Should We Sell Our Bishan DBSS And Pay $1m More To Upgrade To A Condo?

October 5, 2024

Hi there!

We’ve always been reading your articles at stacked homes and appreciate the insights given. Hope you can help shed some light on our situation too!

We are a couple in our early 40s and own a 5 room DBSS in Bishan with 2 pri sch going kids. Our outstanding loan is about $320k.

Honestly we love staying here but we are thinking if it would be a good time to upgrade to a condo nearby for better capital retention in future. As our kids are studying nearby, we will want to remain in this area at least for the next 6-10 years or even longer till retirement.

Or would it make better sense to stay put (and do a major renovation since we are the first owners and it has been 10 plus years), since a condo in our area with compatible size would cost at least $1mil above the selling price of our DBSS?

Some background and requirements

Financial Situation

- Combined monthly income of about $20-$25k

- Investments – $1.2 mil

- Cash & CPF – $500k

Requirements

- Still within 1-2km of our current place

- Minimally 1200 sq ft and above

Would want to still keep probably half our investments if possible as retirement is not that far off

Thank you.

Hi there,

Thank you for your kind support so far!

This is a very common dilemma many HDB owners face today as prices are high – whether to cash in on their gains and upgrade or remain status quo. This is made tougher because of the significantly higher prices of private properties, especially if you wish to stay in the same area.

Let’s start by first assessing your affordability.

So many readers write in because they're unsure what to do next, and don't know who to trust.

If this sounds familiar, we offer structured 1-to-1 consultations where we walk through your finances, goals, and market options objectively.

No obligation. Just clarity.

Learn more here.

Affordability

Given that there is only one DBSS in Bishan (Natura Loft), here are some of the recent transactions for a 5-room flat in the development:

| Date | Block | Level | Size (sqm) | Price |

| Jul 2024 | 275A | 37 to 39 | 120 | $1,568,000 |

| Jun 2024 | 273B | 04 to 06 | 120 | $1,336,000 |

| Jun 2024 | 275A | 28 to 30 | 120 | $1,538,000 |

| May 2024 | 275A | 22 to 24 | 120 | $1,500,000 |

| Mar 2024 | 273B | 04 to 06 | 120 | $1,320,000 |

For calculation purposes, we will use the average price of $1,452,400 as the selling price.

Selling Natura Loft

| Selling price | $1,452,400 |

| Outstanding loan | $320,000 |

| Sales proceeds (CPF + cash) | $1,132,400 |

Combined affordability (for a private property after selling Natura Loft)

Since we don’t have your exact ages, we’ll assume both of you are 42 years old for this calculation. Additionally, we’ll use the median of $20,000 and $25,000 as your combined monthly income.

| Maximum loan based on ages of 42 with a combined monthly income of $22,500, at 4.8% interest | $2,065,780 (23-year tenure) |

| CPF + cash | $1,632,400* |

| Total loan + CPF + cash | $3,698,180 |

| BSD based on $3,698,180 | $161,490 |

| Estimated affordability | $3,536,690 |

*Here we used the sales proceeds from Natura Loft and the $500,000 CPF + cash you currently have. We did not include funds from your investments.

With this, you’ll be able to secure a unit that’s at least 1,200 sq ft in your preferred location.

For reference, here are some recent transactions for condominiums within 1-2KM of Natura Loft sized between 1,200 – 1,400 sq ft.

| Sale Date | Project Name | Tenure | Completion Year | Transacted Price ($) | Area (Sqft) | Unit Price ($ Psf) | Floor Level |

| Sep 2024 | Clover By The Park | 99 Years | 2011 | $2,480,000 | 1292 | $1,920 | 16 To 20 |

| Aug 2024 | Country Esquire | Freehold | 1992 | $2,030,000 | 1270 | $1,598 | 01 To 05 |

| Aug 2024 | The Gardens At Bishan | 99 Years | 2004 | $2,085,000 | 1227 | $1,699 | 06 To 10 |

| Jul 2024 | Sky Habitat | 99 Years | 2015 | $2,300,000 | 1249 | $1,842 | 06 To 10 |

| Jul 2024 | Boonview | Freehold | 2003 | $2,131,800 | 1292 | $1,650 | 01 To 05 |

| Jul 2024 | The Windsor | Freehold | 1988 | $1,950,000 | 1302 | $1,497 | 01 To 05 |

| Jul 2024 | Jadescape | 99 Years | 2022 | $2,950,000 | 1259 | $2,342 | 06 To 10 |

| Jul 2024 | Thomson Grand | 99 Years | 2015 | $2,416,000 | 1356 | $1,781 | 06 To 10 |

| Jun 2024 | Bishan Loft | 99 Years | 2003 | $2,200,000 | 1378 | $1,597 | 11 To 15 |

Now that we have a better idea of your budget, let’s look at how HDBs and private condominiums in Bishan have been performing.

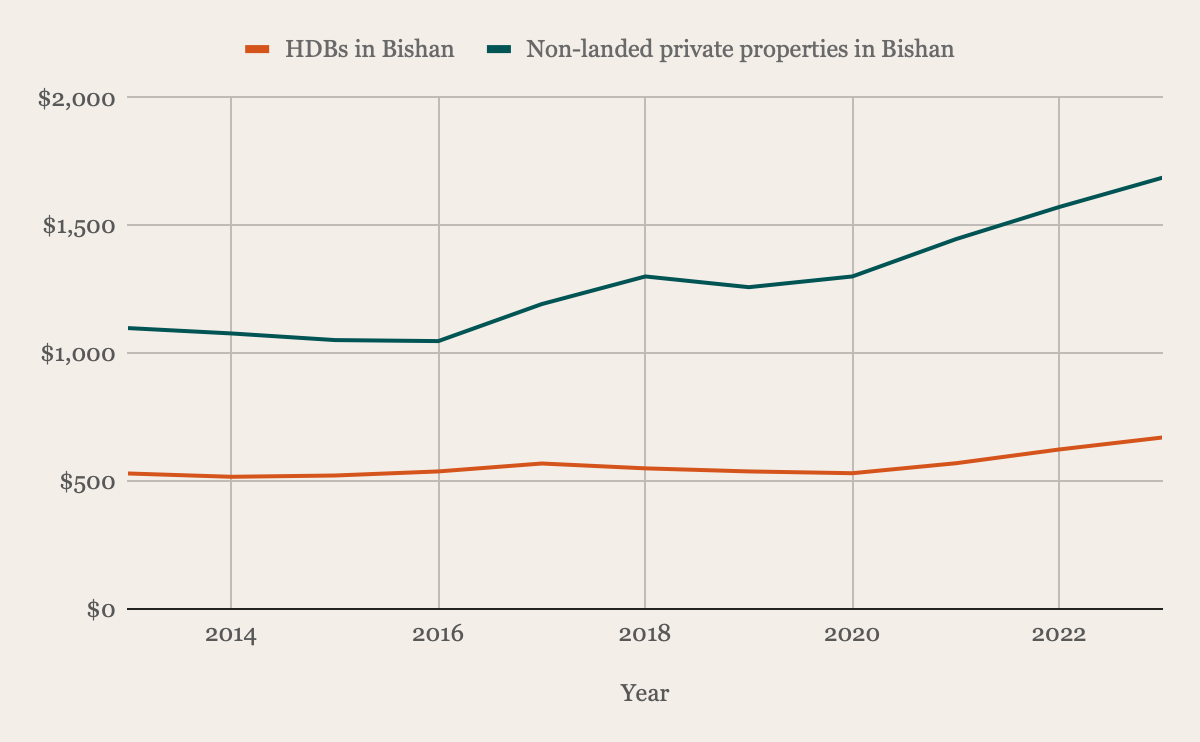

Performance of HDBs and condos in Bishan

| Year | HDBs in Bishan | All HDBs | Non-landed private properties in Bishan | All non-landed private properties | % difference of HDB and non-landed in Bishan |

| 2013 | $530 | $469 | $1,099 | $1,245 | 107.36% |

| 2014 | $517 | $441 | $1,078 | $1,190 | 108.51% |

| 2015 | $522 | $423 | $1,052 | $1,191 | 101.53% |

| 2016 | $538 | $424 | $1,048 | $1,248 | 94.80% |

| 2017 | $569 | $425 | $1,193 | $1,292 | 109.67% |

| 2018 | $550 | $419 | $1,301 | $1,325 | 136.55% |

| 2019 | $538 | $416 | $1,259 | $1,344 | 134.01% |

| 2020 | $531 | $431 | $1,301 | $1,294 | 145.01% |

| 2021 | $570 | $488 | $1,447 | $1,345 | 153.86% |

| 2022 | $624 | $532 | $1,573 | $1,455 | 152.08% |

| 2023 | $671 | $564 | $1,688 | $1,562 | 151.56% |

| Average growth rate | 2.49% | 2.02% | 4.55% | 2.37% | – |

The data shows that both HDB flats and non-landed private properties in Bishan have outperformed the overall market over the past ten years. This strong demand is unsurprising, given Bishan’s prime location on the city fringe, its wide range of amenities, and its proximity to several renowned schools.

Additionally, the table highlights the widening price gap between HDB flats and private properties in the area. This growing disparity makes it increasingly difficult for HDB owners to upgrade to private housing.

Since the data above provides a general overview, let’s take a closer look by comparing 5-room HDB flats with condominiums in Bishan that are between 1,200 and 1,400 sq ft.

| Year | 5-room HDBs in Bishan | All 5-room HDBs | Non-landed private properties in Bishan (1,200-1,400 sqft) | All non-landed private properties (1,200-1,400 sqft) | % difference of HDB and non-landed in Bishan |

| 2013 | $559 | $445 | $1,104 | $1,118 | 97.50% |

| 2014 | $528 | $422 | $1,050 | $1,055 | 98.86% |

| 2015 | $535 | $405 | $1,049 | $1,044 | 96.07% |

| 2016 | $565 | $411 | $1,026 | $1,077 | 81.59% |

| 2017 | $598 | $419 | $1,162 | $1,095 | 94.31% |

| 2018 | $584 | $417 | $1,264 | $1,169 | 116.44% |

| 2019 | $569 | $415 | $1,270 | $1,175 | 123.20% |

| 2020 | $567 | $429 | $1,259 | $1,134 | 122.05% |

| 2021 | $616 | $480 | $1,364 | $1,199 | 121.43% |

| 2022 | $665 | $520 | $1,489 | $1,308 | 123.91% |

| 2023 | $688 | $543 | $1,543 | $1,416 | 124.27% |

| Average growth rate | 2.20% | 2.13% | 3.56% | 2.50% | – |

While their growth rates are slightly slower than the overall market trends in the area, these properties in Bishan are still outperforming similar units across the island. In previous pieces, we’ve also observed that larger unit types tend to hold their value better during market downturns, even if they are older.

Now, let’s take a closer look at the performance of Natura Loft.

| Year | Natura Loft | HDBs in Bishan | All HDBs |

| 2016 | $749 | $538 | $424 |

| 2017 | $750 | $569 | $425 |

| 2018 | $771 | $550 | $419 |

| 2019 | $804 | $538 | $416 |

| 2020 | $788 | $531 | $431 |

| 2021 | $889 | $570 | $488 |

| 2022 | $959 | $624 | $532 |

| 2023 | $1,011 | $671 | $564 |

| Average growth rate | 4.48% | 3.33% | 4.28% |

Over the past 8 years, Natura Loft has outperformed other HDBs in Bishan and has slightly exceeded the growth rate of the overall HDB market.

Aside from Natura Loft, all the HDB flats in Bishan were built in the 1990s or earlier. It wasn’t until 2020 and 2023 that new Build-To-Order (BTO) flats were launched in the area, though these projects are still under construction. Notably, none of the three new BTO clusters include 5-room flats, which gives your property an advantage as the newest 5-room flat option in Bishan.

Looking at BTO launches in recent years, 5-room flats have not been built in the central region. In a 2020 report, The Straits Times cited an explanation from HDB that space constraints were the main reason behind the limitation of 5-room flats in central areas. This trend suggests that new 5-room flats are unlikely to be developed in Bishan anytime soon. Furthermore, with HDB’s new BTO categorization into Standard, Plus, and Prime flats launching in October, several of the remaining land plots (in Bishan) near MRT stations could potentially be designated as Plus flats, which come with a 10-year MOP.

Taking these factors into account, it’s reasonable to expect that prices for your HDB flat will remain stable for the foreseeable future, especially given the limited supply of newer 5-room units in the area.

Let’s take a look at how private condos in Bishan are doing. Since freehold developments don’t face the issue of lease decay, we will focus on 99-year leasehold properties to assess how age affects their value retention. The oldest development in the area is Bishan Park Condominium. With its lease starting in 1991 and being completed in 1994, it is now 33 years old.

To better understand how age impacts growth rates, let’s examine a few 99-year leasehold projects of varying ages in Bishan and compare their performance over the past decade.

| Year | Bishan Park Condo (TOP 1994) | Bishan 8 (TOP 2000) | Bishan Loft (TOP 2003) | The Gardens At Bishan (TOP 2004) | Clover By The Park (TOP 2011) | Sky Habitat (TOP 2015) | Sky Vue (TOP 2016) |

| 2013 | $912 | $1,166 | $1,132 | $1,093 | $1,225 | – | – |

| 2014 | $870 | $1,131 | $1,195 | $1,016 | $1,220 | – | – |

| 2015 | $888 | $1,109 | $1,168 | $1,024 | $1,189 | $1,573 | – |

| 2016 | $868 | $1,100 | $1,083 | $986 | $1,163 | $1,457 | $1,745 |

| 2017 | $863 | $1,080 | $1,047 | $1,015 | $1,221 | $1,435 | $1,623 |

| 2018 | $902 | $1,174 | $1,129 | $1,044 | $1,240 | $1,469 | $1,641 |

| 2019 | $969 | $1,207 | $1,154 | $1,083 | $1,290 | $1,480 | $1,734 |

| 2020 | $1,031 | $1,187 | $1,176 | $1,129 | $1,233 | $1,508 | $1,670 |

| 2021 | $1,080 | $1,240 | $1,223 | $1,218 | $1,384 | $1,599 | $1,766 |

| 2022 | $1,143 | $1,366 | $1,359 | $1,415 | $1,535 | $1,658 | $1,874 |

| 2023 | $1,293 | $1,600 | $1,468 | $1,502 | $1,718 | $1,736 | $1,998 |

| Average growth rate (2016-2023) | 5.93% | 5.69% | 4.54% | 6.28% | 5.89% | 2.56% | 2.08% |

| Average growth rate (2015-2023) | 4.90% | 4.87% | 3.06% | 5.03% | 4.88% | 1.32% | – |

| Average growth rate (2013-2023) | 3.67% | 3.40% | 2.78% | 3.40% | 3.61% | – | – |

When analysing the performance of older condominium projects from 2013 to 2023, the disparity between developments built more than a decade apart is surprisingly minimal. In fact, compared to newer projects like Sky Habitat and Sky Vue, the older condominiums have performed notably better. One reason for this could be the lower price PSF of the older condos, which allows buyers to either acquire a larger unit for the same amount or pay less for a unit of the same size compared to the newer developments.

This is a phenomenon we are observing which could be explained by the growing unaffordability of property prices given its strong run-up in prices in recent years. Additionally, these older projects may have more room for price appreciation since their initial PSF was much lower than that of the newer condos.

Comparing the price growth of these condominiums to that of Natura Loft from 2016 to 2023, the older condominiums experienced a higher growth rate.

While there isn’t an official price cap for HDB flats, their prices are more controlled compared to private properties due to government regulations. Although we have seen an increasing number of HDB flats being transacted for over a million dollars, they still make up only a small fraction of the overall market. HDB flats may experience price appreciation, but their growth is moderated by government policies. In contrast, private property prices are driven by the open market and are more susceptible to economic fluctuations and have the potential for higher appreciation, as evidenced by their average growth rates.

Naturally, upgrading to a more expensive property will involve significantly higher costs compared to holding onto your HDB flat. However, let’s review the numbers to give you a clearer understanding of the financial implications.

Potential pathways and costs

Upgrade to a nearby condo

Just for calculation purposes, let’s say you purchase a unit at Clover by the Park for $2.48M. We will look at a 10 year timeframe.

| Purchase price | $2,480,000 |

| BSD | $93,600 |

| CPF + cash | $1,632,400 |

| Loan required | $941,200 |

| BSD | $93,600 |

| Interest expense (Assuming a 23-year tenure at 4% interest) | $319,692 |

| Property tax | $85,480 |

| Maintenance fees (Assuming $350/month) | $42,000 |

| Renovation* | $20,000 |

| Total costs | $560,772 |

*Will vary depending on the extent of renovation works done

Remain status quo and renovate the flat

Since you are the first owner and the development was completed in 2011, we will presume that your remaining loan tenure is 12 years. The calculation below also assumes the cost for the next 10 years:

| Interest expense (Assuming a 12-year tenure at 4% interest) | $80,721 |

| Property tax | $25,630 |

| Town council service and conservancy fees (Assuming $120/month) | $14,400 |

| Renovation* | $60,000 |

| Total costs | $180,751 |

*Will vary depending on the extent of renovation works done

What should you do?

| Potential pathway | Costs incurred over 10 years | Property value today | Funds remaining |

| Upgrade to a nearby condo | $560,772 | $2,480,000 | $1,200,000 |

| Remain status quo and renovate the flat | $180,751 | $1,452,400 | $1,700,000 |

Given that your HDB flat is situated in a prime location and is relatively new compared to other flats in the area, retaining it can be seen as a prudent choice. As mentioned earlier, the performance of Natura Loft and other flats in Bishan, along with potential future supply, suggests that prices will remain relatively stable in the near term. However, this depends on the absence of significant economic disruptions, like those seen during the pandemic. This approach would incur lower expenses and allow you to allocate more funds toward alternative investments.

Conversely, upgrading to a condominium offers the opportunity to capitalise on your HDB’s value and invest in a property with higher appreciation potential. Historical data indicates that most condominiums in the area have outperformed HDB flats, including Natura Loft, in terms of growth rates. If your investment horizon is 6 to 10 years, it is reasonable to expect that private property prices in the area will remain stable, given past trends.

Upgrading can also act as a form of forced savings and a hedge against inflation. Once the property is fully paid off, you are likely to realise a greater return from the condo compared to your HDB. In retirement, you could downsize to an older flat and use the proceeds from the condo sale to support your retirement plans.

With all this said and done, how can we decide which option to go for from a financial standpoint?

We can do this by looking at what your private property has to appreciate by over the next 10 years, year on year, taking our assumed costs into consideration.

Assuming your HDB appreciates at the average annual HDB growth rate of 2.02% over the next decade, the potential gain would be approximately $321,542.

After accounting for costs, the net profit would be around $140,791.

If you were to upgrade to a private property, for it to achieve similar returns and cover associated costs within 10 years, it will need to grow at an average annual rate of 2.52%.

Looking at the growth trend outlined earlier in the article, this appears to be achievable.

Ultimately, the decision comes down to which option aligns better with your financial goals and comfort level. Both pathways have their merits given the current demand and supply dynamics in Bishan. However, if you’re looking to make capital gains over the next 10 years, it looks to be quite achievable if you purchase a private property even with the assumed costs in place.

At Stacked, we like to look beyond the headlines and surface-level numbers, and focus on how things play out in the real world.

If you’d like to discuss how this applies to your own circumstances, you can reach out for a one-to-one consultation here.

And if you simply have a question or want to share a thought, feel free to write to us at stories@stackedhomes.com — we read every message.

Need help with a property decision?

Speak to our team →Read next from Editor's Pick

Property Advice We Sold Our EC And Have $2.6M For Our Next Home: Should We Buy A New Condo Or Resale?

Editor's Pick Happy Chinese New Year from Stacked

Property Market Commentary How I’d Invest $12 Million On Property If I Won The 2026 Toto Hongbao Draw

Overseas Property Investing Savills Just Revealed Where China And Singapore Property Markets Are Headed In 2026

Latest Posts

Singapore Property News I’m Retired And Own A Freehold Condo — Should I Downgrade To An HDB Flat?

New Launch Condo Reviews What $1.8M Buys You In Phuket Today — Inside A New Beachfront Development

Overseas Property Investing This Singaporean Has Been Building Property In Japan Since 2015 — Here’s What He Says Investors Should Know

0 Comments