Should You Pay More For A Good View? A Case Study Of Two Sea-Facing Condos In Singapore

April 4, 2024

Investing in a new launch condo has many quirks to think about. Every developer will have a different price strategy, and prices can differ even more when it comes to a large development with many different stacks and facings.

The price difference for a unit that has a better waterfront view, greenery view, etc. can reach tens of thousands or even more. This isn’t just about enjoying the view – some homeowners also believe that, if the view from their unit is worse, they may end up with worse gains at resale. This week, we took a look at an actual case study involving Avenue South Residences, where we examined the price impact of a better facing:

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

The performance of an Avenue South Residence seafront unit

Avenue South Residence (ASR) is a 1,074-unit mega-development, along Silat Avenue. The developers capitalised on the location’s proximity to Keppel Harbour, which provided some south-facing units that would have a seafront view. Avenue South Residence is also known as the highest PPVC residential building in the world at 192 metres – and at 56 stories tall one of its main selling points would be the sea views.

As a case study, we worked with a buyer who was interested in unit #33-30, which offered a seafront view.

The unit in question was purchased in September 2019, and held for a very short period – about three years and 10 months down the road (July 2023), the unit was already sold.

The purchase price was $1,568,000.

Assuming a maximum Loan To Value (LTV) ratio of 75 per cent, the maximum loan quantum would have been $1,176,000.

We will look only at non-recoverable costs, so that means focusing on just the interest repayment.

In addition to this, we will add conveyancing fees of (need the amount) and the Buyer’s Stamp Duty (BSD) rate of $48,000.

This is a total cost incurred of $183,094.

The unit was subsequently sold for $1,780,000, for a gross profit of $212,000. Deducting the added cost of $183,094, this is a net profit of around $28,906.

Let’s compare this to a buyer who opted for a non-premium facing

We also worked with another buyer, who declined to pay the premium for a seafront unit. Instead, they opted for a unit that faced the nearby HDB estate.

This was unit 33-46, which was also held for a short time only: the buyer purchased the unit in September 2019, and sold it after three years and seven months (April 2023). As such, it makes a good point of comparison against the buyer above.

The price of this unit was much lower, at $1,517,000. Again, we will assume an LTV ratio of 75 per cent, and an interest rate of three per cent (need the loan tenure also). This is a loan quantum of $1,137,750. This is what would be paid over a period of three years and seven months.

In addition to this, there is the conveyancing fee, as well as the BSD of $45,450. This is a total cost of about $176,303.

The unit was sold for $1,770,000, for a gross profit of $253,000. After deducting the further costs above, we have a net profit of about $76,697.

(Note that in both of the above cases, we did not factor in the commission paid to the seller’s agent; while two per cent of the sale price is the norm, this amount is negotiable and hence variable.)

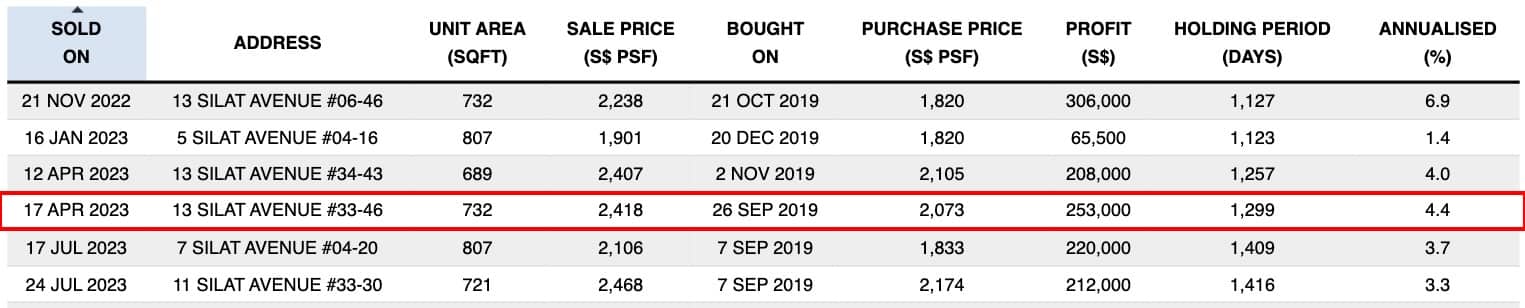

We can also see the annualised returns in Square Foot Research:

As we can see in this case, buying a unit without the premium view can bring better returns, at least in the context of holding for a shorter period. But as this is only just one example, let’s take a look at another development that has somewhat similar characteristics – just in another time frame.

Premium vs non-premium view – a case study with The Seafront on Meyer

Launched in 2007, The Seafront on Meyer houses 327 units and goes up to 24 floors. While it’s not as tall as Avenue South Residence, The Seafront on Meyer boasts a seaside location right opposite East Coast Park.

We chose this condo to see the effect of buying a premium sea-facing unit versus a non-premium one in a different era. As mentioned, its launch in 2007 and completion in 2010 means that it was sold at very different property market conditions compared to today.

However, a longer trading history also means we can better study how the premium gap has changed over time, from 2007 up till now.

As such, we’ll consider stacks 05 and 11 as the premium-facing sea-facing stack and stack 03 as the non-premium stack which faces the Equatorial Apartments condo opposite as well as the Margate Road landed homes.

More from Stacked

Why Lentor Central Residences And Aurelle Sold 1,127 Units In One Weekend

It’s been quite the weekend for new launches: Lentor Central Residences and Aurelle of Tampines saw overwhelming demand, with nearly…

First, let’s look at two new sales, one at unit #10-03 (non-premium) and another at #09-11 (premium):

| Date | Address | Type of Sale | Size (Sq Ft) | $PSF | Price | Facing |

| 31-Oct-07 | 55 MEYER ROAD #10-03 | NEW SALE | 1,615 | $1,478 | $2,386,000 | Non-Premium |

| 28-Nov-07 | 59 MEYER ROAD #09-11 | NEW SALE | 1,604 | $1,723 | $2,764,000 | Premium |

Apart from the 1st floor difference, both units are very similar to each other. But in terms of price, the premium stack costs approximately 15.84% more (or $378k in dollar terms).

So how has the difference in price changed over time? Fast forward 5 years to 2012, here’s a look at the premium difference comparing 3 different levels (within 3 floors of each other).

| Date | Address | Type of Sale | Size (Sq Ft) | $PSF | Price | Facing |

| 15-May-12 | 55 MEYER ROAD #15-03 | RESALE | 1,615 | 1,536 | 2,480,000 | Non-Premium |

| 30-Apr-12 | 59 MEYER ROAD #13-11 | RESALE | 1,604 | 1,715 | 2,750,000 | Premium |

Premium difference: 10.89% more (or $270k in price)

| Date | Address | Type of Sale | Size (Sq Ft) | $PSF | Price | Facing |

| 22-Oct-12 | 55 MEYER ROAD #12-03 | RESALE | 1,615 | 1,579 | 2,550,000 | Non-Premium |

| 9-Oct-12 | 59 MEYER ROAD #15-11 | RESALE | 1,604 | 1,857 | 2,978,000 | Premium |

Premium difference: 16.78% more (or $428k in price).

| Date | Address | Type of Sale | Size (Sq Ft) | $PSF | Price | Facing |

| 29-Nov-12 | 55 MEYER ROAD #05-03 | RESALE | 1,615 | 1,536 | 2,480,000 | Non-Premium |

| 29-Nov-12 | 59 MEYER ROAD #04-11 | RESALE | 1,604 | 1,621 | 2,600,000 | Premium |

Premium difference: 4.84% more (or $120k in price)

Aside from units #12-03 and #15-11 where the premium did increase slightly, both #05-03 vs #04-11 and #15-03 vs #13-11 saw a fall in premium to 4.84% and 10.89% respectively. However, it must be highlighted that this premium was not as obvious because #04-11 doesn’t have a huge view bonus.

From here, we can observe that while developers can consistently price higher for a premium view, this gap does not necessarily remain once it hits the resale market. In some cases, it can shrink which presents an opportunity for non-premium stack buyers to make more, relatively speaking.

Next, let’s make a comparison at a different time frame. This time, we will be looking at 9-10 years from launch, in 2016 and 2017:

| Date | Address | Type of Sale | Size (Sq Ft) | $PSF | Price | Facing |

| 13-Apr-16 | 55 MEYER ROAD #21-03 | RESALE | 1,615 | 1,641 | 2,650,000 | Non-Premium |

| 28-Jan-16 | 59 MEYER ROAD #22-11 | RESALE | 1,604 | 1,590 | 2,550,000 | Premium |

Premium difference: 3.77% less (or $100k less)

| Date | Address | Type of Sale | Size (Sq Ft) | $PSF | Price | Facing |

| 20-Nov-17 | 55 MEYER ROAD #20-03 | RESALE | 1,615 | 1,765 | 2,850,000 | Non-Premium |

| 17-Oct-17 | 59 MEYER ROAD #20-11 | RESALE | 1,604 | 1,871 | 3,000,000 | Premium |

Premium difference: 5.26% more (or $150k more)

In 2016/2017, we can see that the premium gap has continued to go lower. In the case of units #21-03 and #22-11, the premium gap was even negative where the non-premium facing stack costs more.

It’s difficult to say that this is down to purely the views since factors such as renovations, completion and option periods could affect the price here. However, the takeaways are the same – non-premium vs premium gaps can narrow, and to some degree, become negative.

Now, let’s fast forward even more to 2020 – 2021 which would make it 13-14 years since its launch:

| Date | Address | Type of Sale | Size (Sq Ft) | $PSF | Price | Facing |

| 20-Jan-21 | 55 MEYER ROAD #13-03 | RESALE | 1,615 | 1,771 | 2,860,000 | Non-Premium |

| 11-Dec-20 | 55 MEYER ROAD #19-05 | RESALE | 1,615 | 2,007 | 3,240,000 | Premium |

| 13-Nov-20 | 59 MEYER ROAD #17-11 | RESALE | 1,604 | 2,026 | 3,250,000 | Premium |

In this case, we averaged the prices of #19-05 and #17-11 to derive a premium difference of 13.46% (or $385k more).

Finally, let’s look at our last comparison in 2023:

| Date | Address | Type of Sale | Size (Sq Ft) | $PSF | Price | Facing |

| 15-Aug-23 | 55 MEYER ROAD #24-03 | RESALE | 1,615 | 2,341 | 3,780,000 | Non-Premium |

| 3-Apr-23 | 55 MEYER ROAD #22-05 | RESALE | 1,604 | 2,400 | 3,850,000 | Premium |

Premium difference: 1.85% (or $70k more)

Although the time frames were somewhat distant, the resale volume during this period was low, and the median price per square foot (PSF) for freehold (FH) properties ranging from 1,500 to 2,000 square feet was gradually decreasing.

After making these comparisons over 16 years, we can see how the premium gap was either around the same for certain units, or lower in some cases.

What does this mean for home buyers?

It’s not necessarily the case that buying a premium stack would allow buyers to make more, and neither is it necessarily true that a non-premium stack would be the bigger winner. In those more extreme cases where premiums were high or low, it could just be a case of a good buy or good sell situation.

So while this mainly boils down to what the gap was in the first place (in the case of Seafront on Meyer, a gap of 15% during its launch was less likely maintained given the transaction data through the years), another factor is down to the reality of the project once it’s launched. Are the views really worth that premium in real life? Are there other factors that have come up (blocked views) that could have changed the equation? These can all have an impact on the resale performance.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Frequently asked questions

Does paying more for a sea view in a condo always lead to higher resale profits?

How does the value difference between premium and non-premium sea-facing units change over time?

Is it worth paying extra for a sea view when buying a condo in Singapore?

What should buyers consider besides the view when choosing a condo unit?

How do premium sea-facing units compare to non-premium units in terms of price appreciation?

Ryan J. Ong

A seasoned content strategist with over 17 years in the real estate and financial journalism sectors, Ryan has built a reputation for transforming complex industry jargon into accessible knowledge. With a track record of writing and editing for leading financial platforms and publications, Ryan's expertise has been recognised across various media outlets. His role as a former content editor for 99.co and a co-host for CNA 938's Open House programme underscores his commitment to providing valuable insights into the property market.Need help with a property decision?

Speak to our team →Read next from Property Investment Insights

Property Investment Insights Older Jurong East Flats Are Holding Their Value Surprisingly Well — Even After Lease Decay Kicks In

Property Investment Insights This 130-Unit Boutique Condo Launched At A Premium — Here’s What 8 Years Revealed About The Winners And Losers

Property Investment Insights This 55-Acre English Estate Owned By A Rolling Stones Legend Is On Sale — For Less Than You Might Expect

Property Investment Insights Why Some Central Area HDB Flats Struggle To Maintain Their Premium

Latest Posts

On The Market A Rare Pair Of Conserved Shophouses In Chinatown Just Hit The Market For $32.5M

Singapore Property News Some Units At This Freehold Riverfront Condo Could Lose Their Views — But Here’s How Prices Have Actually Moved

Property Market Commentary Singapore’s Tallest HDB Yet: A 60-Storey Project Is Coming To Pearl’s Hill

0 Comments