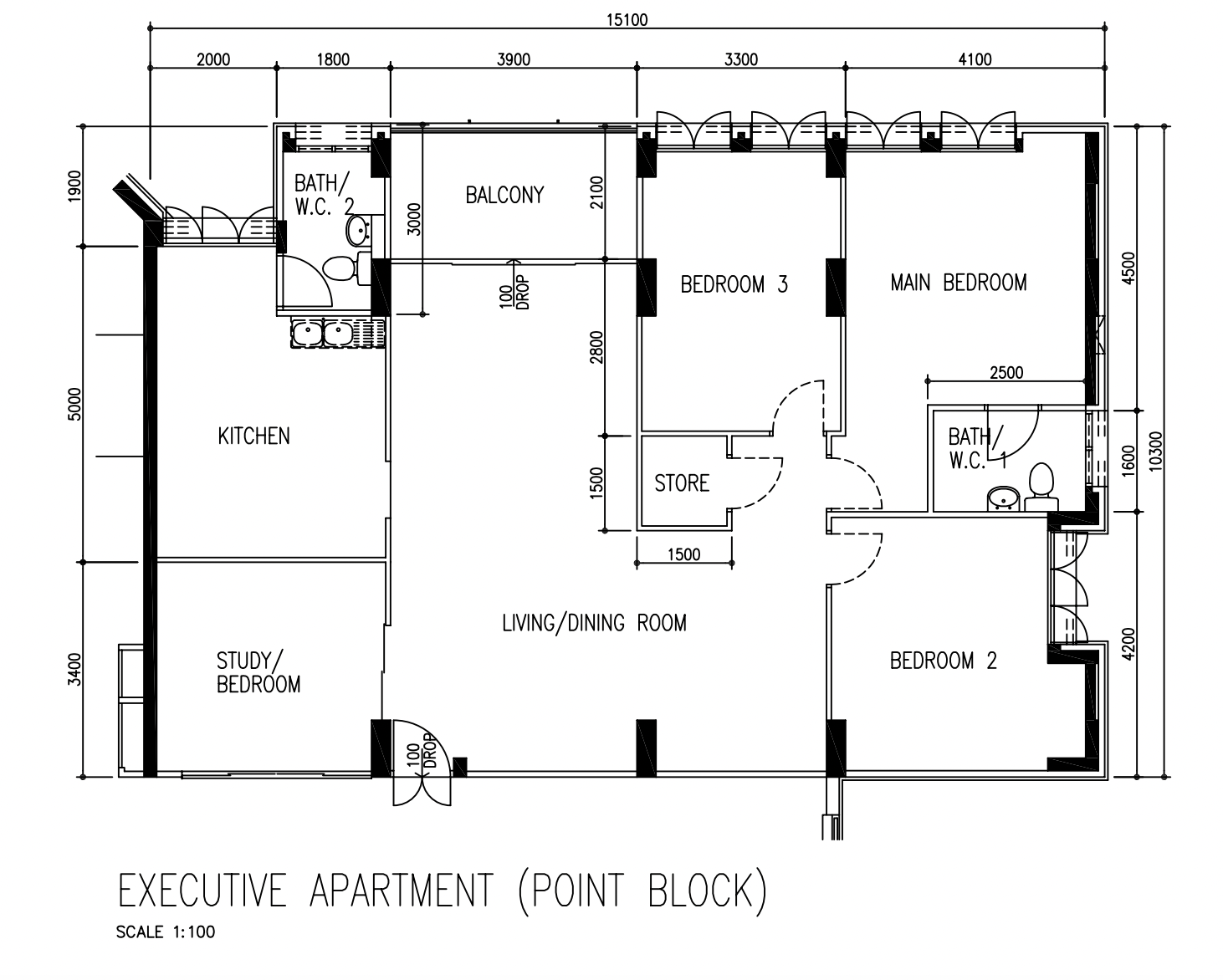

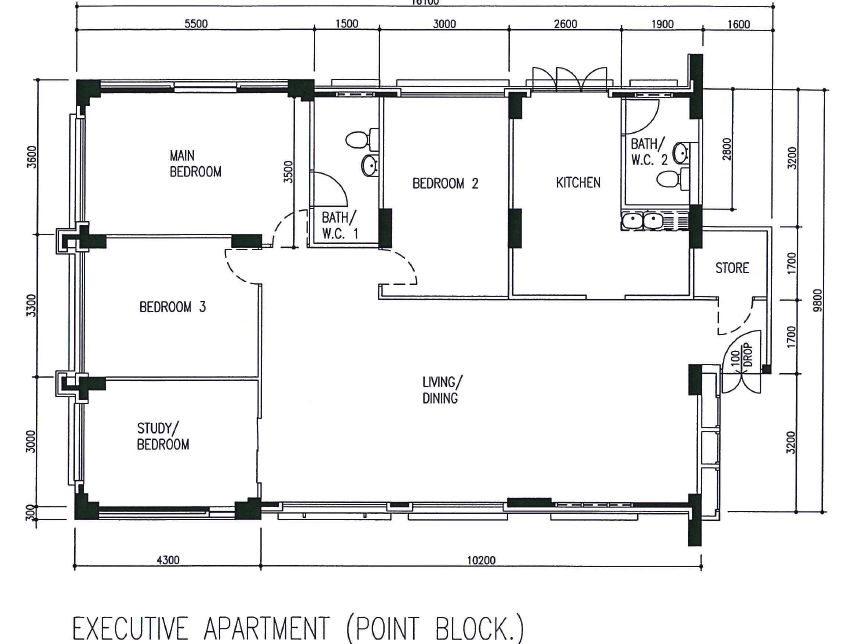

We have a more detailed description in our previous piece. But in short, the first Executive Apartment came about in 1984. Unlike their Executive Maisonette (EM) counterparts which have 2 storeys, EAs are set over just one floor, but they were still among the largest flats built by HDB. At the time, they ranged between 141 to 156 sqm.

Executive Apartments have certain features that you won’t find in many other flats. The main ones are balconies and study rooms (which can be easily reconfigured to other purposes).

Here are some of the various floor plans you can check out too, if you are looking for an HDB Executive Apartment.

We’ve also done several house tours of Executive Apartments if you want to see just how different each can be:

Current EA prices and locations

| HDB EA | No. of Tnx | Price | Average Price | Age | Size |

| Ang Mo Kio | 7 | $800,000 – $1,120,000 | $948,571 | 26 – 26 | 146 – 156 |

| Bedok | 22 | $690,000 – $980,000 | $852,626 | 26 – 38 | 141 – 158 |

| Bishan | 3 | $870,000 – $1,180,000 | $1,059,333 | 30 – 35 | 141 – 142 |

| Bukit Batok | 29 | $640,000 – $900,000 | $773,151 | 24 – 38 | 140 – 152 |

| Bukit Panjang | 37 | $500,000 – $960,800 | $680,756 | 19 – 34 | 124 – 145 |

| Choa Chu Kang | 50 | $580,000 – $880,000 | $679,833 | 19 – 33 | 125 – 151 |

| Clementi | 1 | $890,000 – $890,000 | $890,000 | 37 – 37 | 149 – 149 |

| Geylang | 6 | $815,000 – $965,000 | $915,167 | 35 – 37 | 142 – 160 |

| Hougang | 28 | $618,000 – $1,072,888 | $771,587 | 23 – 38 | 136 – 149 |

| Jurong East | 15 | $620,000 – $960,000 | $844,333 | 24 – 36 | 142 – 147 |

| Jurong West | 89 | $503,000 – $750,000 | $648,424 | 20 – 33 | 125 – 154 |

| Kallang/Whampoa | 5 | $800,000 – $1,095,000 | $954,600 | 28 – 36 | 141 – 147 |

| Pasir Ris | 130 | $635,000 – $928,000 | $749,057 | 26 – 30 | 143 – 161 |

| Punggol | 21 | $605,000 – $750,000 | $655,411 | 18 – 19 | 128 – 130 |

| Queenstown | 4 | $1,046,000 – $1,130,000 | $1,089,000 | 27 – 27 | 142 – 149 |

| Sembawang | 47 | $560,000 – $670,888 | $614,767 | 20 – 24 | 125 – 142 |

| Sengkang | 84 | $567,000 – $828,000 | $678,175 | 19 – 24 | 125 – 144 |

| Serangoon | 12 | $765,000 – $1,150,000 | $903,083 | 24 – 36 | 140 – 150 |

| Tampines | 61 | $670,000 – $950,000 | $793,453 | 25 – 38 | 137 – 159 |

| Toa Payoh | 2 | $908,000 – $950,000 | $929,000 | 29 – 29 | 142 – 145 |

| Woodlands | 118 | $600,000 – $1,040,000 | $779,457 | 21 – 36 | 130 – 192 |

| Yishun | 31 | $660,000 – $1,038,000 | $802,941 | 30 – 36 | 142 – 187 |

Most notable price movements since last year

The biggest price increases happened in the following neighbourhoods:

- Yishun (+10.6%)

- Kallang / Whampoa (+9.5%)

- Bishan (+9.5%)

- Choa Chu Kang (+7.7%)

- Tampines (+7.1%)

| HDB EA | 2021 | 2022 | Price Change | % Change |

| Ang Mo Kio | $910,793 | $948,571 | +$37,779 | +4.1% |

| Bedok | $797,940 | $852,626 | +$54,686 | +6.9% |

| Bishan | $967,600 | $1,059,333 | +$91,733 | +9.5% |

| Bukit Batok | $730,566 | $773,151 | +$42,585 | +5.8% |

| Bukit Panjang | $680,259 | $680,756 | +$497 | +0.1% |

| Bukit Timah | $1,027,500 | None | ||

| Choa Chu Kang | $631,087 | $679,833 | +$48,746 | +7.7% |

| Clementi | $879,000 | $890,000 | +$11,000 | +1.3% |

| Geylang | $910,444 | $915,167 | +$4,722 | +0.5% |

| Hougang | $736,876 | $771,587 | +$34,712 | +4.7% |

| Jurong East | $810,707 | $844,333 | +$33,626 | +4.1% |

| Jurong West | $619,548 | $648,424 | +$28,875 | +4.7% |

| Kallang/Whampoa | $871,438 | $954,600 | +$83,163 | +9.5% |

| Pasir Ris | $705,905 | $749,057 | +$43,153 | +6.1% |

| Punggol | $615,151 | $655,411 | +$40,260 | +6.5% |

| Queenstown | $1,089,333 | $1,089,000 | -$333 | -0.0% |

| Sembawang | $581,541 | $614,767 | +$33,226 | +5.7% |

| Sengkang | $638,940 | $678,175 | +$39,234 | +6.1% |

| Serangoon | $860,842 | $903,083 | +$42,241 | +4.9% |

| Tampines | $740,730 | $793,453 | +$52,723 | +7.1% |

| Toa Payoh | $941,225 | $929,000 | -$12,225 | -1.3% |

| Woodlands | $728,886 | $779,457 | +$50,571 | +6.9% |

| Yishun | $725,987 | $802,941 | +$76,954 | +10.6% |

More from Stacked

Units Of The Week Issue #39

Seeing how we've written about Sentosa properties recently, it seemed like such an obvious choice to hone on in this…

Note that for Geylang, Queenstown, and Toa Payoh, the transaction volumes were very low; this would account for the price movement being mainly flat, or showing a slight dip.

The real eye-opener this year has been Yishun, with the average quantum for EAs in this estate is now $802,941. This may be due in part to the following three transactions this year:

| Month | Address | Storey Range | Size (Sqm) | Type | Lease Commencement | Lease Remaining | Price | Age |

| 2022-06 | 608 YISHUN ST 61 | 01 TO 03 | 164 | Apartment | 1992 | 68 years 11 months | $1,000,000 | 30 |

| 2022-05 | 664 YISHUN AVE 4 | 07 TO 09 | 181 | Apartment | 1992 | 69 years 02 months | $1,000,888 | 30 |

| 2022-02 | 652 YISHUN AVE 4 | 04 TO 06 | 187 | Apartment | 1992 | 69 years 04 months | $1,038,000 | 30 |

In any case, the average EA price in Yishun is now surprisingly higher than the average in Tampines ($793,453) – this is despite Tampines being a mature estate, and the regional centre of the east!

Choa Chu Kang is another non-mature area with a notable price jump. The causes are less apparent, but one realtor mentioned the August 2022 BTO launch exercise. He said that those who fail to obtain a BTO flat, but are insistent on the location, sometimes turn to nearby resale options.

The realtor also noted that Choa Chu Kang will see improved connectivity with the Jurong Region Line, for which Choa Chu Kang MRT station will be an interchange. This improved accessibility will take the estate one step further from its current “ulu” status.

The rising prices in Kallang/Whampoa, Bishan, and Tampines should come as no surprise: resale flat prices are at a new peak in Singapore, and these mature estates are long-time favourites. Do note, however, that Tampines seems on average the cheapest among these hotspots.

A quick note on Tampines

One realtor we spoke to had an opinion about Tampines showing the lowest average EA price.

She noted that recent EA listings in Tampines have been in locations such as Tampines Street 32 to Street 45. These EAs are close to Tampines East MRT station (Downtown Line), but this is not the part of Tampines that most people are attracted to. The “hot spot” for Tampines is the cluster of three malls (Tampines Mall, Tampines 1, and Century Square) and the Tampines MRT station (East-West Line).

She noted that, if you look for EAs along Tampines Avenue 5 – which is within a five to seven minutes walk of Tampines MRT, there are few listings that will go below the $980,000.

So Tampines is a rather large estate, and be aware that the prices can diverge significantly as you get closer to Tampines MRT.

EA prices still have room to rise

EA prices are benefitting from a number of factors, similar to the ones we highlighted for Maisonettes. It’s a combination of high demand from the aftermath of Covid-19, and limited supply (even with ramped up production, HDB needs four to five years to build a BTO development).

Another factor are the high prices in the private property market – we’ve seen new launches like AMO Residence and Lentor Modern hit $2 million for three-bedder units.

In light of a pricey private home market, HDB upgraders may set their sights on a larger flat instead; especially with home loan rates climbing (depending on their income level, many EA buyers may be told to get a bank loan instead of an HDB loan).

Barring a drastic change, such as new policy measures to curb Cash Over Valuation (COV), there doesn’t seem to be much reason for EA prices to fall anytime soon.

For more on the situation as it unfolds, follow us on Stacked. You can also visit us for in-depth reviews of new and resale projects alike.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

What are HDB Executive Apartments and how do they differ from other flats?

How have the prices of Executive Apartments changed in recent years?

Which neighborhoods have seen the biggest price increases for Executive Apartments?

Why are prices of Executive Apartments in areas like Choa Chu Kang and Yishun rising?

Are there still opportunities for Executive Apartment prices to increase further?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Picks

Property Picks Where to Find Singapore’s Oldest HDB Flats (And What They Cost In 2025)

Property Picks Where To Find The Cheapest 2 Bedroom Resale Units In Central Singapore (From $1.2m)

Property Picks 19 Cheaper New Launch Condos Priced At $1.5m Or Less. Here’s Where To Look

Property Picks Here’s Where You Can Find The Biggest Two-Bedder Condos Under $1.8 Million In 2025

Latest Posts

Singapore Property News This Rare Type Of HDB Flat Just Set A $1.35M Record In Ang Mo Kio

Singapore Property News A Rare New BTO Next To A Major MRT Interchange Is Coming To Toa Payoh In 2026

Singapore Property News New Tampines EC Rivelle Starts From $1.588M — More Than 8,000 Visit Preview

0 Comments