The First New Condo In Toa Payoh In 8 Years: What You Need To Know About The 777-Unit Orie

November 28, 2024

As we’ve seen from the last few new condos that were launched in areas where there hasn’t been a new launch in a while – the pent up demand is real (See Chuan Park, Norwood Grand).

This trend is expected to repeat itself with The Orie, a new launch condo in Toa Payoh. As one of Singapore’s most mature estates, Toa Payoh hasn’t seen many fresh additions to its condo landscape in the last 8 years, making this launch particularly enticing for potential homeowners. With its prime location, access to amenities, and seamless connectivity, The Orie is poised to attract both investors and homebuyers alike.

But is this buzz warranted? Here’s what we know so far about what The Orie has to offer and why it’s creating a stir in the market.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Profile of The Orie

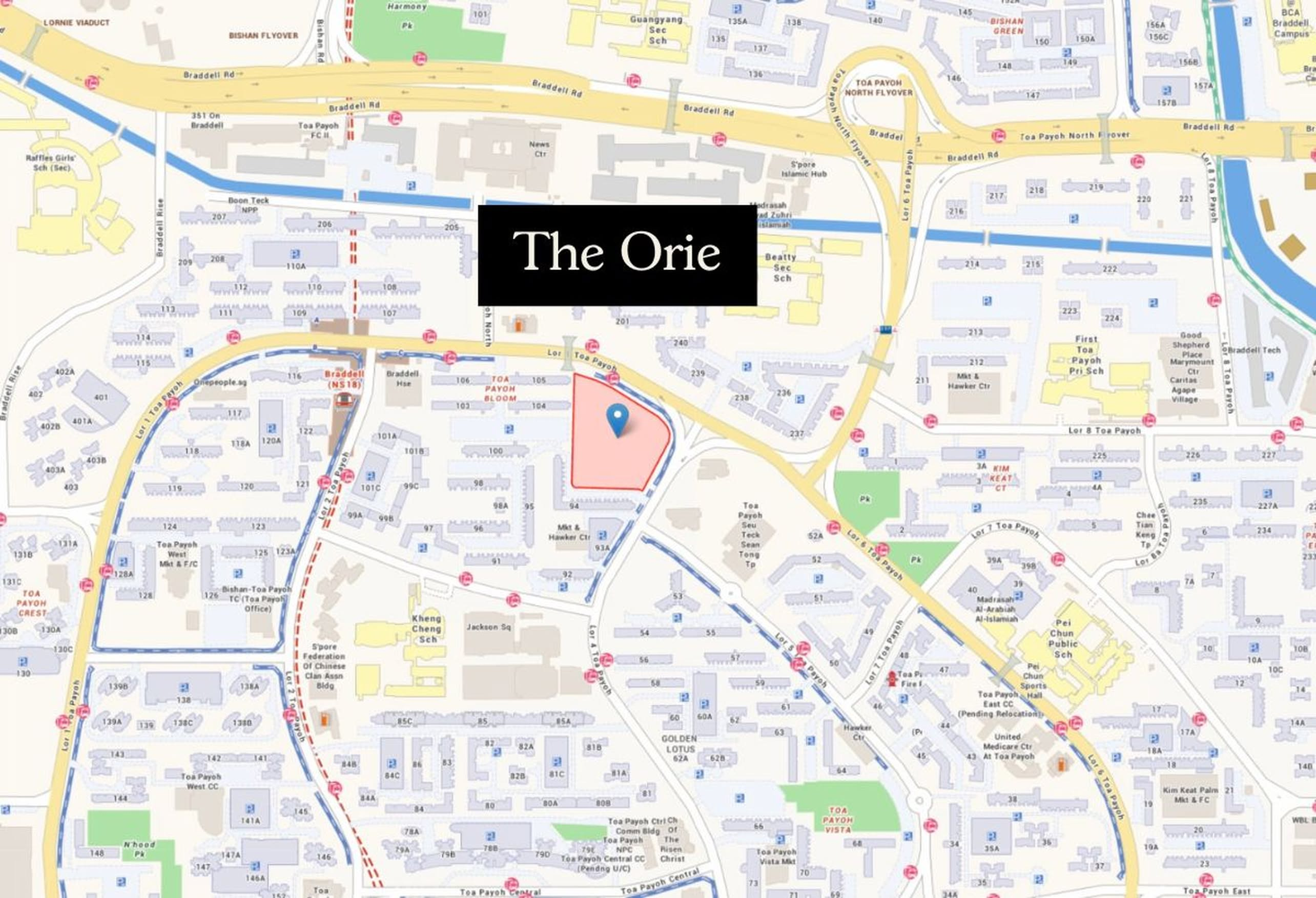

The Orie will be a leasehold, 777-unit condo project by Frasers Property, City Developments Limited (CDL), and Sekisui House. This will be spread over two blocks, 40 storeys each, with a total land area of 169,458 sq. ft. It’s located at Lorong 1 Toa Payoh, next to Gem Residences, placing it in the RCR (District 12).

CDL and Frasers are familiar names in Singapore and have been associated with several high-end developments. CDL started big changes in District 7 with South Beach Residences, and Frasers Property was behind 8@Mount Sophia and Riviere.

The name that may be less familiar to Singaporeans is Sekisui House; this is a Japanese developer. They’re not newcomers though; their past projects include Hillsta and One Holland Village Residences.

The unit mix at The Orie is predominantly small, with one-bedders, two-bedders, and smaller (850 sq. ft.) three-bedders making up 60 percent of the units. The numbers are quite even, with about 77 or 78 of each of these small unit types.

The remaining 40 per cent consists of three to five-bedders, including a dual-key layout for some of these bigger three-bedders:

| Unit Type | Size (SQFT) | Number of Units |

| 1-bedroom + Study | 512 sqft | 78 units |

| 2-bedroom, 1 bath | 590 sqft | 78 units |

| 2-bedroom | 647 sqft | 77 units |

| 2-bedroom Premium | 675 sqft | 77 units |

| 2-bedroom + Study | 699 sqft | 78 units |

| 3-bedroom | 845 sqft | 78 units |

| 3-bedroom Premium | 1,025/1,040 sqft | 78 units |

| 3-bedroom Dual Key | 1,128 sqft | 39 units |

| 4-bedroom | 1,220 sqft | 78 units |

| 4-bedroom + Study | 1,359 sqft | 39 units |

| 5-bedroom with private lift | 1,455 sqft | 77 units |

The unit mix does suggest some rental intent

The larger number of small units and the availability of dual-key units could make this viable for landlords. This would make sense given the location: it’s close to Orchard (four train stops), and the RCR location makes for a short drive to the CBD.

There are still a healthy number of 1,000+ sq. ft. family-sized units, though, so The Orie can accommodate both rental and own-stay use.

Looking at the floor plans, we can see many layouts use the newer “dumbbell” style: the living/dining area is used as the connecting point between rooms, mitigating the need for inefficient corridor spaces. This is also a post-GFA harmonisation project, so it avoids wasteful features like big air-con ledges or planter boxes.

Note that the dual-key units are side-by-side rather than being on two floors, which is also good for extended families (no need to worry about who has to climb up to get home). The subunit is neatly tucked to one end, with a pantry of its own.

A smart home system is already installed for each unit, with a mobile app to control your air-con, lights, facilities booking, etc. These are the usual bells and whistles that you’d expect from any modern new condo today, so there’s nothing out of the ordinary to report here.

Facilities-wise, you can expect the usual full suite, with a clubhouse, gym, multiple pools, etc. There is only one tennis court though, which may be a bit packed for a 777-unit condo but very decent in today’s context.

The expected TOP for The Orie is 2028.

The location of The Orie

The land plot for The Orie was from the November 2023 GLS. The winning bid was for $968 million, or about $1,360 psf. At the time, it was the first GLS site in the area for around eight years. From what we’ve heard, prices are expected to be between $2,700 to $2,800 psf. It’s hard to say at this point if that is an attractive price, we’d have to do a full price review when we hear of more details in the subsequent weeks.

More from Stacked

Zyon Grand Pricing Review: How It Compares To Nearby Resale And New Launches In River Valley

When it comes to pricing, Zyon Grand sits in one of the most competitive positions we’ve seen this year. Unlike…

In any case, if you were house hunting in 2016, you might remember that Gem Residences next door also did well because of the location; it sold out half of its units in the VIP preview alone (at the time between $1,279 to $1,551 psf).

Recent Transactions for Gem Residences

| Date | Address | Type Of Sale | Unit Area (SQFT) | Price $PSF | Price ($) |

| 29 Oct 2024 | 1 Lorong 5 Toa Payoh #37-XX | Resale | 592 | $1,993 | $1,180,000 |

| 25 Sep 2024 | 3 Lorong 5 Toa Payoh #23-XX | Resale | 678 | $1,973 | $1,338,000 |

| 19 Sep 2024 | 3 Lorong 5 Toa Payoh #14-XX | Resale | 1,249 | $2,082 | $2,600,000 |

| 17 Sep 2024 | 3 Lorong 5 Toa Payoh #33-XX | Resale | 678 | $2,020 | $1,370,000 |

| 22 Aug 2024 | 3 Lorong 5 Toa Payoh #03-XX | Resale | 678 | $1,901 | $1,288,888 |

| 20 Aug 2024 | 1 Lorong 5 Toa Payoh #31-XX | Resale | 592 | $1,944 | $1,151,000 |

| 24 Jul 2024 | 1 Lorong 5 Toa Payoh #19-XX | Resale | 570 | $1,928 | $1,100,000 |

| 22 Jul 2024 | 3 Lorong 5 Toa Payoh #04-XX | Resale | 1,249 | $1,906 | $2,380,000 |

| 15 Jul 2024 | 1 Lorong 5 Toa Payoh #13-XX | Sub Sale | 1,313 | $1,918 | $2,518,888 |

| 8 Jul 2024 | 1 Lorong 5 Toa Payoh #11-XX | Sub Sale | 592 | $1,917 | $1,135,000 |

| 21 Jun 2024 | 1 Lorong 5 Toa Payoh #17-XX | Sub Sale | 570 | $1,893 | $1,080,000 |

Besides Gem Residences (completed in 2019), the only other major condos here are Trevista, Trellis Towers, and Oleander. These are much older, having been completed in 2011, 2000, and 1998 respectively. So it’s been quite some time since Toa Payoh has seen a new launch, and sales might benefit from pent-up demand.

Recent Transactions for Nearby Condos

| Condo | Completion Year | Date | Address | Type Of Sale | Unit Area (SQFT) | Price $PSF | Price ($) |

| Trellis Towers | 2000 | 11 Nov 2024 | 700 Lorong 1 Toa Payoh #23-03 | Resale | 1,141 | $1,981 | $2,260,000 |

| Braddell View | 1981 | 11 Nov 2024 | 10Q Braddell Hill #02-72 | Resale | 1,582 | $1,005 | $1,590,000 |

| Trevista | 2011 | 8 Nov 2024 | 25 Lorong 3 Toa Payoh #31-13 | Resale | 1,109 | $2,043 | $2,265,000 |

| Braddell View | 1981 | 5 Nov 2024 | 10K Braddell Hill #05-41 | Resale | 1,798 | $968 | $1,740,888 |

| Braddell View | 1981 | 5 Nov 2024 | 10P Braddell Hill #04-68 | Resale | 1,561 | $980 | $1,530,000 |

| Trevista | 2011 | 1 Nov 2024 | 21 Lorong 3 Toa Payoh #22-03 | Resale | 926 | $1,815 | $1,680,000 |

| Braddell View | 1981 | 28 Oct 2024 | 10B Braddell Hill #23-05 | Resale | 1,615 | $1,041 | $1,680,000 |

| Braddell View | 1981 | 15 Oct 2024 | 10D Braddell Hill #10-16 | Resale | 1,615 | $1,033 | $1,668,000 |

| Trevista | 2011 | 23 Sep 2024 | 25 Lorong 3 Toa Payoh #08-13 | Resale | 1,130 | $1,823 | $2,060,000 |

| Trevista | 2011 | 23 Sep 2024 | 25 Lorong 3 Toa Payoh #36-13 | Resale | 1,130 | $2,017 | $2,280,000 |

| Trevista | 2011 | 23 Sep 2024 | 25 Lorong 3 Toa Payoh #17-15 | Resale | 1,733 | $1,806 | $3,130,000 |

| Trellis Towers | 2000 | 18 Jul 2024 | 700 Lorong 1 Toa Payoh #17-14 | Resale | 1,141 | $1,836 | $2,095,000 |

| Trellis Towers | 2000 | 2 Jul 2024 | 700 Lorong 1 Toa Payoh #06-06 | Resale | 1,163 | $1,892 | $2,200,000 |

| Oleander Towers | 1998 | 30 May 2024 | 913 Lorong 1 Toa Payoh #04-06 | Resale | 1,227 | $1,418 | $1,740,000 |

The Orie is one of the closest condos to Braddell MRT (NSL), which is just one stop from Bishan, and one stop to Toa Payoh in the opposite direction. This puts Bishan’s gigantic Junction-8 Mall in easy reach of residents, as well as Toa Payoh’s HDB Hub (this is a major hub area with supermarkets, eateries, bank branches, etc.) Orchard is just four stops away.

The surrounding HDB enclave is also very old and well-developed: besides the usual slew of coffee shops and mixed-retail, there’s also an NTUC in the direction of Toa Payoh Lorong 4.

Schools may also be a strong draw for parents, with CHIJ Primary, First Toa Payoh Primary, Pei Chun, Beatty Secondary, and Keng Cheng being within one kilometre.

Do note that there appears to be a place of worship near this area (a temple).

Finally, there are reportedly an estimated 627 car park lots – not quite a 1:1 ratio but good enough considering the number of small units and convenient location. There are also going to cater 19 lots for EV cars, which is a very healthy number when most new launches are only allocating 2 or 3 at the moment.

This is a good catchment area for HDB upgraders

Toa Payoh is quite famous for churning out million-dollar flats. In January this year, for instance, the highest-priced resale flat ($1.57 million) was The Peak @ Toa Payoh, close to The Orie (139A Lorong 1 Toa Payoh).

HDB upgraders tend to prefer condos near familiar areas. As such, you can expect demand to be strong despite the luxury-level selling price of The Orie: there will be a good number of potential upgraders with the purchasing power to manage the leap.

It also bodes well for future resale value, as it will continue to draw upgraders further down the road. This is on the basis of being much newer than surrounding resale condos, and the general scarcity of private non-landed homes in the Toa Payoh area.

Overall, this is one of those projects that sells itself, because of where it’s located. It’s likely to be one of the pricier RCR options, but you’re getting what you pay for: it’s got fantastic access to the twin hotspots of Bishan and Toa Payoh, can be rented out easily if you decide to, and is well differentiated from surrounding competition by age (with the exception of Gem Residences, which is the closest rival).

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Why is The Orie in Toa Payoh attracting attention now?

What are the main features of The Orie condo?

How does the location of The Orie benefit residents?

What is the expected TOP date for The Orie, and how might that affect buyers?

How does the unit mix at The Orie cater to different needs?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from New Launch Condo Analysis

New Launch Condo Analysis This New Dairy Farm Condo Starts From $998K — How the Pricing Compares

New Launch Condo Analysis This New Freehold CBD Condo Starts From $1.29M — Here’s How the Pricing Compares

New Launch Condo Analysis This Freehold New Launch Condo In The CBD Is Launching From Just $1.29M

New Launch Condo Analysis I Reviewed A New Launch 4-Bedroom Penthouse At Beauty World

Latest Posts

Pro Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Singapore Property News Singapore Could Soon Have A Multi-Storey Driving Centre — Here’s Where It May Be Built

Singapore Property News Will the Freehold Serenity Park’s $505M Collective Sale Succeed in Enticing Developers?

0 Comments