This Secret Hack Gets You The Best New Launch Units In Singapore

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.

There’s a secret exploit for getting the exact unit you want at a launch

Here’s the thing, the real secret to getting a profitable property (other than identifying the right one) is to get a good ballot number. You may have done everything right but still secured a terrible ballot number – in which case you may either not be able to buy any unit at all, or the prices may have risen to a state where it doesn’t make any more sense.

As such from the recent hype over the latest new launches, we’ve heard of buyers adopting a different strategy. That is – to just apply for all the launches, and see which ballot number would be the best (which is probably why some developments like Chuan Park had their sales launch moved forward to get ahead of the curve).

After all, it’ll probably be better to get a good ballot number at say, Nava Grove, than it would be to get a bad number at Emerald of Katong.

Here’s another more extreme strategy, but it’s also simpler than you think: just be a property agent. This isn’t a joke by the way, we’ve heard that some buyers that weren’t able to secure a unit sound quite serious about it.

We all ballot for the units we want; but if the person buying a unit is, say, an actual property agent, then they’re always going to be ahead of the curve. As is, they already know about an upcoming launch, long before the rest of the market; and if they want to buy a unit for their own gains, they have the added edge of jumping the queue and inside information.

This wasn’t so much a thing until the recent mega launches like Emerald of Katong and Chuan Park, where we saw a large number of agents putting down cheques to join – except that they had an earlier queue before the public launch. Hence the “joke” that maybe, buyers should all sign up and take the exams to be property agents themselves. Hey, it comes with the guarantee of at least one transaction you’ll be closing.

More from Stacked

Here’s How Much I Made In My First Year As A Property Agent (Complete Breakdown)

Google property agent income and just take a look at the number of results that is out there.

What is serious though, is the rumblings coming from the market. Increasingly, I hear buyers express the sentiment that this isn’t transparent or fair. Some complain that a better-informed and privileged minority is being allowed to buy, rent, and sell in the same market as them. Others say it distorts the number of “real” transactions at a launch.

There is, also, the obvious issue that getting the jump on others means a lot of money. A good ballot number can be the difference between making a substantial profit that isn’t just 5 figures. It’s not hard for agents to quickly identify the unit with the best possible traits, and secure them before anyone else gets a shot at buying. The windfall may even come very quickly, such as during a sub sale transaction as they’ve essentially gotten the earliest units.

For now, there isn’t any word from authorities on whether they intend to manage all this. But if the rumblings get louder, I suspect we may see some form of action; especially with the number of launches on the horizon.

Speaking of new launches, can we say again: STOP PUTTING DOWN TONS OF MONEY UPFRONT FOR YOUR RENOVATION

It’s happened again: a contractor ghosted a client after taking $152,000 in deposits for a $252,000 project (it was a big penthouse, hence the cost). Perhaps it’s because Singapore is such a low-crime, low-corruption country; but it surprises me how trusting some people are with these services.

Given the number of new home transactions coming up soon – especially after Chinese New Year – I’m willing to bet CASE is going to have a gigantic file of complaints about this issue again – a whole ring binders full of complaints, heavy enough to herniate an intern.

Please don’t join the ranks and add to those binders: pay your contractor according to milestones reached, and never pay a huge sum all at once. Even if they were referred by a friend or relative, or actually are a friend or relative.

*I’m referring to the five per cent cash down for a bank loan

Also upcoming next year: a property tax break

There’s going to be a tax rebate of up to 20 per cent for homeowners, sometime in 2025. This has been confirmed by IRAS, but note that it’s only for owner-occupiers. Sorry, landlords.

The rebate is the full 20 per cent for HDB flats and 15 per cent or $1,000 (whichever is higher) for private properties.

This is to cushion the cost-of-living issues we’re facing today. I mean, there could be other alternatives, like maybe toning down the GST during this tough time. But what do I know? I’m sure some expert has worked out how this one-time tax rebate is going to make a huge difference to our problems.

Meanwhile in other property news:

- Want a bigger executive flat? Here are the cheapest ones, from just $670,000!

- A lot of new homes are coming up soon; but before you move in with the in-laws, think about these issues.

- Freehold walk-up apartments near MRT stations: not always pretty and kind of old, but you do get incredible convenience.

- Here are the most profitable ECs after hitting the resale market, in 2024.

Weekly Sales Roundup (25 November – 01 December)

Top 5 Most Expensive New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| MIDTOWN MODERN | $5,888,000 | 1808 | $3,256 | 99 yrs (2019) |

| UNION SQUARE RESIDENCES | $5,114,000 | 1518 | $3,370 | 99 yrs |

| KLIMT CAIRNHILL | $4,664,020 | 1432 | $3,258 | FH |

| GRAND DUNMAN | $4,445,000 | 1927 | $2,307 | 99 yrs |

| THE RESERVE RESIDENCES | $4,235,000 | 1625 | $2,606 | 99 yrs |

Top 5 Cheapest New Sales (By Project)

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| KASSIA | $1,032,000 | 474 | $2,179 | FH |

| THE COLLECTIVE AT ONE SOPHIA | $1,181,000 | 431 | $2,743 | 99 years |

| EMERALD OF KATONG | $1,437,000 | 484 | $2,967 | 99 years |

| MIDTOWN MODERN | $1,488,000 | 409 | $3,638 | 99 yrs (2019) |

| HILL HOUSE | $1,527,000 | 452 | $3,378 | 999 years |

Top 5 Most Expensive Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| THE CLAYMORE | $7,900,000 | 2680 | $2,948 | FH |

| THE RESIDENCES AT W SINGAPORE SENTOSA COVE | $6,191,600 | 3272 | $1,892 | 99 yrs (2006) |

| THE GRANGE | $4,970,000 | 2077 | $2,392 | FH |

| ISLAND VIEW | $4,800,000 | 3498 | $1,372 | FH |

| THE IMPERIAL | $4,612,500 | 1905 | $2,421 | FH |

Top 5 Cheapest Resale

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | TENURE |

| PEOPLE’S PARK COMPLEX | $590,000 | 409 | $1,442 | 99 yrs (1968) |

| EASTWOOD REGENCY | $700,000 | 452 | $1,548 | FH |

| THE ALPS RESIDENCES | $740,000 | 441 | $1,677 | 99 yrs (2015) |

| PALM ISLES | $750,000 | 517 | $1,452 | 99 yrs (2011) |

| THE PROMENADE@PELIKAT | $768,000 | 484 | $1,586 | FH |

Top 5 Biggest Winners

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| ISLAND VIEW | $4,800,000 | 3498 | $1,372 | $3,500,000 | 19 Years |

| PANDAN VALLEY | $3,450,000 | 2239 | $1,541 | $2,509,620 | 23 Years |

| THE MARBELLA | $3,800,000 | 1625 | $2,338 | $2,500,000 | 22 Years |

| THE CLAYMORE | $7,900,000 | 2680 | $2,948 | $2,300,000 | 18 Years |

| TWIN REGENCY | $3,100,000 | 1442 | $2,149 | $2,082,500 | 18 Years |

Top 5 Biggest Losers

| PROJECT NAME | PRICE S$ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE PEAK @ CAIRNHILL II | $1,838,888 | 904 | $2,034 | -$517,112 | 6 Years |

| DEVONSHIRE RESIDENCES | $1,050,000 | 495 | $2,121 | -$150,000 | 6 Years |

| RV SUITES | $1,030,000 | 560 | $1,840 | -$34,000 | 12 Years |

| HILLOCK GREEN | $2,335,000 | 1023 | $2,283 | -$20,000 | 1 Month |

| SOPHIA HILLS | $1,180,000 | 570 | $2,068 | $6,000 | 7 Years |

Transaction Breakdown

Follow us on Stacked for more on the Singapore property market as it happens.

Ryan J

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Read next from Singapore Property News

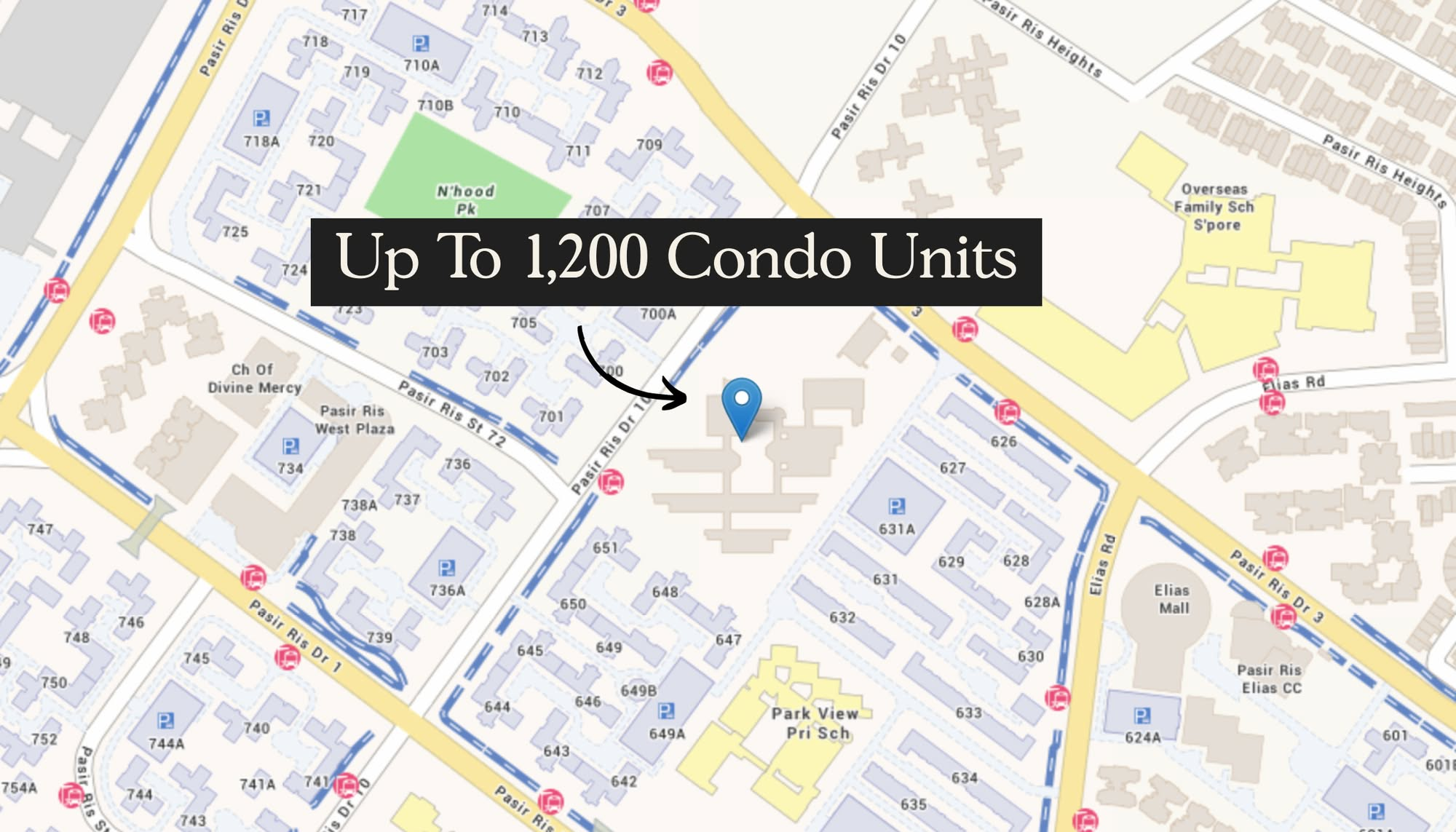

Singapore Property News 5 Former School Sites In The East Are Now Zoned For Homes In Singapore: Here’s What We Know

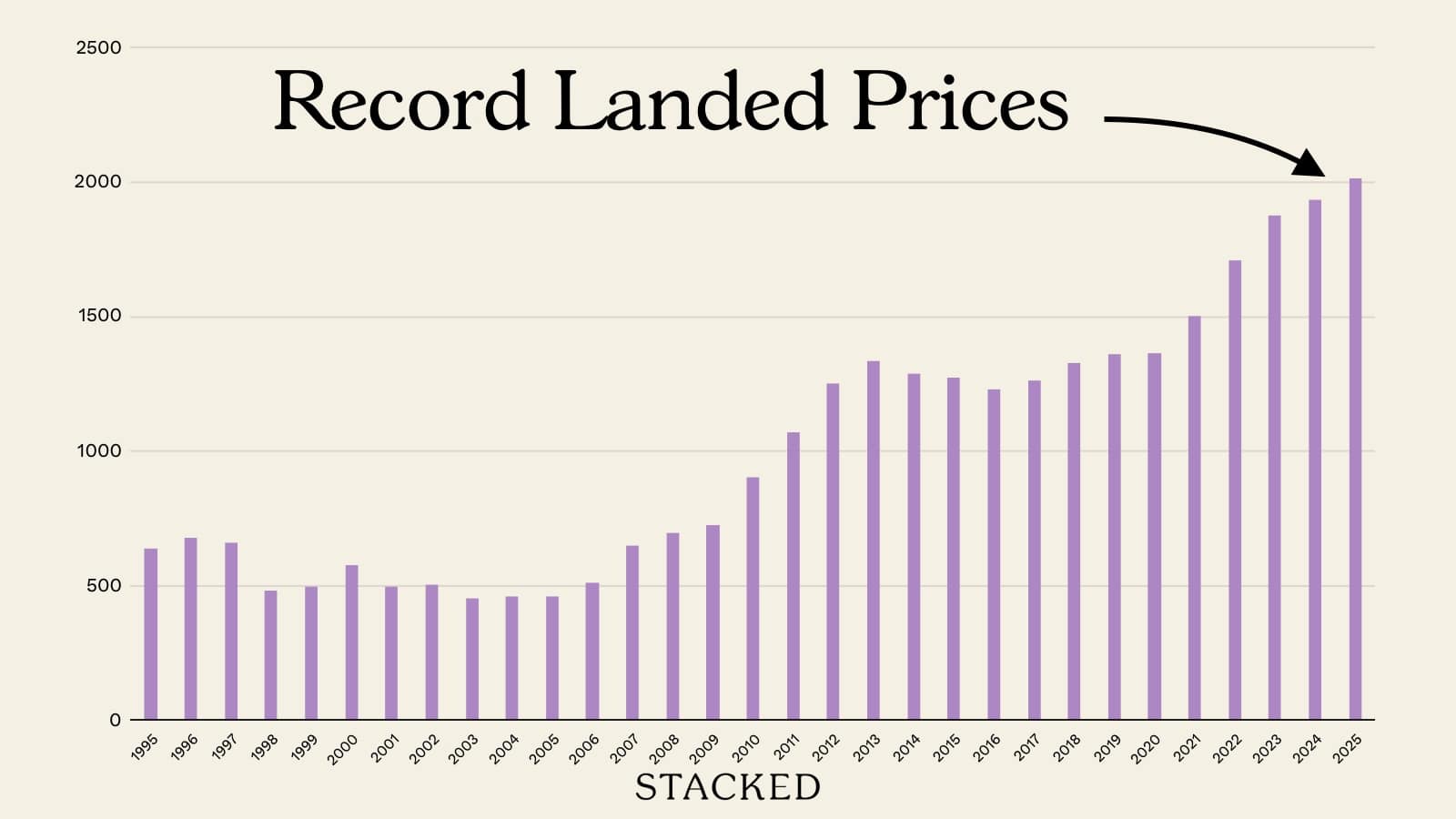

Singapore Property News New Record For Landed Home Prices In Singapore: It’s Like An A+ in The Least Important Exam

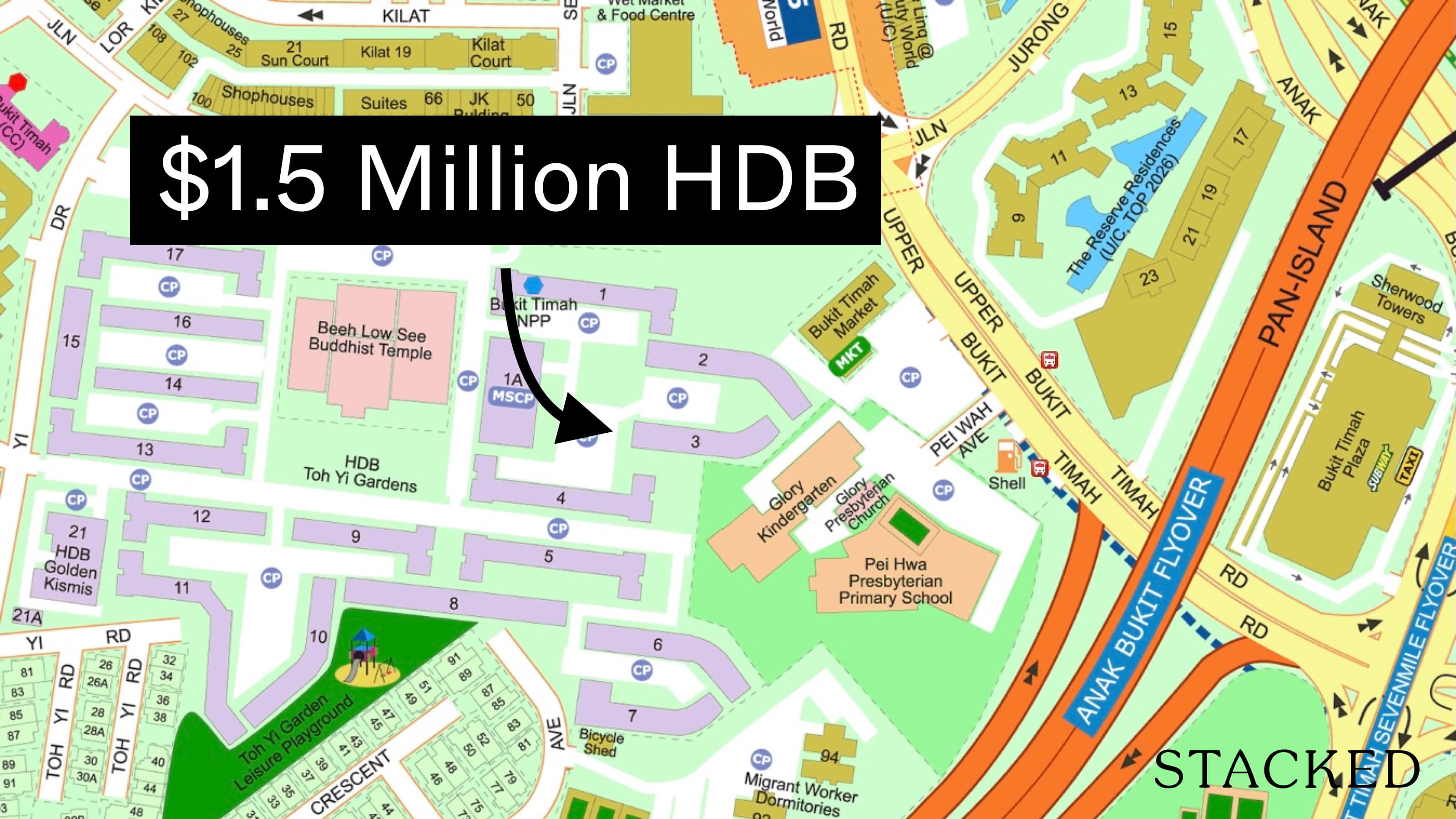

Singapore Property News This $1.5M Bukit Timah Executive HDB Flat With 62-Years Lease Left Just Set A Record: Here’s Why

Singapore Property News Now That GE2025 Is Over, Let’s Talk About The Housing Proposals That Didn’t Get Enough Scrutiny

Latest Posts

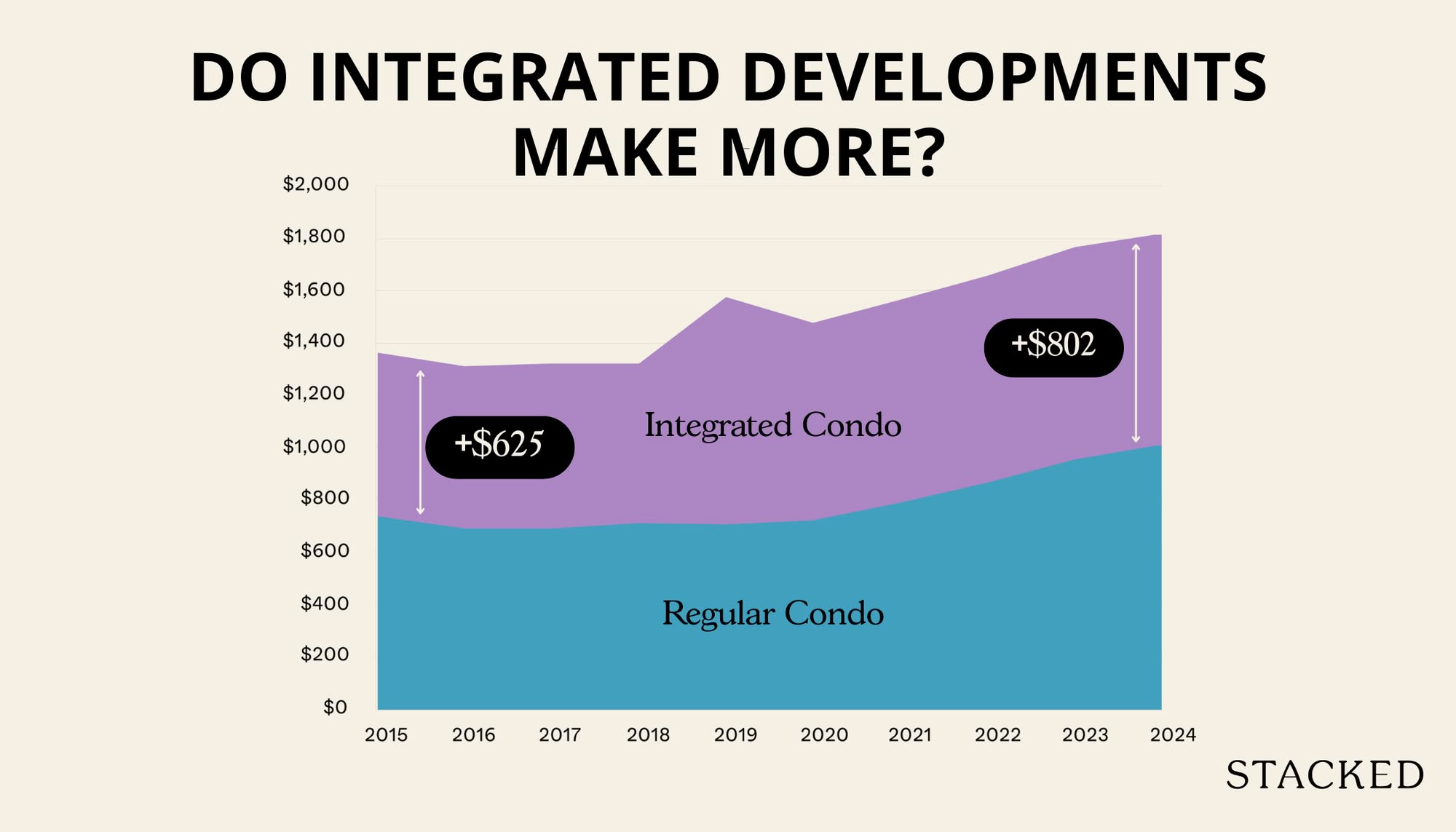

Pro Are Integrated Developments In Singapore Worth the Premium? We Analysed 17 Projects To Find Out

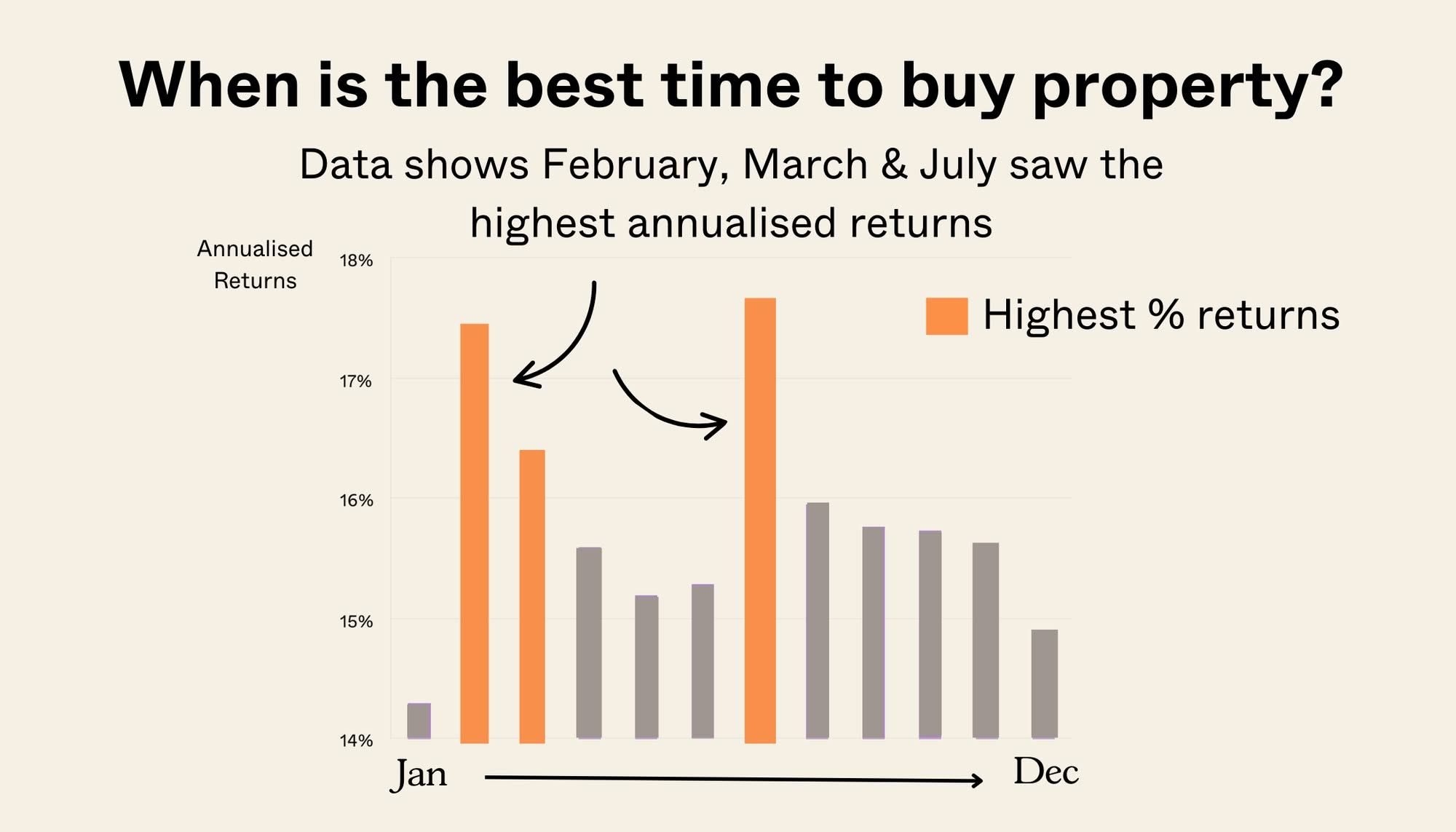

Pro Is There A ‘Best’ Time To Buy (Or Sell) Property In Singapore? We Analysed 56,000 Transactions To Find Out

On The Market 5 Unique High-Ceiling HDB Flats Priced From $650k

Editor's Pick Six Prime HDB Shophouses For Sale At $73M In Singapore: A Look Inside The Rare Portfolio

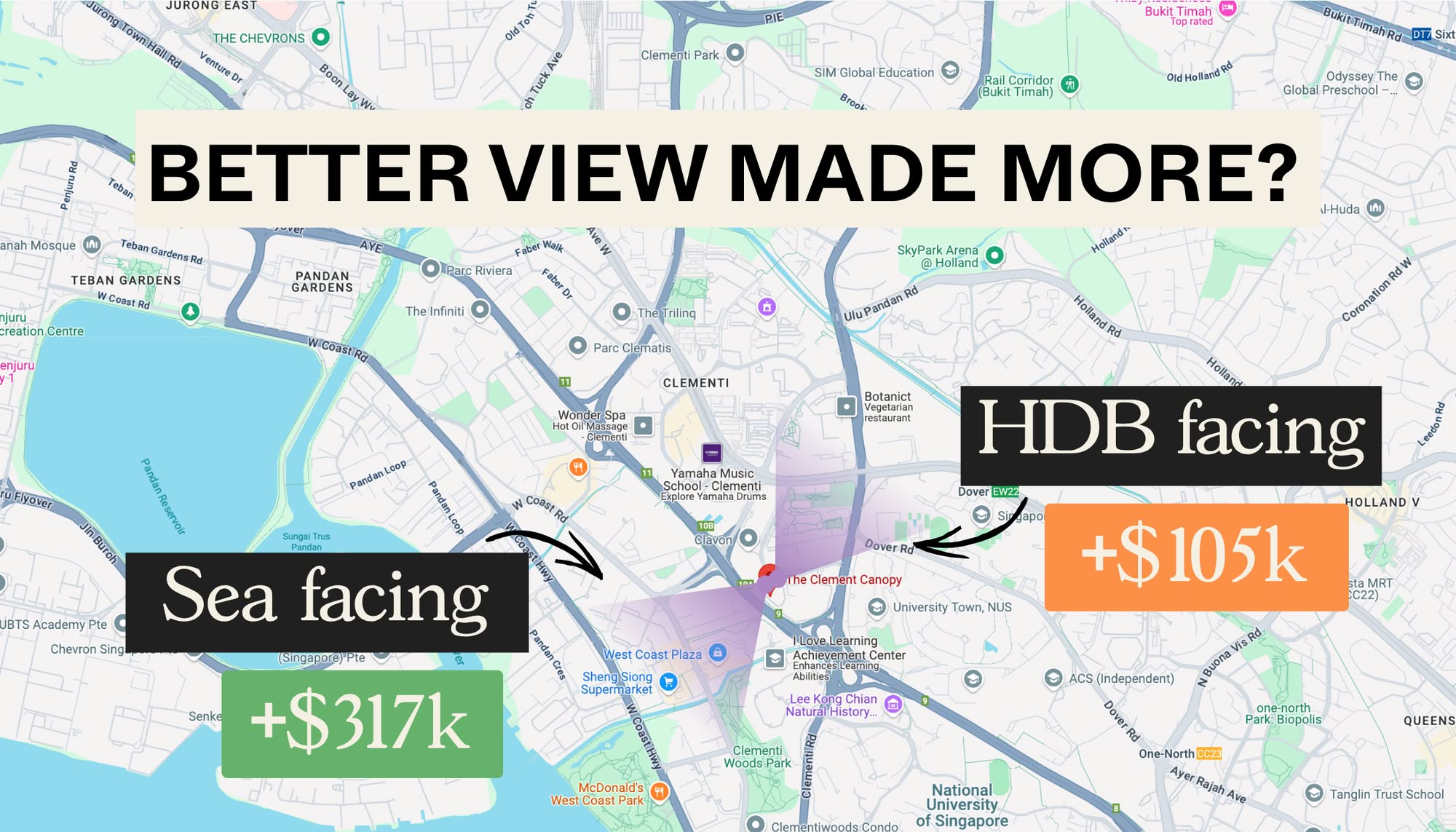

Pro $317K Condo Profit Vs $105K: We Analysed How Views Affected Clement Canopy Resale Gains

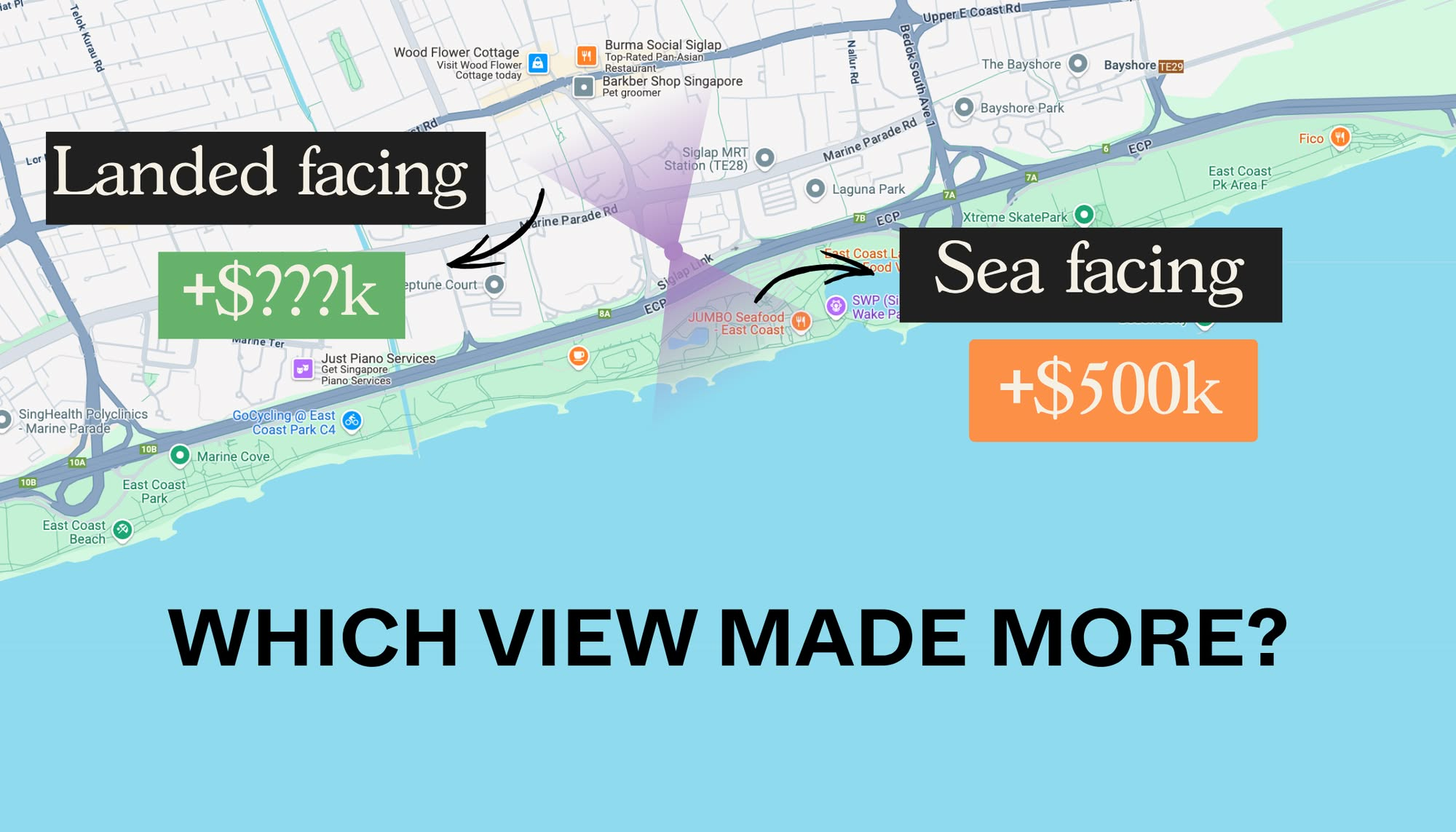

Pro Sea View Vs Landed View: We Analysed Seaside Residences Resale Profits — Here’s What Paid Off

Editor's Pick Selling Your Condo? This Overlooked Factor Could Quietly Undercut Your Selling Price

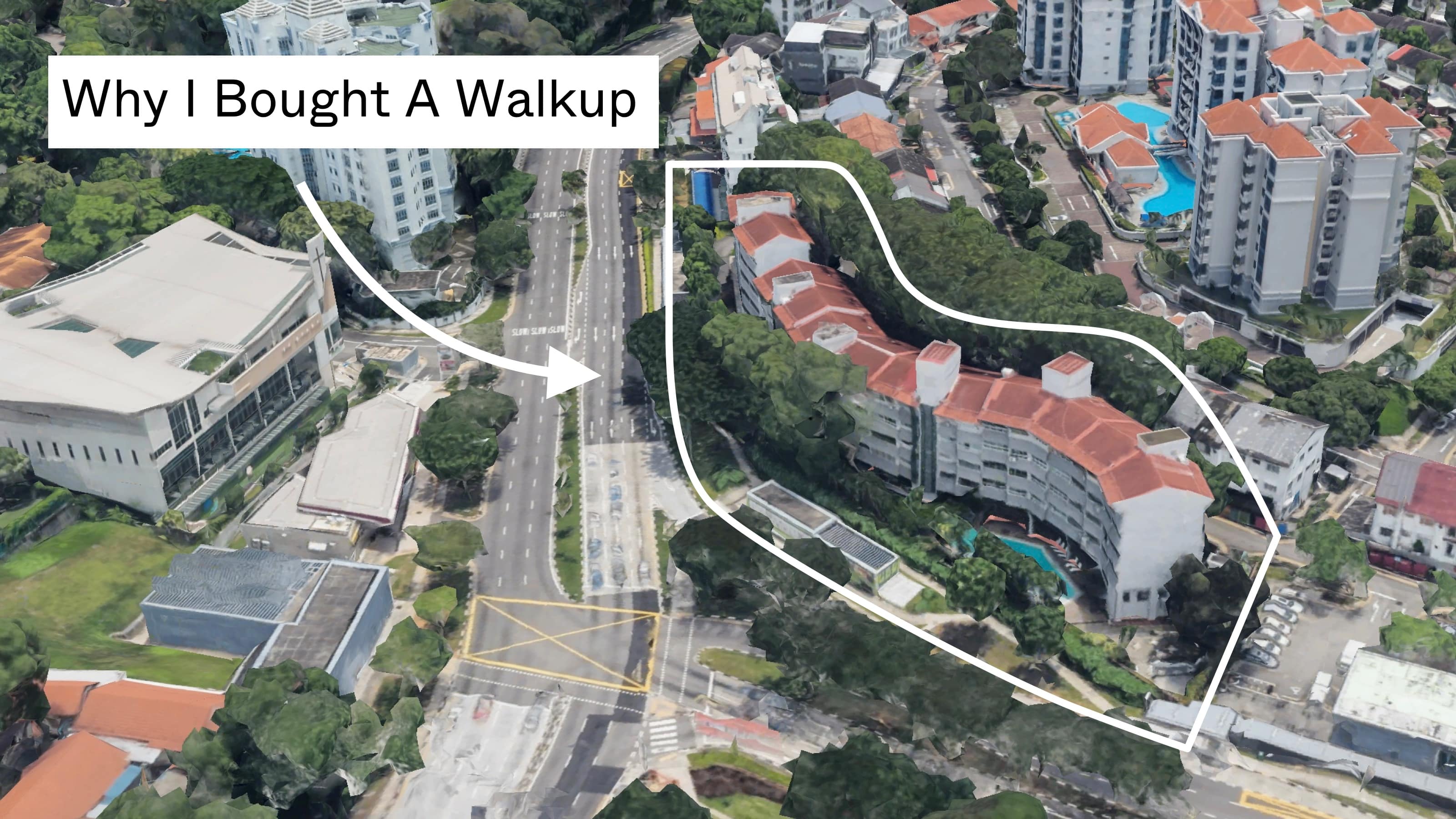

Editor's Pick Why We Chose A Walk-Up Apartment (Yes, With No Lift) For Our First Home

Editor's Pick Inside Balmoral Park: Rare Freehold Landed Homes With 1.6 Plot Ratio In District 10

Homeowner Stories How a 57% Rent Spike Drove Flor Patisserie Out — And What It Says About Singapore’s Retail Scene

Property Trends Should You Wait For The Property Market To Dip? Here’s What Past Price Crashes In Singapore Show

Pro How Different Condo Views Affect Returns In Singapore: A 25-Year Study Of Pebble Bay

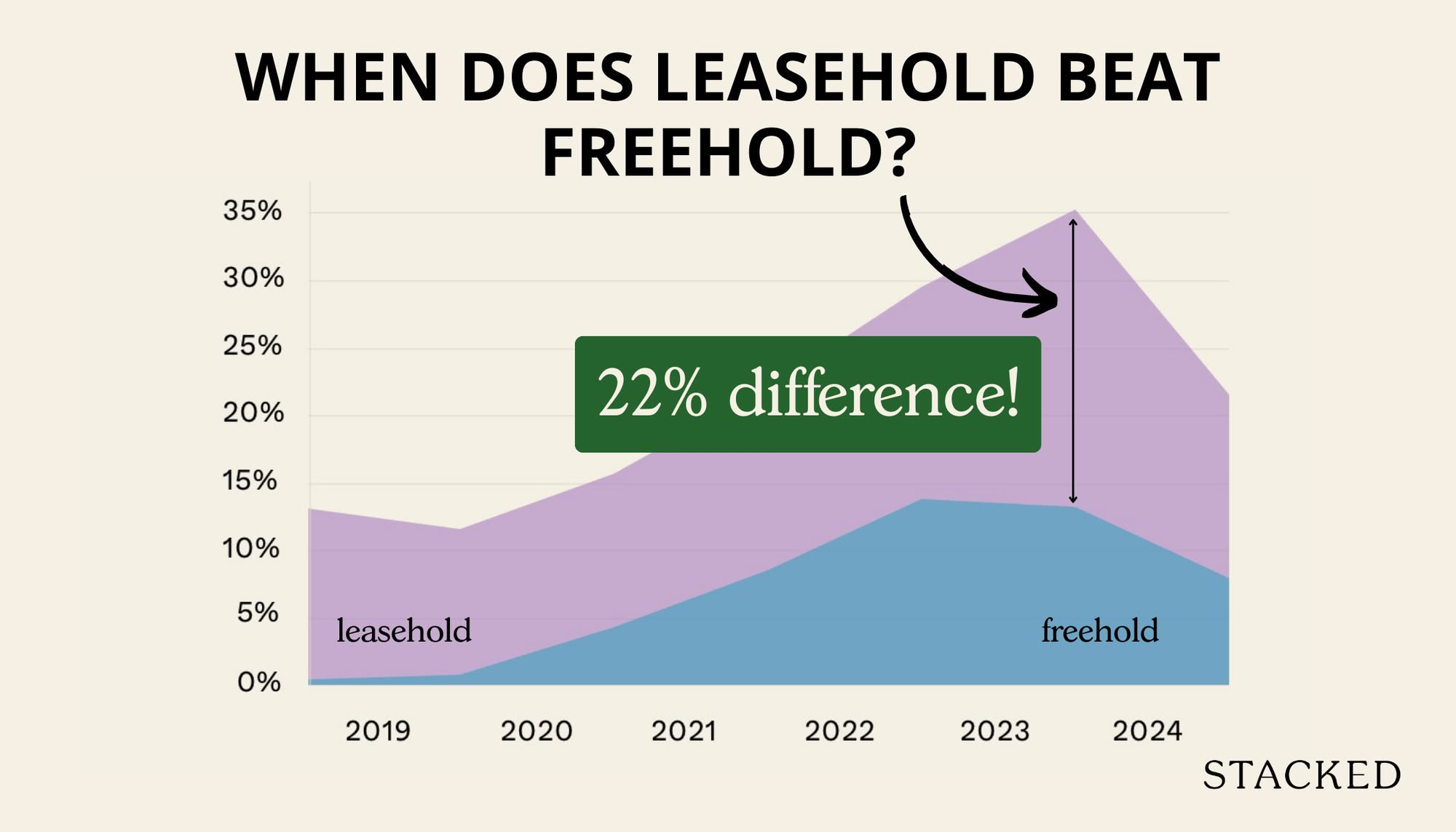

Pro Can Leasehold Condos Deliver Better Returns Than Freehold? A 10-Year Data Study Says Yes

Home Tours Inside A Minimalist’s Tiny Loft With A Stunning City View

On The Market 5 Most Affordable Newly MOP 4-Room HDB Flats From $585k